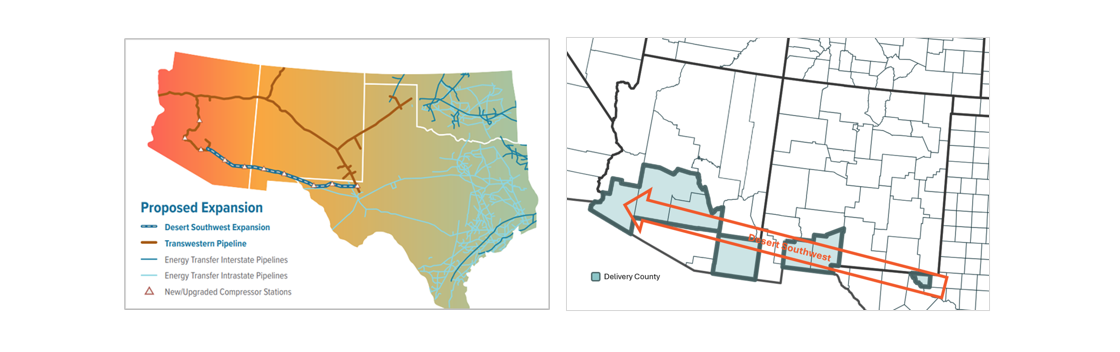

Energy Transfer (ET) is expanding the capacity of the Desert Southwest expansion on Transwestern Pipeline, adding momentum to the boom underway in Permian gas pipelines.

In mid-December, ET announced that Desert Southwest capacity will increase from an initial 1.5 Bcf/d to 2.3 Bcf/d. The company will expand the pipeline’s diameter from 42 to 48 inches to create the additional capacity. ET previously indicated in its 3Q25 earnings that it was considering upsizing the project, after an initial open season received significant interest above the planned capacity.

Desert Southwest will incur an additional $0.3B cost for the larger pipe, bringing the estimated construction budget to $5.6B. ET still expects the project to enter service in 4Q29, consistent with the original timeline.

Desert Southwest will incur an additional $0.3B cost for the larger pipe, bringing the estimated construction budget to $5.6B. ET still expects the project to enter service in 4Q29, consistent with the original timeline.

The project announcement made no mention of changes to the route, indicating the pipeline still expects to deliver gas to six counties across southern New Mexico and Arizona (see project map from ET).

Desert Southwest may see more updates ahead, as ET left open the possibility of increasing the announced 2.3 Bcf/d capacity. The final scope will depend on the final compression configuration, and that “ultimate capacity … will be based on market demand.”

The upsize to Desert Southwest keeps momentum in the boom for new Permian gas takeaway. With the announcement, new Permian gas egress passes 11Bcf/d through 2030, including the recent start-up of the expanded Matterhorn line, based on projects with an FID. Along with Desert Southwest, Eiger Express (+3.7 Bcf/d), Blackcomb Pipeline (+2.5 Bcf/d) and ET’s Hugh Brinson Pipeline (+2.2 Bcf/d) are scheduled to start through 2027.

Desert Southwest will help meet growing gas demand across the Southwest, driven by population growth and data center development. East Daley is currently tracking nearly 15 GW of announced data center load in Arizona alone by 2032, which could require as much as 950 MMcf/d of new gas supply.

Existing pipelines supplying the region already operate at or near capacity seasonally, so more capacity is needed in the coming years. Desert Southwest is well suited to meet that demand. – Ian Heming Tickers: ET.

The Permian Basin at a Crossroads: Why This Pipeline Boom is Different

The Permian’s next big buildout is already taking shape, but this time the driver isn’t oil. East Daley Analytics’ latest white paper reveals how gas demand from AI data centers, utilities and LNG exports is rewriting the midstream playbook. Over 10 Bcf/d of new capacity and $12 billion in investments are reshaping flows, turning the Permian into a gas powerhouse even as rigs decline. Read Part II: Why This Pipeline Boom is Different

Meet Daley, the Best AI Tool in Energy

Meet Daley, the newest member of our energy team. Our new AI assistant is live and available to all East Daley Analytics clients. Early feedback has been phenomenal. Daley is platform-specific and only pulls from East Daley’s own proprietary data and content. It’s not open-source or generic AI, but built to understand our structure, language and analytics. Whether you’re looking for a specific metric, forecast or explanation, Daley can get you there quicker. — Reach out to learn more about Daley!

The Daley Note

Subscribe to The Daley Note for energy insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.