Executive Summary:

Infrastructure: The North Dakota Industrial Commission is backing a pipeline expansion from the Bakken planned by WBI Energy.

Rigs: The US lost 6 rigs for the week of Aug. 30, bringing the total rig count to 526.

Flows: US natural gas volumes averaged 70.1 Bcf/d in pipeline samples for the week ending Sept. 7, down 0.4% W-o-W.

Storage: Traders expect the EIA to report a 70 Bcf injection for the week ending Sept. 5.

Infrastructure:

A North Dakota government agency is backing a pipeline expansion planned by WBI Energy, raising the odds of new gas infrastructure from the Bakken.

On Aug. 21, the North Dakota Industrial Commission (NDIC) announced it will support WBI Energy Transmission’s new Bakken East project. While the commission isn’t funding the project directly, it has directed the head of the North Dakota Pipeline Authority to begin contract discussions to purchase capacity on the line. The NDIC is authorized to appropriate up to $100MM every two years to fund pipeline projects in this manner.

WBI held an open season soliciting bids for the 375-mile greenfield project that concluded on Jan. 31. Originally, WBI proposed a pipeline with 750 MMcf/d of capacity, but the North Dakota Monitor reports that Bakken East will be capable of transporting up to 1.0 Bcf/d and that WBI added a new southern lateral to the scope. Financing could be as much as $50MM for 10 years, the paper reports, or a guarantee of up to $500MM.

The award represents a major win for WBI. As covered by East Daley Analytics in May, WBI is competing with a second pipeline proposal to move Bakken gas to eastern North Dakota. Intensity Infrastructure Partners also has proposed a pipeline spanning the state, and held an open season for the project earlier this year. Both WBI and Intensity submitted competing proposals to NDIC in July, the North Dakota Monitor reports. The decision to back WBI’s project serves as a setback for Intensity.

East Daley has not identified any demand sources in the eastern part of the state significant enough to justify the construction of a pipeline of this size, suggesting that both proposals would serve as supply push pipelines that could incentivize industrial growth and act as a relief valve allowing for more Bakken production growth. This makes it unlikely that both projects will be able to achieve FID without a large player entering the conversation, and Intensity may see its project unable to move forward

Rigs:

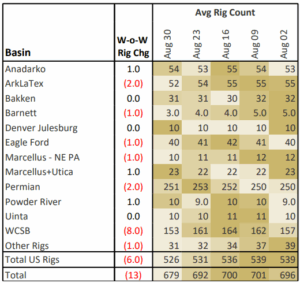

The US lost 6 rigs for the week of Aug. 30, bringing the total rig count to 526. The Anadarko (+1), Marcellus+Utica (+1) and Powder River (+1) gained rigs and the ArkLaTex (-2), Permian (-2), Barnett (-1), Eagle Ford (-1) and Marcellus – NE PA (-1) lost rigs W-o-W.

At the company level, OKE and ENLC (+4), WES (+3), EPD (+2), KNTK (+1), XTO Energy (+1) and Aethon Energy (+1) gained rigs and TRGP (-6), ET (-5), PSX (-1), MPLX (-1), KMI (-1), WMB (-1), Comstock Oil & Gas (-1) and XOM (-1) lost rigs W-o-W.

See East Daley Analytics’ weekly Rig Activity Tracker for more information on rigs by basin and company.

Flows:

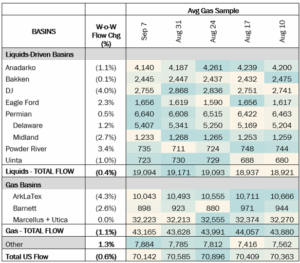

US natural gas volumes averaged 70.1 Bcf/d in pipeline samples for the week ending Sept. 7, down 0.6% W-o-W.

Major gas basin samples declined 1.1% W-o-W to 43.1 Bcf/d. The Haynesville sample decreased 4.3% to 10.0 Bcf/d, and the Marcellus+Utica sample held steady at 32.2 Bcf/d.

Samples in liquids-focused basins declined 0.4% W-o-W to 19.1 Bcf/d. The Eagle Ford sample rose 2.3% to 1.7 Bcf/d, while the DJ sample declined 4.0%.

Storage:

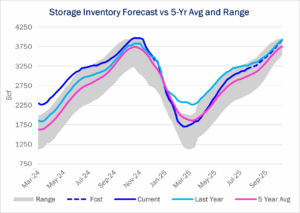

Traders and analysts expect the Energy Information Administration (EIA) to report a 70 Bcf net injection for the week ending Sept. 5. A 70 Bcf injection would increase the surplus to the five-year average by 14 Bcf to 187 Bcf. The storage deficit to last year would fall to just 39 Bcf from 73 Bcf the prior week.

Despite inventories rapidly approaching last year’s levels, prices remain high. Henry Hub cash prices have spent the week above $3.10/MMBtu vs $2.16 last year for the second week of September. This supports the Henry Hub “island” theory, which posits that prices can stay high around the Hub due to rising demand, mainly from LNG facilities in Louisiana. This phenomenon is also playing out in the forward curve, with the prompt month up about $.06 since the beginning of the month to $3.02/MMBtu. Forward weather indicates mid-September will be quite hot and supportive of $3.00+ prices.

See the latest Macro Supply & Demand Report for more analysis on the storage outlook.

Calendar:

Subscribe to East Daley’s The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices, and EDA research likely to affect markets in the short term.