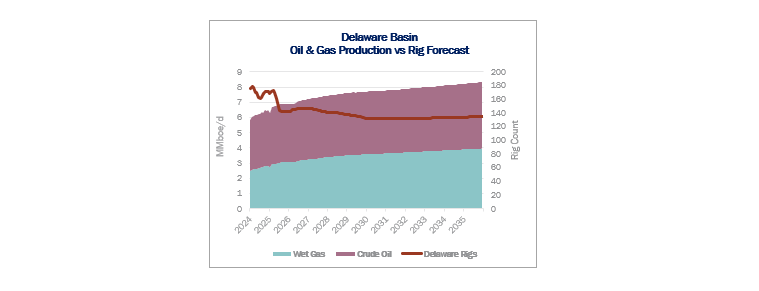

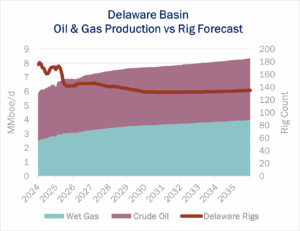

Managing sour gas is becoming a challenge for producers in the Delaware Basin. Development is shifting to the deeper Avalon and Bone Spring benches, where the associated gas has higher carbon dioxide and hydrogen sulfide content. The trend toward more sour gas production creates opportunities for midstream companies to expand their services and, in some cases, consolidate.

Handling sour gas requires specialized treating facilities to remove the CO2 and H2S streams prior to processing, plus acid gas injection (AGI) wells to dispose of the waste. While treating and cryogenic capacity can be added in a matter of quarters, AGI wells require 12–24+ months to permit, plus several months to drill and commission. The extended timeline makes AGI wells the main impediment to expansions for sour volumes. Systems that pair treating, AGI and takeaway nearest to sour gas benches are best positioned to capture throughput and maintain higher utilization.

Handling sour gas requires specialized treating facilities to remove the CO2 and H2S streams prior to processing, plus acid gas injection (AGI) wells to dispose of the waste. While treating and cryogenic capacity can be added in a matter of quarters, AGI wells require 12–24+ months to permit, plus several months to drill and commission. The extended timeline makes AGI wells the main impediment to expansions for sour volumes. Systems that pair treating, AGI and takeaway nearest to sour gas benches are best positioned to capture throughput and maintain higher utilization.

Producers in the Permian remain focused on liquids, but East Daley Analytics anticipates the basin’s natural gas will grow in value as rising LNG and power demand calls on more supply. A second tailwind comes from Section 45Q carbon capture credits, which may apply to the CO2 collected and stored with the injected acid gas. Regulations and investor pressures also tilt the market toward sequestration over flaring, so we expect producers will increasingly shoulder the extra costs associated with lifting sour gas.

The moat for midstream is AGI disposal backed by long-dated dedications, which keeps upstream volumes sticky and midstream assets full. In the G&P System Analysis tool in Energy Data Studio, systems with filed or approved AGI wells are best positioned to capture more pieces of the value chain, from gathering and treating through compression, disposal and processing. Gathering footprints without disposal wells or firm tolling contracts face constraints until they can secure access to AGI wells.

Midstream operators in the Delaware are converging on the same strategy. Targa Resources (TRGP), Enterprise Products (EPD), MPLX, Delek (DK) and Kinetik (KNTK) all highlight treating expansions and AGI well access to unlock sour volumes. Treating assets are also driving merger activity, from EPD’s acquisition of Piñon Midstream to KNTK’s purchase of Durango Midstream in 2024.

Which company could be the next target? East Daley Analytics’ Energy Data Studio shows private Delaware systems owned by Salt Creek Midstream and Vaquero Midstream lack disclosed AGI wells and are running below full capacity (see the figure from Energy Data Studio for the Salt Creek G&P system). These assets offer immediate synergies when tied to a disposal node. Producers Midstream also owns a smaller sour-ready system and is advancing AGI wells alongside a processing expansion, enhancing its value as potential takeover candidate.

We expect continued AGI-focused consolidation and longer-dated sour take-or-pay contracts as midstream operators compete for control of choke points. As Delaware development tilts toward sour gas, the systems that combine treating with permitted AGI wells and reliable takeaway will set the pace for throughput and cash generation. – Jaxson Fryer Tickers: DK, EPD, KNTK, MPLX, TRGP.

Join Our September Oil & Gas Production Webinar

East Daley will host our next monthly Oil & Gas Production Webinar on Sept. 17. This month we’ll unpack:

- Gas egress and infrastructure from the Permian Basin

- How our latest forecasts stack up for crude oil, natural gas and NGLs

- Scenarios that stress-test capacity and identify market winners and losers

Join us Sept. 17 at 10 AM MST for the latest updates on energy production trends. — RSVP here to attend the Oil & Gas Production Webinar!

Meet Daley, the Best AI Tool in Energy

Meet Daley, the newest member of our energy team. Our new AI assistant is live and available to all East Daley Analytics clients. Early feedback has been phenomenal. Daley is platform-specific and only pulls from East Daley’s own proprietary data and content. It’s not open-source or generic AI, but built to understand our structure, language and analytics. Whether you’re looking for a specific metric, forecast or explanation, Daley can get you there quicker. — Reach out to learn more about Daley!

Get the FERC Intrastate Pipeline Data

East Daley Analytics’ FERC 549D Intrastate Contract Data delivers contract shipper data for intrastate pipelines — scrubbed and ready to use. Use the 549 data to identify which intrastate pipelines have available capacity, understand pipeline rate structures, gain insights into shippers, and spot contract cliffs and opportunities for higher rate renewals. Reach out to East Daley to learn more.

The Daley Note

Subscribe to The Daley Note for energy insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.