Kinder Morgan (KMI) will buy Outrigger Energy II’s Bakken G&P assets for $644MM, the company announced last Monday (Jan 13). The acquisition can support two other projects KMI is pursuing to open more takeaway for Bakken natural gas and NGLs.

East Daley Analytics tracks rigs, volumes and counterparties for the Outrigger assets in Energy Data Studio. The system includes a 270 MMcf/d processing plant and a 104-mile, 350 MMcf/d gathering header.

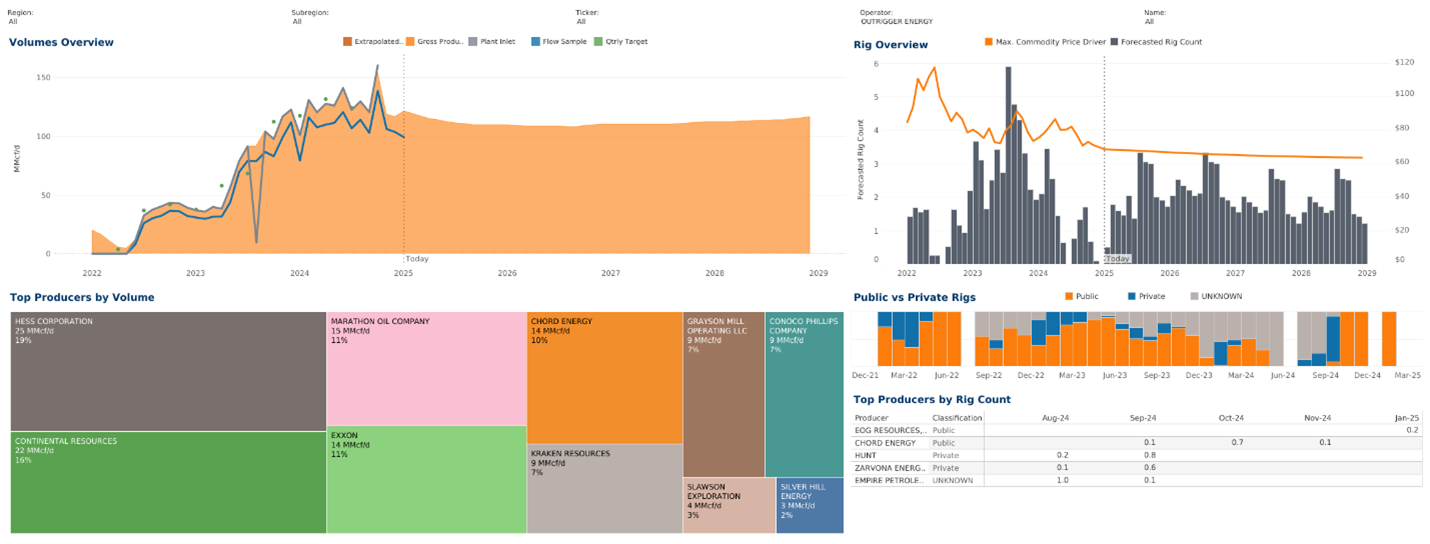

The picture shows the “G&P System Profile” dashboard for Outrigger in Energy Data Studio. Outrigger serves a diverse group of Baken producers including Continental Resources (CLR), Exxon (XOM), Hess (HES) and Marathon (MRO). Rig counts on the system reached a high of 6 in mid-2023, according to our rig allocations, then declined through 2024 and averaged just 1 rig in 4Q24.

KMI expects the deal to close in 1Q25 and quotes an ~8.0x multiple on 2025 EBITDA, or estimated ‘25 EBITDA of ~$80MM. However, EDA see synergies that can further unlock value.

What We Like About the Deal: The Outrigger acquisition can help support two other KMI projects. KMI is converting Double H Pipeline from crude oil to NGL service, and can route NGLs from Outrigger’s Bill Sanders plant to Double H once the conversion is completed in 1Q26. We currently assign the NGLs to the ONEOK (OKE) system, creating downside risk to those volumes.

Outrigger can also help KMI and producers on its systems grow into the Bison Xpress project. Bison Xpress will expand capacity on Northern Border and reverse Bison Pipeline, opening ~300 MMcf/d of Bakken takeaway in 2026. KMI has paired a lease on the Bison Xpress project with the new plant acquisition to offer its producers a path out of the basin.

Speculation City: Plant inlets to the Bill Sanders plant peaked at 160 MMcf/d in Oct ’24, or 110 MMcf/d below the plant’s nameplate capacity (see the figure). HES and CLR are the top producers on KMI’s Bakken assets, as well as the Outrigger – Bill Sanders system. Look for them to grow production as more egress opens through Bison Xpress in 2026. – Zach Krause Tickers: CLR, HES, KMI, MRO, OKE, XOM.

Request the Dirty Little Secrets 2025 Written Report

A full written report will be available in January for the 2025 Dirty Little Secrets. This report will go beyond the webinar discussions to provide a deeper analysis of the topics covered. Learn how commodities are intertwined and identify opportunities for profit from market dislocations. Request a copy of the Dirty Little Secrets report.

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.