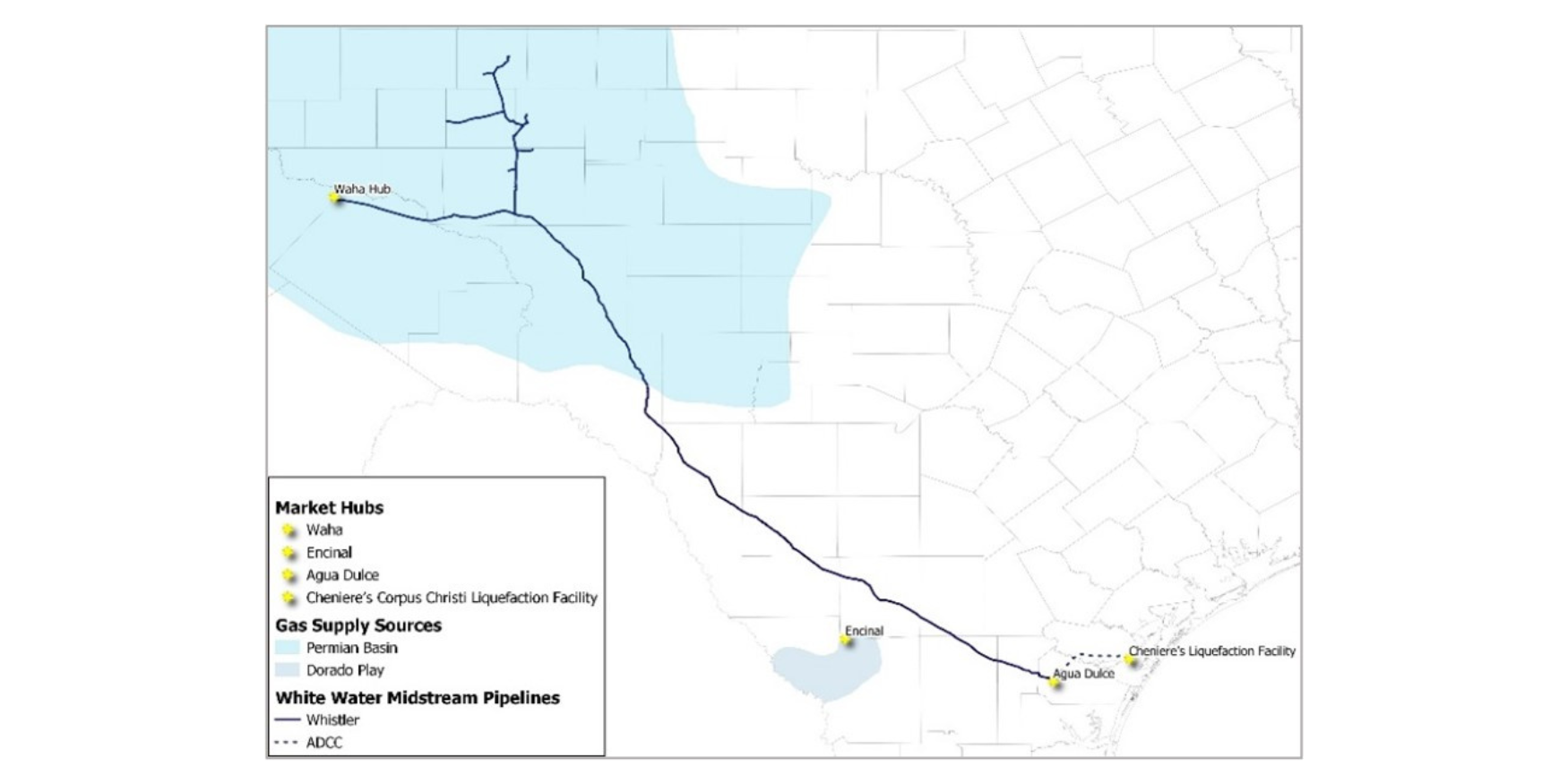

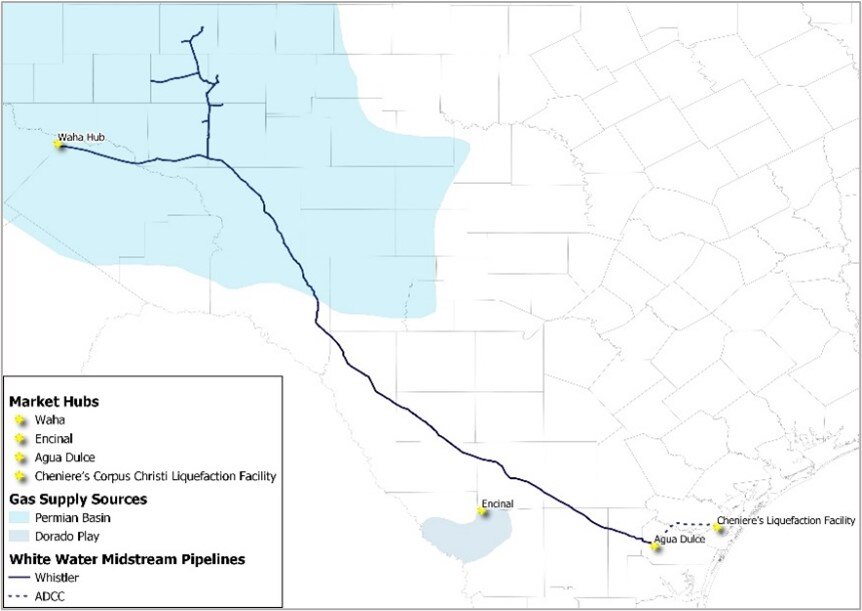

Whistler Pipeline and Cheniere Energy (LNG) are building the ADCC Pipeline in South Texas ahead of an expansion at Cheniere’s Corpus Christi Liquefaction (CCL) terminal. Construction work on the 42-inch pipe should be nearing completion based on a timeline the partners previously laid out.

ADCC Pipeline will run 43 miles from the Agua Dulce hub in South Texas to the CCL facility (see map). In an investor update earlier this year, Cheniere executives said construction was progressing well on the ADCC project and predicted it would begin service in 3Q24, well ahead of the Stage 3 expansion.

East Daley Analytics tracks the two Cheniere projects in the Houston Ship Channel Supply and Demand Report. The ADCC pipeline is designed to transport up to 1.7 Bcf/d in support of the Stage 3 expansion at Corpus Christi. Cheniere is building seven midscale trains capable of producing over 10 Mtpa of LNG (~1.3 Bcf/d).

In Cheniere’s 1Q24 earnings update in May, executives said the CCL Stage 3 expansion is on track to make first LNG by YE24, and predicted that all seven trains would be brought into service over the 2025-26 period.

The ADCC line will give Cheniere more flexibility to source gas at Corpus Christi, particularly in 2H24 and early 2025 when demand from the Stage 3 expansion is unavailable. The CCL facility is currently only served by the Corpus Christi Pipeline. The new pipe will move Permian gas further downstream via Whistler and provide access to Eagle Ford supply at the Agua Dulce hub.

East Daley does not expect a big shift in basin dynamics given that Whistler Pipeline already runs full at ~2.5 Bcf/d to Agua Dulce. Looking further out, we expect new LNG demand from projects like CCL Stage 3 will create big shifts in the South Texas market later this decade, as we forecast in the Houston Ship Channel Report.

Cheniere is likely to use the new ADCC line to optimize flows to Corpus Christi. Prices at the Waha hub in West Texas are often heavily discounted and traded below zero earlier this spring, so a connection to the Permian market should prove valuable for the large gas buyer.

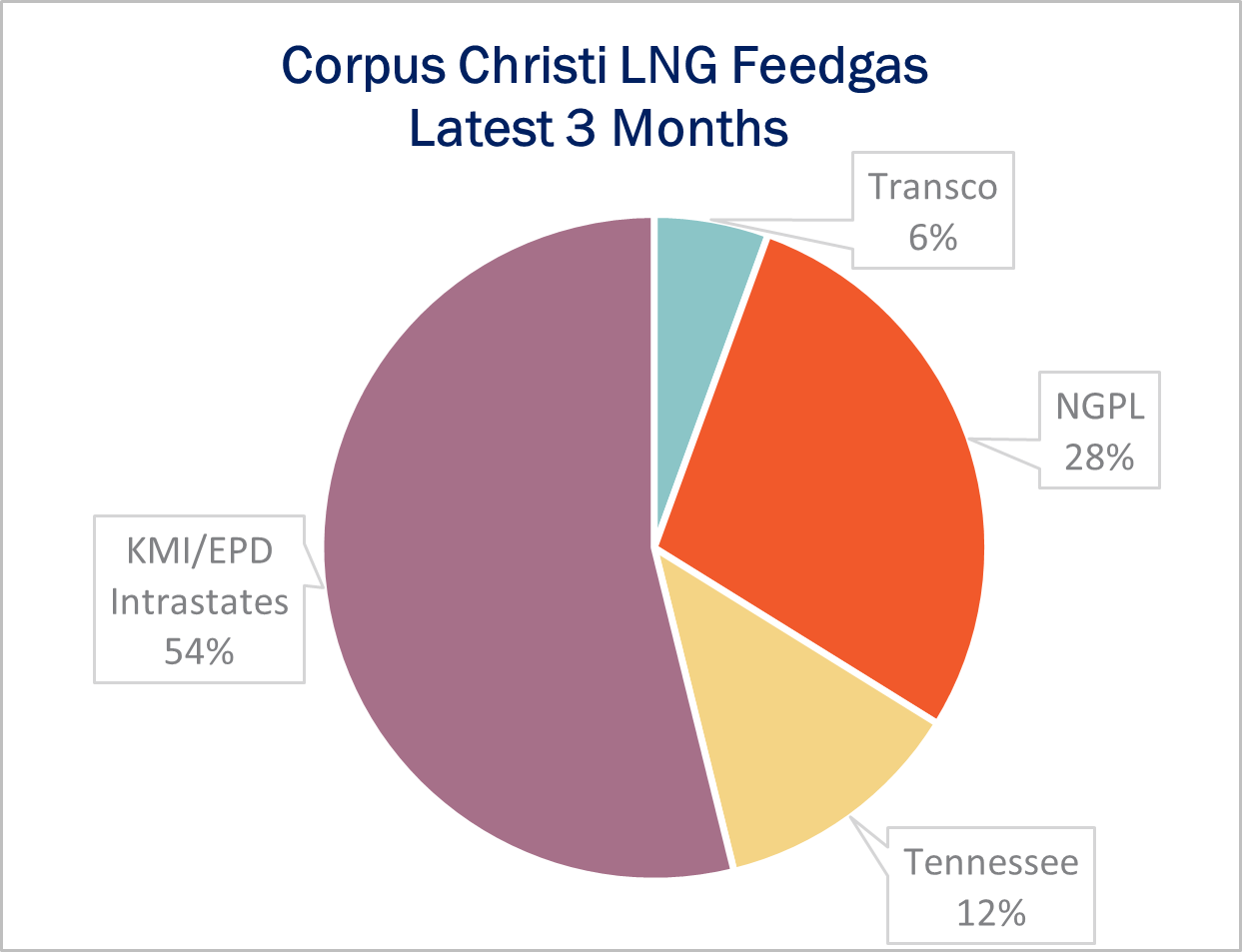

Intrastate pipelines owned by Kinder Morgan (KMI) and Enterprise Products (EPD) deliver the most gas to CCL, accounting for over half of deliveries to the facility in the latest three months (see figure). Cheniere also moved significant volumes (~600 MMcf/d) on KMI’s Natural Gas Pipeline Company of America (NGPL) system over the latest three months. – Andrew Ware and Alex Gafford Tickers: EPD, LNG, KMI.

New Product: EDA’s LNG Stack

East Daley has added the new LNG Stack to our monthly gas Macro report and data set. The LNG Stack connects LNG export demand to producers through pipelines and processing, for a comprehensive view of the market. Build our LNG data into your own demand forecasts, or use it to validate against your own view of the coming LNG super-build. Learn more about the LNG Stack and Macro.

Meet with East Daley in Europe

As part of East Daley Analytics’ expansion into European markets, we are excited to announce Rob Wilson (VP of Analytics) has an upcoming trip to Europe to present our latest insights on energy markets. Fill out the form to request a meeting.

Sign Up for the NGL Insider

East Daley NGL Insider provides weekly updates on the US NGLs market including supply and demand fundamentals, basin-level views, and analysis of market constraints and infrastructure proposals. We explore sub-basin dynamics and provide market insights on NGL flows, infrastructure, and purity products. Sign up now for the NGL Insider.

Energy Data Studio

East Daley Analytics has launched Energy Data Studio, a platform for our industry-leading midstream data and commodity production forecasts. All clients have access to the new client portal. If you have not yet logged in, please fill out the form to request a registration email be resent.

Energy Data Studio leverages our G&P data set for insights into midstream assets across every major oil and gas basin in North America. Users can navigate detailed visual dashboards by region, pipeline, or individual asset to understand crude oil, natural gas and NGL supply at the most granular level.

Energy Data Studio is available through data downloads from the visual interface, in Excel files, or as a direct feed delivered into subscribers’ workflow via secure file transfer. To learn more about Energy Data Studio, please contact [email protected].

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.