Sentiment is dour in the oil patch as independents and the supermajors adjust to a new era of US oil maintenance rather than growth. Instead, natural gas is poised to shoulder the growth in the next commodity cycle, driven by surging demand for LNG exports and data centers.

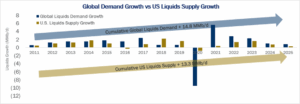

Over the past 15 years, growth in US liquids production has largely kept pace with global demand (see chart below). But the next cycle looks different — at a crude forward curve hovering near $60/bbl, US producers have pulled back on growth capital. Companies have reshaped into leaner organizations, focused on free cash flow and built to endure low-growth conditions.

It’s a tale of two cities in commodity markets. While oil growth downshifts, US gas markets are entering a demand-driven boom fueled by data centers and LNG exports. Capital has rapidly shifted to gas-targeted basins such as the Haynesville, Marcellus/Utica and Rockies plays, including the Green River, San Juan and Piceance.

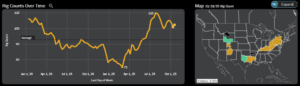

The ramp-up is visible in East Daley Analytics’ Energy Data Studio. Active rigs in gassy basins bottomed near 75 rigs at the end of 1Q25 and climbed to 110 by the end of July, a remarkable 45% increase in just four months (see figure from the “Rig Activity Tracker” dashboard in Energy Data Studio). US gas is poised for its most significant structural expansion in decades — both at home and abroad.

Why it Matters: Despite the pain and uncertainty facing oil producers, opportunities in gas remain abundant. The surge in activity across gas-focused regions is not a flash in the pan; it marks the beginning of a long-term realignment of US hydrocarbon investments. Organic growth projects will be required to connect new supply to rising demand — and we expect executives to highlight this momentum in 3Q25 earnings calls.

East Daley will explore these dynamics in greater depth in our upcoming Dirty Little Secrets: 2026 Outlook. This clients-only report will set the table for how the energy transition reshapes US infrastructure, capital allocation and investment narratives in the year ahead. – Rob Wilson, CFA.

The Permian Basin at a Crossroads: Download the Latest White Paper

The Permian Basin at a Crossroads: Download the Latest White Paper

The Permian Basin is the heart of the US energy industry, supplying half of crude oil and NGL production and nearly 20% of natural gas. Yet market pressures are forcing changes, prompting billions in new pipeline investments and reorienting how operators approach the basin. East Daley’s new white paper, The Permian Basin at a Crossroads, is the first of a 3-part series looking at the shifts underway in the Permian. In this series, we reveal how LNG demand and AI data centers could transform Permian gas into a primary revenue driver. We also review the multi-billion-dollar infrastructure needed to unlock this shift, and what’s at stake for oil, gas and midstream operators. — Click here to download the The Permian Basin at a Crossroads white paper!

Meet Daley, the Best AI Tool in Energy

Meet Daley, the newest member of our energy team. Our new AI assistant is live and available to all East Daley Analytics clients. Early feedback has been phenomenal. Daley is platform-specific and only pulls from East Daley’s own proprietary data and content. It’s not open-source or generic AI, but built to understand our structure, language and analytics. Whether you’re looking for a specific metric, forecast or explanation, Daley can get you there quicker. — Reach out to learn more about Daley!

The Daley Note

Subscribe to The Daley Note for energy insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.