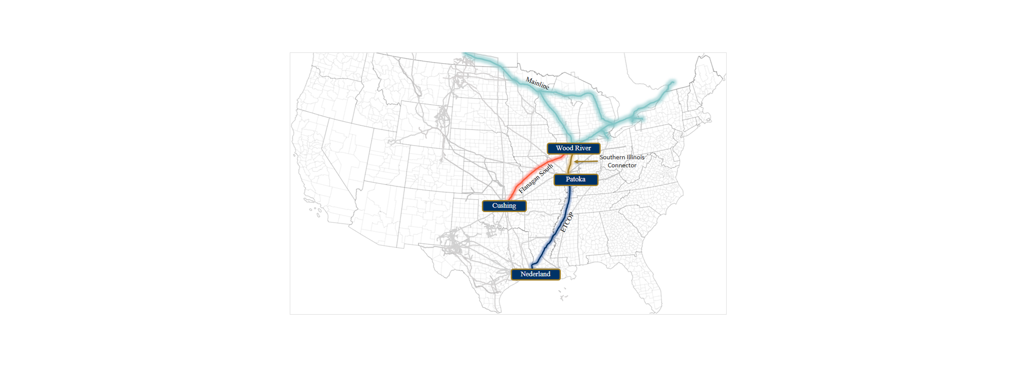

The Energy Transfer Crude Oil Pipeline (ETCOP) is poised for increased volumes as Enbridge (ENB) and Energy Transfer (ET) close out an open season for the Southern Illinois Connector Pipeline. The project would create a direct path to ship Canadian crude oil from ENB’s Mainline in Wood River, IL into ETCOP at the Patoka hub and on to the Gulf Coast.

Southbound takeaway from Patoka is becoming congested as rising Canadian supply pushes the Flanagan South line – recently expanded to 720 Mb/d – toward full utilization. The Southern Illinois Connector would absorb this overflow and reroute volumes to ETCOP, which is only ~46% utilized, according to East Daley Analytics’ Crude Hub Model. The open season ran from June 18 to July 18, 2025 and offered up to 200 Mb/d of capacity.

Southbound takeaway from Patoka is becoming congested as rising Canadian supply pushes the Flanagan South line – recently expanded to 720 Mb/d – toward full utilization. The Southern Illinois Connector would absorb this overflow and reroute volumes to ETCOP, which is only ~46% utilized, according to East Daley Analytics’ Crude Hub Model. The open season ran from June 18 to July 18, 2025 and offered up to 200 Mb/d of capacity.

East Daley expects the Southern Illinois Connector to redirect 50 Mb/d to ETCOP under Phase 1 of ENB’s Mainline expansion. Our Financial Blueprint Model for ET estimates a ~$13MM uplift in quarterly EBITDA. However, ENB anticipates the proposed pipeline can move up to 200 Mb/d by upgrading existing infrastructure. If ENB executes Phase 2 of the Mainline expansion, an additional 150 Mb/d could flow to ETCOP, raising the total potential quarterly EBITDA growth to ~$55MM.

In the Crude Hub Model, East Daley expects oil production from the Western Canadian Sedimentary Basin to exceed available egress capacity by 2027, making continued pipeline expansions out of Canada likely. As these incremental volumes enter the US, regional infrastructure must keep pace to prevent downstream bottlenecks. The Southern Illinois Connector enables ENB and ET to maximize existing pipelines by redirecting flows through underutilized assets. – Thomas Gorbold Tickers: ENB, ET.

NEW – The Burner Tip

The Burner Tip provides East Daley’s weekly coverage of natural gas markets. Every Thursday, The Burner Tip brings you our expert perspective on drivers shaping prices and flows in North America — including production trends, infrastructure dynamics, and forward-looking fundamentals — all grounded in EDA’s proprietary data and models. Whether you’re trading, investing, or managing risk, The Burner Tip delivers the insights you need to drive smarter strategy. Subscribe now to The Burner Tip!

Data Center Demand Monitor – Available Now!

The Data Center Demand Monitor is your go-to source for tracking data center projects and demand. We monitor and visualize nearly 300 US data center projects. Use Data Center Demand Monitor to forecast demand, identify pipeline corridors and track data center projects. — Request your demo now of the Data Center Demand Monitor!

The Daley Note

Subscribe to The Daley Note for energy insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.