Executive Summary: Rigs: The total rig count decreased by 1 for the July 17 week, down to 553 from 554. Infrastructure: Rig activity continues to decline in the Permian Basin, weighed down by consolidation and operators’ drive to control spending. Storage: East Daley expects an injection of 273 Mbbl in commercial and Strategic Petroleum Reserve (SPR) inventories for the week ending July 12.

Rigs:

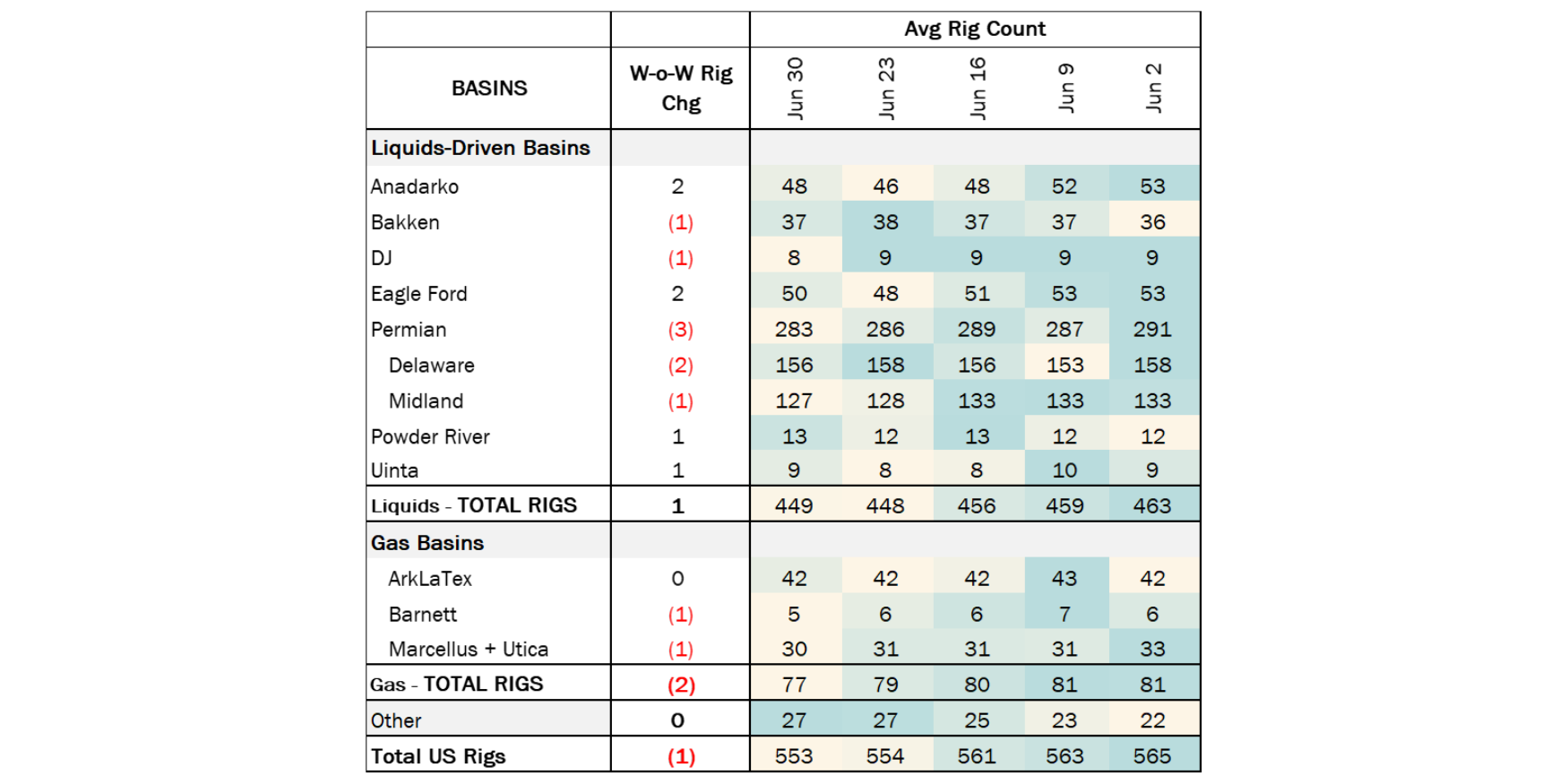

The total rig count decreased by 1 for the July 17 week, down to 553 from 554. Liquids-driven basins saw an increase of 1 rig, increasing the total count from 448 to 449. The Bakken and DJ basins both decreased by 1 rig, whereas the Permian Basin decreased by 3.

In the Bakken, operator Chord Energy removed 1 rig from its system. In the DJ, Bison Operating dropped 1 rig. In the Permian Basin, Delaware operators EOG Resources (EOG) and Coterra Energy (CTRA) each decreased rigs by 1, and Midland operator Exxon (XOM) also released 1 rig.

Infrastructure:

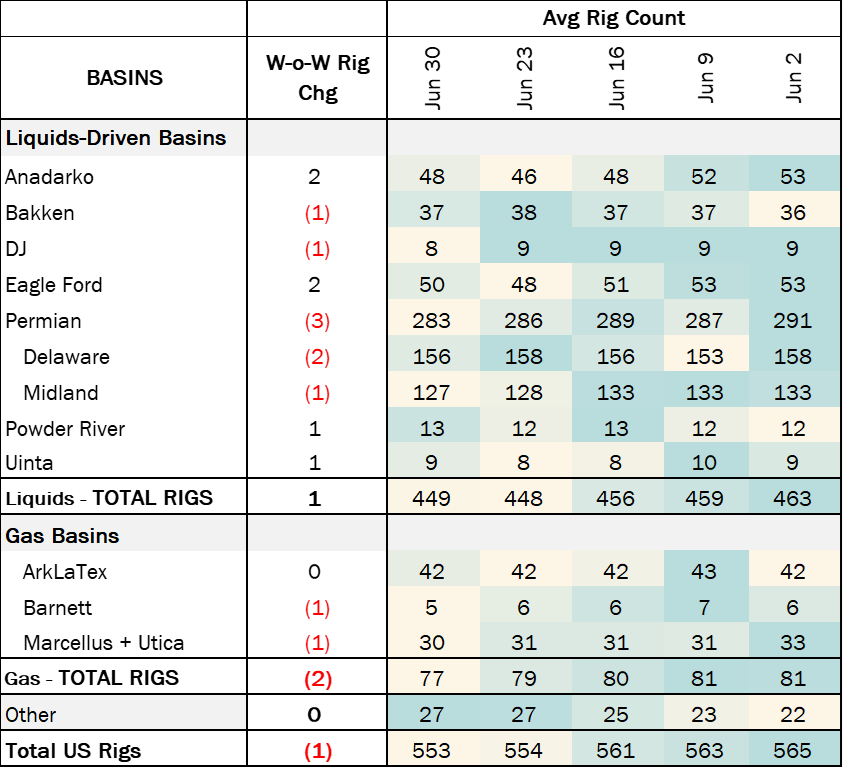

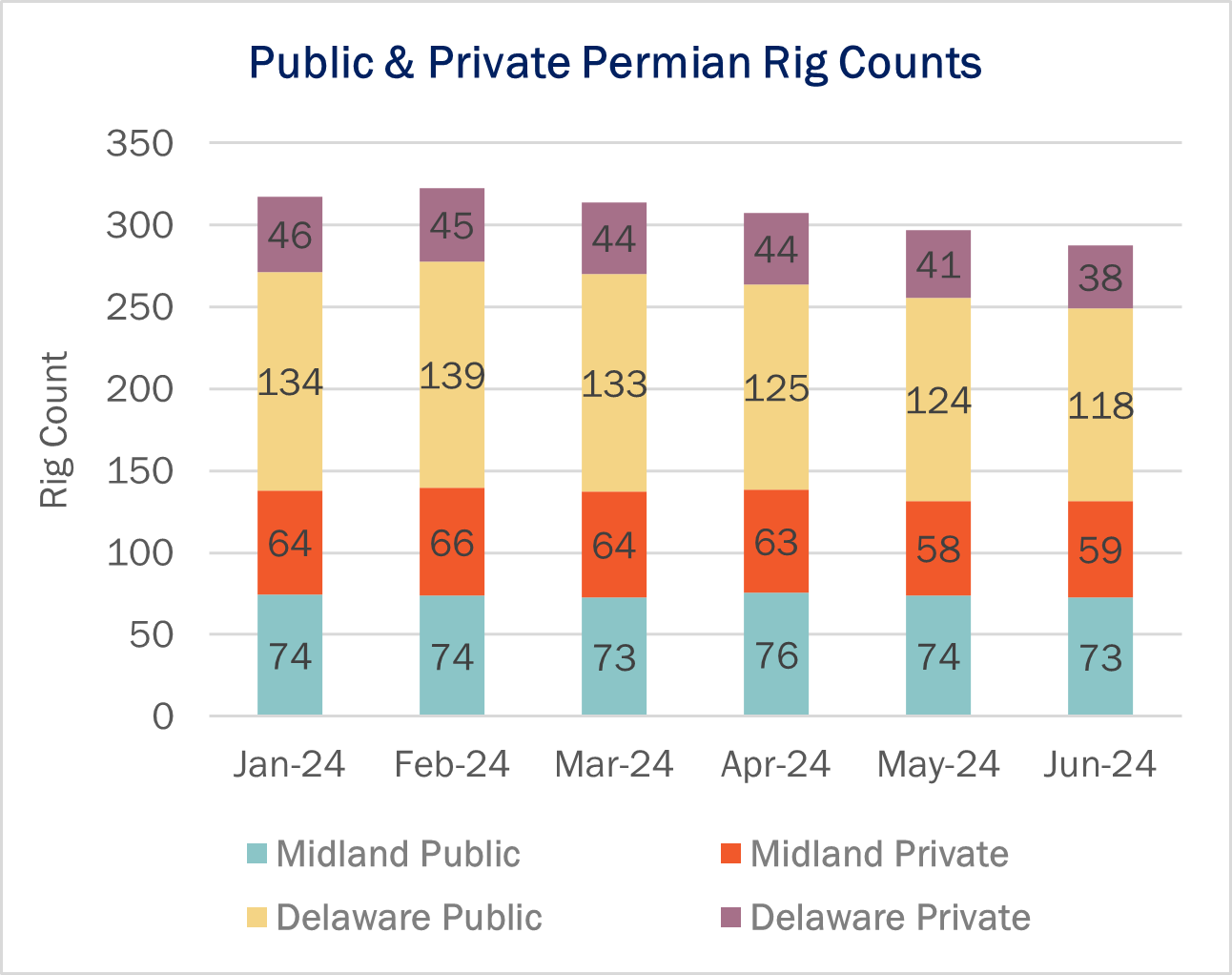

Rig activity continues to decline in the Permian Basin, weighed down by consolidation and operators’ drive to control spending. Rig counts in the Permian fell by 35, or 10% through the first half of 2024, from an average of 318 rigs in January to 288 in June ‘24. Several big E&P mergers have yet close and could pressure rig counts lower later this year.

While both sides of the Permian have lost rigs, the largest drop has occurred in the Delaware sub-basin. Overall, rig counts in the Delaware have fallen by 24 since the start of the year, a 15% decline, while the Midland is down 8 rigs, or 5% during the same period (see figure).

In the Delaware, public producers have been most actively shedding rigs. In the first six months of 2024, public operators dropped 16 rigs in the Delaware, or 14% of the total count. Large operators Occidental Petroleum (OXY), ExxonMobil (XOM) and Diamondback Energy (FANG) have each dropped 3 rigs since the start of the year. Both OXY and FANG guided to lower rig counts in the Permian at the start of the year. Meanwhile, private operators in the Delaware have reduced their rigs by 8, with names like Mewbourne and Point Energy Partners each dropping 2 rigs since the start of 2024.

M&A activity has driven much of the decline since 2023, though that seems less of a factor for recent activity as E&Ps elect to operate within cash flow. APA Corp. and Callon Petroleum represent one of the larger E&P mergers to close this year, and APA so far has maintained its legacy rig program and elected not to drop any of the inherited Callon rigs.

However, two of the larger deals have yet to close, including Occidental’s (OXY) acquisition of CrownRock and Diamondback’s purchase of Endeavor Energy Resources. CrownRock and Endeavor operate a combined 16 rigs that could be potentially lost if OXY and FANG choose to drop legacy rigs and only backfill their drilling inventory.

Storage:

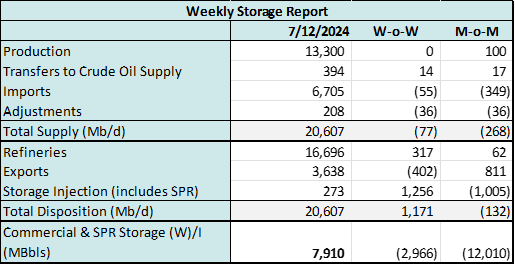

East Daley expects an injection of 273 Mbbl in commercial and Strategic Petroleum Reserve (SPR) inventories for the week ending July 12. We expect total US stocks, including the SPR, will close at 826 MMbbl.

The US natural gas pipeline sample, a proxy for change in oil production, decreased 1.09% W-o-W across all liquids-focused basins. Samples decreased 5.26% in the Gulf of Mexico, 5.41% in the Eagle Ford, 1.78% in the Williston, and 0.13% in the Permian. The Williston Basin and Gulf of Mexico have a high correlation between gas volumes and crude oil volumes, whereas the Permian Basin and Eagle Ford basins’ correlation is less than 45%. We expect US crude production to remain flat at 13.3 MMb/d.

According to US bill of lading data, US crude imports decreased by 55 Mb/d W-o-W to 6.7 MMb/d. More than 60% of the supply originated from Canadian pipelines into the US, with the remainder largely coming from ships carrying crude from Mexico, Venezuela and Argentina.

As of July 12, there was ~510 Mb/d of refining capacity offline, including downtime for planned and unplanned maintenance. EDA expects gross crude inputs into refineries to decrease by ~413 Mb/d W-o-W, coming in at 16.7 MMb/d.

Vessel traffic monitored by EDA along the Gulf Coast increased W-o-W. There were 26 vessels loaded for the week ending July 12 and 22 the prior week. EDA expects US exports to be 3.64 MMb/d.

The SPR awarded contracts for 3.2 MMbbl to be delivered in July 2024. The SPR has 374 MMbbl in storage as of July 12, 2024.

Regulatory and Tariffs:

Presented by ARBO

Tariffs:

Marketlink, LLC Most volume incentive rates were increased for the month of July 1, 2024. FERC No 3.27.0 IS24- 619 filed June 27, 2024)

TransCanada Keystone Pipeline, LP The temporary discounted uncommitted rates were extended through August 31, 2024. FERC No 6.100.0 IS24- 620 filed June 27, 2024) Effective August 1, 2024.

The above information is provided by ARBO’s Oil Pipeline Tariff Monitor. For more information on regulatory proceedings or tariff rates, please contact please contact Corey Brill via email at [email protected] or phone at 202-505-5296. https://www.goarbo.com/