Executive Summary: Rigs: The US total rig count decreased by 2 for the August 18 week, down to 563 from 565. Infrastructure: Enbridge (ENB) Mainline, Canada’s largest crude oil egress pipeline, is lowering its uncommitted rates to keep its utilization high, an acknowledgement of new competition from Trans Mountain Pipeline for heavy barrels. Storage: East Daley expects a 685 Mbbl withdrawal from commercial and Strategic Petroleum Reserve (SPR) inventories for the week ending September 4.

Rigs:

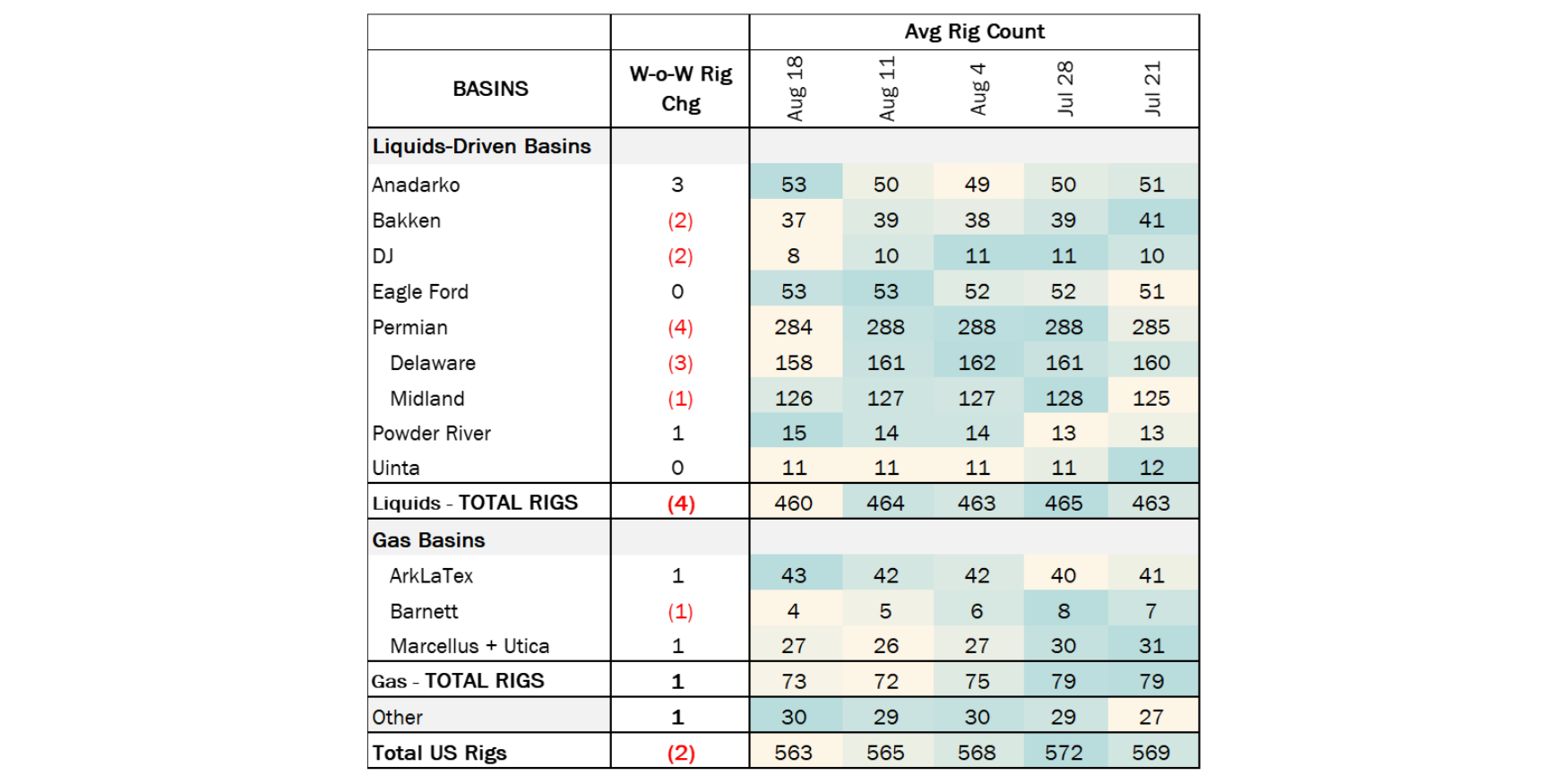

The US total rig count decreased by 2 for the August 18 week, down to 563 from 565. Liquids-driven basins saw a decrease of 4 rigs, moving the count from 464 to 460. The Bakken and DJ basin counts each decreased by 2, whereas the Permian Basin lost 4 rigs on the week. On the other hand, the Anadarko Basin gained 3 rigs and the Powder River Basin rig count increased by 1.

In the Bakken, Continental Resources and Grayson Mill Operating LLC each dropped 1 rig. In the DJ Basin, Chevron and GMT Exploration each saw a loss of 1 rig. In the Delaware, Mewbourne Oil, EOG Resources and Chevron Corporation each dropped 1 rig. In the Midland, operator Civitas Resources shed 1 rig.

Infrastructure:

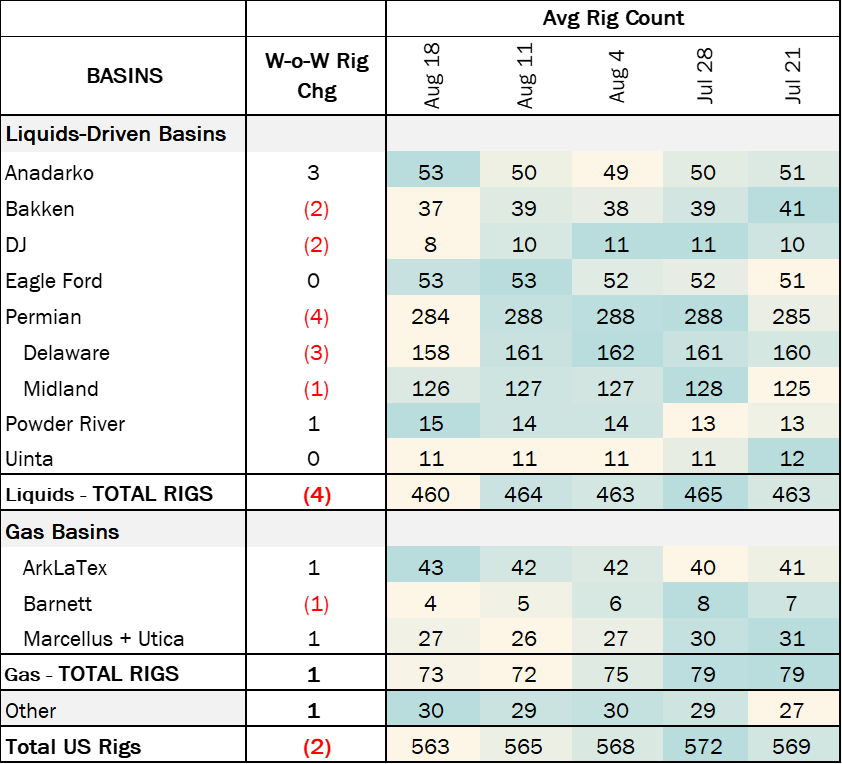

Enbridge (ENB) Mainline, Canada’s largest crude oil egress pipeline, is lowering spot rates in joint tariffs to keep utilization high to the Gulf Coastg, an acknowledgement of new competition from Trans Mountain Pipeline for heavy barrels.

Effective September 1, 2024, uncommitted Mainline heavy crude tolls will decrease for joint tariffs with the Flanagan South and Seaway pipelines. The Mainline can transport up to 3.2 MMb/d from Western Canada to the Midwest and, using the joint pipeline tariffs, move up to 720 Mb/d all the way to the Gulf Coast. Notably, ENB has cut heavy crude rates from Edmonton, AB to Houston, TX (Harris County) from $10.9319/bbl to $9.8380/bbl.

The Mainline has been running effectively full, and the lower uncommitted joint rates will help keep throughput high. The new rates only apply to joint services with the downstream pipes and do not affect Mainline tolls from Alberta to Chicago.

ENB is cutting rates to compete after the Trans Mountain Expansion (TMX) came online in May. TMX added 590 Mb/d of takeaway to Pacific markets. With minimum volume commitments (MVCs) totaling 525 Mb/d, the expanded Trans Mountain is primarily shipping heavy sour Canadian crude to Burnaby, BC with some batching of syncrude.

Tolls for TMX have not been finalized (the Canadian Energy Regulator (CER) is aiming to finalize rates in 2025), but the current benchmark toll for shippers with a 15-year contract transporting less than 75 Mb/d from Edmonton, AB to Burnaby, BC is $11.46/bbl, consisting of a fixed $10.88/bbl plus $0.58/bbl variable rate. The fixed rate is lower than the uncommitted joint tariff on Mainline to the Gulf Coast, making it a more attractive egress route for Canadian producers.

However, this cost advantage for TMX will not last much longer. Trans Mountain experienced long delays and severe overages during its construction, which will increase tolls. Benchmark fixed rates were raised from $5.76 to $10.88/bbl based on a May 2023 project cost estimate of $30.9B. The most recent update suggests a total cost of ~$34B, which will be reflected in the CER’s finalized rates next year.

According to East Daley’s Crude Hub Model, TC Energy’s (TRP) Keystone Pipeline is fully utilized. Average 1Q24 volumes are ~637 Mb/d, above the stated 620 Mb/d nameplate capacity. It is highly likely TRP is using drag reducing agents (DRA) on Keystone due to the high ratio of heavy sour to light crude oil. Furthermore, Keystone is 94% contracted, TRP executives said on its 2Q24 earnings call. With a market low committed heavy crude rate of $2.508/bbl, throughput on Keystone will be minimally impacted by the effects of TMX and lower Mainline rates.

Storage:

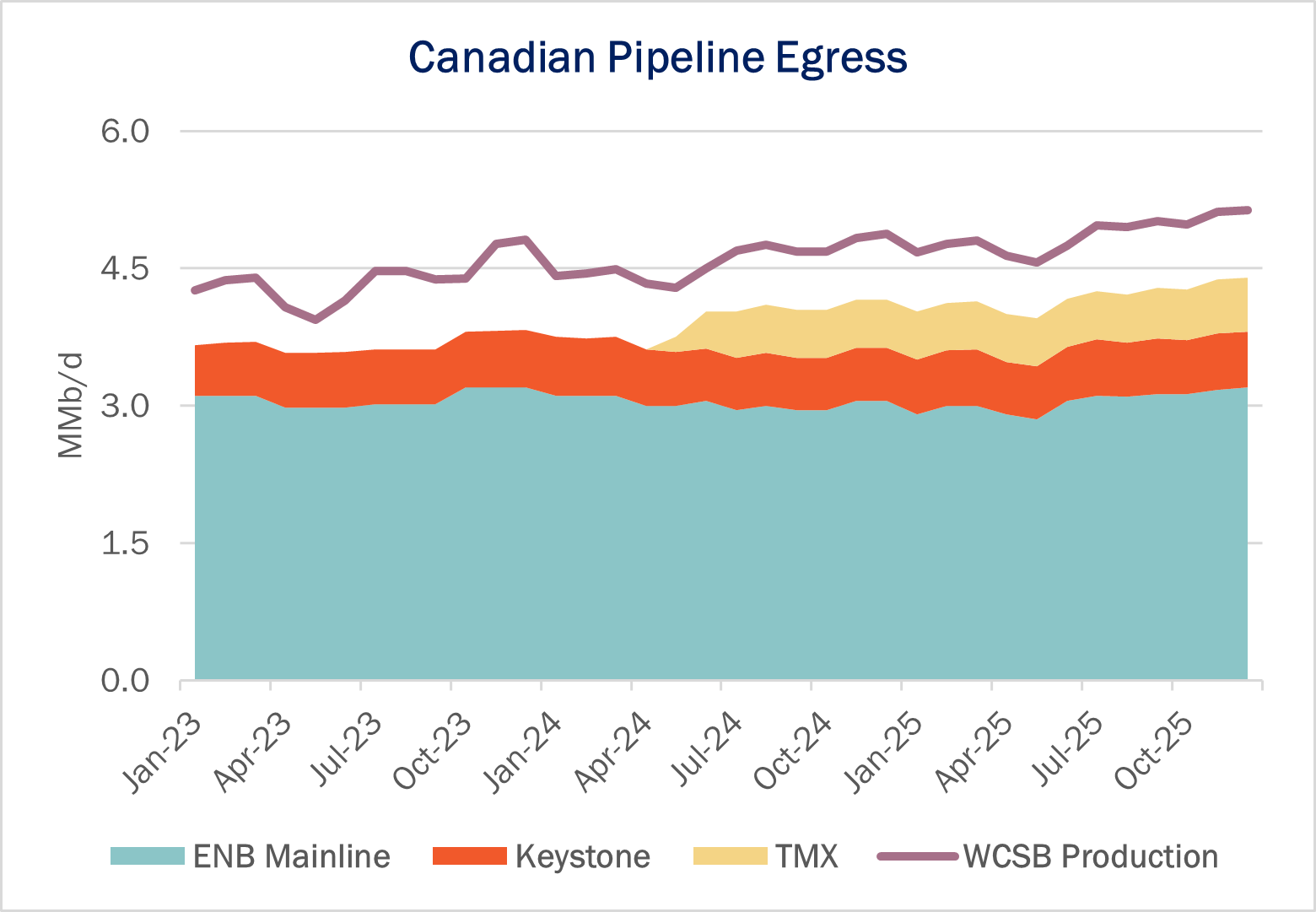

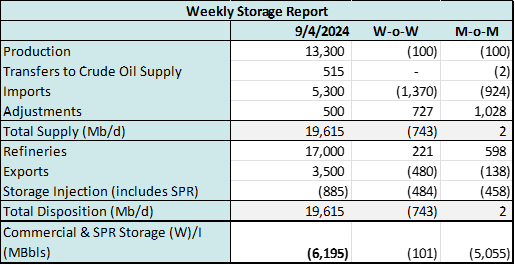

East Daley expects a 685 Mbbl withdrawal from commercial and Strategic Petroleum Reserve (SPR) inventories for the week ending September 4. We expect total US stocks, including the SPR, will close at 798 MMbbl.

The US natural gas pipeline sample, a proxy for change in oil production, increased 1.18% W-o-W across all liquids-focused basins. Samples increased 7.15% in the Eagle Ford, 7.56% and in the Gulf of Mexico. The increase was offset by samples decreasing 0.5% in the Permian and 1.11% in the Williston Basin. The Gulf of Mexico and Williston Basin have a high correlation between gas volumes and crude oil volumes, whereas the Permian Basin and Eagle Ford basins’ correlation is less than 45%. We expect US crude production to remain flat at 13.3 MMb/d.

According to US bill of lading data, US crude imports decreased by 1,370 Mb/d W-o-W to 5.30 MMb/d. More than 60% of the supply originated from Canadian pipelines into the US, with the remainder largely coming from ships carrying crude from Mexico, Venezuela and Argentina.

As of August 30, there was ~70 Mb/d of refining capacity offline, including downtime for planned and unplanned maintenance. EDA expects gross crude inputs into refineries to increase by ~20 Mb/d W-o-W, coming in at 16.8 MMb/d.

Vessel traffic monitored by EDA along the Gulf Coast increased W-o-W. There were 23 vessels loaded for the week ending August 30 and 21 the prior week. EDA expects US exports to be 3.50 MMb/d.

The SPR awarded contracts for 3.25 MMbbl to be delivered in August 2024. The SPR has 379 MMbbl in storage as of August 30, 2024.

Regulatory and Tariffs:

Presented by ARBO

Tariffs:

The DC Circuit Court ruled in favor of a legal challenge by the Liquid Energy Pipeline Association (LEPA) that FERC failed to comply with the APA when it modified the Index in the 2022 Rehearing Order without adhering to notice and comment procedures. As a result, the court vacated the Rehearing and modified Index.

The following Pipelines have increased indexed rates to the revised ceiling levels that will be effective when the official mandate is issued: Buckeye Pipe Line Transportation LLC, NuStar Pipeline Operating Partnership L.P., Sunoco Pipeline L.P., NuStar Logistics, L.P., ETP Crude LLC, Sorrento Pipeline Company, LLC, Baton Rouge Pipeline LLC, Permian Express Partners LLC, Marketlink, LLC, TransCanada Keystone Pipeline, LP, Centurion Pipeline L.P., West Texas Gulf Pipeline Company LLC, White Cliffs Pipeline, Enable Bakken Crude Services, LLC, Dakota Access, LLC, Mid Valley Pipeline Company LLC, Energy Transfer Crude Oil Company, Bayou Bridge Pipeline, LLC and ET-S Permian Pipeline Company LLC.

The above information is provided by ARBO’s Oil Pipeline Tariff Monitor. For more information on regulatory proceedings or tariff rates, please contact please contact Corey Brill via email at [email protected] or phone at 202-505-5296. https://www.goarbo.com/