Executive Summary:

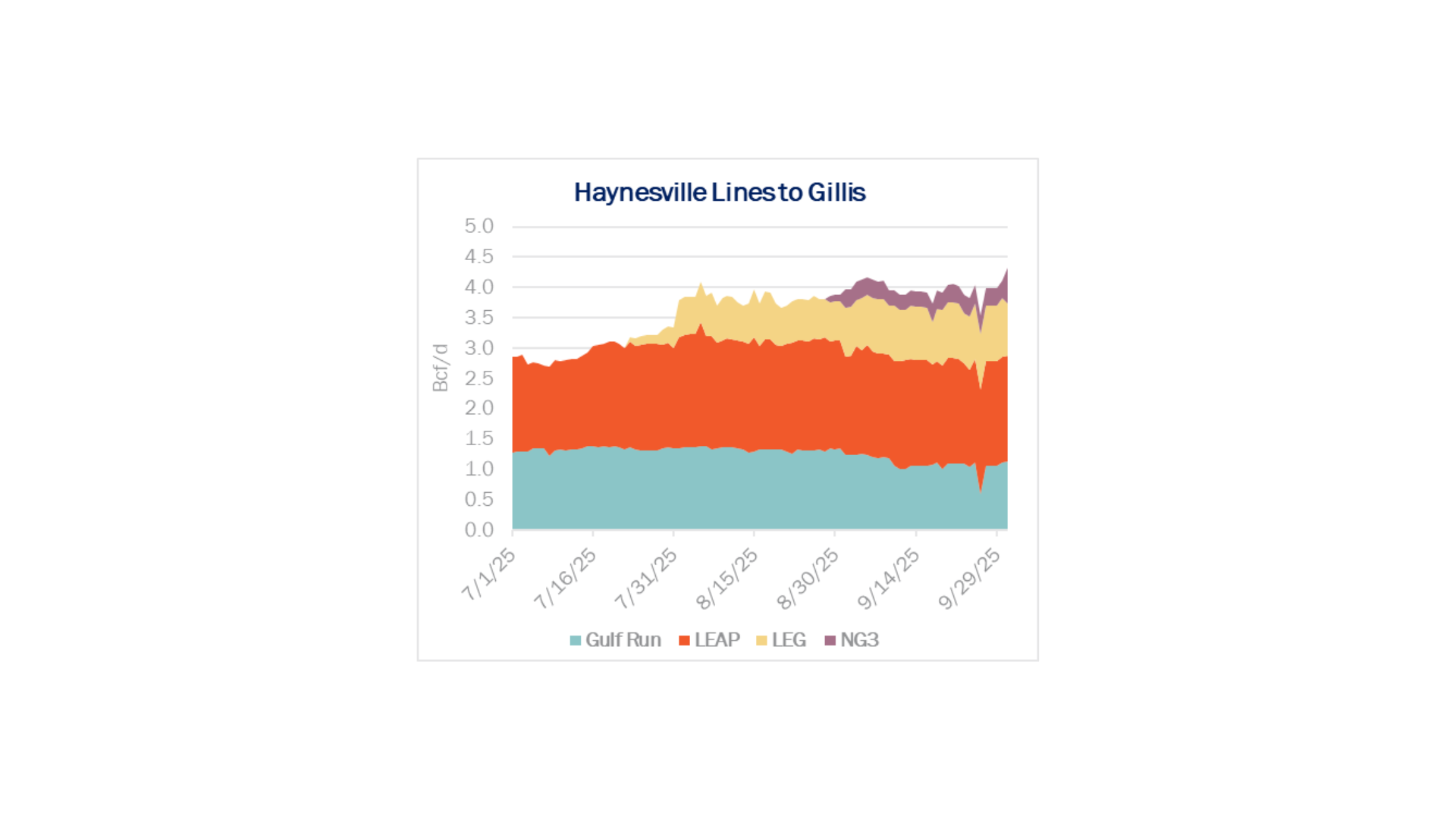

Infrastructure: Momentum Midstream’s NG3 pipeline began service on Oct. 1, flowing over 0.5 Bcf/d on the first day.

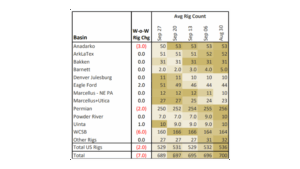

Rigs: The US lost 2 rigs for the week of Sept. 27, bringing the total rig count to 529.

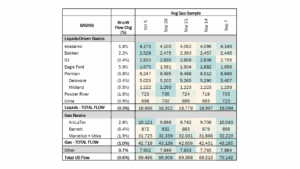

Flows: US natural gas volumes averaged 69.9 Bcf/d in pipeline samples for the week ending Sept. 28, up 0.8% W-o-W.

Storage: US natural gas volumes averaged 69.5 Bcf/d in pipeline samples for the week ending Oct. 5, down 0.6% W-o-W.

Infrastructure:

Momentum Midstream’s New Generation Gas Gathering (NG3) pipeline officially started service on Oct. 1, flowing over 0.5 Bcf/d on the first day. The line adds another 1.7 Bcf/d of capacity and brings total Louisiana Haynesville southbound egress to 9.5 Bcf/d.

East Daley Analytics observes NG3 interconnects with TC Louisiana Intrastate and Transcontinental pipeline (Transco), with more likely to pop up soon. The pipeline had been nominating 250-300 MMcf/d into Transco in September during commissioning, according to the Transco bulletin board, but shippers told East Daley that NG3 formally began service at the start of October.

Momentum has a large gathering footprint and has acquired several smaller systems in recent years, namely Align Midstream and Clearfork Midstream. Major producers on those systems include Aethon, EXCO Resources, and TG Natural Resources.

Clearfork Midstream operates two non-contiguous gathering systems in the Haynesville. The Holly system in Louisiana sits in the center of the high-producing core acreage, gathering nearly 0.5 Bcf/d for major producers like Expand Energy (EXE), Comstock Resources (CRK) and Exco Resources. Aethon also produces on the Holly system from legacy Tellurian assets acquired in 2024. East Daley forecasts Clearfork system volumes to grow to over 900 MMcf/d by YE28, supported by LNG demand growth at the Gillis hub.

The chart below shows all four major Haynesville egress pipes to Gillis. Williams’ (WMB) Louisiana Energy Gateway (LEG) has ramped quickly to over 0.85 Bcf/d on average in September, and DT Midstream’s (DTM) LEAP is running nearly full at 1.9 Bcf/d capacity. DTM expects to put the Phase 4 expansion (+0.2 Bcf/d) into service ahead of schedule in early 2026. Gulf Run’s Zone 2 line is running under capacity and has actually seen a slight reduction in flows as volumes begin to fill new pipes. However, we expect that volumes will rapidly increase once Golden Pass LNG turns online; Golden Pass holds 1.1 Bcf/d of capacity on Gulf Run.

EXE also owns a 35% equity stake and signed on as an anchor shipper for NG3. Speaking at the Pickering Energy Partners Conference in Austin on Sept. 30, EXE CEO Nick Dell’Osso said that most of the capacity coming online into Gillis would be fed by Louisiana acreage.

We recently noted that total ArkLaTex rigs have climbed to 55. Most of the year that count was skewed towards East Texas, where exploratory drilling is building a sizable inventory of deferred production, although recent rig adds have been concentrated in Louisiana. Either way, Momentum is well positioned to take advantage of 5 Bcf/d of forecasted Y-o-Y growth out of the ArkLaTex.

For a closer look at the Gillis supply and demand outlook, see East Daley’s Southeast Gulf S&D Report.

Rigs:

The US lost 2 rigs for the week of Sept. 27, bringing the total rig count to 529. The Anadarko (-3) and Permian (-2) lost rigs while the Eagle Ford (+2) and Uinta (+1) gained rigs W-o-W.

At the company level, PSX (-4), Iron Horse Midstream (-2), ET (-1), MPLX (-1), WES (-1), OKE (-1), XTO Energy (-1), Hess (-1) and Vaquero (-1) lost rigs while ENLC (+5), TRGP (+1), KMI (+1), Salt Creek Midstream (+1), and San Mateo Midstream (+1) gained rigs W-o-W.

See East Daley Analytics’ weekly Rig Activity Tracker for more information on rigs by basin and company.

Flows:

US natural gas volumes averaged 69.5 Bcf/d in pipeline samples for the week ending Oct. 5, down 0.6% W-o-W.

Major gas basin samples decreased 1.0% W-o-W to 42.7 Bcf/d. The Haynesville sample increased 2.6% to 10.1 Bcf/d, while the Marcellus+Utica sample declined 1.9% to 31.7 Bcf/d.

Samples in liquids-focused basins declined 0.3% W-o-W to 18.9 Bcf/d. The Permian sample fell 3.8% to 6.2 Bcf/d, while the Eagle Ford sample rose 5.9%.

Storage:

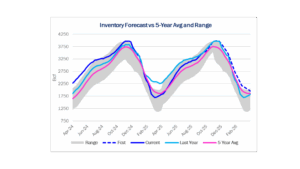

Traders and analysts expect the Energy Information Administration (EIA) to report a net injection of 75 Bcf for the week ending Oct. 3.

A 75 Bcf injection would decrease the surplus to the five-year average by 19 Bcf to 152 Bcf. This would mark the second week in a row that the surplus drops – it was above 200 Bcf just two weeks ago. The storage surplus to last year would fall by 3 Bcf to 18 Bcf.

Storage levels are on track to end at 3,603 Bcf for the month of September. Over the course of October, East Daley expects inventories to finish the formal injection season at 3,937 Bcf, which means injections would average 83.5 Bcf over the next four weeks. The five-year average injection over this same time period is 67.3 Bcf/week. Last year’s injection pace for the last four weeks of the season averaged 75 Bcf/week.

With five weeks left in the official injection season, inventory levels are on track to pass 3,900 Bcf. Should injections match the 5-year average for the next five weeks, stocks would reach 3,936 Bcf by the end of October, or just 5 Bcf above last year’s levels.

See the latest Macro Supply & Demand Report for more analysis on storage and the winter market outlook.

Calendar:

Subscribe to East Daley’s The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices, and EDA research likely to affect markets in the short term.