Phillips 66 (PSX) will acquire Pinnacle Midstream for $550MM in cash, advancing the company’s goal to expand into the Permian G&P business. PSX disclosed a 7x multiple, with potential to bring that down to 5.5x on downstream synergies to its Sand Hills pipeline and Sweeny fractionators. We see volume risk for several NGL players from the combination.

PSX announced the agreement for Pinnacle Midstream last Monday (May 20) with investor Energy Spectrum Capital. Pinnacle operates 80 miles of gathering pipeline and 220 MMcf/d of gas processing capacity in Midland County, TX. The companies plan to close the transaction mid-2024.

East Daley Analytics tracks the Pinnacle Midstream assets in Energy Data Studio. The system serves 50,000 acres dedicated to two primary customers: Pioneer Natural Resources (recently acquired by ExxonMobil (XOM)) and CrownQuest Operating (on track to be acquired by Occidental (OXY)). Pinnacle developed the assets with the backing of a 15-year contract with DoublePoint Energy, and PXD later acquired DoublePoint in April 2021.

In Energy Data Studio, we allocate 96% of Pinnacle’s volumes between Pioneer and CrownQuest. The latest plant data (as of March 2024) shows inlet volumes of ~137 MMcf/d.

According to PSX, the Pinnacle assets are “scalable for a second 220 MMcf/d plant”. Pinnacle had previously announced that construction was underway on the second plant, Dos Picos II, and had estimated an in-service date of 4Q24. However, PSX’s wording suggests there may be delays to that start date.

We view Pinnacle as a good acquisition for PSX given the system’s prime location and top-tier customers in the Midland. The deal will advance PSX’s goal to capture more NGLs along the value chain to feed its pipelines and downstream operations on the Gulf Coast. It may also place at risk some NGL volumes for Enterprise (EPD) and ONEOK (OKE).

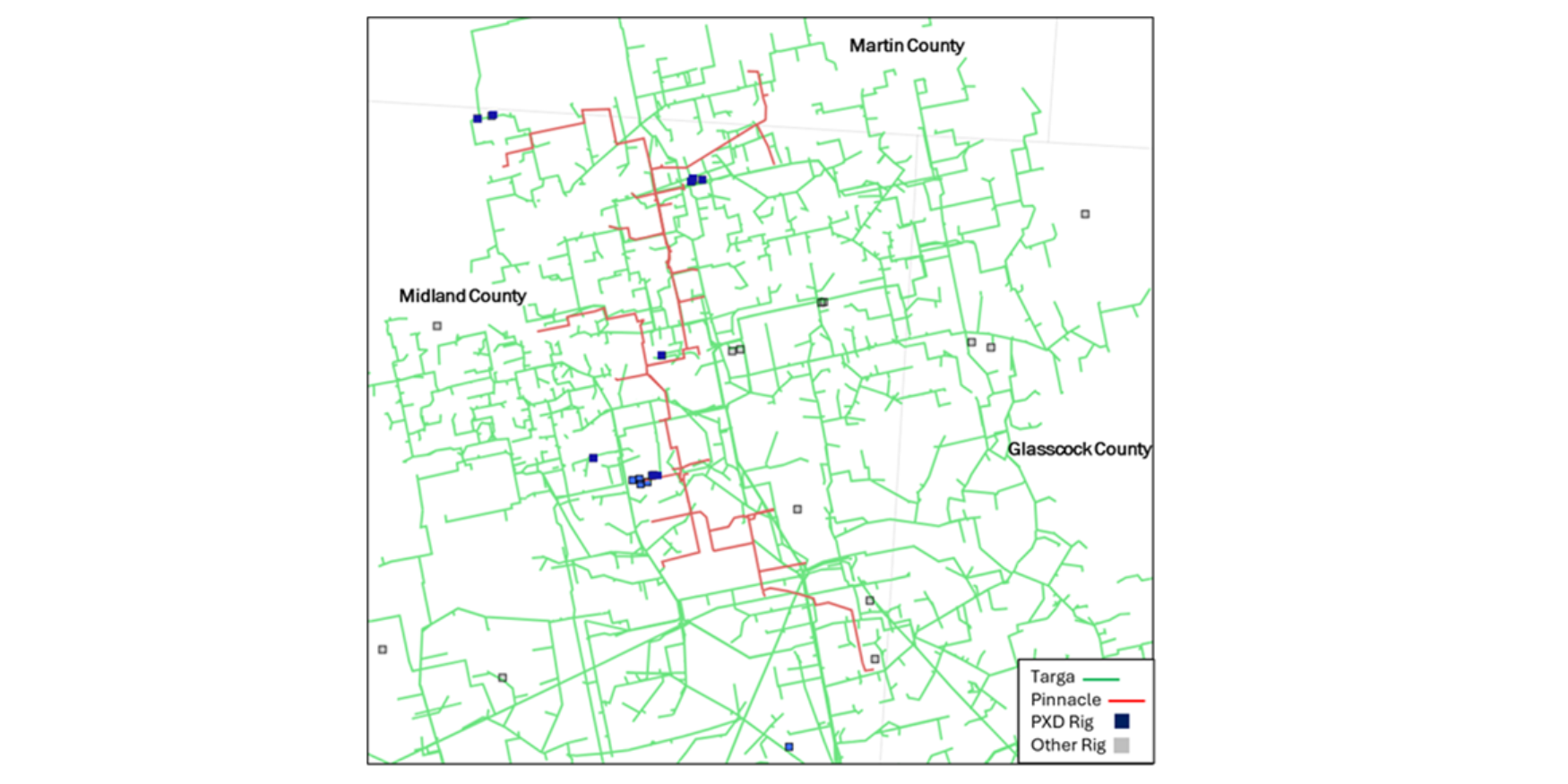

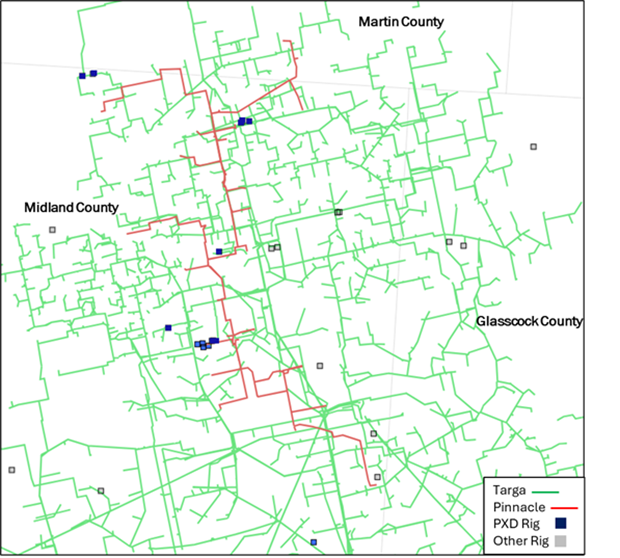

Pioneer has 10 rigs operating very close to Pinnacle’s system, according to EDA’s G&P Allocation model (see map). Given the system has only 220 MMcf/d of capacity, Pinnacle is likely offloading gas to third-party systems until its new plant is online. We expect the volumes are likely offloaded to Targa’s (TRGP) West TX system, of which PXD owns a portion.

Currently, Pinnacle’s gas volumes can reach the Gulf Coast on Whistler Pipeline, and its NGLs move on EPD’s Shin Oak and OKE’s West Texas NGL pipelines. After the acquisition closes, PSX could reroute NGLs to Sand Hills for delivery to its Sweeny fractionators, and ultimately export products from its Freeport LPG terminal. EDA estimates Pinnacle produced ~16 Mb/d of NGLs from its Dos Picos plant in 1Q24, a little over half of the plant capacity of 30 Mb/d.

The offload to Targa could imply future downside for its Grand Prix pipes once any offload agreement ends. The strong nearby activity also bodes well for new owner PSX, as it implies a rapid step-up in volumes once the second plant is online. – James Taylor Tickers: EPD, OKE, PSX, TRGP, XOM.

New Product: EDA’s LNG Stack

East Daley has added the new LNG Stack to our monthly gas Macro report and data set. The LNG Stack connects LNG export demand to producers through pipelines and processing, for a comprehensive view of the market. Build our LNG data into your own demand forecasts, or use it to validate against your own view of the coming LNG super-build. Learn more about the LNG Stack and Macro.

Sign Up for the Crude Oil Edge

East Daley’s Crude Oil Edge provides weekly updates on the US crude oil market including supply and demand fundamentals, basin-level views, and analysis of market constraints and infrastructure proposals. We explore sub-basin dynamics and provide market insights on crude oil flows, production growth, and import and export characteristics. Sign up now for the Crude Oil Edge.

Energy Data Studio

East Daley Analytics has launched Energy Data Studio, a platform for our industry-leading midstream data and commodity production forecasts. All clients have access to the new client portal. If you have not yet logged in, please fill out the form to request a registration email be resent.

Energy Data Studio leverages our G&P data set for insights into midstream assets across every major oil and gas basin in North America. Users can navigate detailed visual dashboards by region, pipeline, or individual asset to understand crude oil, natural gas and NGL supply at the most granular level.

Energy Data Studio is available through data downloads from the visual interface, in Excel files, or as a direct feed delivered into subscribers’ workflow via secure file transfer. To learn more about Energy Data Studio, please contact [email protected].

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.