Energy Transfer (ET) picked up a G&P system in the Powder River Basin (PRB) when it bought Crestwood Equity in 2023 for $7.1B. Since then, the company’s growth machine has been squarely pointed at the Permian and Gulf Coast, leaving Wyoming as increasingly non-core.

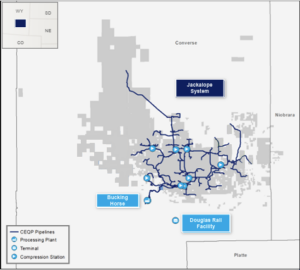

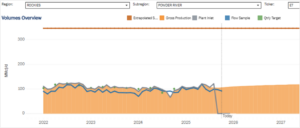

The PRB assets include the Jackalope gathering system and the Bucking Horse I/II cryogenic plants in Converse County, WY (see map from ET). Jackalope includes ~180 miles of gathering line and primarily serves Continental Resources, Occidental Petroleum and Anschutz. The Bucking Horse plants have total processing capacity of 345 MMcf/d and deliver residue gas to Kinder Morgan’s (KMI) Wyoming Interstate system. East Daley’s “G&P System Analysis” dashboard in Energy Data Studio shows throughput of ~100 MMcf/d through the plants (see figure below).

The PRB assets include the Jackalope gathering system and the Bucking Horse I/II cryogenic plants in Converse County, WY (see map from ET). Jackalope includes ~180 miles of gathering line and primarily serves Continental Resources, Occidental Petroleum and Anschutz. The Bucking Horse plants have total processing capacity of 345 MMcf/d and deliver residue gas to Kinder Morgan’s (KMI) Wyoming Interstate system. East Daley’s “G&P System Analysis” dashboard in Energy Data Studio shows throughput of ~100 MMcf/d through the plants (see figure below).

Why the PRB assets screen as non-core:

- Strategy mismatch. ET’s current spending is dominated by Permian gas/NGL expansions (processing at Red Lake/Badger, fractionation at Mont Belvieu), NGL terminal expansions at Nederland and Marcus Hook, and long-haul gas pipelines. The Powder River is not a focus of growth.

- Marginal earnings impact. ET has guided to $16.1–16.5B of 2025 Adj. EBITDA, leaving the PRB system at well under 1% of the total. This is consistent with a divestible, niche position in ET’s large portfolio.

- Outside core operations. Since the Crestwood deal closed, ET has expanded its Permian footprint, including the $3.25B WTG Midstream acquisition and its Permian crude/water JV with Sunoco. Wyoming has not factored into the company’s dealing.

Who would buy it?

Who would buy it?

- Western Midstream (WES). WES expanded in the Powder River by buying Meritage Midstream, giving the company a large G&P footprint in Wyoming. The Jackalope/Bucking Horse assets would expand its footprint and create potential synergies for shared customers.

- Tallgrass Energy. Tallgrass also operates Powder River midstream assets, including the nearby Casper and Douglas processing plants and Tallgrass Interstate Gas Transmission (TIGT). Folding in Jackalope/Bucking Horse could lift volumes on TIGT and strengthen one-stop midstream services in the basin.

What changes for ET: A sale would allow Energy Transfer to marginally delever while it continues to commit resources to Permian gas and NGL projects.

Investor Takeaway: The PRB system is a logical non-core candidate for ET – small, remote, and overshadowed by Permian and Gulf Coast growth opportunities. A sale could unlock strategic value for the right buyer, with immaterial earnings impact to ET. – Jaxson Fryer Tickers: ET, KMI, WES.

The Permian Basin at a Crossroads: Download the Latest White Paper

The Permian Basin at a Crossroads: Download the Latest White Paper

The Permian Basin is the heart of the US energy industry, supplying half of crude oil and NGL production and nearly 20% of natural gas. Yet market pressures are forcing changes, prompting billions in new pipeline investments and reorienting how operators approach the basin. East Daley’s new white paper, The Permian Basin at a Crossroads, is the first of a 3-part series looking at the shifts underway in the Permian. In this series, we reveal how LNG demand and AI data centers could transform Permian gas into a primary revenue driver. We also review the multi-billion-dollar infrastructure needed to unlock this shift, and what’s at stake for oil, gas and midstream operators. — Click here to download the The Permian Basin at a Crossroads white paper!

Meet Daley, the Best AI Tool in Energy

Meet Daley, the newest member of our energy team. Our new AI assistant is live and available to all East Daley Analytics clients. Early feedback has been phenomenal. Daley is platform-specific and only pulls from East Daley’s own proprietary data and content. It’s not open-source or generic AI, but built to understand our structure, language and analytics. Whether you’re looking for a specific metric, forecast or explanation, Daley can get you there quicker. — Reach out to learn more about Daley!

The Daley Note

Subscribe to The Daley Note for energy insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.