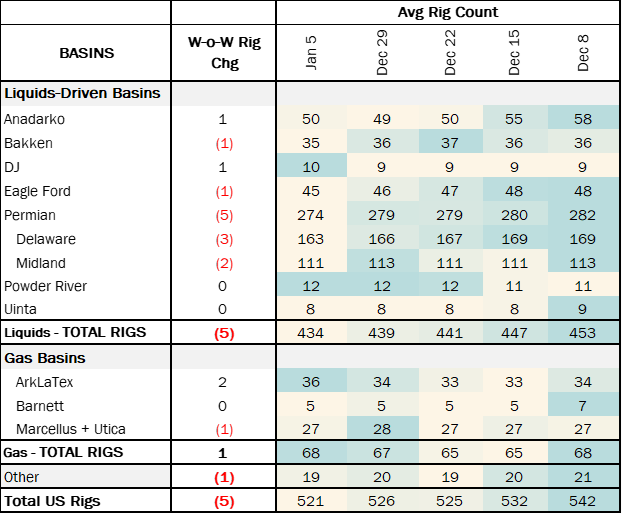

Executive Summary- Rigs: The total rig count decreased by 5 for the January 5 week, down to 521 from 526. Infrastructure: Plains All American Pipeline (PAA) made several bolt-on acquisitions totaling $670MM to expand its crude oil gathering footprint in the Permian and Eagle Ford basins. Storage: East Daley expects a 350 Mbbl injection into commercial and Strategic Petroleum Reserve (SPR) inventories for the week ending January 17.

Rigs:

The total rig count decreased by 5 for the January 5 week, down to 521 from 526. Liquids-driven basins declined by 5 rigs W-o-W.

- Permian (-5):

- Delaware (-3): Coterra Energy, Devon Energy, Mewbourne Oil

- Midland (-2): Diamondback Energy

- Bakken (-1): Kraken Resources

- Eagle Ford (-1): Hilcorp

- Anadarko (+1): Reach Oil & Gas

- DJ (+1): Chord Energy

Infrastructure:

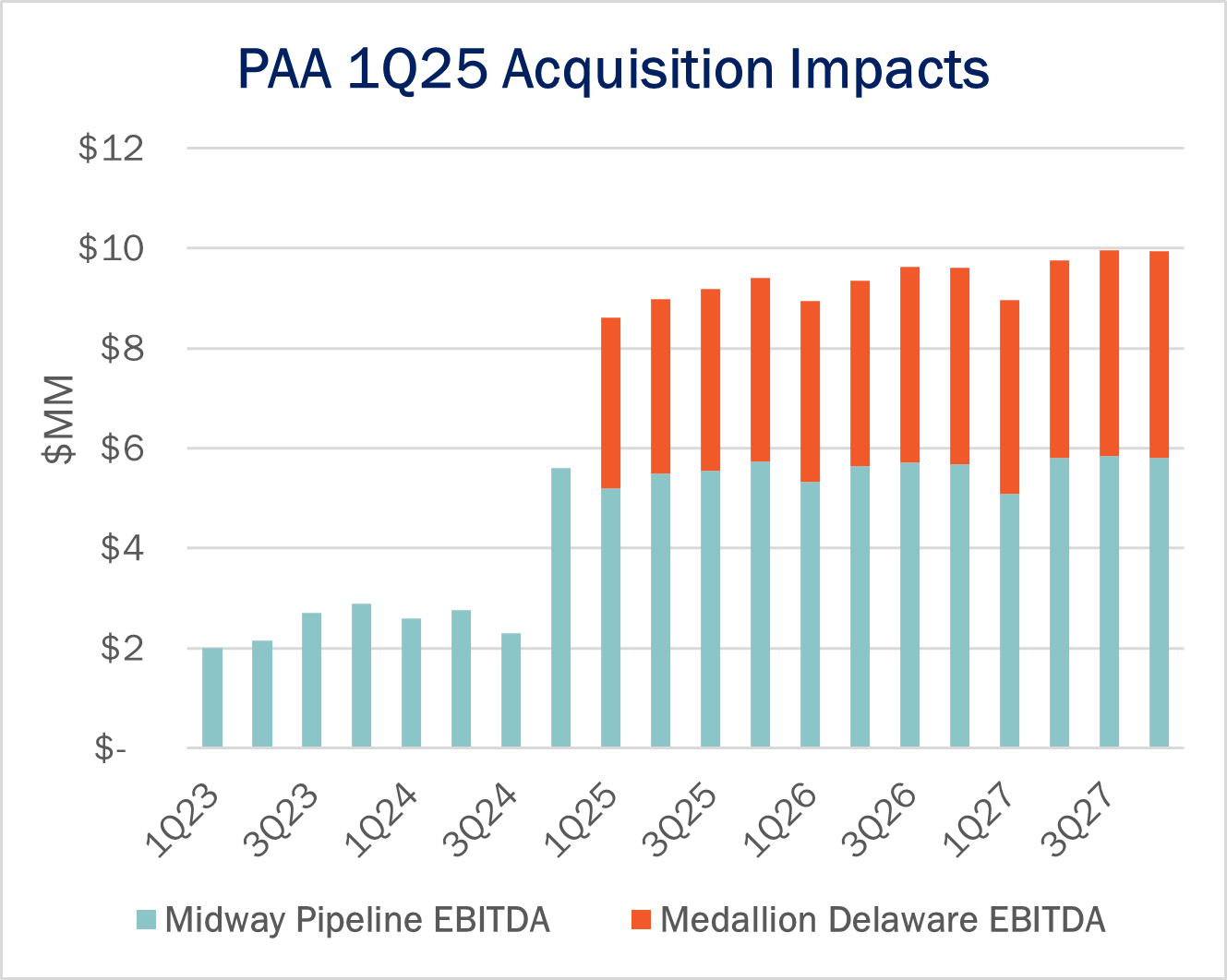

Plains All American Pipeline (PAA) made several bolt-on acquisitions totaling $670MM to expand its crude oil gathering footprint in the Permian and Eagle Ford basins. The deals with Ironwood Midstream Energy Partners, Medallion Midstream, and Midway Pipeline create operational synergies and position PAA to benefit from oil production growth.

PAA announced the acquisitions January 7. The assets include Ironwood’s Eagle Ford Basin gathering system for $475MM, Medallion’s Delaware Basin crude oil gathering business for $160MM (~$105MM net to PAA), and the remaining 50% interest in Midway Pipeline for $90MM.

According to East Daley’s Financial Blueprint for PAA, the Midway Pipeline transaction will boost the asset’s FY25 EBITDA contribution to ~$22MM compared to EBITDA of ~$10.5MM for the latest twelve months. Beginning 1Q25, the Medallion Delaware asset will contribute another ~$14MM to FY25 EBITDA and gather ~55 Mb/d as a part of the Plains Oryx Permian Basin JV.

Along with the acquisitions, PAA rolled out several initiatives friendly to shareholders. The company will repurchase $330MM of 12.7MM Series A preferred units from EnCap Flatrock Midstream to reduce its leverage and improve financial flexibility. PAA also raised its quarterly distribution by 20%.

As modeled in the Financial Blueprint, PAA issued $1B of 5.950% senior unsecured notes due 2035 to fund these acquisitions and repurchase shares, maintaining a 3.2x leverage ratio in 1Q25. The net proceeds will also be used to repay amounts outstanding under PAA’s credit facilities and commercial paper program.

East Daley will release our 4Q24 Earnings Preview for PAA this week. Moving forward, Plains is better positioned to capitalize on robust activity in the Permian, ensuring sustainable growth and enhanced profitability. Management noted the acquisitions and financial steps create immediate value by increasing earnings and accelerating capital returns.

Storage:

East Daley expects a 350 Mbbl injection into commercial and Strategic Petroleum Reserve (SPR) inventories for the week ending January 17. We expect total US stocks, including the SPR, will close at 807 MMbbl.

The US natural gas pipeline sample, a proxy for change in oil production, decreased 2.52% W-o-W across all liquids-focused basins. Samples decreased 5.44% in the Eagle Ford, 3.41% in the Permian Basin, and 3.70% in the Gulf of Mexico. The Rockies and the Gulf of Mexico have a high correlation between gas volumes and crude oil volumes, whereas the Permian and Eagle Ford basins correlation is less than 45%.

We expect US crude production to average 13.5 MMb/d. According to US bill of lading data, US crude imports increased by 475 Mb/d W-o-W to 6.5 MMb/d. More than 60% of the supply originated from Canadian pipelines and vessels into the US, with the remainder largely coming from vessels carrying crude from Mexico, Argentina and Venezuela.

As of January 17, there was ~790 Mb/d of refining capacity offline, including downtime for planned and unplanned maintenance. EDA expects gross crude inputs into refineries to decrease by ~350 Mb/d W-o-W, coming in at 16.1 MMb/d.

Vessel traffic monitored by EDA along the Gulf Coast increased W-o-W. There were 26 vessels loaded for the week ending January 18 and 24 the prior week. EDA expects US exports to be 4.1 MMb/d.

The SPR awarded contracts for 1.5 MMbbl to be delivered To Choctaw in January and 2.475 to be delivered to Bryan Mount Jan – March 2025. The SPR has 394 MMbbl in storage as of January 10, 2025.

Regulatory and Tariffs:

Presented by ARBO

Tariffs:

Caddo Pipeline LLC A new contract rate was established for movements from Longview, TX to Shreveport, LA available to shippers signing a TSA for a minimum of 22,500 b/d for a term of 7 years. Contract A was revised to change the minimum commitment to 20,000 b/d. FERC No 2.14.0 IS25-172 (filed December 31, 2024) Effective January 1, 2025.

Marketlink, LLC The actual temporary volume incentive rates were increased and extended through January 31, 2025. FERC No 3.38.0 IS25-188 (filed December 13, 2024) Effective January 1, 2025.

Marketlink, LLC Temporary volume incentive rates were extended through February 28, 2025. FERC No 2.83.0 IS25-187 (filed December 13, 2024) Effective February 1, 2025.

The above information is provided by ARBO’s Oil Pipeline Tariff Monitor. For more information on regulatory proceedings or tariff rates, please contact please contact Corey Brill via email at [email protected] or phone at 202-505-5296. https://www.goarbo.com/