Driven by new LNG projects, natural gas demand growth is poised to exceed supply in 2025, according to our latest Macro Supply and Demand Forecast. East Daley Analytics anticipates this new demand will change the dynamics driving gas prices and put the bulls back in the driver’s seat once again.

Our Macro Forecast points to brighter days ahead for gas producers contending with oversupply and $1 prices in 2024. EDA earlier laid out the bullish case for gas for 2025, noting we expect higher Henry Hub prices than are currently priced in the forward curve.

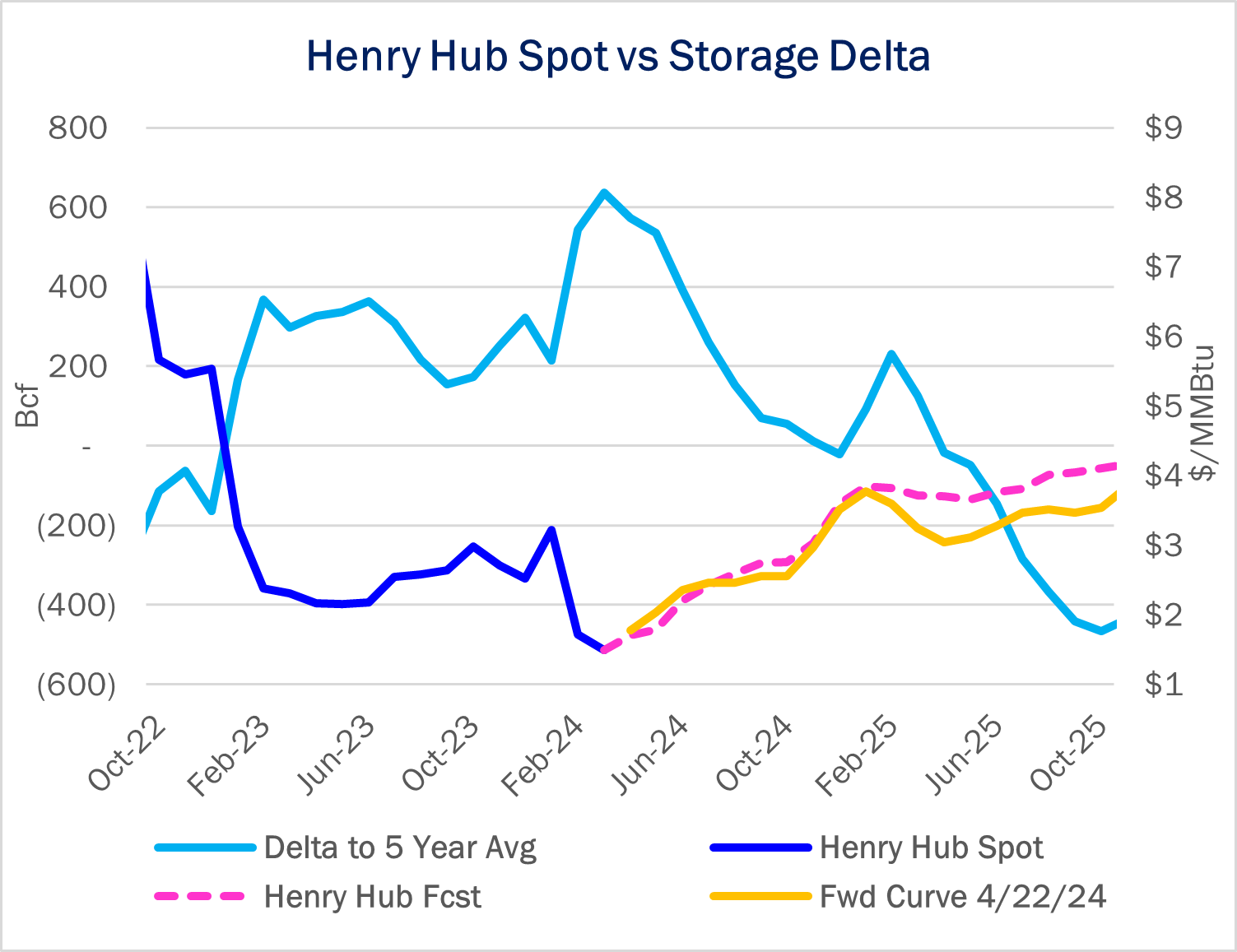

Looking ahead, we expect modest strength in prices starting in the 2024 summer as demand increases and production remains at lower levels. The figure from the monthly Macro compares our latest forecast for storage inventory and gas prices in 2024-25. The massive storage overhang, totaling 600 Bcf vs the 5-year average at the start of April, steadily shrinks as the market tightens. EDA predicts prices surpass $2.00/MMBtu in June ’24 and top $3.00 before the end of the year. The storage surplus then moves into deficit in 2025 as demand expands and production struggles to keep pace.

Demand growth will come from the start-up of several LNG projects under construction on the Gulf Coast, including Golden Pass, Corpus Christi Liquefaction Phase 3, and Plaquemines LNG. These projects together could add up to 6.5 Bcf/d of new LNG exports.

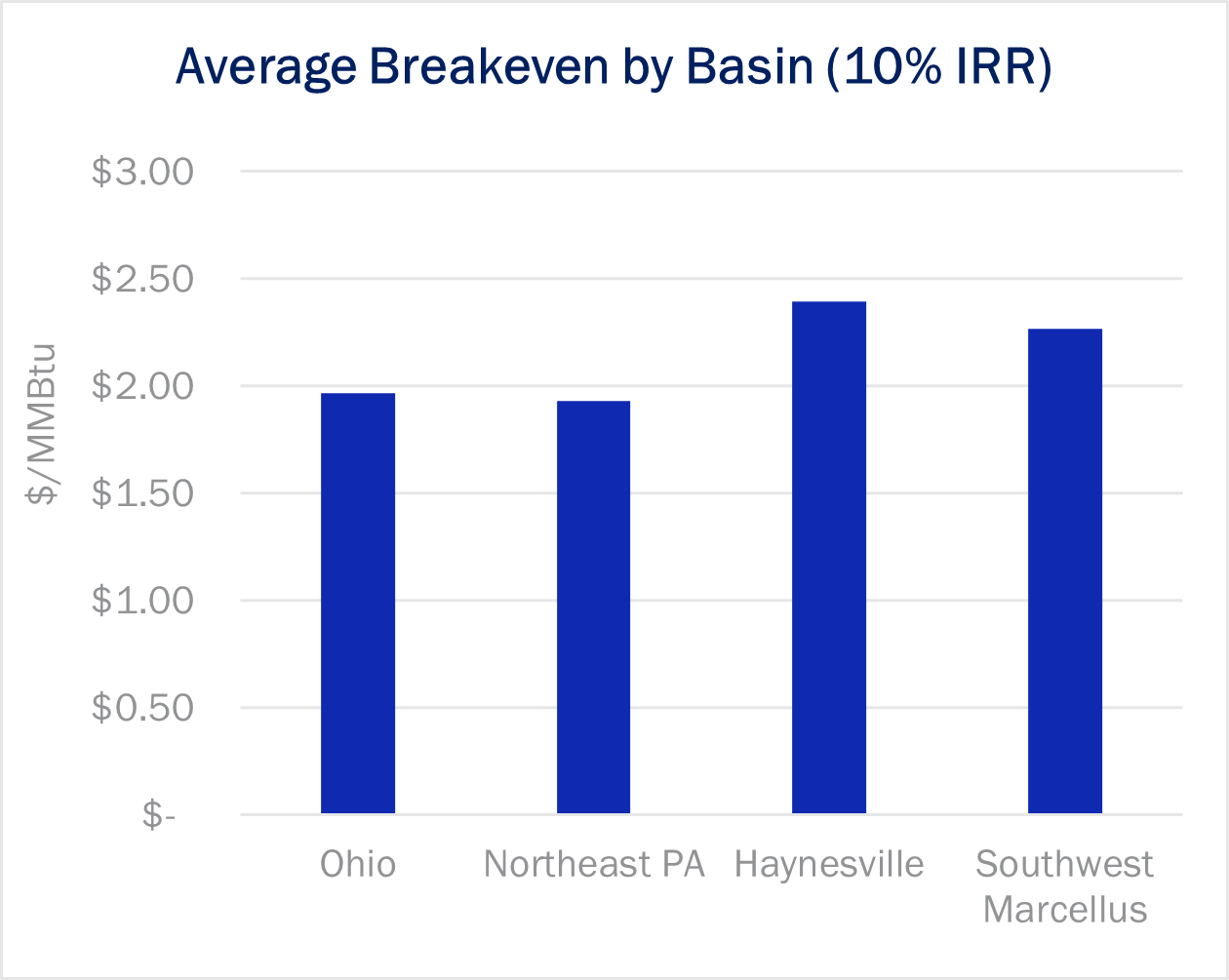

We expect this new demand will flip the economics driving prices, moving from a dynamic of gas-on-gas competition currently to one where producers will need adequate price signals to incentivize new supply. In this environment, breakeven costs to develop new resources will help set the floor for prices.

The figure looks at various breakeven price estimates for Haynesville and Marcellus/Utica producers. These calculations show the realized natural gas price required for producers to financially ‘break even’ (0% IRR + 10% hurdle rate) on the next well drilled.

EDA calculates Haynesville breakevens to be around $2.40/MMBtu with Marcellus breakevens closer to $2.00. These calculations are an average of a subset of producers in each region, and do not include land acquisition costs, corporate G&A, etc. Our estimates do include gathering & transmission expenses, production taxes, and the 10% hurdle rate. These estimates include some data back to 2018, which may not reflect inflated service costs that producers might be facing currently.

Breakeven models can be misleading, but they are a good benchmark to help reinforce our view for production growth in 2025 and compare differences between basins. For more information, review updates to our gas outlook each month in the Macro Supply and Demand Forecast. EDA will also discuss these themes in our upcoming natural gas webinar on May 8. – Alex Gafford.

Join EDA’s Natural Gas Webinar on May 8 – “The Case for More Volatility”

EDA will host an upcoming natural gas webinar on May 8. In “Finding Equilibrium: Seesaw Natural Gas Markets and the Case for More Volatility”, we review the big factors impacting natural gas markets: Production has retreated across most basins, but for how long? What will be the impact of summer gas-fired power burn and looming LNG demand? Will infrastructure challenges create new hurdles? We’ll also look at storage inventory and the price outlook. Sign up to join our webinar on May 8.

Available Now: Ethane Supply and Demand Report and Data Set

This is a comprehensive data file and report that provides valuable insights into historical and forecasted supply and demand components for ethane. The report covers crucial metrics such as ethane supply from US gas processing plants, and demand from domestic ethylene steam crackers and ethane exports. Learn more about the Ethane Supply and Demand Report and Data Set.

Access the NEW G&P System Financial Dashboard

We are thrilled to introduce a groundbreaking addition to East Daley’s suite of energy management tools: the G&P System Financial dashboard. This dynamic tool is designed to revolutionize how you scope and analyze multiple financial metrics and throughput forecasts for individual G&P systems across the US. Clients can log in to Energy Data Studio to review the G&P System Financial dashboard protype. Learn more here.

Energy Data Studio

East Daley Analytics has launched Energy Data Studio, a platform for our industry-leading midstream data and commodity production forecasts. All clients have access to the new client portal. If you have not yet logged in, please fill out the form to request a registration email be resent.

Energy Data Studio leverages our G&P data set for insights into midstream assets across every major oil and gas basin in North America. Users can navigate detailed visual dashboards by region, pipeline, or individual asset to understand crude oil, natural gas and NGL supply at the most granular level.

Energy Data Studio is available through data downloads from the visual interface, in Excel files, or as a direct feed delivered into subscribers’ workflow via secure file transfer. To learn more about Energy Data Studio, please contact [email protected].

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.