Crude oil has failed to gain traction in the days since the US launched a military strike in Venezuela, with prices hovering just above multi-year lows. Despite potential upside from the new geopolitical uncertainty, WTI has reached a threshold that could stall activity in the Permian Basin, the last engine of US production growth.

The WTI front-month contract traded just under $57/bbl late Tuesday (Jan. 6). Prices have declined about $0.30 since Jan. 3, when President Trump authorized a military raid in Venezuela to capture President Nicolàs Maduro. WTI is now priced about $3 lower than a month ago.

The Permian Basin at a Crossroads: Why This Pipeline Boom is Different

The Permian’s next big buildout is already taking shape, but this time the driver isn’t oil. East Daley Analytics’ latest white paper reveals how gas demand from AI data centers, utilities and LNG exports is rewriting the midstream playbook. Over 10 Bcf/d of new capacity and $12 billion in investments are reshaping flows, turning the Permian into a gas powerhouse even as rigs decline. Read Part II: Why This Pipeline Boom is Different

The market has clawed back most of the losses since mid-December. WTI settled at $55.27/bbl on Dec. 15, the lowest close since the world was recovering from the global pandemic in 2021.

The market has clawed back most of the losses since mid-December. WTI settled at $55.27/bbl on Dec. 15, the lowest close since the world was recovering from the global pandemic in 2021.

Consensus opinion expects crude production to flatten or potentially decline in 2026, a result of geopolitical risks and fears of a looming global supply glut. The Venezuelan operation introduces a new variable of uncertainty in the outlook.

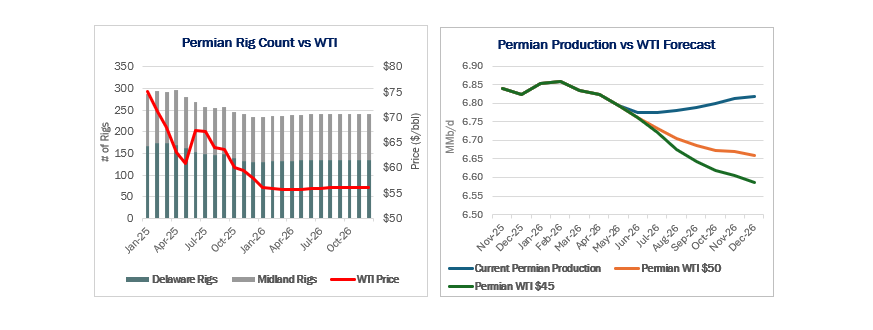

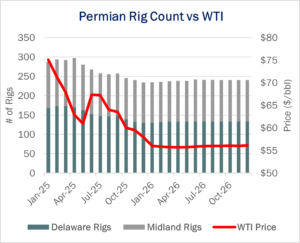

The oil market is dangerously close to reaching a price where Permian supply begins to turn over. Permian rig counts averaged 240 rigs in 4Q25, down ~50 rigs from 1Q25’s 291 rigs between the Midland and Delaware basins.

In the Crude Hub Model, East Daley Analytics projects a low of 235 Permian rigs going into 2026. But if prices continue to slide, we are likely to revise down our rig outlook, and production will be lost in 2026.

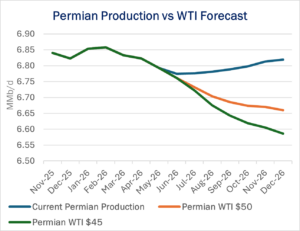

WTI prices of $50 or $45/bbl would have a significant impact on 2026 production in the Permian, based on East Daley’s Production Scenario Tools (see figure below). Enterprise Products (EPD) stated on its 1Q25 earnings call that a WTI price of $55-$60/bbl would largely put the basin’s producers into maintenance mode.

Producers in other regions are also looking at oil prices to determine budgets in 2026. The merging SM Energy (SM) and Civitas Resources (CIVI) stated on their 3Q25 earnings call that if prices do not reach a $65/bbl target in 2026, the merged company is likely to reduce production and instead focus on other goals, such as reaching net leverage of 1.0x and reducing debt.

Producers in other regions are also looking at oil prices to determine budgets in 2026. The merging SM Energy (SM) and Civitas Resources (CIVI) stated on their 3Q25 earnings call that if prices do not reach a $65/bbl target in 2026, the merged company is likely to reduce production and instead focus on other goals, such as reaching net leverage of 1.0x and reducing debt.

The market is punishing producers that plan to grow in the current environment. For example, Matador Resources (MTDR) saw its stock price drop from $43.91 to $39.68 after its 3Q25 earnings call, when MTDR guided to production growth in 2026. Investor concerns are likely to push more producers to pull back.

As the market enters 2026, US crude oil production is expected to remain flat, or potentially fall if WTI continues to slide into the lower $50s. 2026 is an environment with risk of oversupply of crude, and a world hungry for gas molecules, creating a demand-pull tension in the Permian never seen before. East Daley explores this topic more in the 2026 Dirty Little Secrets, coming soon for prospects. – Alec Gravelle and Rob Wilson, CFA Tickers: CIVI, EPD, MTDR, SM.

Meet Daley, the Best AI Tool in Energy

Meet Daley, the newest member of our energy team. Our new AI assistant is live and available to all East Daley Analytics clients. Early feedback has been phenomenal. Daley is platform-specific and only pulls from East Daley’s own proprietary data and content. It’s not open-source or generic AI, but built to understand our structure, language and analytics. Whether you’re looking for a specific metric, forecast or explanation, Daley can get you there quicker. — Reach out to learn more about Daley!

The Daley Note

Subscribe to The Daley Note for energy insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.