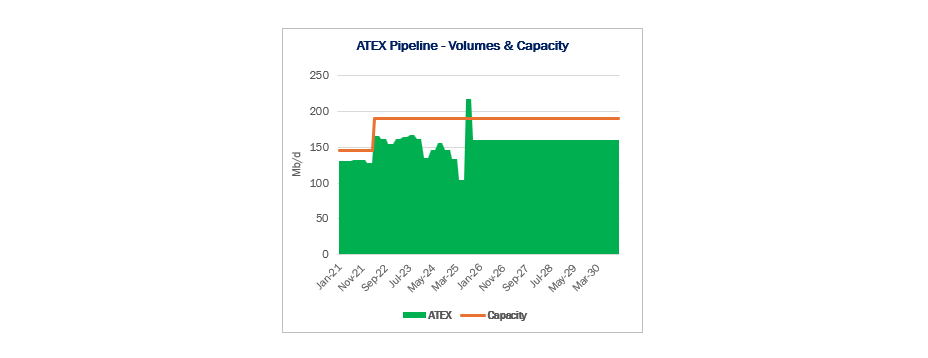

Ethane volumes shipped on ATEX Pipeline more than doubled in 3Q25, surging after the start of Enterprise Products’ (EPD) Neches River Terminal on the Texas Gulf Coast.

New filings at the Federal Energy Regulatory Commission (FERC) show ATEX (Appalachia-to-Texas) moved 218 Mb/d of ethane in 3Q25, up 107% from throughput of 105 Mb/d in 2Q25. Flows ran ~28 Mb/d above ATEX’s 190 Mb/d nameplate capacity, highlighting the system’s ability to flex in response to market conditions.

New filings at the Federal Energy Regulatory Commission (FERC) show ATEX (Appalachia-to-Texas) moved 218 Mb/d of ethane in 3Q25, up 107% from throughput of 105 Mb/d in 2Q25. Flows ran ~28 Mb/d above ATEX’s 190 Mb/d nameplate capacity, highlighting the system’s ability to flex in response to market conditions.

The gains underscore two structural advantages that are becoming increasingly important in today’s NGL market: ATEX’s operational flexibility, and Enterprise’s fully integrated Gulf Coast system.

East Daley Analytics believes the startup of EPD’s Neches River was the primary catalyst for the jump. Enterprise in mid-July started Phase 1 of the terminal near Beaumont, TX. ATEX feeds directly into EPD’s broader Gulf Coast distribution network, which ultimately supplies Neches River. Ethane cargoes from the new terminal ramped quickly through September, creating a timely outlet for incremental barrels.

ATEX also likely picked up some displaced ethane volumes in the Northeast. A furnace at Shell’s (SEL) Monaca cracker in Pennsylvania exploded in June, cutting into regional demand. FERC filings show deliveries on Shell’s Falcon Pipeline, which feeds ethane to the Monaca facility, fell nearly 50% to 48 Mb/d in 2Q25. While Falcon throughput increased to 78 Mb/d in 3Q25, volumes remained about 20 Mb/d lower than the recent peak of 97 Mb/d in 4Q24.

The Permian Basin at a Crossroads: Why This Pipeline Boom is Different

The Permian’s next big buildout is already taking shape, but this time the driver isn’t oil. East Daley Analytics’ latest white paper reveals how gas demand from AI data centers, utilities and LNG exports is rewriting the midstream playbook. Over 10 Bcf/d of new capacity and $12 billion in investments are reshaping flows, turning the Permian into a gas powerhouse even as rigs decline. Read Part II: Why This Pipeline Boom is Different

EPD was well positioned to arbitrage the regional dislocation, pulling discounted Northeast ethane south to fill its new export capacity. Shell also has some reserved capacity on ATEX, and may have used the pipeline to offload stranded barrels during the Monaca outage. In effect, ATEX functioned as a pressure-release valve, linking Appalachian oversupply with new waterborne demand.

Why this matters: The jump in 3Q25 demonstrates that ATEX can operate above its stated nameplate when market incentives are strong, and that EPD’s integrated footprint allows it to rapidly redirect barrels across regions.

East Daley does not view 3Q25 flows as a new steady state, and we expect volumes on ATEX to retreat toward historical levels when the Monaca cracker returns to full operations. However, the setup is instructive. As US ethane markets grow more entwined with exports, similar displacement episodes are likely to occur during cracker outages, maintenance events, or step-changes in export demand.

In other words, this is not the new normal, but it may be a preview. ATEX’s role is evolving from a steady baseload pipe into a swing asset that clears regional imbalances, reinforcing the strategic value of integrated systems as US NGL markets become more globally connected. – Julian Renton Tickers: EPD, SEL.

Meet Daley, the Best AI Tool in Energy

Meet Daley, the newest member of our energy team. Our new AI assistant is live and available to all East Daley Analytics clients. Early feedback has been phenomenal. Daley is platform-specific and only pulls from East Daley’s own proprietary data and content. It’s not open-source or generic AI, but built to understand our structure, language and analytics. Whether you’re looking for a specific metric, forecast or explanation, Daley can get you there quicker. — Reach out to learn more about Daley!

The Daley Note

Subscribe to The Daley Note for energy insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.