MPLX reached a deal to sell its Rockies G&P assets in the Green River and Uinta basins to Harvest Midstream for $1.0B in cash, but will retain control of the associated NGLs. The deal helps MPLX right-size its portfolio as the company pursues an NGL export strategy on the Gulf Coast.

MPLX and Harvest announced the deal last Wednesday (Aug. 27). The assets sold include:

- Uinta Basin – G&P assets with 700 miles of gathering and 345 MMcf/d of processing capacity at the Ironhorse and Stagecoach plants.

- Green River – G&P assets include 800 miles of gathering and 500 MMcf/d of processing capacity at the Black Forks and Vermillion plants. The Green River assets include 10 Mb/d of fractionation capacity.

As part of the transaction, Harvest agreed to dedicate 12 Mb/d of NGLs from the two systems to MPLX for seven years beginning in 2028, following the expiration of an existing commitment. The companies expect to close the transaction in 4Q25.

The Strategy: Portfolio rebalancing drives this deal for MPLX. Based on asset data in Energy Data Studio, East Daley Analytics estimates the divested assets generate $135MM in annual EBITDA, or less than 2% of MPLX’s forecasted EBITDA. In contrast, its Permian and Northeast assets drive almost the entire G&P segment EBITDA and almost one-third of total company EBITDA.

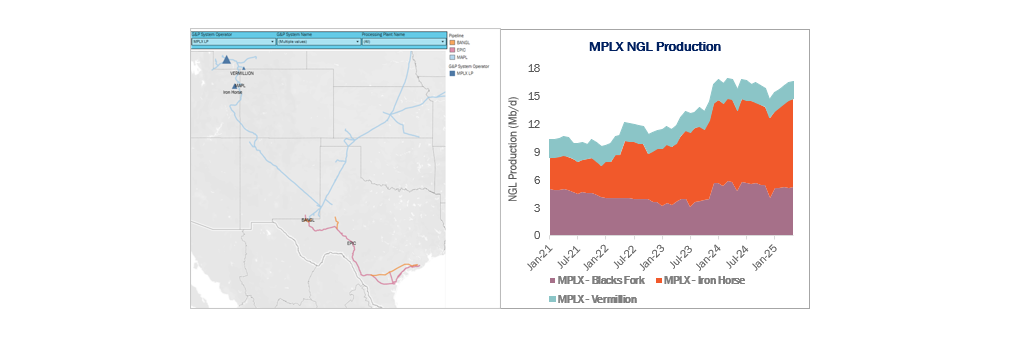

MPLX is focusing its efforts on the Permian and Marcellus wellhead-to-water strategy. That is why the NGL dedication of 12 Mb/d is more than a footnote. Those NGL barrels will likely make their way to the Gulf Coast via Enterprise Products’ (EPD) MAPL NGL pipeline, where they will be fractionated and exported via the MPLX/ONEOK (OKE) joint venture (see the map above from the NGL Hub Model in Energy Data Studio showing the route to the MPLX/OKE JV on the Gulf Coast). East Daley wrote about the MPLX/OKE JV here.

We track NGLs by plant in Energy Data Studio. The three plants sold by MPLX produced over 15 Mb/d combined in the latest monthly data, shown above.

The Verdict: We believe this is a good deal for MPLX for two reasons.

- It allows MPLX to focus on its wellhead-to-water strategy linking NGLs from growing supply basins to international demand.

- Deal accretion. We estimate MPLX’s recent investment in Northwind Midstream and the divestment of the Rockies G&P assets yields a net EBITDA multiple of 9.1x. This compares to the MPLX EV/EBITDA multiple of 10.7x. Net growth was purchased for a bargain compared to current company cost of capital. Of course, the paper accretion depends on MPLX’s ability to grow Northwind volumes and associated cash flows over the next few years.

To learn more, see details on the G&P assets and the MPLX financial outlook in Energy Data Studio. – Jaxson Fryer and Rob Wilson, CFA Tickers: EPD, OKE, MPLX.

Meet Daley, the Best AI Tool in Energy

Meet Daley, the newest member of our energy team. Our new AI assistant is live and available to all East Daley Analytics clients. Early feedback has been phenomenal. Daley is platform-specific, and only pulls from East Daley’s own proprietary data and content. It’s not open-source or generic AI, but built to understand our structure, language and analytics. Whether you’re looking for a specific metric, forecast or explanation, Daley can get you there quicker. — Reach out to learn more about Daley!

Get the Data Center Demand Monitor

The Data Center Demand Monitor is your go-to source for tracking data center projects and demand. Available as part of the Macro Supply & Demand Report, East Daley monitors and visualizes nearly 500 US data center projects. Use the Data Center Demand Monitor to forecast demand, identify pipeline corridors and track data center projects. — Request your demo now of the Data Center Demand Monitor!

The Daley Note

Subscribe to The Daley Note for energy insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.