Momentum continues to grow behind new Permian Basin natural gas pipelines. Last Monday (Aug. 25), the Matterhorn joint venture, consisting of WhiteWater, ONEOK (OKE), MPLX and Enbridge (ENB), announced a final investment decision (FID) for the Eiger Express Pipeline.

Eiger Express would twin the existing Matterhorn Express line and add 2.5 Bcf/d of capacity from the Permian to the Katy hub near Houston. The pipeline is expected to be completed in mid-2028 and includes reserved capacity for deliveries to the Corpus Christi market, likely on WhiteWater’s Traverse Pipeline, a 1.5 Bcf/d bidirectional line linking the Katy and Agua Dulce hubs.

The Eiger Express joint venture is owned 70% by the Matterhorn JV, 15% by OKE and 15% by MPLX. WhiteWater will construct and operate the pipeline.

The Eiger Express joint venture is owned 70% by the Matterhorn JV, 15% by OKE and 15% by MPLX. WhiteWater will construct and operate the pipeline.

Eiger Express is the latest project targeting growing demand for gas from the Permian Basin. On Aug. 6, Energy Transfer (ET) announced a positive FID on an expansion of its Transwestern Pipeline, dubbed Desert Southwest. The project will add 1.5 Bcf/d of westward capacity to meet demand growth in New Mexico and Arizona, particularly in Maricopa County, one of the hotspots for data center expansion. Later, on the company’s earnings call, co-CEO Mackie McCrea said ET had already received calls from shippers demonstrating interest in further expansion capacity.

Desert Southwest will help address a supply shortage East Daley Analytics has flagged in the Southwest. The West Coast Supply & Demand Report sees growing demand for data center development and the expected startup of ECA LNG on Mexico’s Pacific coast driving a regional imbalance of over 1.6 Bcf/d by YE2030.

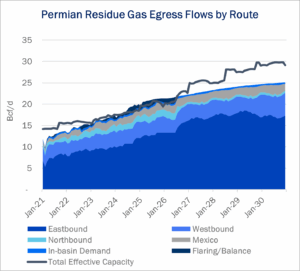

In total, East Daley expects over 9.5 Bcf/d of new egress capacity out of the Permian over the next five years, not including potential expansions on Hugh Brinson, Desert Southwest, or Tallgrass Energy’s proposed Permian-to-Rockies Express connector. In the same period, we see production growth of just 4 Bcf/d, leading to a significant overbuild (see figure).

Our outlook has two caveats. First, some amount of overbuild, or underutilized capacity, is necessary to close the spread between Waha and Henry Hub, enabling Permian producers to receive better margins on their molecules. Second, we see potential for significant additional supply growth without rig adds, simply by moving rigs to gassier acreage on systems like Kinetik’s (KNTK) Alpine High.

These latest project FIDs validate East Daley’s thesis that the value of Permian gas is growing in the market. They also throw into question the view that the basin’s oil production will soon peak. For example, the EIA currently expects US oil production to decline by 400 Mb/d in 2026, a forecast we disagree with. The Permian clearly has plenty of life left. The important question moving forward is: What is the optimal eastbound utilization that maintains strong Waha prices while maximizing volumes sold to LNG projects? – Oren Pilant Tickers: ENB, ET, KNTK, MPLX, OKE.

Meet Daley, the Best AI Tool in Energy

Meet Daley, the newest member of our energy team. Our new AI assistant is live and available to all East Daley Analytics clients. Early feedback has been phenomenal. Daley is platform-specific, and only pulls from East Daley’s own proprietary data and content. It’s not open-source or generic AI, but built to understand our structure, language and analytics. Whether you’re looking for a specific metric, forecast or explanation, Daley can get you there quicker. — Reach out to learn more about Daley!

Get the Data Center Demand Monitor

The Data Center Demand Monitor is your go-to source for tracking data center projects and demand. Available as part of the Macro Supply & Demand Report, East Daley monitors and visualizes nearly 500 US data center projects. Use the Data Center Demand Monitor to forecast demand, identify pipeline corridors and track data center projects. — Request your demo now of the Data Center Demand Monitor!

The Daley Note

Subscribe to The Daley Note for energy insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.