Market Movers: Hydrocarbon production in the Permian Basin is growing gassier. Depending on where you sit in the industry, the trend is a source of immense frustration, or a driver of new opportunities.

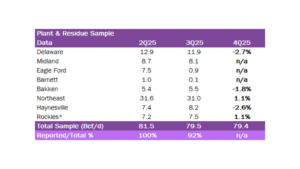

Estimated Quarterly Volumes: Flow samples for the Delaware (-2.7%), Haynesville (-2.6%) and Bakken (-1.8%) are down while flow samples for the Northeast (1.1%) and Rockies (1.1%) are up Q-o-Q..

Calendar: EDA will be in NYC Feb 9 – 12 and updated models will be released Feb 13.

Market Movers:

Hydrocarbon production in the Permian Basin is growing gassier. Depending on where you sit in the industry, the trend is a source of immense frustration, or a driver of new opportunities.

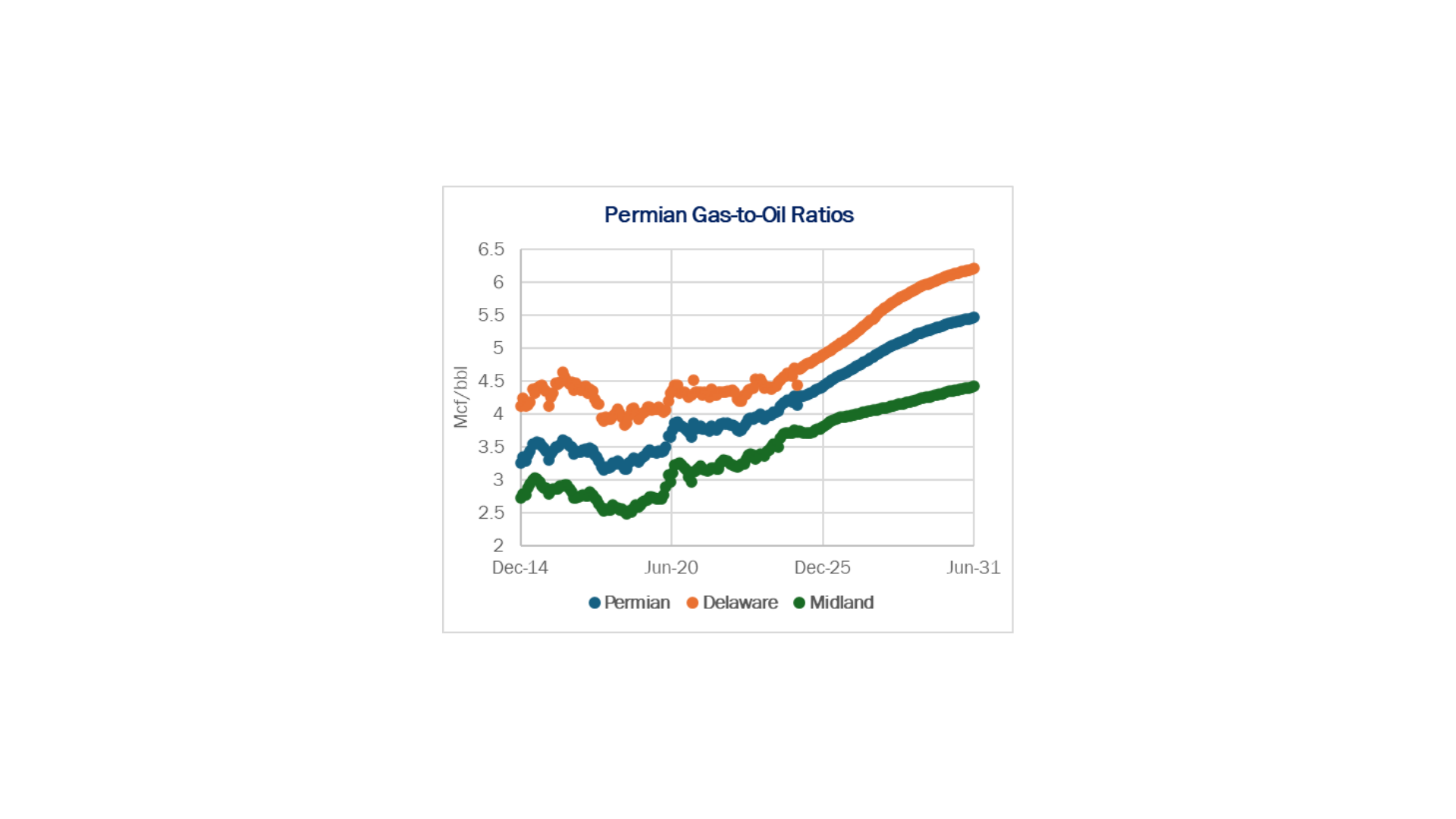

Rising gas-to-oil ratios (GOR) from Permian wells is one of the most widely discussed industry topics. Upstream investors, who favor higher-priced liquids production over natural gas, view it as a drag on equities. But growing Permian gas production is spurring a range of investments by midstream companies, from pipelines to processing plants, to capitalize on the trend in an otherwise uncertain outlook for crude oil.

East Daley Analytics’ review of Permian well data finds several drivers for rising GORs. First, operators are migrating toward the Delaware sub-basin, where target formations yield relatively more gas than oil compared to the Midland (see chart). Second, the Permian has a large base of maturing wells, and as oil wells age and reservoir pressure declines, more methane is released from hydrocarbon formations. The GOR increase is partly mathematical, partly geologic, and partly driven by development evolution.

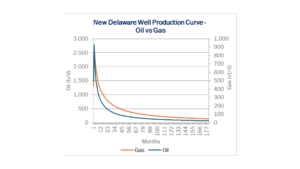

The decline dynamic is easy to see in the average new Delaware well, shown in the chart below. Oil production falls sharply in the early months, while gas volumes flatten more gradually, meaning a well’s GOR trends higher as the curves separate.

To quantify this behavior, East Daley uses the Production Durability Index (PDIₓ) — defined as the number of months it takes for production in a well to deplete to X% of its peak rate.

The Permian Basin at a Crossroads: Download Why This Pipeline Boom is Different

The Permian’s next big buildout is already taking shape, but this time, the drivers aren’t producers chasing oil. East Daley’s latest white paper reveals how gas demand from AI data centers, LNG exports, and utilities is rewriting the midstream playbook. Over 9 Bcf/d of new capacity and $12 billion in investments are reshaping flows, turning the Permian into a gas powerhouse even as rigs decline. Read Part II: Why This Pipeline Boom is Different

Across both Permian sub-basins, gas production is consistently more durable than oil — but this effect is amplified in the Midland. Gas production from a Midland well takes 12.5 months on average to fall to 75% of its peak, compared with 4 months for oil production in a Midland well. In the Delaware, the gap is smaller — 4.5 vs 3.5 months —but still directionally consistent.

This difference shapes how each sub-basin contributes to Permian supply:

- Delaware wells deliver higher absolute volumes thanks to stronger initial production (IP) rates.

- Midland wells deliver longer life — their slow-declining gas tails provide a structural uplift to basin-wide GORs and long-term gas supply.

Put simply: Delaware drilling gives you the magnitude; the Midland gives you longevity. And even though Midland gas declines more slowly, Delaware wells still produce more total gas because they start at higher IPs.

Bottom line: This is a structural effect driven by physics, not targeted gas drilling. Modern development and natural decline behavior are steadily pushing the Permian toward a more gas-weighted production profile, simply because that is what the wells give you.

Estimated Quarterly Volumes:

The Total Sample represents the flow sample and plant data accessible to EDA. The latest Q-o-Q percentage change is estimated by comparing either flow sample data Q-o-Q or plants within a basin that have continuously reported inlet volumes from the prior quarter to the current quarter. Sample data is now inclusive of all plant data within a basin, resulting in a one-time change to total sample basin levels in 2Q and 3Q. 4Q25 is expressed as Q-o-Q growth from 3Q25.

Rockies represents the aggregate of Big Horn, DJ, Green River, Piceance, Powder River, San Juan, Uinta and Wind River basins.

Northeast: Northeast flow sample data is up 1.1% Q-o-Q. DT Midstream’s Tioga system is up 400% while its Bluestone system is down 3.8% Q-o-Q. Top producers on Bluestone include Expand Energy and Coterra Energy.

Haynesville: Haynesville flow sample data is down -2.6% Q-o-Q. Kinder Morgans’ KinderHawk system is down 7.4% Q-o-Q while Energy Transfers’ Louisiana system is up 6.9% Q-o-Q. Top producers on the Louisiana system include Comstock Resources, Trinity Operating and TG Natural Resources.

Calendar: