Executive Summary: Rigs: The total rig count decreased by 2 for the August 25 week, down to 566 from 568. Infrastructure: Permian Basin oil production is primed to pop along with natural gas in 4Q24 when WhiteWater Midstream’s Matterhorn Express Pipeline comes online. Storage: East Daley expects a 368 Mbbl withdrawal in commercial and Strategic Petroleum Reserve (SPR) inventories for the week ending September 11.

Rigs:

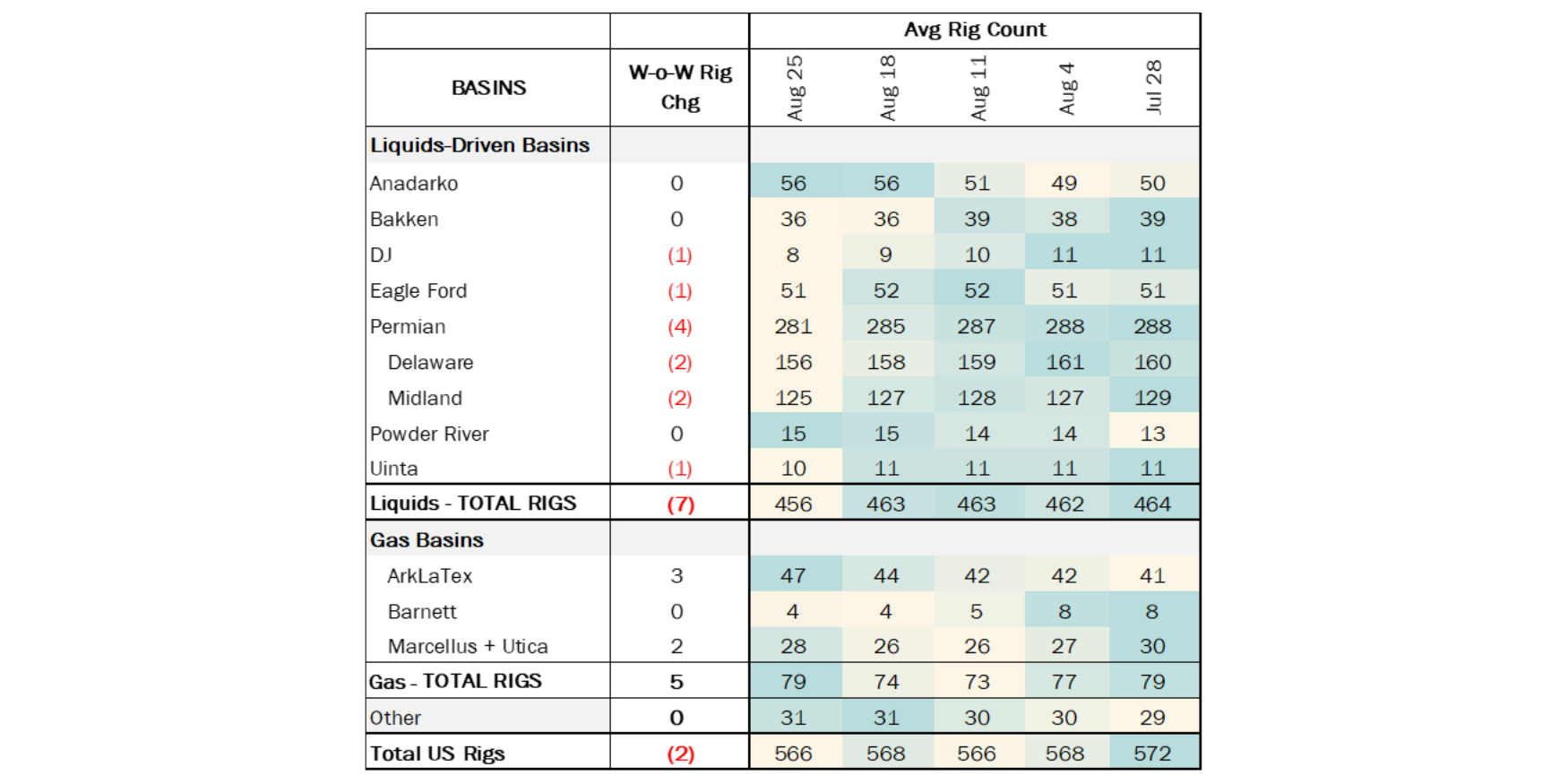

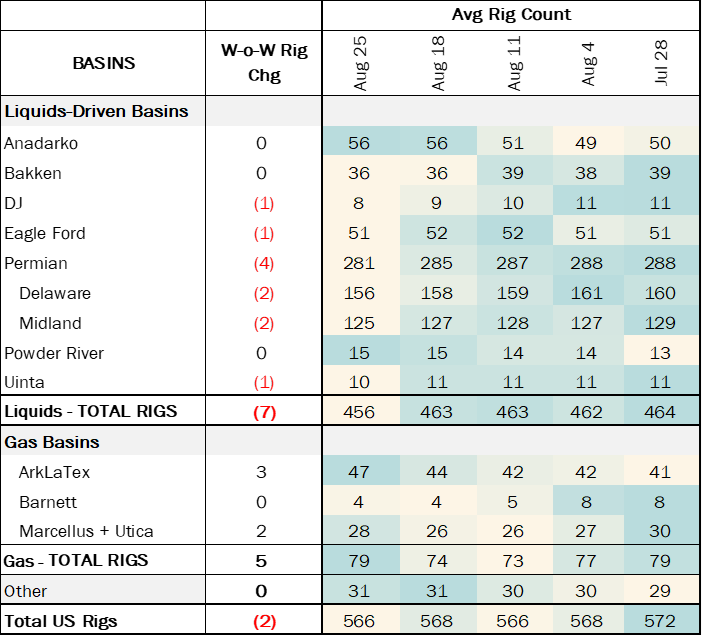

The total rig count decreased by 2 for the August 25 week, down to 566 from 568. Liquids-driven basins decreased by 7 rigs, moving the count from 463 to 456. The DJ, Eagle Ford and Uinta basins each lost 1 rig whereas the Permian Basin saw a decrease of 4 rigs. Rig counts for the Bakken, Powder River and Anadarko basins remained flat.

In the DJ Basin, operator GMT Exploration dropped 1 rig. In the Eagle Ford, Kimmeridge Texas Gas shed 1 rig. In the Delaware, operators Mewbourne Oil and Permian Oilfield Partners each removed 1 rig. In the Midland, Occidental Petroleum and Browning Oil each dropped 1 rig, and in the Uinta basin, Contango Operators removed 1 rig.

Infrastructure:

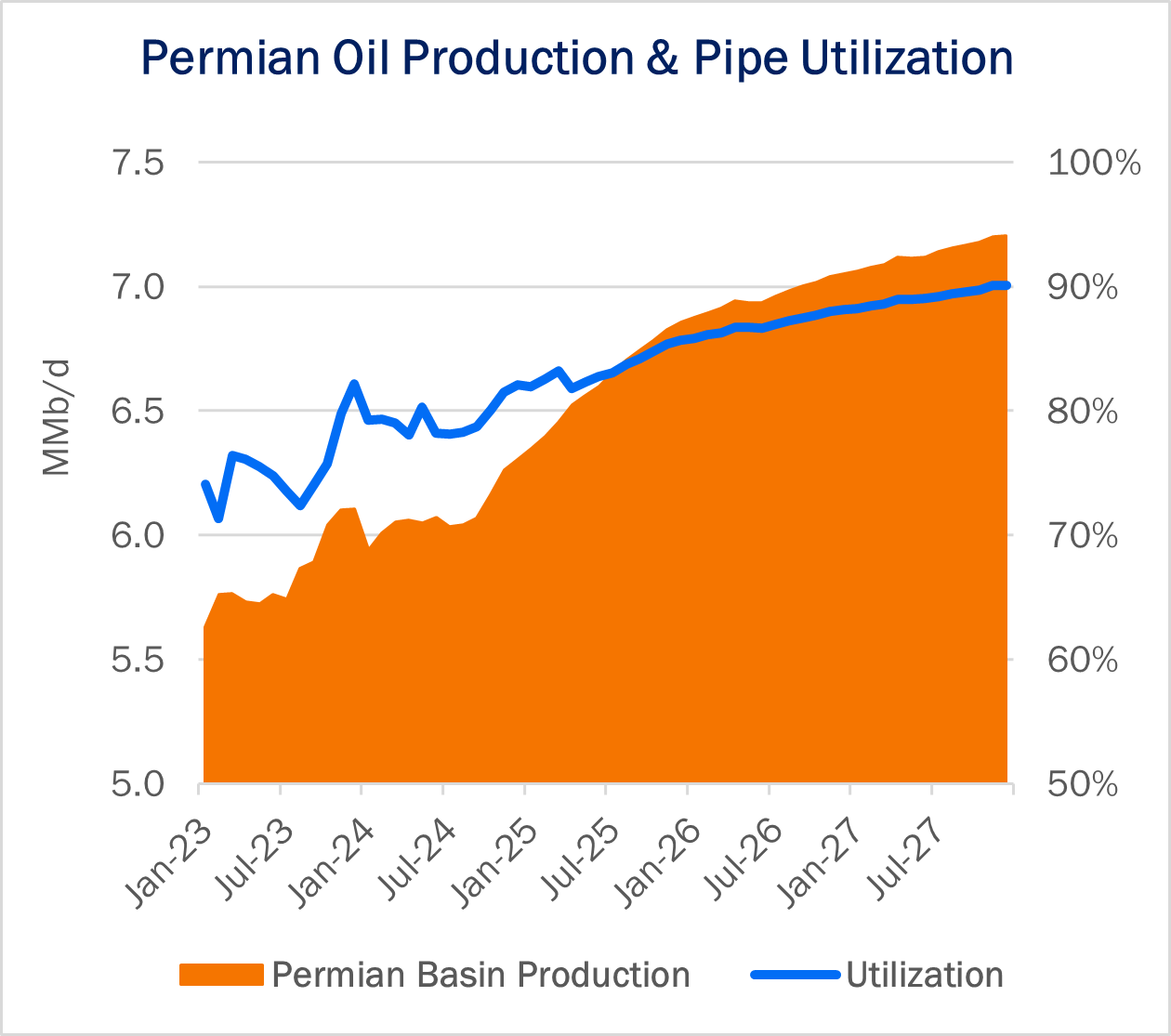

Permian Basin oil production is primed to pop along with natural gas in 4Q24 when WhiteWater Midstream’s Matterhorn Express Pipeline comes online. East Daley expects Matterhorn to begin operations from September 15 – October 1, allowing crude oil to grow in tandem with gas and contributing new business for pipelines.

Reuters reports Matterhorn has started taking small quantities of gas, consistent with pressure-testing work performed in the late stages of pipeline construction. Gulf Companies, the contractor responsible for building Matterhorn, completed the pipeline’s “golden weld” on August 26, according to a company posting on LinkedIn. The golden weld marks the completion of physical pipeline construction. Matterhorn will add 2.5 Bcf/d of capacity from the Waha hub to Katy, TX.

East Daley’s Permian Basin Production Model forecasts crude oil to grow 2.3% in 4Q24, adding 144 Mb/d of production. October will mark the first month that Permian oil production exceeds the recent high of 6.1 MMb/d set in December ’23, according to the model. On the gas side, we expect Permian production to exit 2024 ~7% higher, or a gain of 1.73 Bcf/d exit-to-exit.

Looking ahead to 2025, we forecast Permian oil production grows 8.7% (533 Mb/d) on average from 2024. The growth leads to higher utilization rates for crude oil pipelines exiting the basin. Oil pipeline egress grows from ~75% utilized in 2023 to 79% and 83% utilization in 2024 and 2025, according to the Crude Hub Model.

Routes to export terminals in Corpus Christi continue to see the highest utilization, rising from 88% in 2023 to 93% in 2025. By mid-year 2025, Houston and Nederland export ports catch up to Corpus Christi as Enterprise Products’ (EPD) Midland-to-Echo pipelines and Energy Transfer’s (ET) Permian Express to Nederland reach 93% utilization.

Two pipeline expansions are planned in 2025 to keep the oil moving. Enbridge (ENB) will increase volumes by 120 Mb/d on Gray Oak to 1.02 MMb/d of capacity, and EPD will return Midland-to-Echo II back to crude service during 2H25, adding another 200 Mb/d of space. But even with this added egress the Permian continues to be tight. YE25 sees total pipeline egress at 86% with Corpus Christi egress returning to 93% and Nederland pipes rising to 92% utilization. Price volatility is more likely with utilization this tight, as any small market event can causing waves through the market.

Storage:

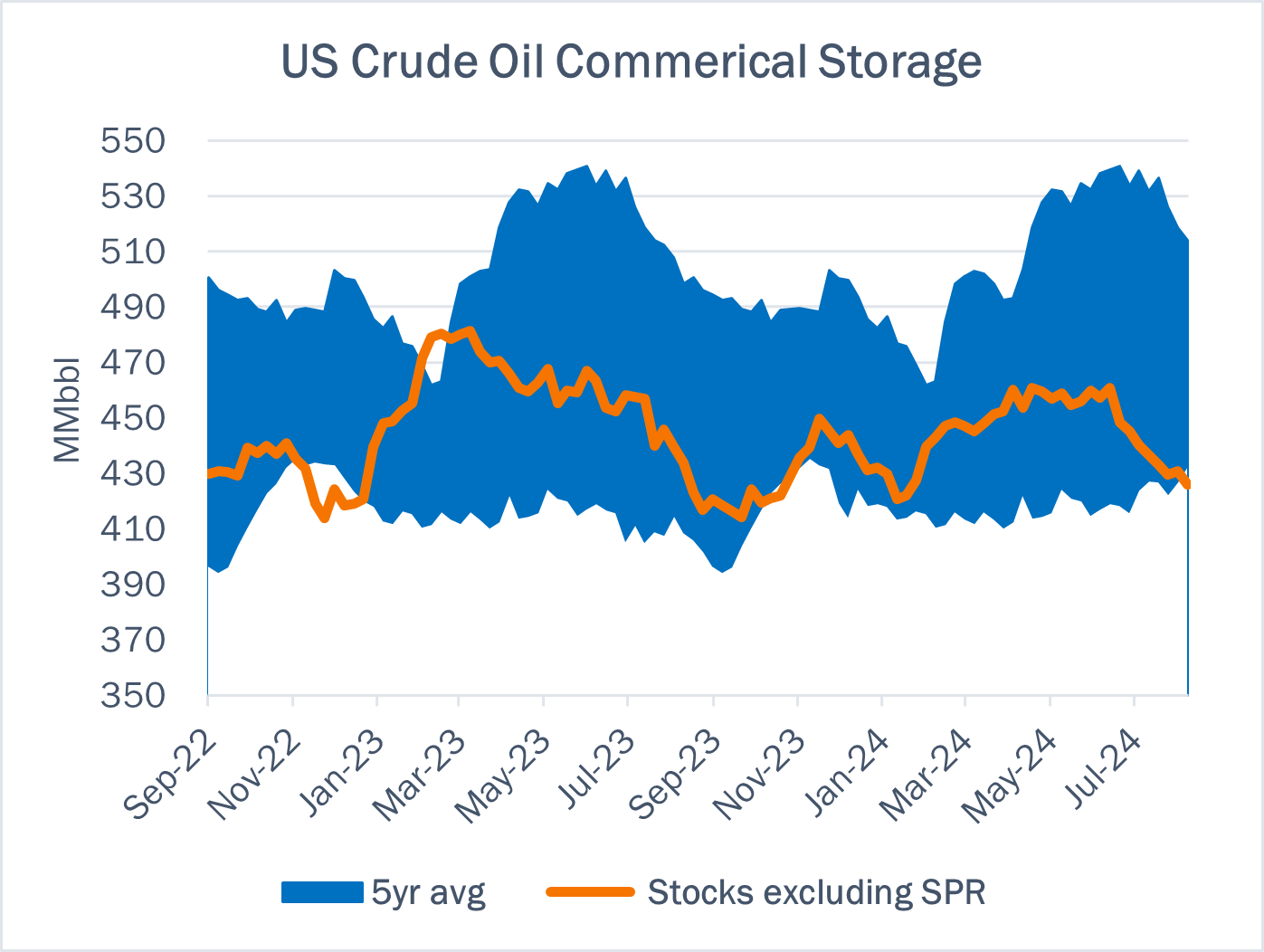

East Daley expects a 368 Mbbl withdrawal in commercial and Strategic Petroleum Reserve (SPR) inventories for the week ending September 11. We expect total US stocks, including the SPR, will close at 792 MMbbl.

The US natural gas pipeline sample, a proxy for change in oil production, increased 1.1% W-o-W across all liquids-focused basins. Samples increased 3.20% in the Gulf of Mexico, 1.69% in the Williston, and 1.3% in the Rockies. The increase was offset by samples decreasing 3.1% in the Eagle Ford. The Gulf of Mexico and Williston Basin have a high correlation between gas volumes and crude oil volumes, whereas the Permian and Eagle Ford correlation is less than 45%. We expect US crude production to remain flat at 13.3 MMb/d.

According to US bill of lading data, US crude imports increased by 769 Mb/d W-o-W to 6.56 MMb/d. More than 60% of the supply originated from Canadian pipelines into the US, with the remainder largely coming from ships carrying crude from Mexico, Venezuela and Argentina.

As of August 30, there was ~71 Mb/d of refining capacity offline, including downtime for planned and unplanned maintenance. EDA expects gross crude inputs into refineries to decrease by ~140 Mb/d W-o-W, coming in at 16.8 MMb/d.

Vessel traffic monitored by EDA along the Gulf Coast decreased W-o-W. There were 22 vessels loaded for the week ending September 11 and 23 the prior week. EDA expects US exports to be 3.84 MMb/d.

The SPR awarded contracts for 2.77 MMbbl to be delivered in September 2024. The SPR has 377 MMbbl in storage as of September 11, 2024.

Regulatory and Tariffs:

Presented by ARBO

Tariffs:

Enbridge Pipelines (FSP) LLC The additional rate for volumes tendered at the Sour Lake interconnect facility increased in accordance with the index rate increases applicable to the local rates. FERC No 7.36.0 IS24- 712 (filed Aug 16, 2024) Effective September 16, 2024.

TransCanada Keystone Pipeline, LP The high-viscosity charge was canceled as it is no longer needed based on the pipeline receipts. A high-viscosity penalty was added for crude petroleum in excess of 8 centistokes at 60 degrees F to limit high-viscosity crude from entering the pipeline’s common stream, slowing the flow rate and reducing capacity. FERC No 2.17.0 IS24- 667 (filed July 31, 2024) Effective September 1, 2024.

The above information is provided by ARBO’s Oil Pipeline Tariff Monitor. For more information on regulatory proceedings or tariff rates, please contact please contact Corey Brill via email at [email protected] or phone at 202-505-5296. https://www.goarbo.com/