Top Stories of 2025: The Daley Note, June 11, 2025. Restrictions on US ethane exports to China have come to a head for the energy sector. The Department of Commerce’s Bureau of Industry and Security (BIS) has formally denied export licenses to Enterprise Products (EPD) for three ethane cargoes totaling 2.2 MMbbl.

The denial follows a May 23 BIS determination that high-purity ethane (≥95%) exports to China pose a national security risk. The agency warned that ethane could be diverted to military end-users, requiring exporters to apply for special licenses. The June 3 notice to EPD gives the company 20 days to respond, after which the denials will become final unless reversed. Though butane was initially included in the BIS rulemaking, EPD said this restriction was later dropped.

Energy Transfer (ET) confirmed it also received a BIS letter indicating its ethane cargoes to China fall under the same export control framework, placing further pressure on the US–China NGL trade.

Energy Transfer (ET) confirmed it also received a BIS letter indicating its ethane cargoes to China fall under the same export control framework, placing further pressure on the US–China NGL trade.

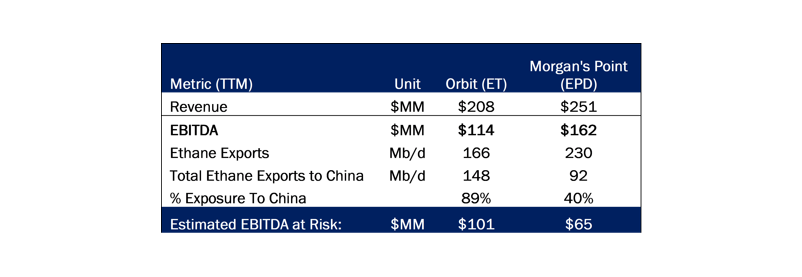

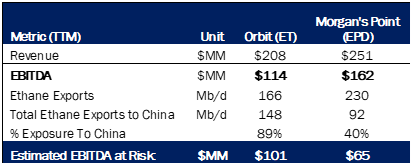

The new US export restrictions create material risk for companies in the ethane trade. With ~40% of EPD’s ethane exports and nearly all of ET’s Orbit volumes destined for China, the two face up to $166MM in EBITDA exposure.

East Daley Analytics estimates the EBITDA at risk from ethane exports to China to be $101MM to EPD and $65MM to ET for the trailing twelve months (TTM), shown in the figure above. The estimates are disclosed in EDA’s company Blueprint Financial Models.

Morgan’s Point: In an 8-K reporting the new BIS licenses, Enterprise disclosed that 40% of its ethane exports go to China, or about 92 Mb/d. We know the facility also supplies Reliance Industries in India and INEOS at its Rafnes facility in Norway. It’s quite possible that EPD supplies ethane to Braskem via its ethane import terminal in Veracruz, Mexico as well.

The big question mark for EPD is how much contractual exposure to China is related to its Neches River expansion project. Phase 1 (ISD 3Q25) adds 120 Mb/d of ethane export capacity, and Phase 2 (ISD 1H26) brings another 180 Mb/d of capacity. EPD has said the terminal is 100% contracted already. Likely counterparties include INEOS (for its new Project One facility in Antwerp, Belgium) and Reliance, which has ordered three new very large ethane carriers (VLECs). If another 40% is going to China, that equals 120 Mb/d of capacity, assuming the new facility ships ethane to China in the same proportion as the existing Morgan’s Point dock.

Orbit: EDA believes almost all the ethane exported from ET’s Orbit facility is headed to China. China’s Satellite Chemical is an anchor shipper for the dock and owns 41.9% of the Orbit ethane pipeline feeding the terminal. Presumably the ownership interest in the export facility is the same.

ET realizes ethane export diversification via its Marcus Hook dock and Mariner West pipeline. The dock near Philadelphia, PA ships to INEOS and likely to Borealis as well, whereas Mariner West feeds NOVA’s Corunna steam cracker in Ontario.

Ethane demand has been burgeoning and is likely to continue growing. To mitigate risk, US ethane suppliers will look to diversify counterparties away from China and towards nations that the US has friendly relations like India, Europe, and other southeast Asian countries. See East Daley’s Ethane Supply & Demand Report for more information. – Rob Wilson, CFA and Julian Renton Tickers: EPD, ET.

The Permian Basin at a Crossroads: Download the Latest White Paper

The Permian Basin at a Crossroads: Download the Latest White Paper

The Permian Basin is the heart of the US energy industry, supplying half of crude oil and NGL production and nearly 20% of natural gas. Yet market pressures are forcing changes, prompting billions in new pipeline investments and reorienting how operators approach the basin. East Daley’s new white paper, The Permian Basin at a Crossroads, is the first of a 3-part series looking at the shifts underway in the Permian. In this series, we reveal how LNG demand and AI data centers could transform Permian gas into a primary revenue driver. We also review the multi-billion-dollar infrastructure needed to unlock this shift, and what’s at stake for oil, gas and midstream operators. — Click here to download the The Permian Basin at a Crossroads white paper!

Data Center Demand Monitor – Available Now!

Introducing Data Center Demand Monitor by East Daley Analytics. This is your go-to source for tracking data center projects and demand. We monitor and visualize nearly 300 US data center projects. Use Data Center Demand Monitor to forecast demand, identify pipeline corridors and track data center projects. — Request your demo now of the Data Center Demand Monitor!

The Daley Note

Subscribe to The Daley Note for energy insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.