Michigan regulators have approved an application by Enbridge (ENB) to replace a segment of the Line 5 pipeline running under the Great Lakes, removing one legal hurdle for the oil pipeline.

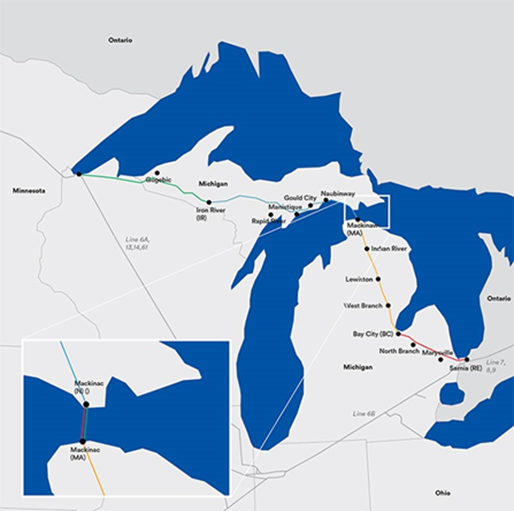

On December 1, the Michigan Public Service Commission (PSC) approved ENB’s application to replace a segment of twin pipelines now located on the bottom of the Straits of Mackinac between Lake Michigan and Lake Huron (see map). ENB proposes to replace them with a single pipeline buried in a concrete tunnel deep below the lakebed.

Line 5 transports up to 540 Mb/d of light crude oil and NGLs from Superior, WI to Sarnia, ON. The pipeline is a key source of propane used for heating homes in Michigan. East Daley Analytics tracks crude oil flows through the Midwest in our Crude Hub Model, as well as regional NGL flows in the NGL Network Model.

In the ruling, the Michigan PSC found a public need for the Line 5 project. The agency determined “that without the pipeline’s operation, suppliers would need to use higher-risk and costlier alternative fuel supply sources and transportation for Michigan customers.”

ENB needs additional approvals from the US Army Corps of Engineers to move ahead with the Line 5 replacement. The approval by the Michigan PSC also comes with conditions related to the tunnel’s safety and construction.

Enbridge is juggling multiple legal issues around Line 5. In June 2023, a US district judge ordered the company to move a 12-mile segment of the pipeline near Ashland, WI that crosses into lands of the Bad River Band of the Lake Superior Chippewa.

The Bad River Band alleges Line 5 is at risk of exposure and rupturing after erosion from heavy rains. The judge agreed and gave ENB three years to relocate the pipeline, a window that would end on July 16, 2026. ENB proposes to replace the segment with 41 miles of pipeline running around the tribe’s land. – Maria Paz Urdaneta Tickers: ENB.

Dirty Little Secrets is Now Available

Dirty Little Secrets is now available. East Daley held our Dirty Little Secrets annual webinar on Wednesday, December 13. In “Volatility Will Continue Until Morale Improves,” we reviewed the factors likely to drive volatility ahead in oil, natural gas and NGL markets. We review the outlook for these markets and the midstream sector. Review the Dirty Little Secrets webinar here.

East Daley, Hart Bring NEW Gas & Midstream Weekly

East Daley is teaming up with Hart Energy on the NEW Gas & Midstream Weekly newsletter. This new report combines the strengths of Hart Energy’s journalistic reporting and analysis on natural gas, LNG, midstream energy and deal-making with EDA’s deep research and intelligence of hydrocarbons, storage and transportation.

Published every Thursday morning, this new powerhouse newsletter is an interactive and enlightening read highlighting breaking news, exclusive interviews, videos, charts, maps and more. The newsletter utilizes East Daley’s Energy Data Studio tools for natural gas predictive analytics with Hart Energy’s Rextag mapping tools to present a holistic view of pricing triggers, infrastructure growth, pipeline and processing bottlenecks, regulatory and legal hurdles, and the inevitable solutions.

Energy Data Studio

East Daley Analytics has launched Energy Data Studio, a platform for our industry-leading midstream data and commodity production forecasts. All clients have access to the new client portal. If you have not yet logged in, please fill out the form to request a registration email be resent.

Energy Data Studio leverages our G&P data set for insights into midstream assets across every major oil and gas basin in North America. Users can navigate detailed visual dashboards by region, pipeline, or individual asset to understand crude oil, natural gas and NGL supply at the most granular level.

Energy Data Studio is available through data downloads from the visual interface, in Excel files, or as a direct feed delivered into subscribers’ workflow via secure file transfer. To learn more about Energy Data Studio, please contact [email protected].

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.