Executive Summary: Rigs: The total rig count decreased by 9 for the June 23 week, down to 554 from 563. Infrastructure: The Bakken industry has experienced a significant transformation after a surge of M&A activity in 2024, resulting in consolidation down to only eight operators. Storage: East Daley expects an injection of 695 Mbbl in commercial and Strategic Petroleum Reserve (SPR) inventories for the week ending July 5.

Rigs:

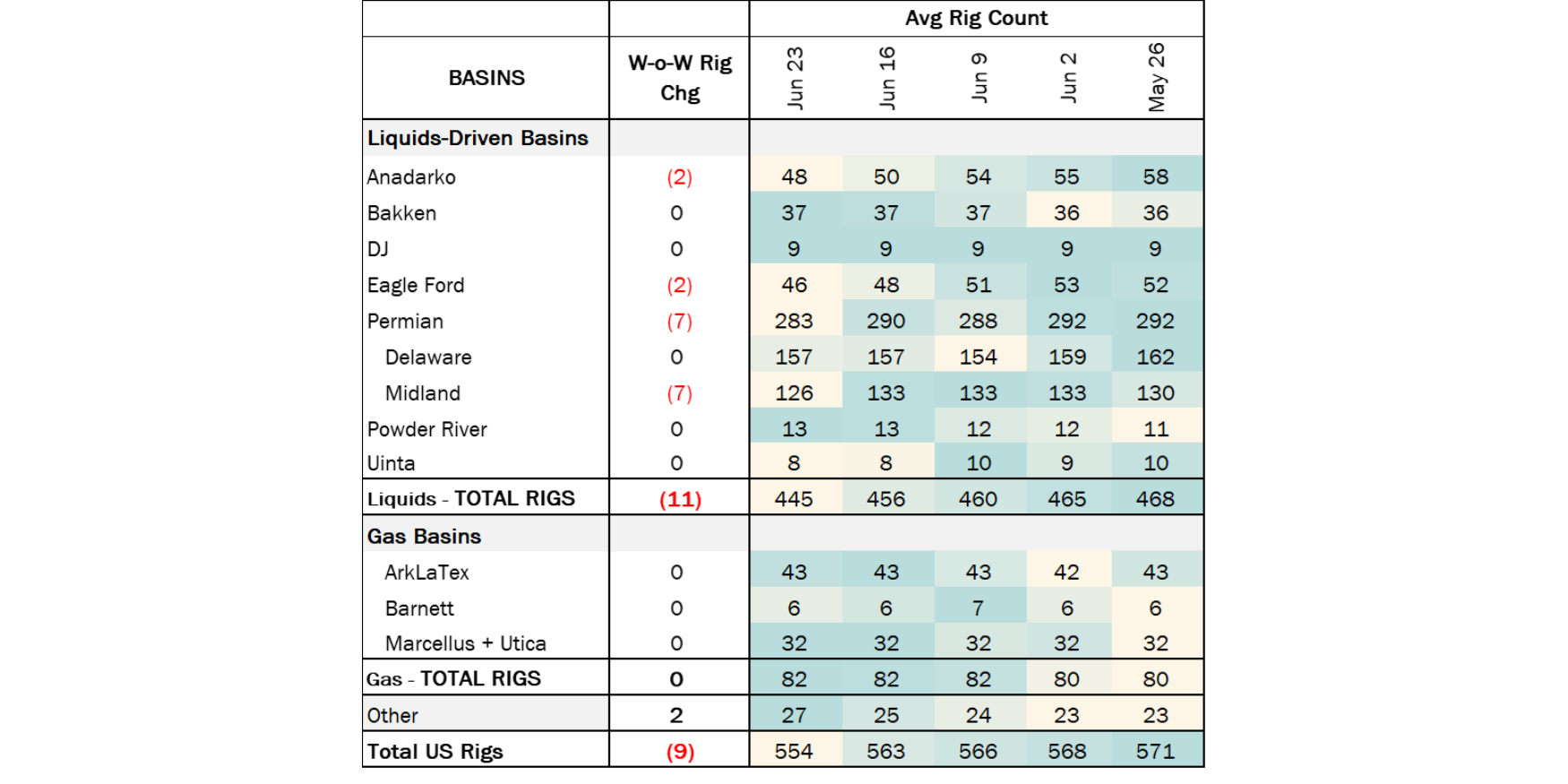

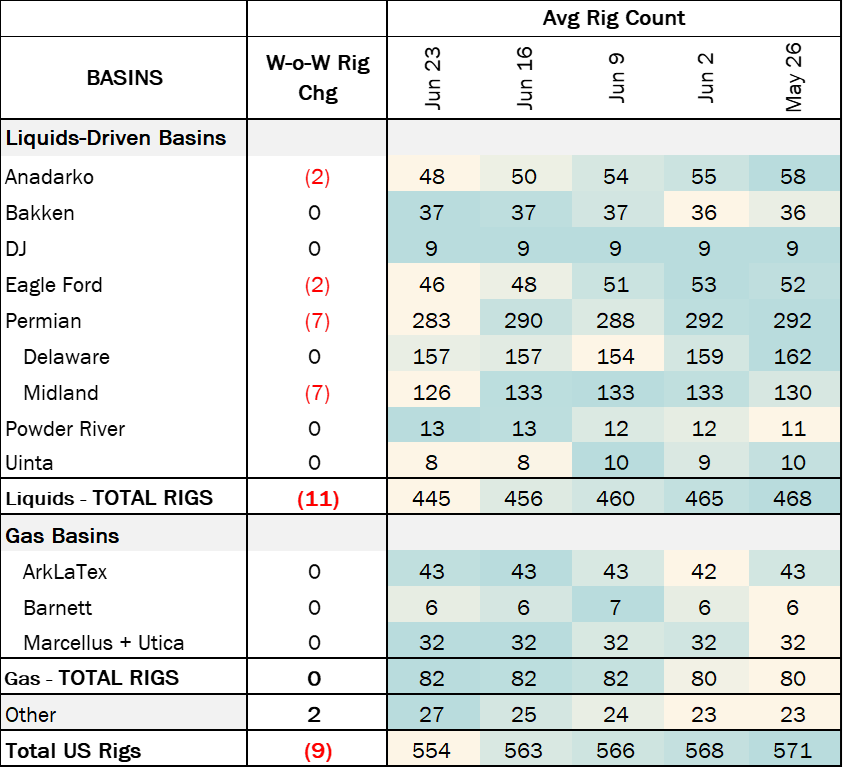

The total rig count decreased by 9 for the June 23 week, down to 554 from 563. Liquids-driven basins saw a large decrease, falling by 11 rigs W-o-W and bringing the total count to 445 from 456. In the Anadarko, 2 rigs were removed from the basin. The Eagle Ford also saw a decrease of 2 rigs, while the Permian dropped 7 rigs W-o-W.

In the Anadarko Basin, operators Shakespear Oil and Raymond Oil each removed 1 rig. In the Eagle Ford, Marathon Oil (MRO) and Auterra both decreased their rig counts by 1. In the Midland Basin, operators Occidental Petroleum (OXY) and Mewbourne Oil each dropped 1 rig while ConocoPhillips (COP) removed 2 rigs. Additionally, Endeavor Energy, Chevron (CVX) and Continental Resources also removed 1 rig each in the Midland while the Delaware stayed flat.

Infrastructure:

The Bakken industry has experienced a significant transformation after a surge of M&A activity in 2024, resulting in consolidation down to only eight operators. These companies account for 80% of the Bakken’s 1.3 MMb/d crude oil production.

In 2023, there were 11 companies producing more than 50 Mb/d in the Bakken, of which only seven were public. By YE24, these 11 companies will consolidate into eight, from one completed and three pending mergers and acquisitions. Currently, there are only six public companies out of the 130 producers in the Bakken.

In May 2024, Chord Energy (CHRD) completed the acquisition of Enerplus, making it the largest producer in the Bakken with ~225 Mb/d. This acquisition moved Continental Resources (~215 Mb/d), down to the second-largest producer. ConocoPhillips’ (COP) acquisition of Marathon Oil, scheduled to close in 4Q24, will make the combined entity the third-largest Bakken producer (~165 Mb/d). Chevron’s (CVX) acquisition of Hess will make CVX number four (~150 Mb/d) by crude oil volumes.

The entry of larger operators like CVX and COP is likely to bring more advanced technological capabilities to the Bakken. These companies have invested in new drilling techniques (longer lateral wells) and enhanced oil recovery methods, expected to increase the efficiency and output of the wells.

The Bakken is ripe for further M&A activity due to the unusually large number of smaller private producers. While eight companies supply 80% of the Bakken’s oil volumes, there are another ~122 private pcompanies producing from ~40 b/d up to 1 Mb/d. This fragmentation presents opportunities for further consolidation and enhanced operational efficiencies to maintain the Bakken’s competitive edge in the global oil market.

Storage:

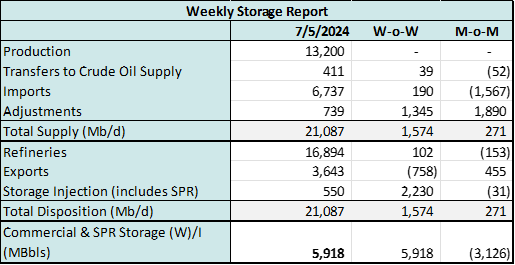

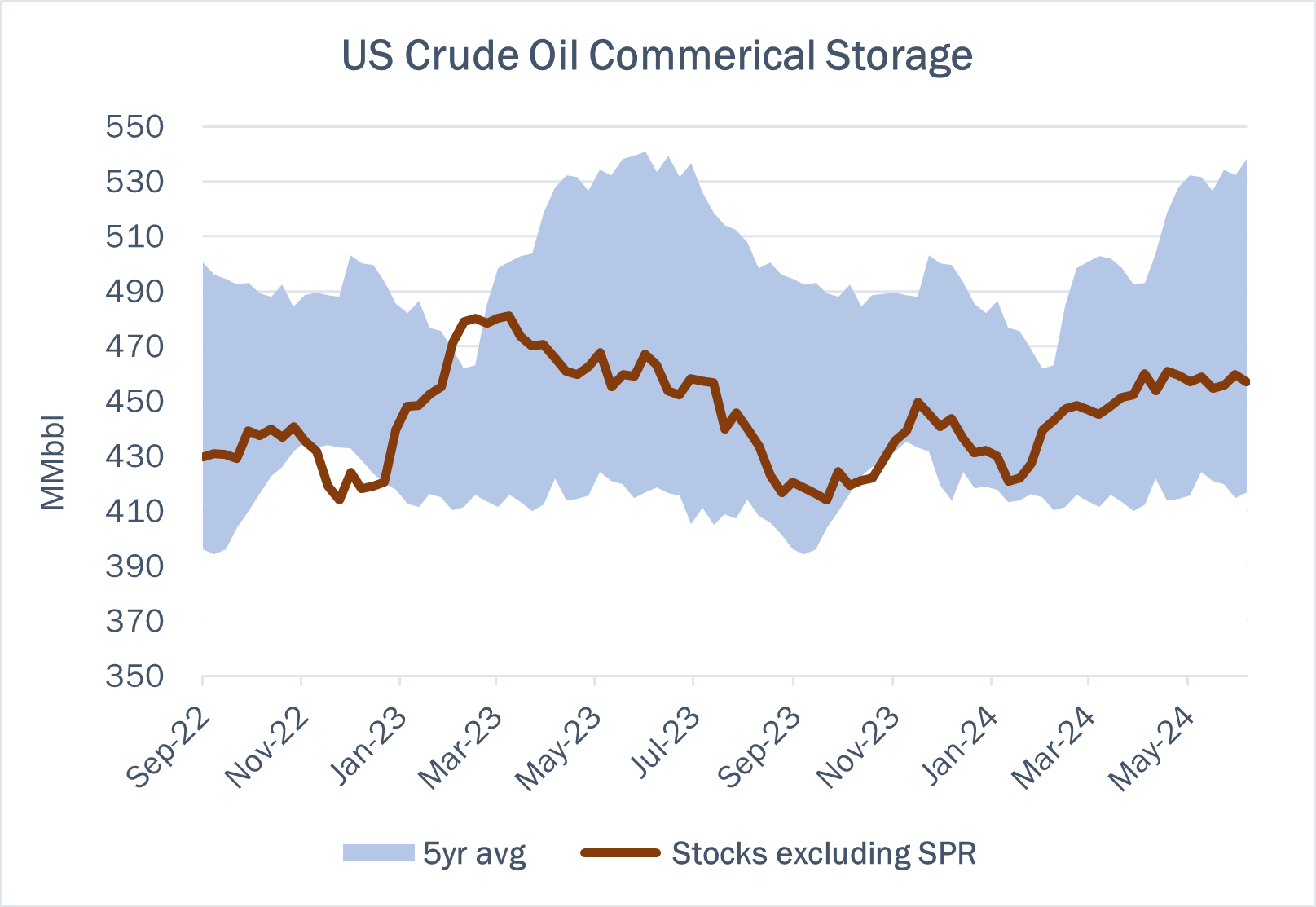

East Daley expects an injection of 695 Mbbl in commercial and Strategic Petroleum Reserve (SPR) inventories for the week ending July 5. We expect total US stocks, including the SPR, will close at 827 MMbbl.

The US natural gas pipeline sample, a proxy for change in oil production, increased ~0.49% W-o-W across all liquids-focused basins. Samples decreased 1.79% in the Permian and 1.28% in the Eagle Ford. The decreases were offset by a 8.74% increase in the Gulf of Mexico and a 1.76% increase in the Williston. The Williston Basin and Gulf of Mexico have a high correlation between gas volumes and crude oil volumes, whereas the Permian Basin and Eagle Ford basins’ correlation is less than 45%. We expect US crude production to remain flat at 13.2 MMb/d.

According to US bill of lading data, US crude imports increased by 190 Mb/d W-o-W to 6.74 MMb/d. More than 60% of the supply originated from Canadian pipelines into the US, with the remainder largely coming from ships carrying crude from Mexico, Venezuela and Argentina.

As of July 5, there was ~391 Mb/d of refining capacity offline, including downtime for planned and unplanned maintenance. EDA expects gross crude inputs into refineries to increase by ~102 Mb/d W-o-W, coming in at 16.9 MMb/d.

Vessel traffic monitored by EDA along the Gulf Coast increased W-o-W. There were 22 vessels loaded for the week ending July 5 and 23 the prior week. EDA expects US exports to be 3.64 MMb/d.

The SPR awarded contracts for 3.2 MMbbl to be delivered in July 2024. The SPR has 372 MMbbl in storage as of July 5, 2024.

Regulatory and Tariffs:

Presented by ARBO

Tariffs:

Marketlink, LLC Most volume incentive rates were increased for the month of July 1, 2024. FERC No 3.27.0 IS24- 619 filed June 27, 2024)

TransCanada Keystone Pipeline, LP The temporary discounted uncommitted rates were extended through August 31, 2024. FERC No 6.100.0 IS24- 620 filed June 27, 2024) Effective August 1, 2024.

The above information is provided by ARBO’s Oil Pipeline Tariff Monitor. For more information on regulatory proceedings or tariff rates, please contact please contact Corey Brill via email at [email protected] or phone at 202-505-5296. https://www.goarbo.com/