Can US propane storage levels top 100 MMbbl in 2024? After a mild winter, the topic is front and center among NGL traders as an indicator of possible constraints ahead. East Daley would take the over on that bet after recent disruptions from Hurricane Beryl. We have discussed this benchmark in the monthly Propane Supply & Demand Report, and see market factors that should push inventory above 100 MMbbl .

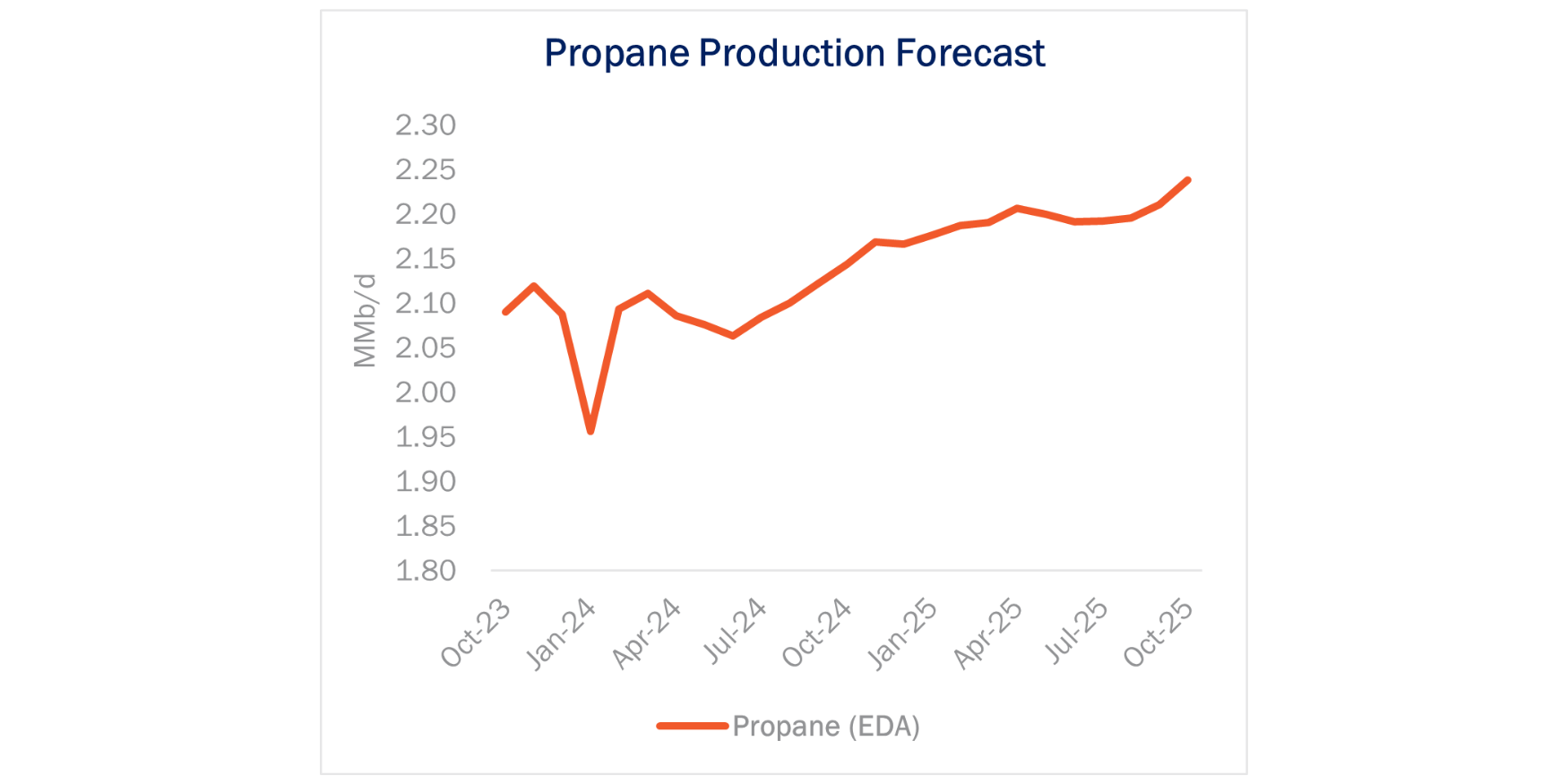

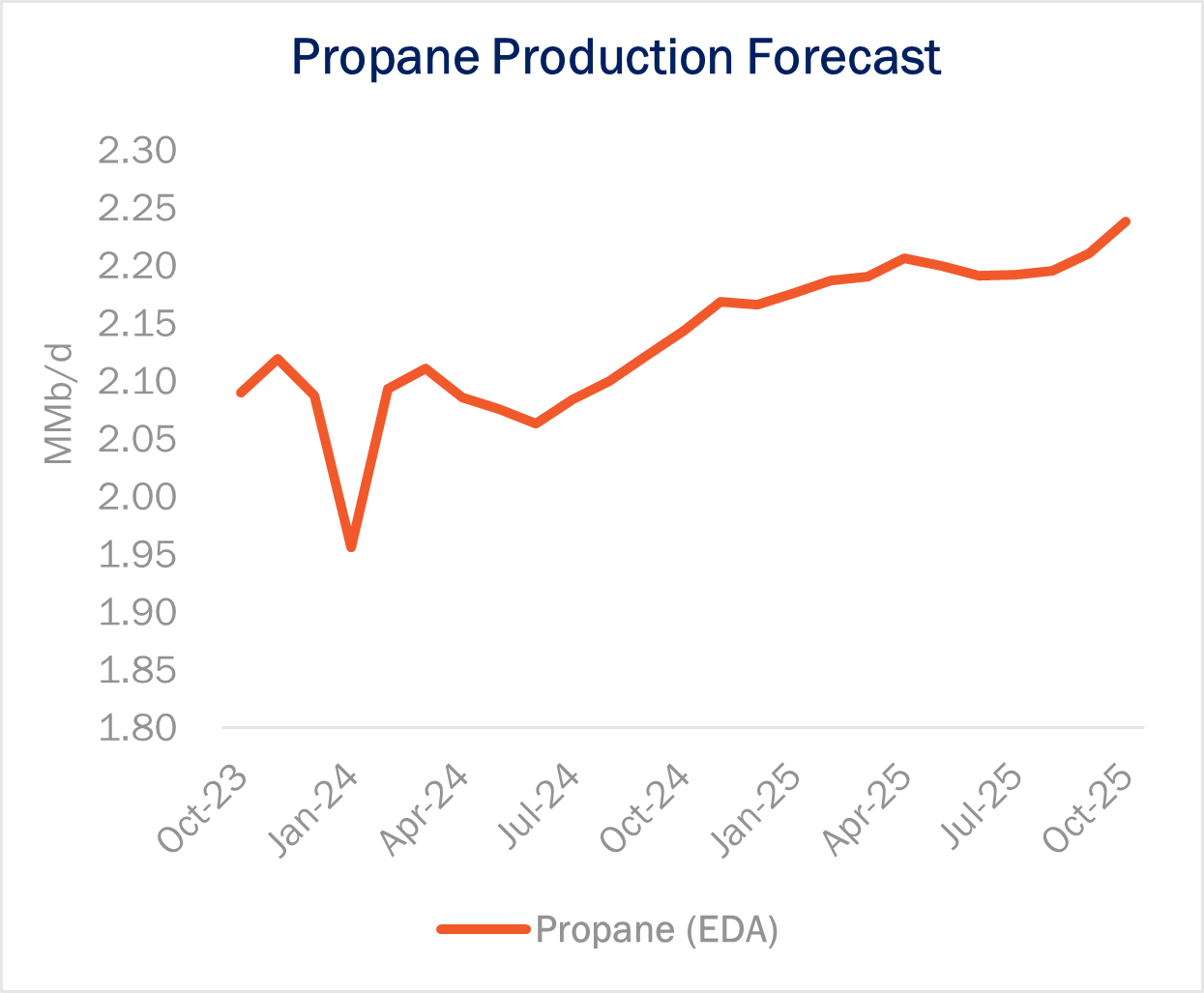

On the supply side, propane production has struggled out of the gate this year. Winter Storm Heather put a dent in January ’24 production for oil and gas – and did the same to propane supply. Propane production then declined almost 50 Mb/d (-2%) from March to June ’24 as a result of lower supply from the Permian. The basin is constrained by tight natural gas egress, and pipeline maintenance on Permian Highway Pipeline (PHP), Gulf Coast Express (GCX), and El Paso Natural Gas (EPNG) further reduced supply in April and May.

The pressure should be alleviated when the Matterhorn pipeline comes online in September ’24, and that’s when we expect propane supply to pick up steam. This is consistent with guidance earlier this year from producers like Chevron (CVX) for most growth to be back-half weighted.

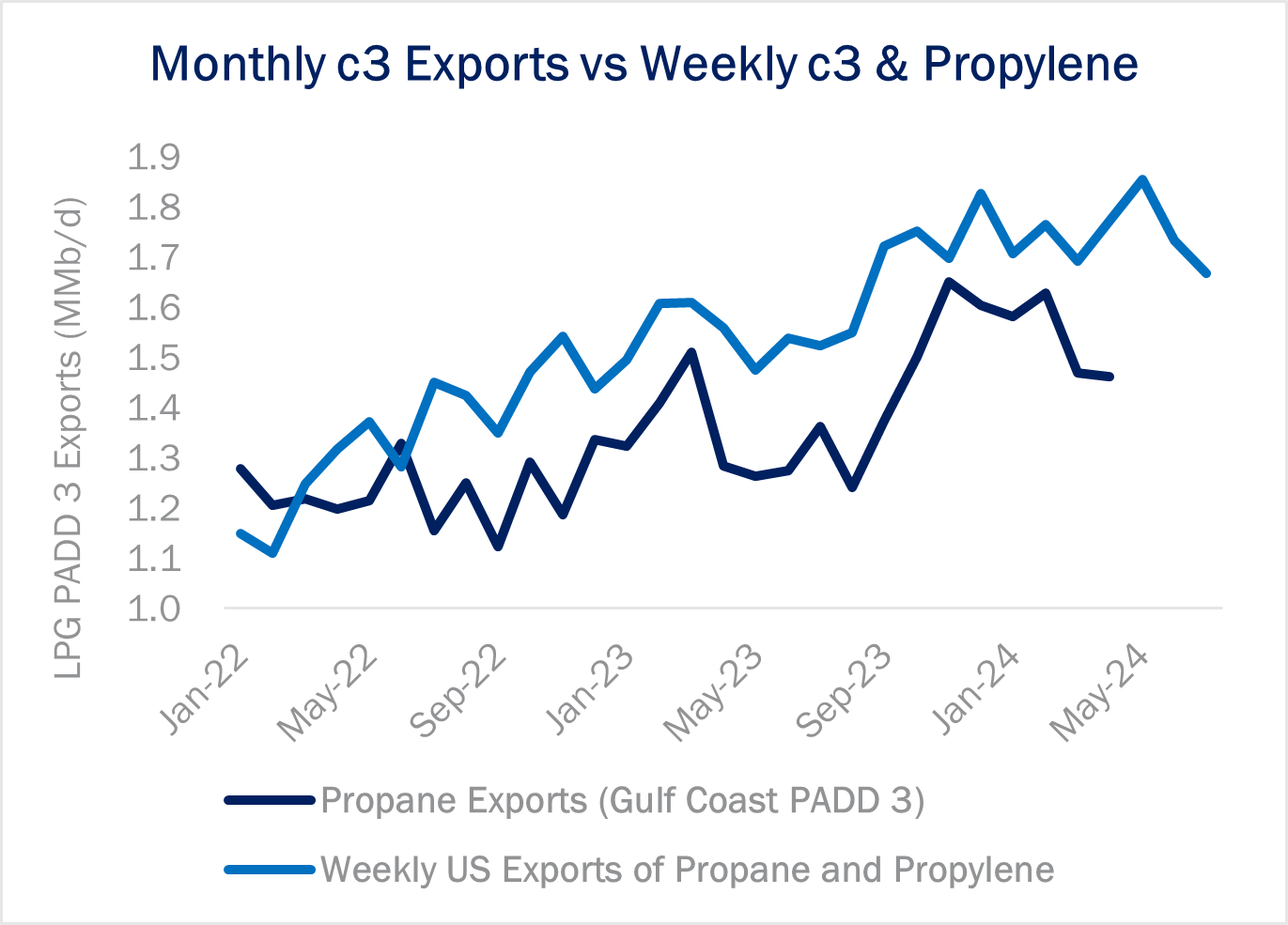

At the same time, propane demand has been strong. The weekly Energy Information Administration (EIA) data on US Exports of Propane & Propylene is up 17% so far in 2Q24 vs 2Q23. The early indication is that Gulf Coast propane exports will match those gains. Enterprise Products (EPD), Energy Transfer (ET), Targa Resources (TRGP) and Phillips 66 (PSX) will likely comment on the persistent strength of international demand being a tailwind for dock volumes in quarterly updates.

Hurricane Beryl has thrown a wrench into Gulf Coast LPG export operations in July ‘24. EDA’s forecast for LPG exports during the month will be revised down in the Propane Supply & Demand Report as Beryl has prevented the normal movement of Very Large Gas Carriers (VLGCs) through the Houston Ship Channel, which means more propane has found a temporary home in storage along the Gulf Coast. We expect propane exports to bounce back starting in the second half of July, but the logistical hiccup caused by Mother Nature will push propane storage above 100 MMbbl by September ’24 in our latest forecast. – Rob Wilson Tickers: EPD, ET, PSX, TRGP.

Propane Supply and Demand Report and Data Set: Coming Soon

Propane Supply and Demand is a Data File & Report that includes historical and forecasted supply and demand components for propane including gas plant propane production, refinery propane production, domestic demand from steam crackers and other consumption, plus propane (LPG) exports. Learn more about the Propane Supply and Demand Report and Data Set.

Energy Data Studio

East Daley Analytics has launched Energy Data Studio, a platform for our industry-leading midstream data and commodity production forecasts. All clients have access to the new client portal. If you have not yet logged in, please fill out the form to request a registration email be resent.

Energy Data Studio leverages our G&P data set for insights into midstream assets across every major oil and gas basin in North America. Users can navigate detailed visual dashboards by region, pipeline, or individual asset to understand crude oil, natural gas and NGL supply at the most granular level.

Energy Data Studio is available through data downloads from the visual interface, in Excel files, or as a direct feed delivered into subscribers’ workflow via secure file transfer. To learn more about Energy Data Studio, please contact [email protected].

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.