Chevron (CVX) is emerging as a player in AI power generation. The major plans to build its first natural gas-fired power complex for a data center in West Texas, part of a trend East Daley Analytics anticipates to take advantage of abundant Permian Basin gas.

Chevron aims to make a final investment decision on the project by early 2026 and begin generating power in 2027, the company announced in November, starting with 2.5 GW of capacity and possibly expanding to 5 GW for a single data-center client. The facility is designed to operate behind the meter, delivering electricity directly to the colocated data center. The project supports CVX’s transition from a conventional fuel supplier, to directly selling electrons to hyperscale consumers.

West Texas fits well in the model. CVX can supply the plant with gas from its Permian oil operations and lean on existing G&P infrastructure to deliver fuel for baseload power. The strategy supports more reliable pricing for Permian gas supply by tying it to firm, behind-the-meter power sales.

The Permian Basin at a Crossroads: Why This Pipeline Boom is Different

The Permian’s next big buildout is already taking shape, but this time the driver isn’t oil. East Daley Analytics’ latest white paper reveals how gas demand from AI data centers, utilities and LNG exports is rewriting the midstream playbook. Over 10 Bcf/d of new capacity and $12 billion in investments are reshaping flows, turning the Permian into a gas powerhouse even as rigs decline. Read Part II: Why This Pipeline Boom is Different

East Daley expects this approach to create a durable new demand wedge for Permian gas. Texas is already a growth market for data centers, and building projects directly in the Permian makes sense.

For developers, it connects projects with reliable fuel to generate power, and solves for power-grid interconnect hurdles. For producers, data centers would support a steady market for their associated gas and solve for pipeline takeaway concerns. They would also shield operators from in-basin price volatility. Waha prices have frequently traded near zero or negative in recent years when Permian gas production outruns pipeline egress.

For developers, it connects projects with reliable fuel to generate power, and solves for power-grid interconnect hurdles. For producers, data centers would support a steady market for their associated gas and solve for pipeline takeaway concerns. They would also shield operators from in-basin price volatility. Waha prices have frequently traded near zero or negative in recent years when Permian gas production outruns pipeline egress.

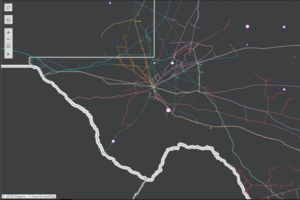

The CVX project is one of several Permian-based data centers East Daly is following in the Data Center Demand Tracker (see map of West Texas data center projects). Chevron has not disclosed the expected gas consumption, but a multi-gigawatt combined-cycle facility of this scale implies several hundred MMcf/d of steady in-basin gas demand. Upside would be materially higher if the project expands toward 5 GW.

CVX is also pursuing similar colocated “power foundry” campuses with Engine No. 1 (energy-focused investment firm) and GE Vernova gas turbine and power systems provider) across the Southeast, Midwest and West, suggesting the Permian build could serve as a template for repeatable gas-to-power projects.

Bottom Line: Behind-the-meter campuses will complement the boom underway in Permian long-haul gas pipelines. East Daley forecasts over 10 Bcf/d of new takeaway by 2030 from greenfield projects like Blackcomb, Desert Southwest and Eiger Express. Data centers would soak up associated gas locally, creating new markets when egress is tight and supporting higher in-basin prices. – Kritika Gaikwad Tickers: CVX.

Meet Daley, the Best AI Tool in Energy

Meet Daley, the newest member of our energy team. Our new AI assistant is live and available to all East Daley Analytics clients. Early feedback has been phenomenal. Daley is platform-specific and only pulls from East Daley’s own proprietary data and content. It’s not open-source or generic AI, but built to understand our structure, language and analytics. Whether you’re looking for a specific metric, forecast or explanation, Daley can get you there quicker. — Reach out to learn more about Daley!

The Daley Note

Subscribe to The Daley Note for energy insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.