Energy Transfer (ET) has made a big move to secure a slice of the Midland NGL pie. The $3.25B acquisition of WTG Midstream Holdings will give ET control of a significant new tranche of NGLs that can boost earnings for the company’s downstream assets.

ET announced terms for WTG on May 28 with Stonepeak, the Davis Estate, and Diamondback Energy (FANG). East Daley Analytics noted the deal will nearly triple ET’s gas processing capacity in the Midland. Control of NGLs is the other part of the strategic equation. We view the acquisition as a strategic play by ET to capture growth at the Mont Belvieu NGL market hub.

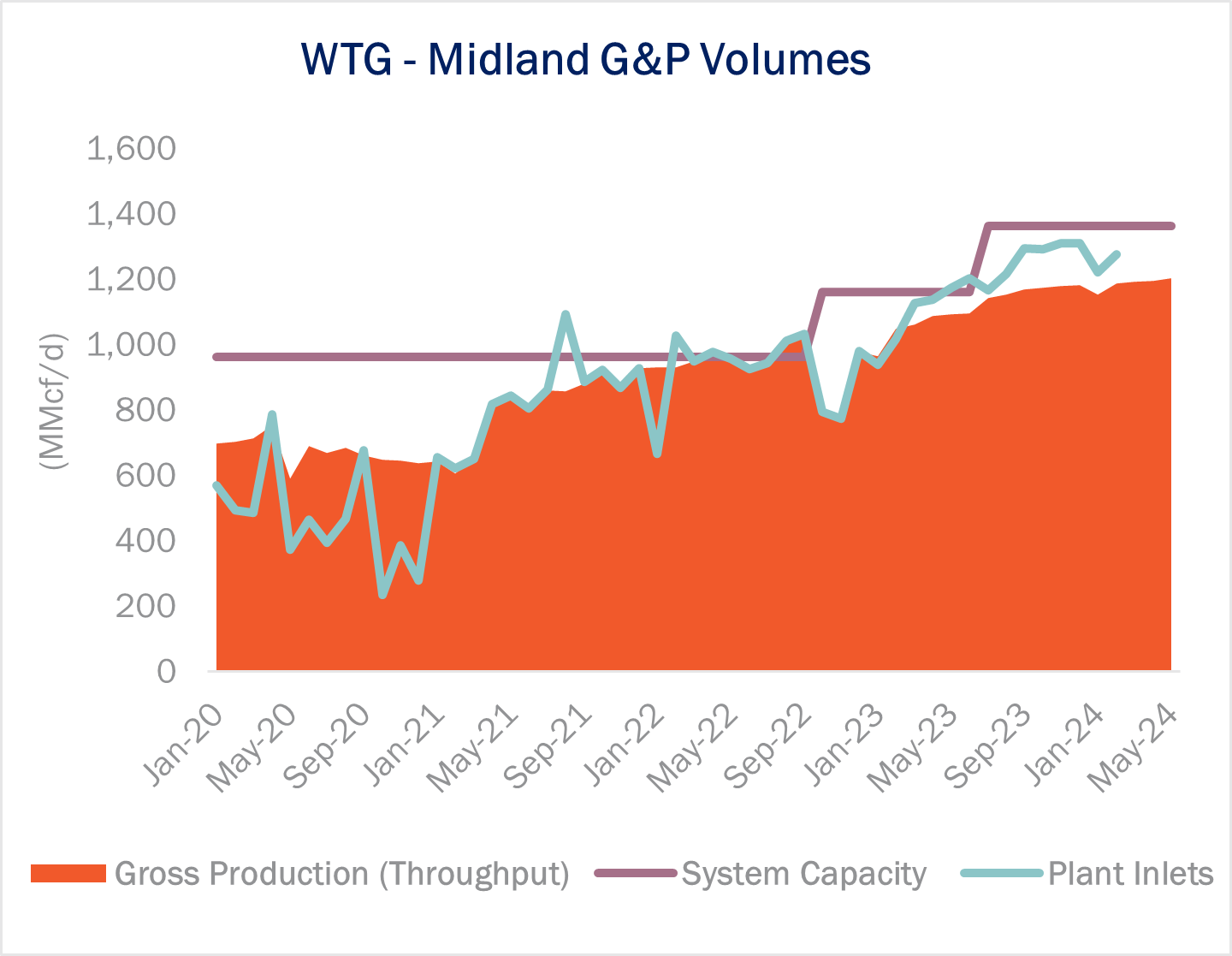

EDA monitors the private WTG assets in Energy Data Studio, WTG processed about 1.25 Bcf/d of Midland Basin gas in 1Q24 (see figure), which translates to about 175 Mb/d of NGL production.

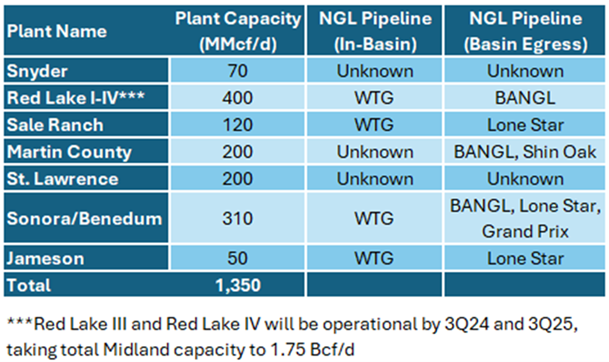

The Lone Star and BANGL pipelines transport most of the NGL production from WTG. This creates a compelling integration story given ET’s 100% ownership in Lone Star and the 20% interest ET will acquire in BANGL (see the figure for plant-to-pipe connections for the WTG assets).

As East Daley discussed in this year’s Dirty Little Secrets, the environment is ripe for midstream M&A. Bigger midstream players are actively seeking to consolidate the NGL value chain, which starts at the wellhead. Recent deals include Kinetik’s (KNTK) purchase of Durango Midstream and Phillips 66’s (PSX) planned acquisition of Pinnacle Midstream. We expect the trend to continue.

Energy Data Studio profiles all leading G&P systems in the Permian Basin, including private and producer-owned assets that could be the next acquisition targets. Large integrated midstream players continue to pursue deals to realize full value-chain economics for NGLs, including exposure to supply growth (Permian) and demand (export docks). – Rob Wilson, CFA Tickers: ET, FANG, KNTK, PSX.

Meet with East Daley in Europe

As part of East Daley Analytics’ expansion into European markets, we are excited to announce Rob Wilson (VP of Analytics) has an upcoming trip to Europe to present our latest insights on energy markets. Fill out the form to request a meeting.

Sign Up for the NGL Insider

East Daley NGL Insider provides weekly updates on the US NGLs market including supply and demand fundamentals, basin-level views, and analysis of market constraints and infrastructure proposals. We explore sub-basin dynamics and provide market insights on NGL flows, infrastructure, and purity products. Sign up now for the NGL Insider.

New Product: EDA’s LNG Stack

East Daley has added the new LNG Stack to our monthly gas Macro report and data set. The LNG Stack connects LNG export demand to producers through pipelines and processing, for a comprehensive view of the market. Build our LNG data into your own demand forecasts, or use it to validate against your own view of the coming LNG super-build. Learn more about the LNG Stack and Macro.

Energy Data Studio

East Daley Analytics has launched Energy Data Studio, a platform for our industry-leading midstream data and commodity production forecasts. All clients have access to the new client portal. If you have not yet logged in, please fill out the form to request a registration email be resent.

Energy Data Studio leverages our G&P data set for insights into midstream assets across every major oil and gas basin in North America. Users can navigate detailed visual dashboards by region, pipeline, or individual asset to understand crude oil, natural gas and NGL supply at the most granular level.

Energy Data Studio is available through data downloads from the visual interface, in Excel files, or as a direct feed delivered into subscribers’ workflow via secure file transfer. To learn more about Energy Data Studio, please contact [email protected].

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.