Executive Summary: Rigs: The US total rig count decreased by 11 rigs for the July 7 week, down to 545 from 556. Infrastructure: Kinder Morgan (KMI) plans to convert the Double H crude oil pipeline out of the Bakken to NGL service. Storage: East Daley expects an injection of 234 Mbbl in commercial and Strategic Petroleum Reserve (SPR) inventories for the week ending July 19.

Rigs:

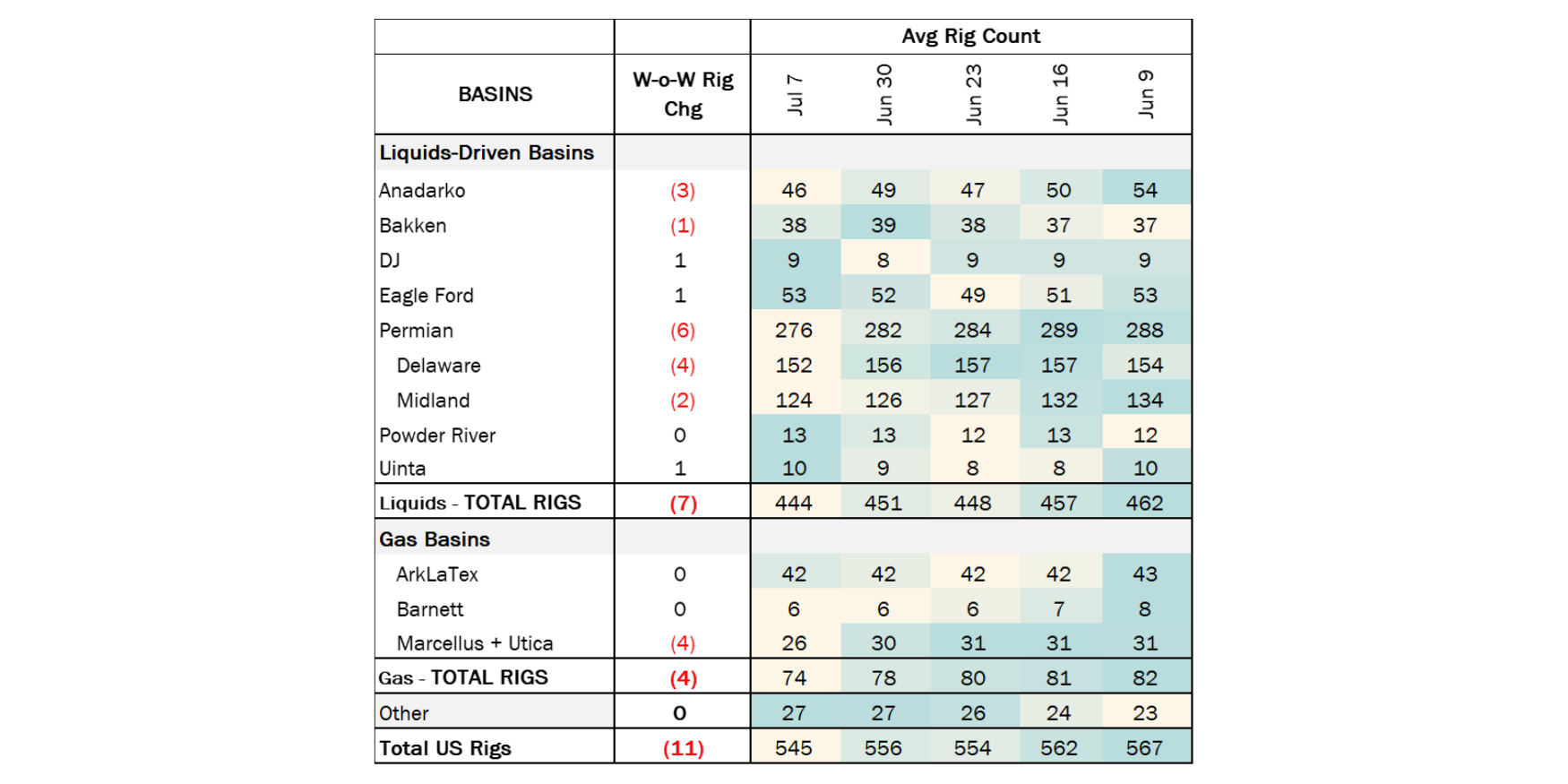

The US total rig count decreased by 11 rigs for the July 7 week, down to 545 from 556. Liquids-driven basins saw a decrease of 7 rigs, moving the count from 451 to 444. The Anadarko Basin decreased by 3 rigs, the Bakken decreased by 1 rig, and the Permian Basin decreased by 6 rigs.

In the Anadarko, operators Mack Energy, Palomino Petroleum, and Courson Oil & Gas each removed 1 rig. In the Bakken, Chord Energy also removed 1 rig. In the Delaware, operator EOG Resources (EOG) decreased its rig count by 2, whereas Matador Resources (MTDR) and Mewbourne Oil both removed 1 rig. In the Midland Basin, ExxonMobil (XOM) and Birch Operations each removed 1 rig.

Infrastructure:

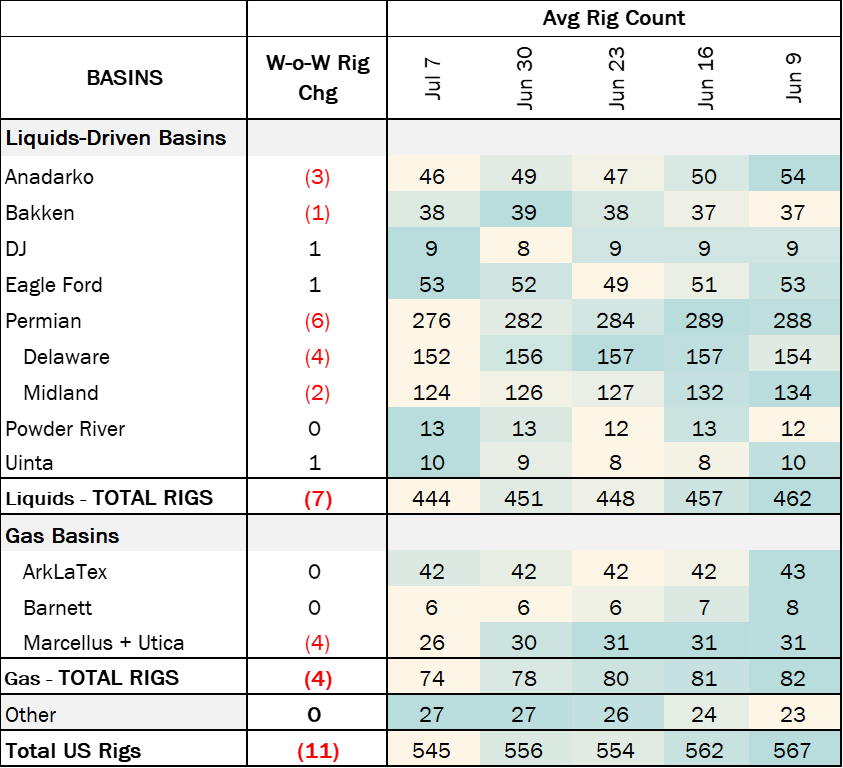

Kinder Morgan (KMI) plans to convert the Double H crude oil pipeline out of the Bakken to NGL service. The project is a shot across the bow of ONEOK (OKE) and could tip a delicate balance in the Bakken for crude oil and NGLs.

KMI announced the pipeline project in its 2Q24 earnings. Double H runs 462 miles from Dore, ND to the Guernsey market in Wyoming. The conversion will begin service in 1Q26, KMI said, allowing time for other infrastructure to bring the Bakken back in balance.

Pipeline egress from the Williston Basin is tight, and disruptions of one commodity market can create imbalances for others. While the Double H conversion adds capacity for NGLs, it will constrain crude oil flow to Guernsey, providing a big opportunity for other pipe expansions.

NGL infrastructure is the most pressing concern for now. Constraints on the NGL side of the business are prompting operators to blend more butane into Bakken crude, according to sources. ONEOK, the dominant NGL service provider in the Bakken, plans to start a 100 Mb/d expansion of Elk Creek Pipeline in 1Q25 that will resolve the issue. However, the Elk Creek project only furthers OKE’s role as the top dog for Bakken NGLs. With the Double H project, KMI is positioning itself as an alternative to OKE, a move that could potentially enhance the competitiveness of Bakken supply in NGL markets.

The Double H conversion will also take away one option for Bakken crude barrels to reach the Cushing market. Today, True Companies’ Bridger and KMI’s Double H transport Bakken barrels to Guernsey. From Guernsey, the Saddlehorn and Pony Express pipelines provide favorable netbacks to ship crude to Cushing.

Once Double H converts to NGL service, the Bakken-to-Guernsey corridor becomes immediately constrained, according to East Daley’s Crude Hub Model. Bridger Pipelines picks up a portion of Double H’s volume and fills to capacity, and other crude oil is diverted to Dakota Access Pipeline (DAPL) and secondary markets. These secondary markets include shipping by rail or using Enbridge’s (ENB) Bakken North Pipeline to move barrels into Canada and back down into the Midwest (PADD 2). Both are relatively expensive options for shippers, and we would expect to see downward pressure on Bakken crude prices if they are heavily used. These market forces would then open new opportunities for other pipe projects to Guernsey.

Storage:

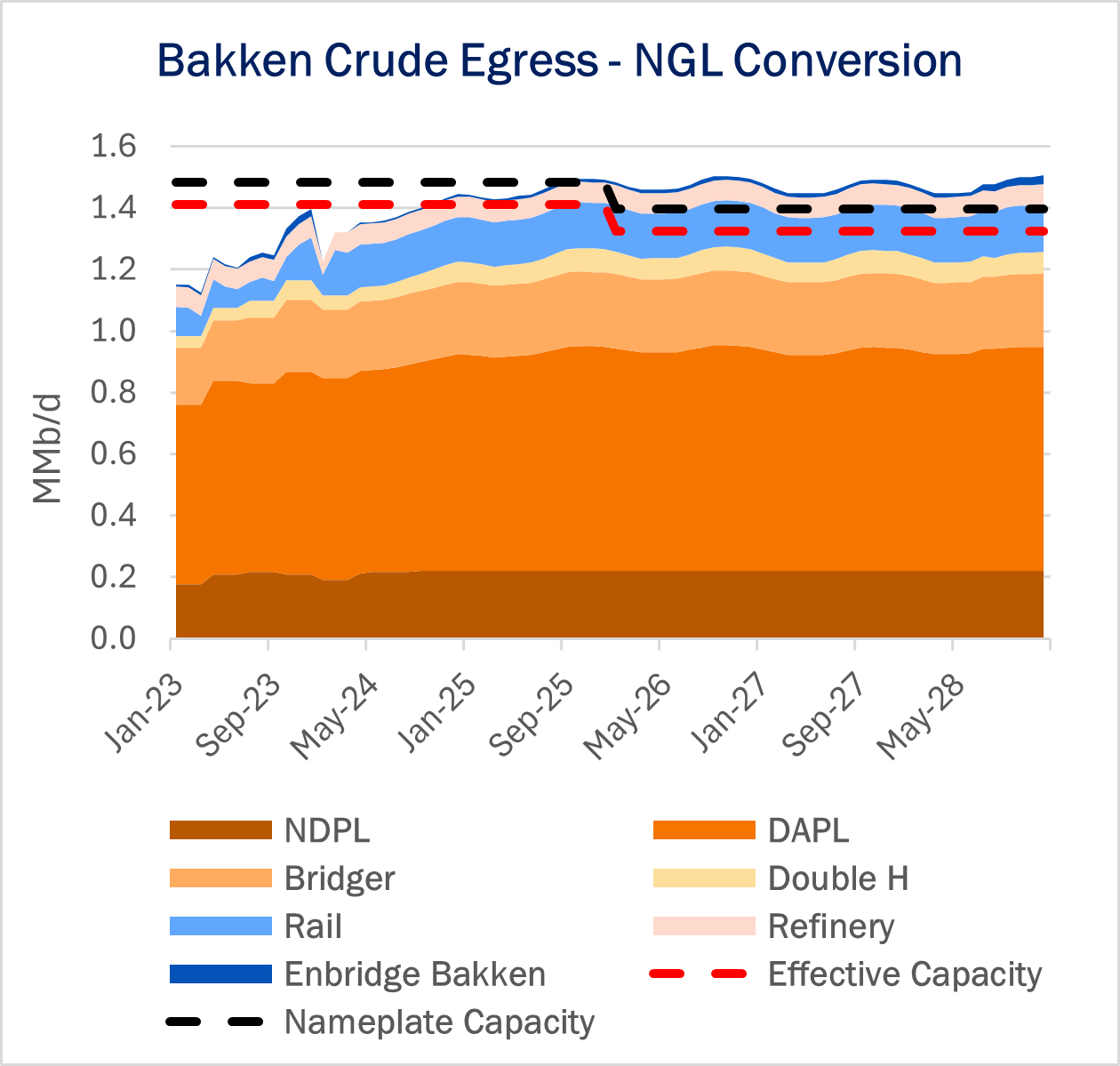

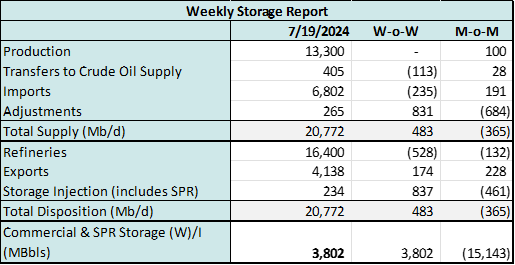

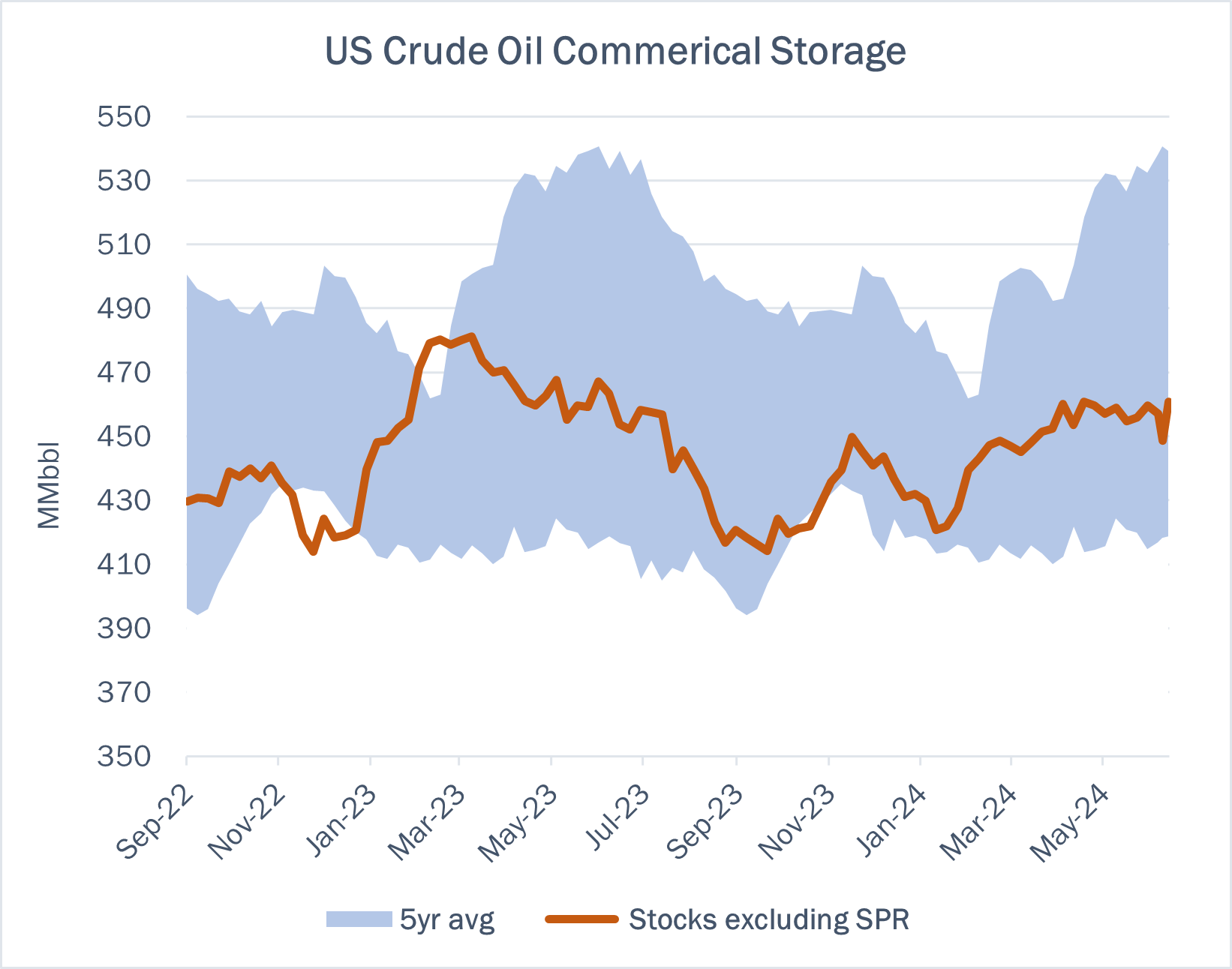

East Daley expects an injection of 234 Mbbl in commercial and Strategic Petroleum Reserve (SPR) inventories for the week ending July 19. We expect total US stocks, including the SPR, will close at 818 MMbbl.

The US natural gas pipeline sample, a proxy for change in oil production, increased 0.3% W-o-W across all liquids-focused basins. Samples increased 7.9% in the Gulf of Mexico, 2.8% in the Permian, and 0.2% in the Rockies. The increase was offset by samples declining 16.2% in the Eagle Ford and 6.5% in the Williston. The Williston Basin and Gulf of Mexico have a high correlation between gas volumes and crude oil volumes, whereas the Permian and Eagle Ford basins’ correlation is less than 45%. We expect US crude production to remain flat at 13.3 MMb/d.

According to US bill of lading data, US crude imports decreased by 235 Mb/d W-o-W to 6.8 MMb/d. More than 60% of the supply originated from Canadian pipelines into the US, with the remainder largely coming from ships carrying crude from Mexico, Venezuela and Argentina.

As of July 19, there was ~726 Mb/d of refining capacity offline, including downtime for planned and unplanned maintenance. EDA expects gross crude inputs into refineries to decrease by ~528 Mb/d W-o-W, coming in at 16.4 MMb/d.

Vessel traffic monitored by EDA along the Gulf Coast decreased W-o-W. There were 20 vessels loaded for the week ending July 19 and 26 the prior week. EDA expects US exports to be 4.138 MMb/d.

The SPR awarded contracts for 3.2 MMbbl to be delivered in July 2024. The SPR has 375 MMbbl in storage as of July 19, 2024.

Regulatory and Tariffs:

Presented by ARBO

Tariffs:

Marathon Pipe Line LLC Rates were increased by the FERC index effective August 9, 2024. FERC No 31.17.0 IS24- 638 filed July91, 2024)

Suncor Energy (U.S.A.) Pipeline Company The temporary discounted uncommitted rates were extended through August 31, 2024. FERC No 6.100.0 IS24- 620 filed June 27, 2024) Effective August 1, 2024.

The above information is provided by ARBO’s Oil Pipeline Tariff Monitor. For more information on regulatory proceedings or tariff rates, please contact please contact Corey Brill via email at [email protected] or phone at 202-505-5296. https://www.goarbo.com/