Flows – According to East Daley’s ArkLaTex Basin forecast, production in the Haynesville declined from 16.1 Bcf/d in 1Q24 to just 14.5 Bcf/d in 4Q24. Weak gas prices, steep rig cuts and deferred well completions have led to lower volumes from the largest producers. However, with prices looking stronger in 2025 and 2026, we expect that trend to reverse.

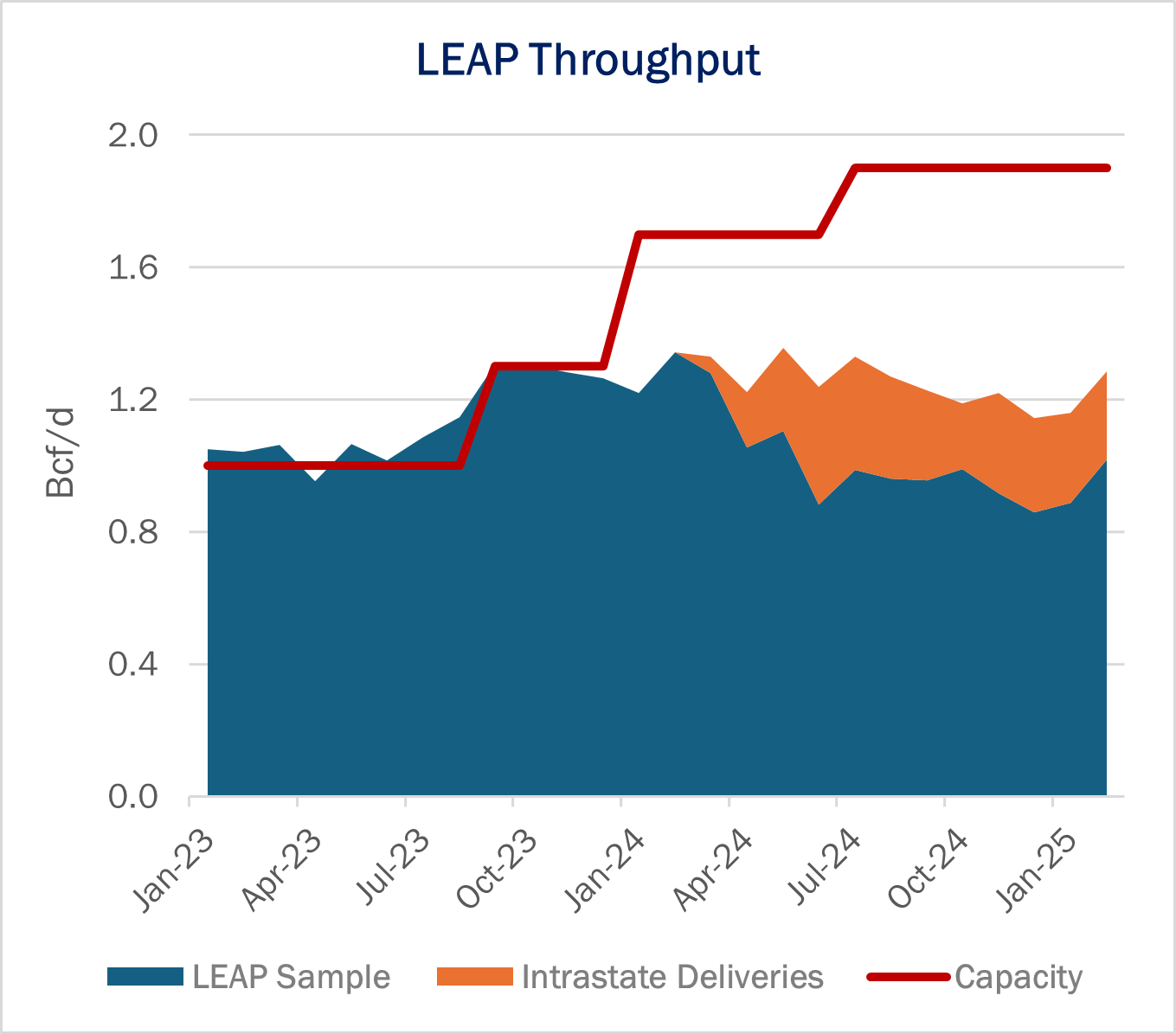

Volumes on DT Midstream’s (DTM) Louisiana Energy Access Pipeline (LEAP) are ticking up in February after a down 4Q in 2024. Last week, the LEAP gas sample averaged over 1.2 Bcf/d for the first time since March ’24. For the month, the LEAP sample has averaged over 1 Bcf/d in February. However, East Daley estimates that volumes are ~300 MMcf/d higher than the sample indicates due to LEAP’s interconnect with TC Energy’s (TRP) intrastate pipeline at Gillis, LA.

TRP started the 1.5 Bcf/d Gillis Access project in March ’24, and shortly afterward saw an influx of volumes from LEAP that had previously supplied the Texas Eastern system (TETCO). LEAP has a 1.0 Bcf/d interconnect with Gillis Access and is currently the only supplier to the pipe.

Currently, Gillis Access ships volumes from LEAP to TRP’s other Louisiana interstate systems, mostly to ANR Pipeline, but the line also connects with Columbia Gulf. We expect this supply chain eventually will allow Plaquemines LNG to source Haynesville gas from DTM via Columbia Gulf’s East Lateral Xpress expansion.

Infrastructure – President Trump has ordered a new 25% tariff on steel imports that could raise costs for some pipeline projects, though East Daley expects the effects will be offset by stockpiles from canceled projects.

On February 11, President Trump issued an executive order eliminating exemptions from a 25% tariff for steel and aluminum imports, effective March 12, 2025. Currently, many of the US’ largest trade partners in steel receive exemptions from the tariff, including Canada, Mexico, Brazil, South Korea and Germany. The US is one of the top five producers of steel in the world.

The tariff could raise capital costs for pipeline expansions using foreign steel. Midstream companies have commercialized multiple projects in recent months, especially in the Southeast where LNG exports, utility expansions, and developing data center markets are competing for gas molecules. These projects will need steel pipe, in some cases hundreds of miles of it.

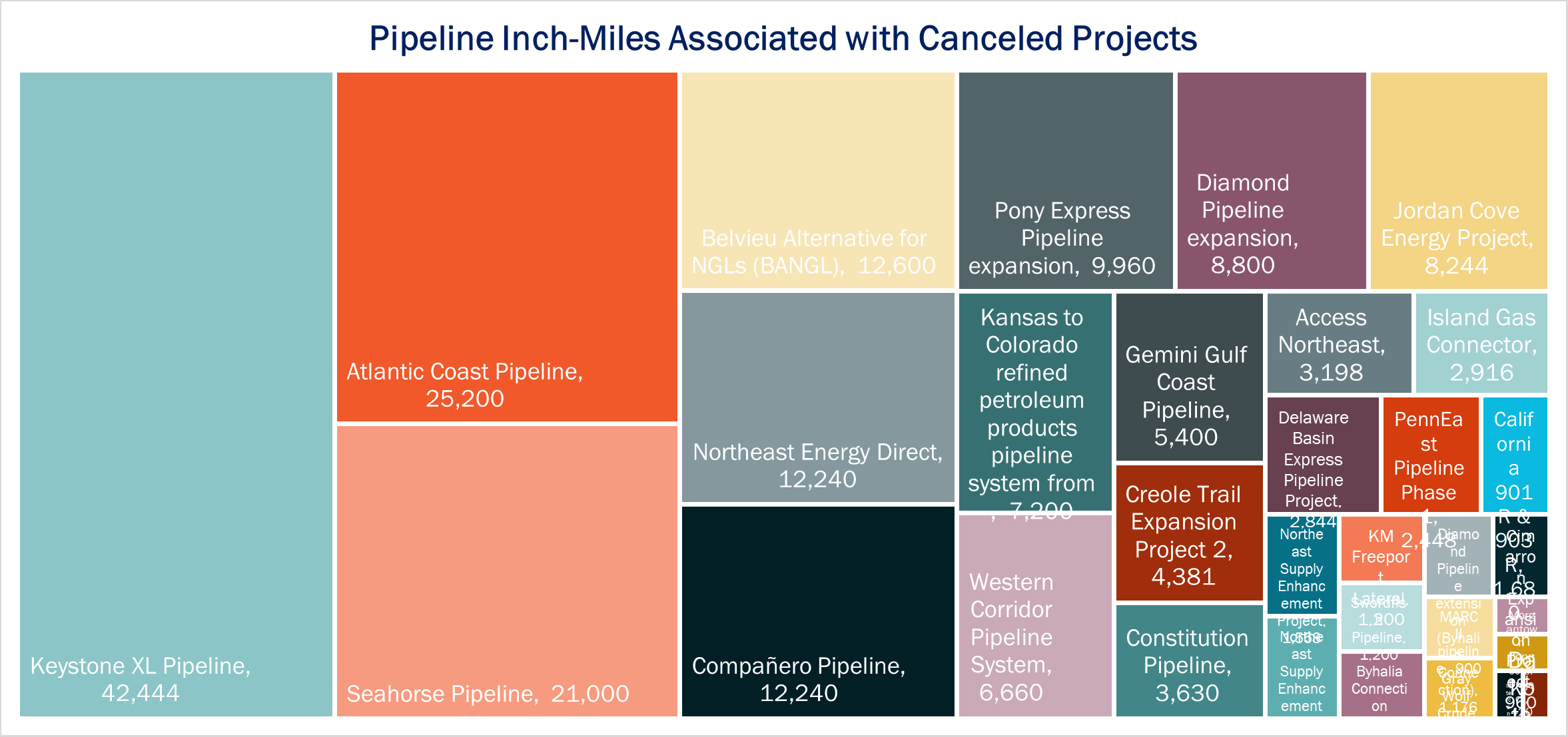

East Daley Analytics expects a stockpile of steel amassed over the past 5-7 years will dampen the effects of the tariff. We analyzed the Energy Information Administration’s gas and liquids project data set and estimate ~205,000 inch-miles of pipeline associated with 35 recently canceled projects (an inch-mile is the # of pipe miles multiplied by the pipeline diameter). These projects are listed in the figure below.

The Keystone XL project stands out on our list with ~42,000 inch-miles, from a planned 1,179 miles of 36-inch pipeline. Notably, South Bow (SOBO), the oil pipeline spinoff of TC Energy (TRP), has repurposed some of the pipeline from the canceled Keystone project, recently reaching an agreement to sell 180 miles of pipe to Cadiz Inc. for a groundwater project.

The 35 projects we identified could provide some reprieve from the steel tariff, assuming developers ordered pipeline ahead. But in the long term, tariffs will raise costs and make the economics of new projects more challenging.

Headwinds from higher material costs would mix with the tailwinds EDA is observing in increased rates. We are seeing lower build multiples and higher shipping rates for recent utility-backed projects, including the Southeast Supply Enhancement on Williams’ (WMB) Transcontinental pipeline and the South System Expansion 4 on Kinder Morgan’s (KMI) Southern Natural system.

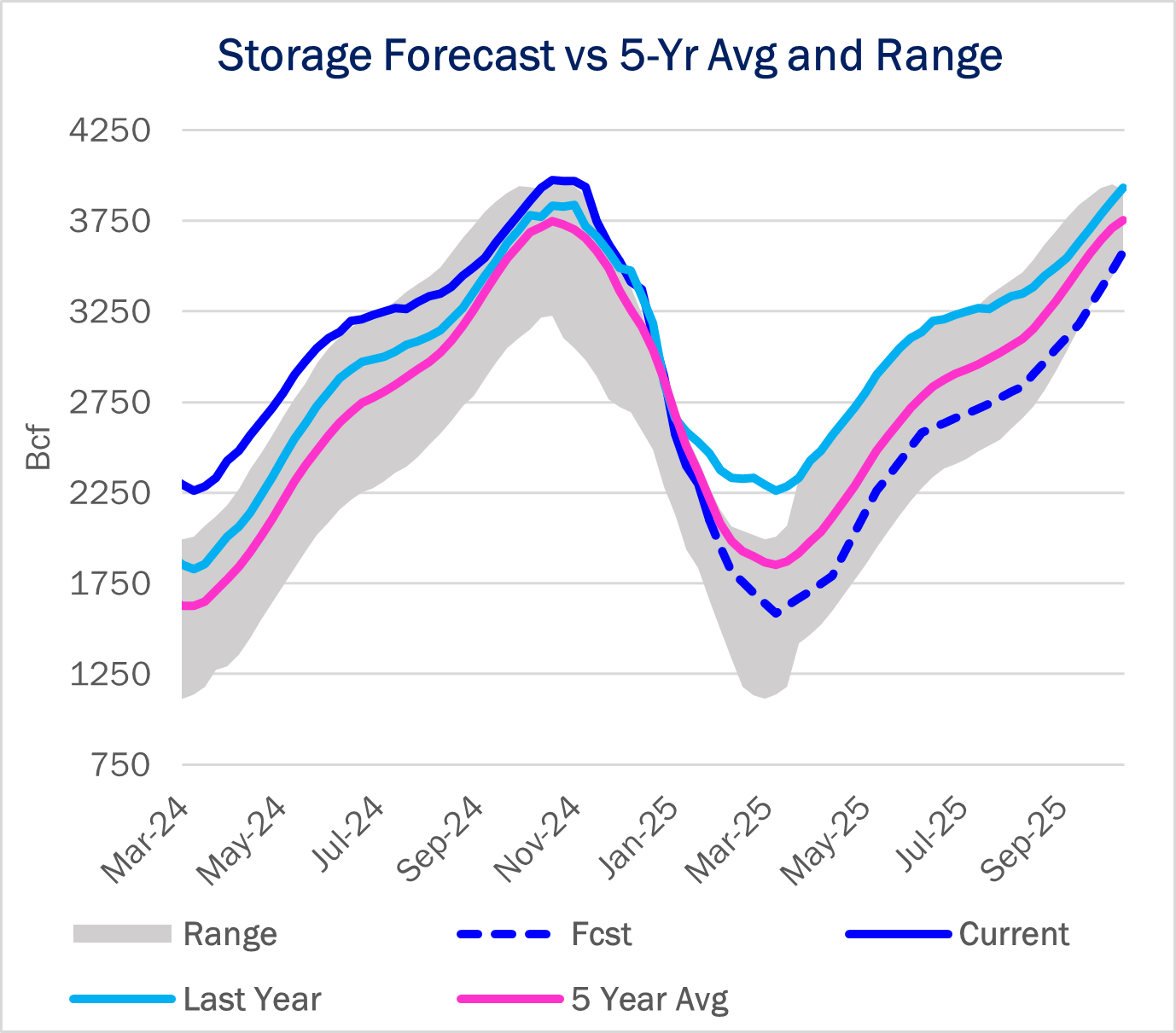

Storage – Traders and analysts expect the Energy Information Administration (EIA) to report a 266 Bcf storage withdrawal for the week ending February 21. A 266 Bcf withdrawal would be a whopping 125 Bcf greater than the 5-year average and would significantly increase the deficit to 243 Bcf. The storage deficit to last year would balloon to 566 Bcf from the current 386 Bcf deficit.

The April ‘25 prompt month has traded in the low-$4.00/MMBtu territory since mid-February. The contract peaked on February 20 at $4.35 and traded early this week around $4.15/MMBtu confirming that we are locked in deficit conditions for the foreseeable future.

In the latest Macro Supply & Demand Report, East Daley predicts Henry Hub cash will average $4.25/MMBtu in March and $4.21 in April ‘25. Generally speaking, we forecast tighter market conditions for the balance of the shoulder season as more non-intermittent LNG feedgas demand takes on a larger share of overall gas demand. Plaquemines LNG has recently taken up to 1.8 Bcf/d off the grid, about 0.5 Bcf/d higher than deliveries last month. Higher prices will support a measured production response from operators, who are expected to increase production from 104.1 Bcf/d this month to 104.6 Bcf/d by the end of April.

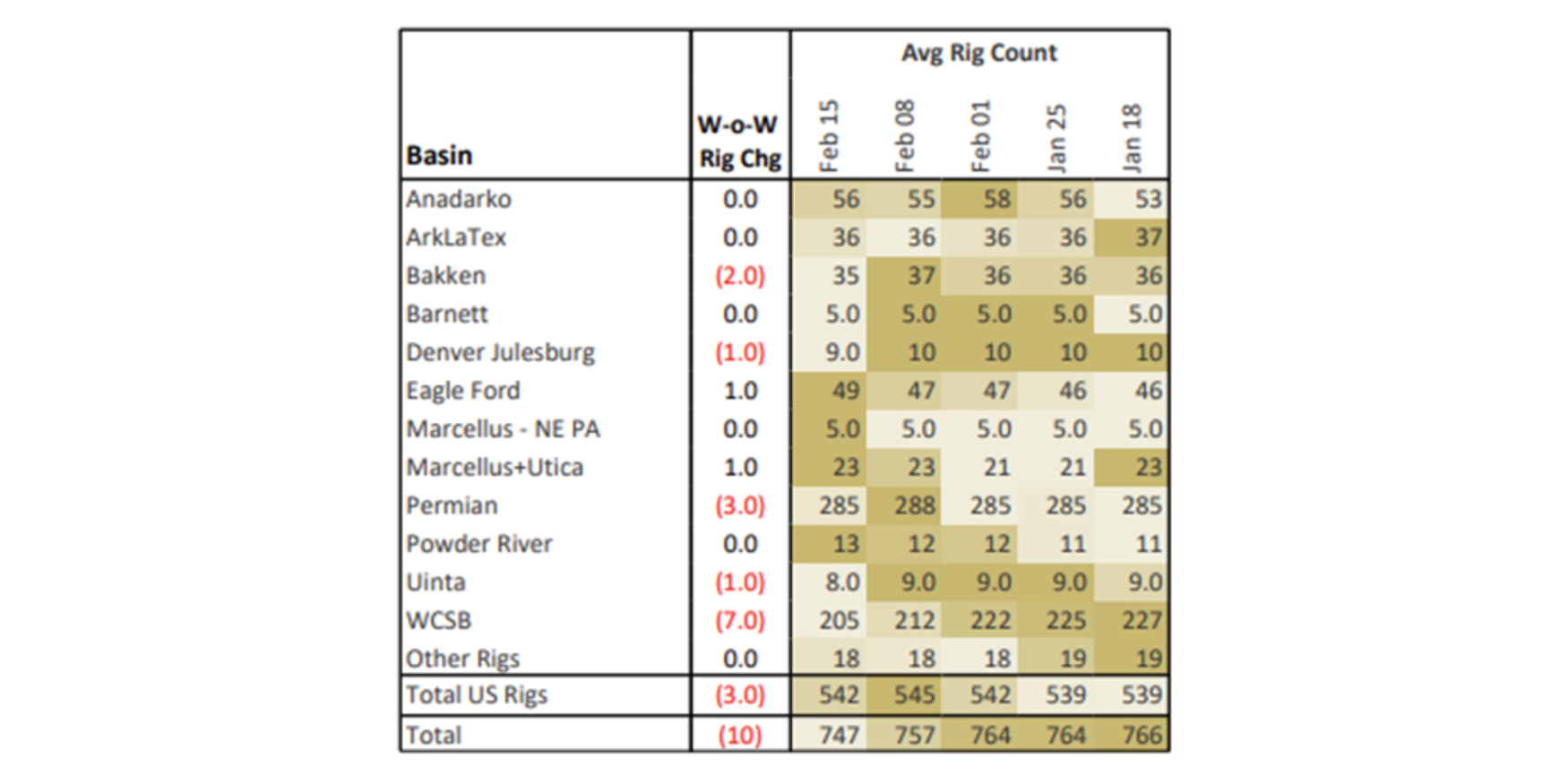

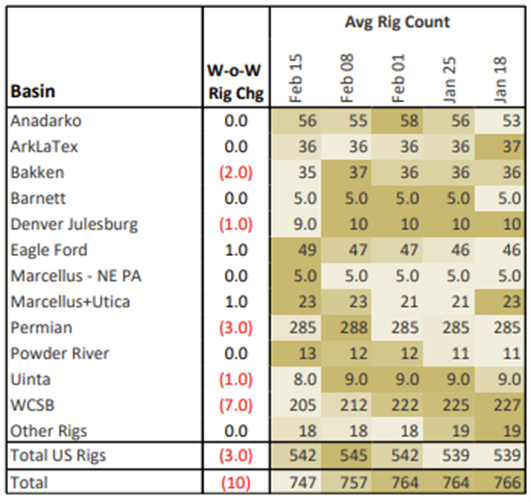

Rigs – The US rig count decreased by 3 for the February 15 week, standing at 542 rigs. Basins losing rigs include the Permian (-3), Bakken (-2), DJ (-1) and Uinta (-1). The Marcellus + Utica and Eagle Ford each added 1 rig on the week.

On the midstream side, Targa Resources (TRGP) is up 2 rigs net with additions on all its Delaware systems. Kinder Morgan (KMI) lost 3 rigs total on its Eagle Ford and Uinta systems.

East Daley’s weekly Rig Activity Tracker monitors rig activity by basin and by gathering and processing (G&P) system to better understand midstream impacts. We allocate rigs and monitor flows through 150+ public and privately owned G&P systems in every North American basin. Reach out for more information on the Rig Activity Tracker.

The Daley Note

Subscribe to East Daley’s The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices, and EDA research likely to affect markets in the short term.