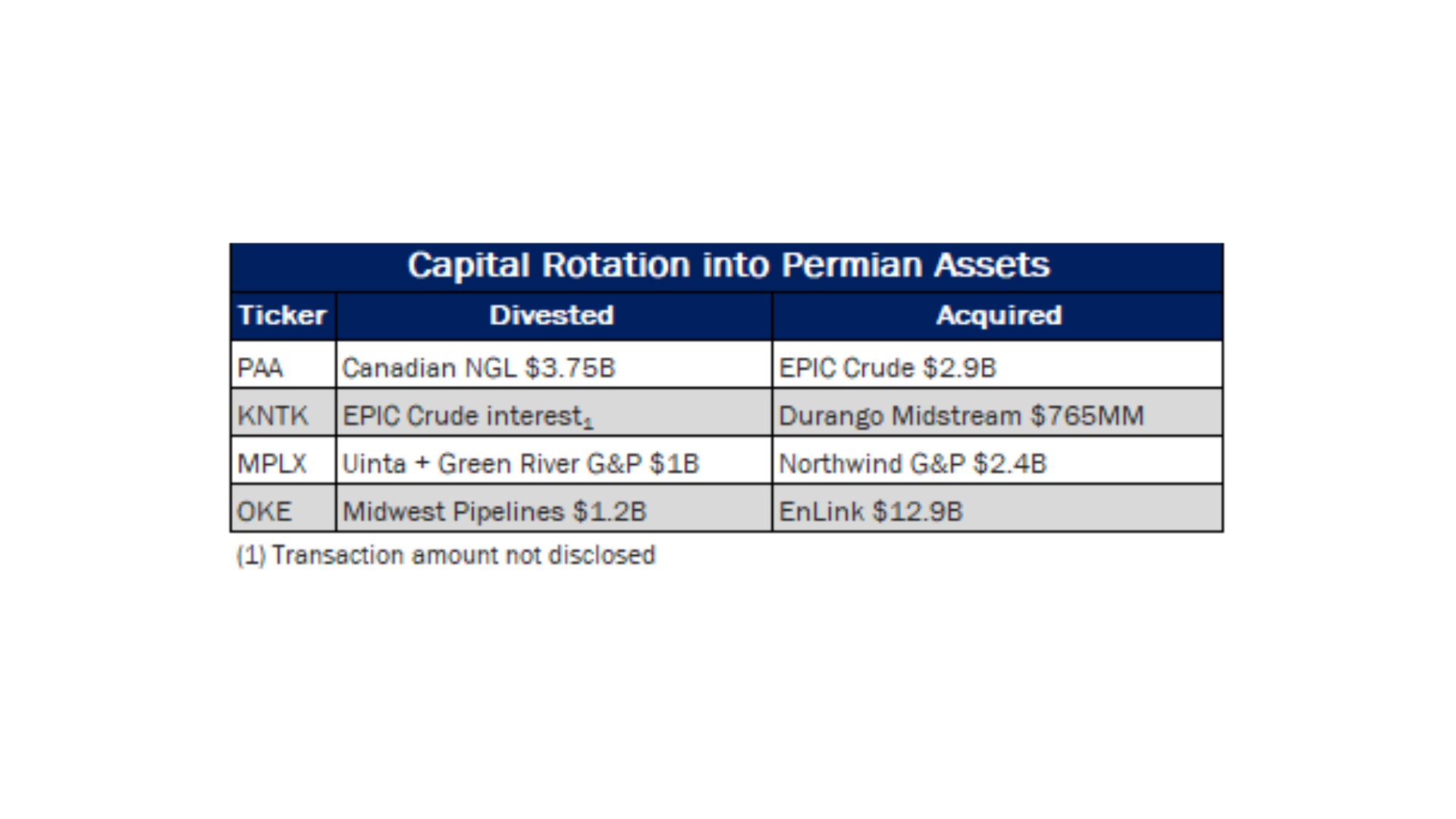

Market Movers: Midstream companies accelerated efforts to vertically integrate in 2025, rotating capital from lower-synergy, non-core assets into highly integrated systems. The Permian Basin has been a focal point of this trend.

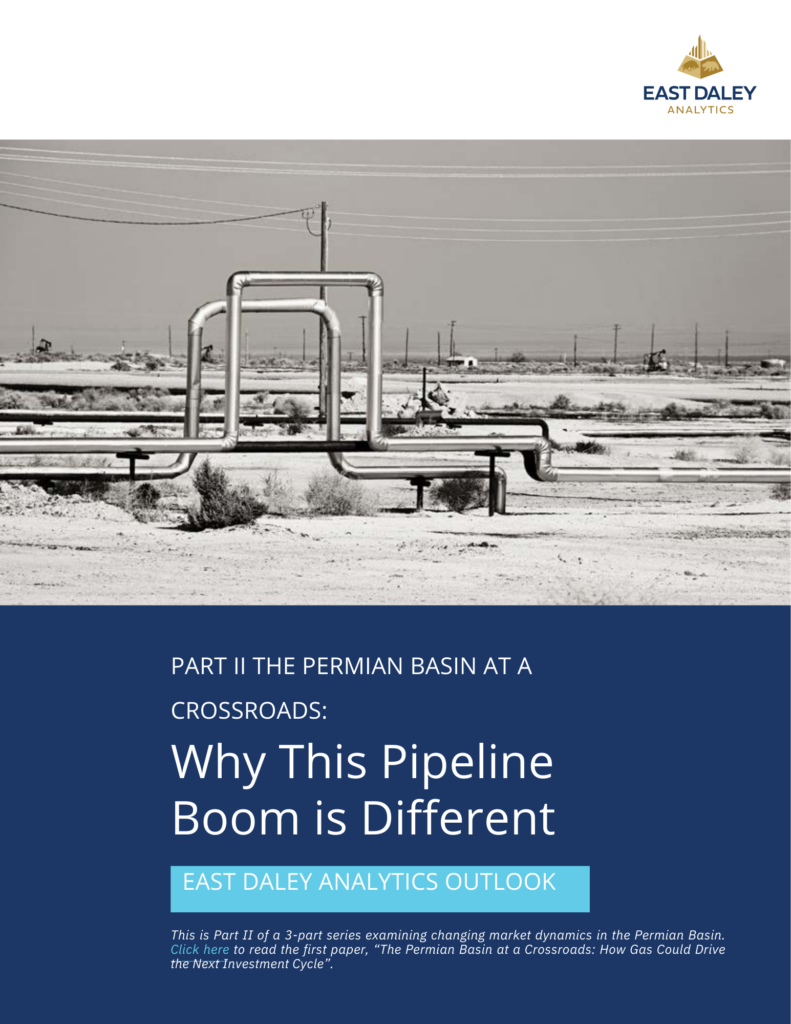

Estimated Quarterly Volumes: The Delaware (-2.7%), Haynesville (-2.6%) and Bakken (-1.8%) samples are down in 4Q25 while the Northeast (1.1%) and Rockies (1.1%) are up Q-o-Q.

Calendar: EDA will be in NYC Feb 9 – 12. Updated models will be released Feb 13. Earnings Previews for AM, WMB, ENB and TRP will be released by Jan. 30.

Market Movers:

Midstream companies in 2025 accelerated efforts to vertically integrate amid rising industry concentration. This trend has driven a rotation of capital out of lower-synergy, non-core assets and into highly integrated systems. The Permian Basin has been a focal point of this trend given its central role in US LNG, NGL and crude exports.

Plains All American (PAA) provides a clear example on the crude side. In 1Q26, PAA will effectively divest its Canadian NGL business to Keyera for $3.75B and redeploy $2.9B of capital into its recently acquired EPIC Crude pipeline. Kinetik (KNTK) and Diamondback (FANG) previously acquired a combined 30% minority stake in EPIC in 4Q24, an investment that offered limited integration benefits given Kinetik’s G&P-centric footprint.

For PAA, EPIC presents a materially stronger strategic fit due to its extensive Permian crude gathering and transmission network. As crude remains flat and organic expansion opportunities narrow, assets that enhance system connectivity and integration are becoming increasingly attractive to large midstream operators like PAA.

A similar capital rotation strategy is playing out in G&P assets. MPLX divested its Uinta and Green River G&P systems for $1B in 3Q25 while acquiring the private equity-backed Northwind system in the Delaware Basin for $2.4B. The Northwind acquisition bolsters MPLX’s NGL volumes ahead of an export terminal planned with ONEOK (OKE) in Texas City. The northern Delaware, where Northwind operates, is one of the fastest growing and least developed areas of the Permian, offering a clear runway for volume growth and incremental NGL supply into MPLX’s downstream network. This deal follows other recent transactions in the region, including Kinetik’s $765MM acquisition of Durango Midstream and Targa’s $1.25B purchase of Stakeholder Midstream.

ONEOK has pursued a comparable strategy. OKE in 4Q24 divested its Guardian, Midwestern and Viking gas transmission pipelines in the Midwest for $1.2B, shortly before completing its acquisition of EnLink Midstream at an implied enterprise value of $12.9B in 1Q25. The move increases NGL volumes available to feed its transmission assets and supports fractionation utilization along the Gulf Coast, while increasing geographic concentration risk.

The Permian Basin at a Crossroads: Download Why This Pipeline Boom is Different

The Permian’s next big buildout is already taking shape, but this time, the drivers aren’t producers chasing oil. East Daley’s latest white paper reveals how gas demand from AI data centers, LNG exports, and utilities is rewriting the midstream playbook. Over 9 Bcf/d of new capacity and $12 billion in investments are reshaping flows, turning the Permian into a gas powerhouse even as rigs decline. Read Part II: Why This Pipeline Boom is Different

As the Permian continues to consolidate, vertical integration is increasingly critical to competitive positioning. East Daley expects highly leveraged operators to lean further into non-core divestitures or alternative financing structures, including selling non-controlling stakes to private equity, as they navigate an increasingly competitive midstream landscape.

Estimated Quarterly Volumes:

The Total Sample represents the flow sample and plant data accessible to EDA. The latest Q-o-Q percentage change is estimated by comparing either flow sample data Q-o-Q or plants within a basin that have continuously reported inlet volumes from the prior quarter to the current quarter. Sample data is now inclusive of all plant data within a basin, resulting in a one-time change to total sample basin levels in 2Q and 3Q. 4Q25 is expressed as Q-o-Q growth from 3Q25.

Rockies represents the aggregate of Big Horn, DJ, Green River, Piceance, Powder River, San Juan, Uinta and Wind River basins.

Delaware: Delaware plant inlet data is down 2.7% Q-o-Q in 4Q25. The decliners include Phillip 66’s DCP Delaware system (-3%) and San Mateo’s Black River system (-1% Q-o-Q). Top producers on Black River include Matador Resources, Occidental Petroleum and Devon Energy.

Bakken: Bakken flow sample data is down 1.8% Q-o-Q, led by ONEOK’s Bakken system (-1.7%) and Targa’s Badlands system (-11% Q-o-Q). Top producers on Badlands include Conoco Phillips, Devon Energy and Chord Energy.

Calendar: