Exec Summary

Market Movers: Kinder Morgan reports earnings Wednesday, kicking off a wave of midstream and producer data releases.

Estimated Quarterly Volumes: The Rockies meter point sample is up 1.1% from 3Q25, led by gains from the WES and PSX systems in the DJ.

Calendar: KMI reports Oct. 22. 3Q25 Earnings Previews out for AM, DTM, EPD, GEL, OKE, TRGP.

Market Movers:

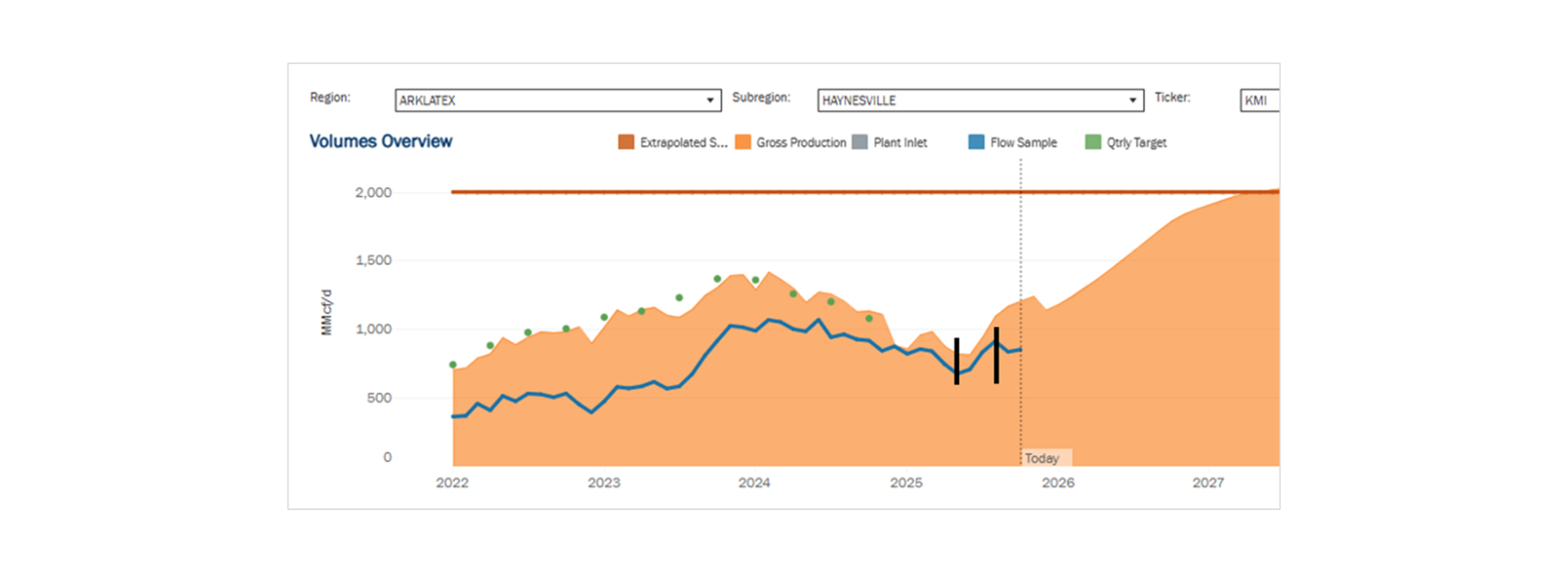

Kinder Morgan (KMI) reports earnings on Wednesday (Oct. 22), kicking off a wave of midstream and producer data releases — Christmas in October for energy analysts. Based on the latest data available in Energy Data Studio, here’s what East Daley is seeing in the field and what management teams are likely to discuss this quarter.

- Haynesville: KinderHawk Flies High: Gas samples in the Haynesville are down slightly from 2Q25 to 3Q25. However, KMI’s KinderHawk system continues to outperform, posting 21% Q-o-Q gas sample growth. The key drivers behind this growth are BP, Comstock Resources (CRK) and Aethon, all active producers on the system.

After consistent gains from May through August, volumes on KinderHawk have leveled off through September and early October as demand catches up with supply (refer to the graph from the “G&P System Analysis” dashboard in Energy Data Studio). For deeper insight into regional dynamics and demand pull, refer to EDA’s Southeast Gulf Supply & Demand product.

- Bakken: Bill Sanderson Plant Leads Growth: Gas samples in the Bakken increased 4% Q-o-Q, while KMI’s system outpaced the basin average with 7.4% growth. Most of the gains came from the recently acquired Bill Sanderson plant, supported by Continental, Chevron (via Hess) and Chord Energy (CHRD).

The chart shows flows through KMI’s Bakken plants from the “Processing Plant Data” dashboard in Energy Data Studio (the green area is Bill Sanderson plant volumes). The asset’s strength underscores KMI’s strategic position in the basin as consolidation and infrastructure optimization continue to reshape gas flows in the region.

- Permian: Flat for Now, But Not Rolling Over: There’s growing market chatter that the Permian Basin is rolling over – but not so fast my friends. Early data from Phillips 66’s (PSX) Delaware system show flat volumes from 2Q25 to 3Q25. Devon Energy (DVN) remains the anchor producer, accounting for nearly half of throughput on the system. Flat Q-o-Q volumes from Devon suggest steady, not declining, activity levels as the basin awaits new takeaway capacity and incremental LNG demand.

The Bottom Line: East Daley expects gas growth to slow in the Permian and Bakken, even as plant inlet volumes continue to outpace crude growth. Gas-focused basins have tapped the brakes in 3Q25, awaiting the next wave of LNG-driven demand that’s coming online as we speak.

Expect an uptick in gas growth in 4Q25, which won’t show up in this quarter’s numbers. Select systems like KinderHawk, where early signs of Haynesville growth are already evident, will prove the exception.

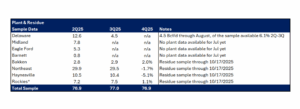

Estimated Quarterly Volumes:

Notes: 3Q25 is expressed as Q-o-Q growth from 2Q25. Rockies is the sum of Big Horn, DJ, Green River, Piceance, Powder River, San Juan, Uinta and Wind River.

- The Rockies meter point sample is up 1.1% from 3Q25. In the Denver-Julesburg Basin, the WES system is up 2.36% and the PSX – DCP system is up 1.64% from 3Q25. Occidental Petroleum is the largest producer behind the WES system, while Chevron is the largest producer behind the PSX system.

- The Bakken meter point sample is up 2% from 3Q25. The OKE – Bakken system is up 3.96% and the HESM – Tioga system is up 1.55% Q-o-Q. Continental Resources is the largest producer behind the OKE system and Chevron is the largest producer behind the HESM system.

Calendar: