The Daley Note: September 14, 2022

Midstream is seeing creative and collaborative solutions to service the current producer supply push amid high commodity prices. Moving ongoing Permian production growth out of the basin will require cooperation.

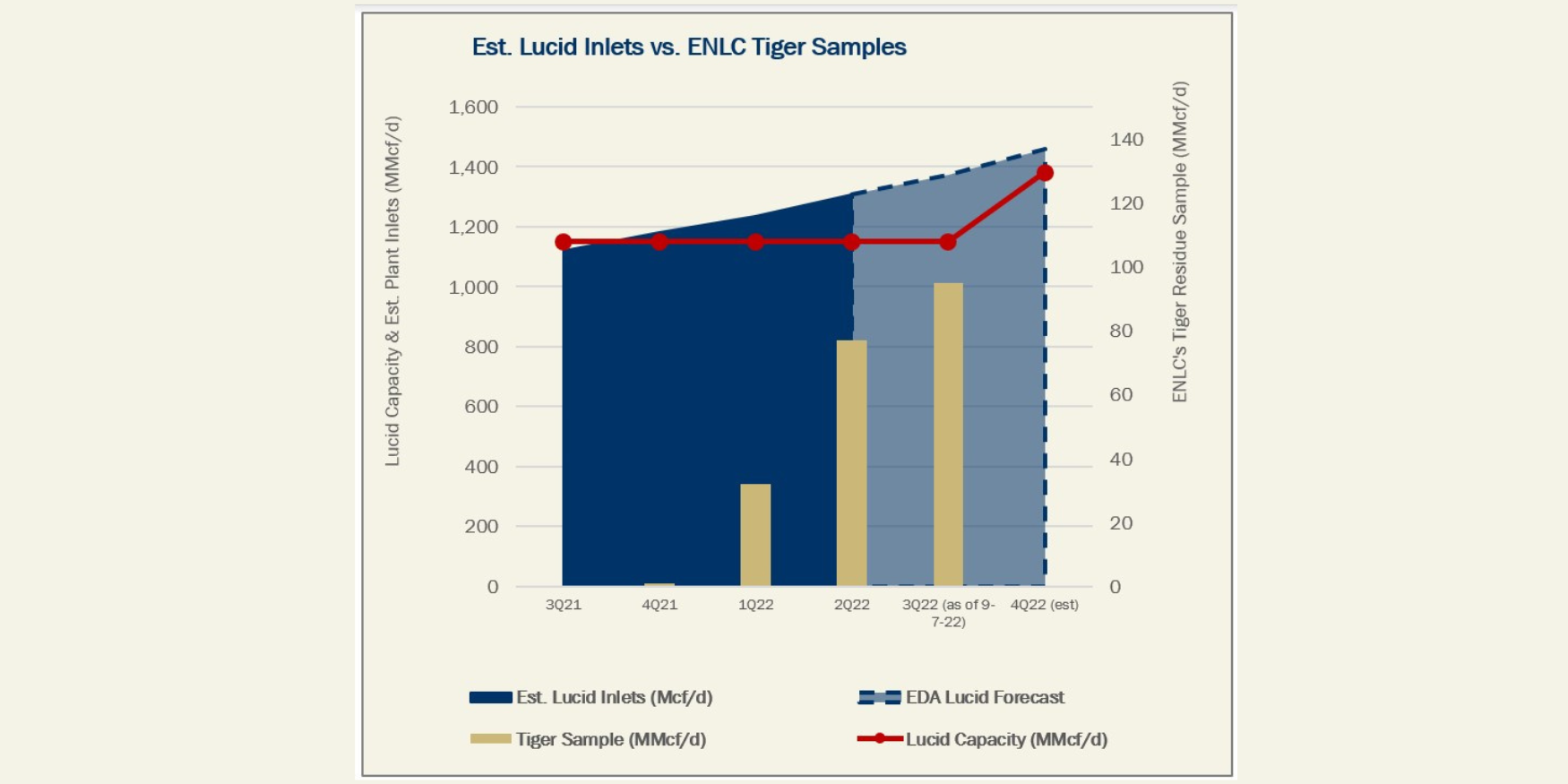

For example, supply growth in the Delaware has outgrown Targa’s (TRGP) recently acquired Lucid system. Help is on the way, however, with TRGP’s new Red Hills VI plant entering service this month. In the meantime, EnLink Midstream’s (ENLC) Delaware G&P system may be a beneficiary of TRGP’s overflow volumes.

During its 2Q22 earnings call, TRGP confirmed the Lucid system is exceeding current processing capacity and that the Red Hills VI plant would run full once it was brought online in September. TRGP management also validated our forecast that overflow volumes from Lucid would be shifted to its “far west Delaware” processing plants to fill spare capacity and add incremental NGL volumes onto Grand Prix (see our June 22 Midstream Navigator, “Targa Acquiring Lucid Energy for $3.55 Billion”).

Before the TRGP acquisition, ENLC confirmed the “restart” of its Tiger processing plant in 4Q21 and subsequently reported total Permian processing volumes grew by an impressive 7%, 10%, and 14% Q-o-Q for 4Q21, 1Q22, and 2Q22 respectively. Residue pipeline samples from the Tiger processing plant seem to spike alongside our estimated overflow forecast for Lucid.

EOG Resources (EOG) and XTO, a subsidiary of ExxonMobil (XOM), are both active on Lucid and EnLink G&P systems. EOG operates its own gathering system that we suspect can divert volumes to both midstream parties.

Although we estimate ENLC’s Delaware system is still growing organically, we also anticipate that the rate of growth for the Delaware system may slow in 4Q22 and FY2023 as this shifting effect subsides.

The Red Hills VI start-up would expand Lucid processing capacity by 230 MMcf/d in September, which could reduce the rate of overflow volumes diverted to ENLC.

As Permian gas processing capacity struggles to keep up with growing demand (especially near the Gulf Coast), midstreamers may be increasingly forced into creative solutions such as this for supplying the gas market. For more information on or company or basin-level forecasts, please contact [email protected]. – J.R. Blumensheid, Senior Equity Research Analyst. Tickers: ENLC, EOG, TRGP, XOM.

Upcoming Event

HART Energy – America’s Natural Gas Conference 9 a.m. – Tuesday, Sept. 27 in Houston, TX

Click here to set up a meeting with Zack on Weds., Sept. 28 in Houston the day following EDA’s presentation.

Subscribe to The Daley Note (TDN), “midstream insights delivered daily,” covers news, commodity prices, security prices, and EDA research likely to affect markets in the short term.

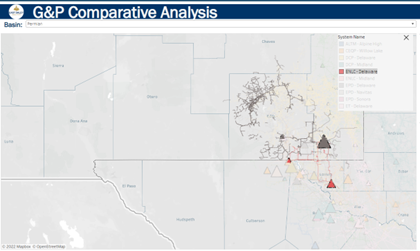

North American Energy Indicators and Equity Prices

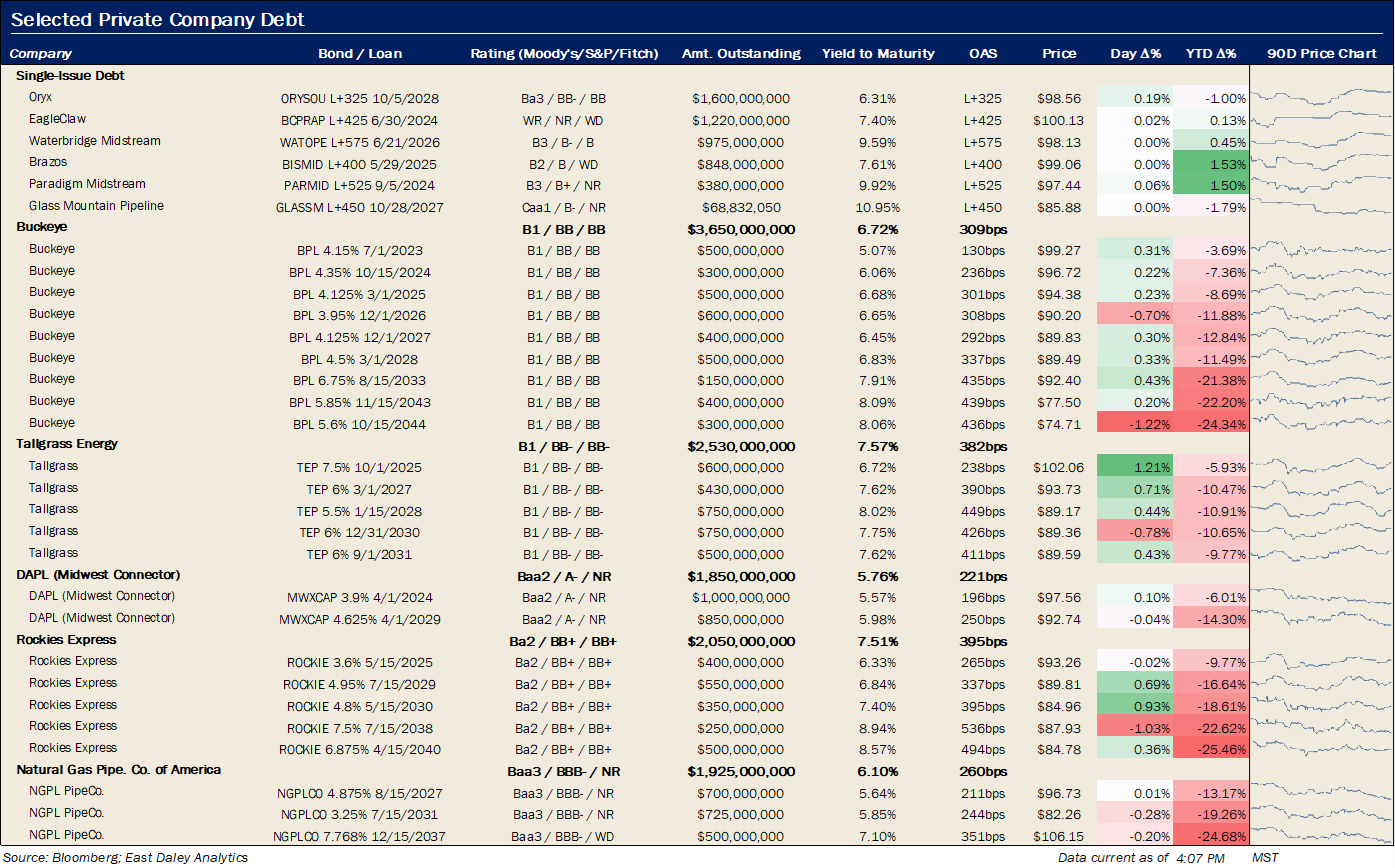

Key Private Debt Metrics

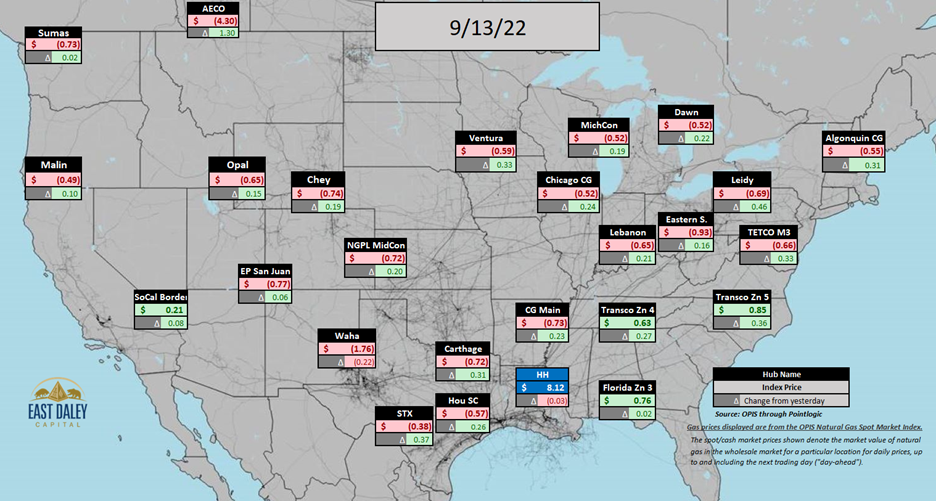

North American Natural Gas Prices

North American Crude Oil Prices

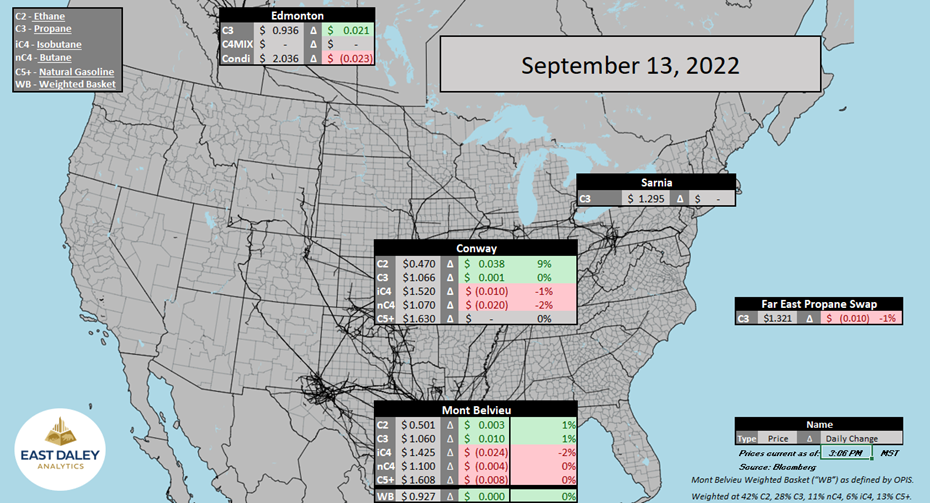

North American Natural Gas Liquids Prices

Subscribe to The Daley Note (TDN), “midstream insights delivered daily,” covers news, commodity prices, security prices, and EDA research likely to affect markets in the short term.