A mid-January Arctic blast put a serious dent in Lower 48 natural gas production last week and sent spot prices soaring. While gas futures have declined with a warm-up in forecasts, a potentially historic storage withdrawal could be reported later this week showing a tighter gas market.

East Daley forecasts the US natural gas market in the US Macro Supply and Demand Forecast. We estimate dry gas production fell below 96.0 Bcf/d last Monday (January 15), a decline of ~8.0 Bcf/d (-7.7 %) from levels seen the week ending January 11, and remained significantly lower last week.

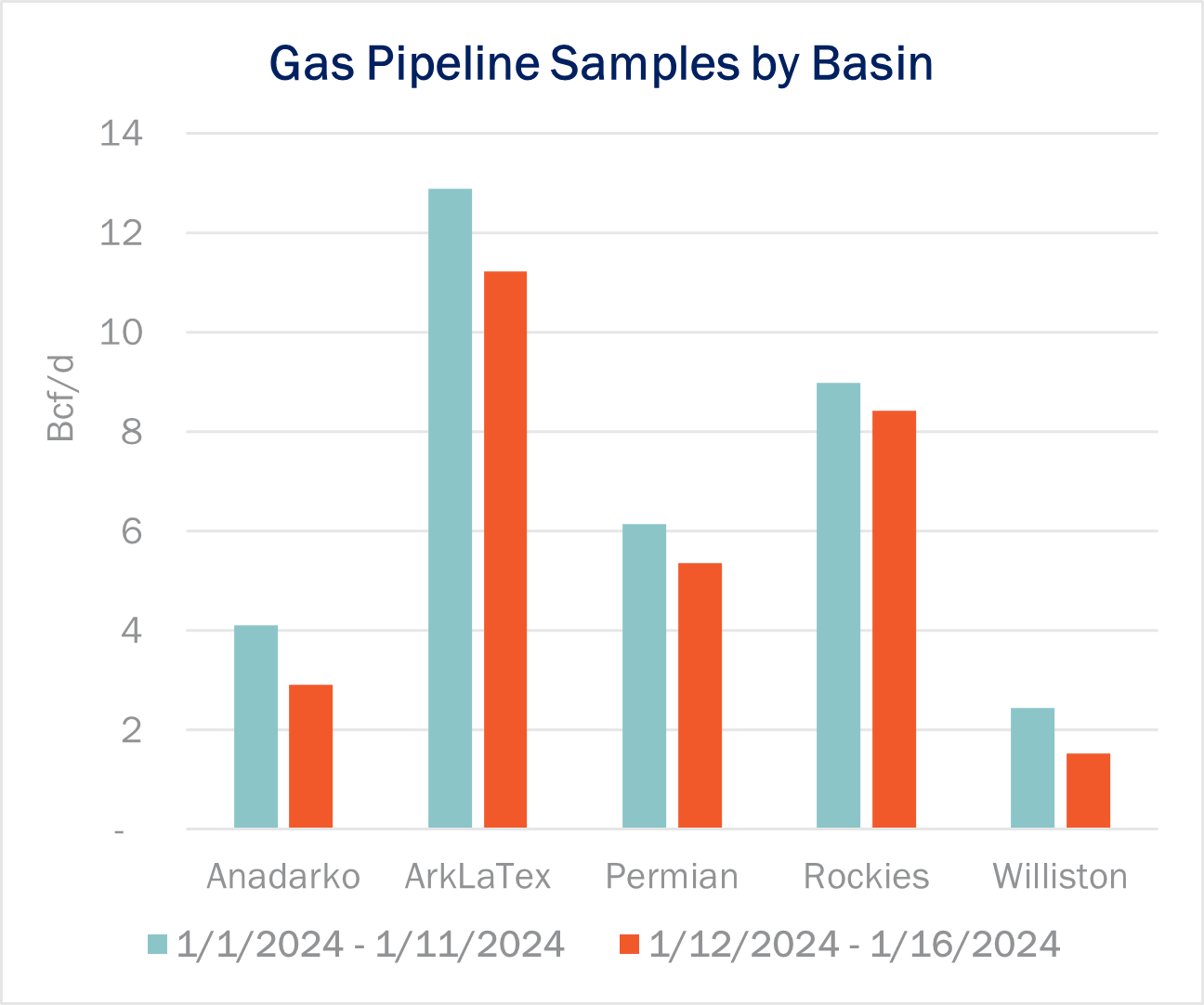

The largest declines from the polar front, dubbed Winter Storm Heather by the Weather Channel, occurred in the Williston, Anadarko, Permian and ArkLaTex basins. Production started falling last Thursday (January 12) as wellheads and equipment froze in sub-zero temperatures across the Central US. Regional pipe samples declined by 6 Bcf/d over the next five days (January 12-16) vs the trend in month-to-date samples in January (see figure). The Haynesville (-1.6 Bcf/d), Anadarko (-1.2 Bcf/d) and Williston (-0.9 Bcf/d) basins saw the largest declines in pipe samples over the 5-day period.

Cash prices at the Henry Hub traded at $13/MMBtu over the long MLK holiday weekend and on Tuesday (January 13-16), exceeding $30 in the Texas Panhandle and upper Midwest. Gas prices then spiked last Wednesday (January 17) across the East Coast as bitter temperatures pushed eastward. Transco Zone 5 traded over $19 while TETCO M3 prices in the Mid-Atlantic spiked to $21. However, Permian and Gulf Coast prices fell rapidly late week as the mercury warmed in the Midwest, falling below $3 Friday.

While production freeze-offs are a concern during cold weather, the impact on storage inventories could be more serious. With less produced gas and elevated Res/Com demand, storage withdrawals are likely to be significant.

The Energy Information Administration’s (EIA) upcoming report for the January 18 week will account for Winter Storm Heather’s impacts, including potentially record demand. Early estimates published Friday (January 19) by The Desk predict a 324 Bcf withdrawal in the upcoming EIA report. The 5-year average withdrawal for the week ending January 18 is 153 Bcf, so the storage surplus should shrink considerably.

Only two other weeks in historical EIA data show 300+ Bcf weekly storage withdrawals. The high water mark for storage withdrawals occurred the week ending January 5, 2018 at 359 Bcf. Winter Storm Uri in February 2021 saw a withdrawal of 338 Bcf for the week ending February 19, 2021.

Despite the bullish weather event, Henry Hub futures have fallen sharply. The prompt month February contract ended trading on January 13 at a high of $3.37/MMBtu but has since retreated to $2.43 on Monday (January 22), a 28% decline over nine days. Futures are discounting the impact to markets given the quick warm-up. NOAA predicts in its 6- to 10-day outlook that much of the country, including heavy gas-consuming areas in the Midwest, will see above-normal temperatures through the end of January. – Jack Weixel and Maria Paz Urdaneta

{{cta(’71cb60db-debd-4dab-a6cc-766c1f718703′,’justifycenter’)}}

Dirty Little Secrets is Now Available

Dirty Little Secrets is now available. East Daley held our Dirty Little Secrets annual webinar on Wednesday, December 13. In “Volatility Will Continue Until Morale Improves,” we reviewed the factors likely to drive volatility ahead in oil, natural gas and NGL markets. We review the outlook for these markets and the midstream sector. Review the Dirty Little Secrets webinar here.

East Daley, Hart Bring NEW Gas & Midstream Weekly

East Daley is teaming up with Hart Energy on the NEW Gas & Midstream Weekly newsletter. This new report combines the strengths of Hart Energy’s journalistic reporting and analysis on natural gas, LNG, midstream energy and deal-making with EDA’s deep research and intelligence of hydrocarbons, storage and transportation.

Published every Thursday morning, this new powerhouse newsletter is an interactive and enlightening read highlighting breaking news, exclusive interviews, videos, charts, maps and more. The newsletter utilizes East Daley’s Energy Data Studio tools for natural gas predictive analytics with Hart Energy’s Rextag mapping tools to present a holistic view of pricing triggers, infrastructure growth, pipeline and processing bottlenecks, regulatory and legal hurdles, and the inevitable solutions. Subscribe Here

Energy Data Studio

East Daley Analytics has launched Energy Data Studio, a platform for our industry-leading midstream data and commodity production forecasts. All clients have access to the new client portal. If you have not yet logged in, please fill out the form to request a registration email be resent.

Energy Data Studio leverages our G&P data set for insights into midstream assets across every major oil and gas basin in North America. Users can navigate detailed visual dashboards by region, pipeline, or individual asset to understand crude oil, natural gas and NGL supply at the most granular level.

Energy Data Studio is available through data downloads from the visual interface, in Excel files, or as a direct feed delivered into subscribers’ workflow via secure file transfer. To learn more about Energy Data Studio, please contact [email protected].

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.