East Daley Analytics has published updated models and 2Q25 Earnings Previews for companies in our coverage including DT Midstream (DTM), Energy Transfer (ET), Genesis Energy (GEL), Kinetik (KNTK), MPLX, Targa Resources (TRGP) and Williams (WMB), with several others out for delivery. Here are a few data points we’re seeing so far.

Kinetik – Ambitious Guidance, Model Realities

Processing volumes for KNTK declined 3.2% Y-o-Y in 1Q25 and slipped a further 3.0% Q-o-Q in our 2Q25 forecast. We expect only modest 2Q25 volume gains through assets like:

- Kings Landing Phase I expansion (modeled for a late-June startup)

- Permian Resources bolt-on in Reeves Country (partial 2025 contribution)

Management’s “high-teens” 2025 growth guidance (13% Y-o-Y) diverges from both the 1Q actuals (–3.2% Y-o-Y) and our full-year model (~9% Y-o-Y). Whether KNTK can reconcile this gap — via a faster Kings Landing ramp or earlier bolt-on synergies — will determine whether KNTK can truly deliver the upside it’s forecasting.

Williams – Ramp at Perdido Norte Still Pending

Perdido Norte flow samples have not shown meaningful increases in East Daley’s latest data through June, suggesting the deepwater system has yet to deliver material volumes into the offshore Perdido hub. WMB has indicated that the projects will be completed on the following delayed timelines:

- Whale: Shell (SEL) achieved first oil Jan. 9, 2025 at the Whale floating production facility. Despite first oil, monthly flow sample data has not shown a step increase toward the ~100 Mboe/d design capacity.

- Great White: Three wells were originally slated to start in April 2025. One well began production in March, but the two remaining wells have been pushed out to YE25. Absent the full three-well ramp, gas and oil flow samples remain near zero against the 265 MMcf/d gas and 100 Mb/d oil‐equivalent processing capacities.

With Whale and Great White still offline, deepwater volumes won’t bolster WMB’s 2Q25 results. A true ramp in the flow sample is the key catalyst for restoring earnings visibility into late 2025 and beyond.

With Whale and Great White still offline, deepwater volumes won’t bolster WMB’s 2Q25 results. A true ramp in the flow sample is the key catalyst for restoring earnings visibility into late 2025 and beyond.

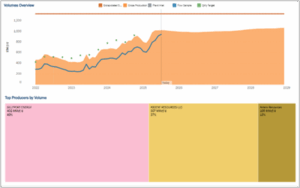

MPLX – Utica JV Sample Spikes in Response to Gas Prices

Processing samples for the MPLX – Utica JV system jumped 33% from 1Q25 into 2Q25 (see asset chart from Energy Data Studio), suggesting an earlier reaction to higher Northeast gas prices than we’d previously modeled. That uptick should provide a modest tailwind for MPLX’s 2Q25 earnings, even as our overall outlook remains flat given a mix of offsetting puts and takes:

- Gulfport Resources (GPOR): GPOR is one of the largest producers on the Utica JV system. Our data shows solid Q-o-Q growth in 2Q25 production.

- Ascent Resources: Another core Utica operator is likewise poised for meaningful volume gains this quarter.

The robust Northeast gas volumes underpin a positive bias for MPLX’s fee-based cash flows in 2Q25, but broader commodity and maintenance dynamics leave our 2025 outlook unchanged. – Rob Wilson, CFA and Jaxson Fryer Tickers: ET, GEL, GPOR, KNTK, MPLX, SEL, WMB.

NEW Webinar – August Monthly Production Stream

Join East Daley on August 13 for the August Monthly Oil & Gas Production Webinar – your essential update on the latest production trends and midstream impacts across natural gas, NGLs and crude oil. In today’s energy markets, all commodities are tied together. Join us as we review shifts in Lower 48 production across key basins, plus infrastructure-driven volume trends, and how a shift in one market can send ripples through the others. Please sign up to join us August 13 at 10 AM MST.

NEW – The Burner Tip

The Burner Tip provides East Daley’s weekly coverage of natural gas markets. Every Thursday, The Burner Tip brings you our expert perspective on drivers shaping prices and flows in North America — including production trends, infrastructure dynamics, and forward-looking fundamentals — all grounded in EDA’s proprietary data and models. Whether you’re trading, investing, or managing risk, The Burner Tip delivers the insights you need to drive smarter strategy. Subscribe now to The Burner Tip!

The Daley Note

Subscribe to The Daley Note for energy insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.