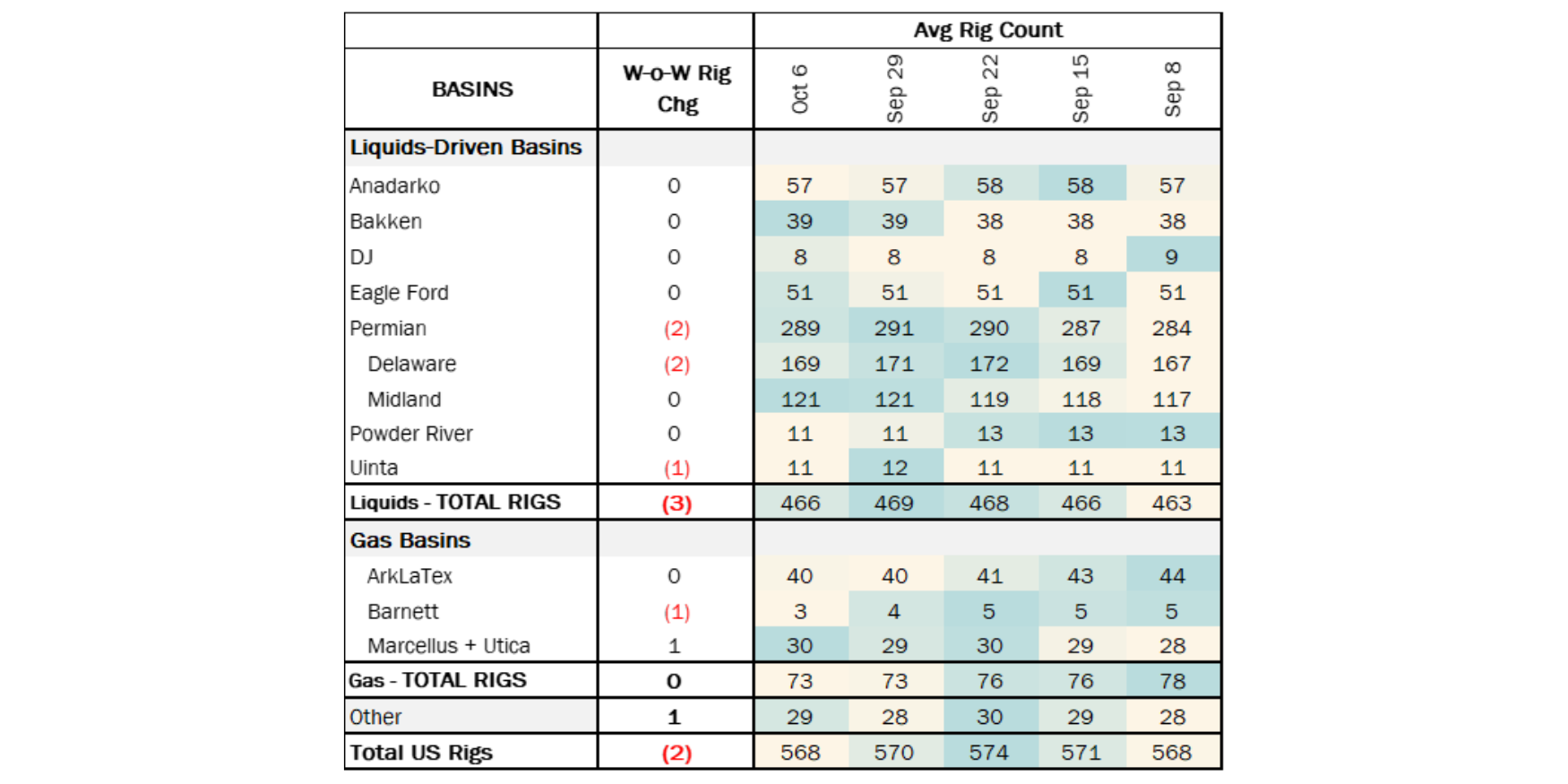

Executive Summary: Rigs: The total rig count decreased by 2 for the October 6 week, down to 568 from 570. Infrastructure: The Energy Information Administration (EIA) recently lowered its US crude supply forecast, moving its outlook closer to East Daley’s own. Storage: East Daley expects a 600 Mbbl injection in commercial and Strategic Petroleum Reserve (SPR) inventories for the week ending October 11.

Rigs:

The total rig count decreased by 2 for the October 6 week, down to 568 from 570. Liquids-driven basins declined by 3 rigs W-o-W.

- Permian – Delaware (-2): Mewbourne Oil and EOG Resources each removed 1 rig.

- Uinta (-1): Anschutz Corporation removed 1 rig.

Infrastructure:

The Energy Information Administration (EIA) recently lowered its US crude supply forecast, moving its outlook closer to East Daley’s own.

In the October ’24 Short-Term Energy Outlook (STEO), EIA predicts US crude production will increase to 13.71 MMb/d by YE25, down ~1.5% from the September forecast of 13.92 MMb/d at YE25. The updates to the STEO forecast are largely due to changes in the Permian Basin. The latest STEO shows a general ramp-up of Permian oil production, rising to 6.625 MMb/d by YE25. Interestingly, the changes made to the October STEO show an increase in Permian production through 1H24 followed by a ~1.2% reduction in the forecast from May 2024 through YE25.

East Daley’s Permian Supply & Demand Forecast takes natural gas egress constraints and new pipelines into account, in addition to rig counts, WTI prices and drill times. These factors give our Permian forecast a different shape, but ultimately we arrive at a similar conclusion as EIA.

East Daley’s latest basin forecast predicts Permian production will reach 6.639 MMb/d by YE25, which is ~2% higher than STEO’s 6.625 MMb/d forecast. The largest discrepancy between the forecasts occurs in July ’24, when EIA expects Permian production to average 6.3 MMb/d vs EDA’s forecast of 6.0 MMb/d, a 270 MMb/d (4%) difference. We consider the 8% rig reduction seen through 1H24, as well as natural gas egress constraints that we anticipate to star limiting crude output once again.

The Permian Supply & Demand Forecast shows crude oil production ramping in late 2024 due to the start of the Matterhorn Express natural gas pipeline. Through 1H25, we believe Permian production will level off once again, then make further gains in 2H25 ahead of the start of the Blackcomb Pipeline in 2026.

Crude egress remains tight through this period, with flows to Corpus Christi exceeding 93% and flows to the Gulf Coast not far behind at ~87% by YE25 in the Crude Hub Model. Flows to Cushing will have ample capacity at ~60% utilization, as East Daley believes flows north will be disadvantaged due to added transportation cost and barrels losing the ‘Permian’ quality when blended into a Cushing WTI spec.

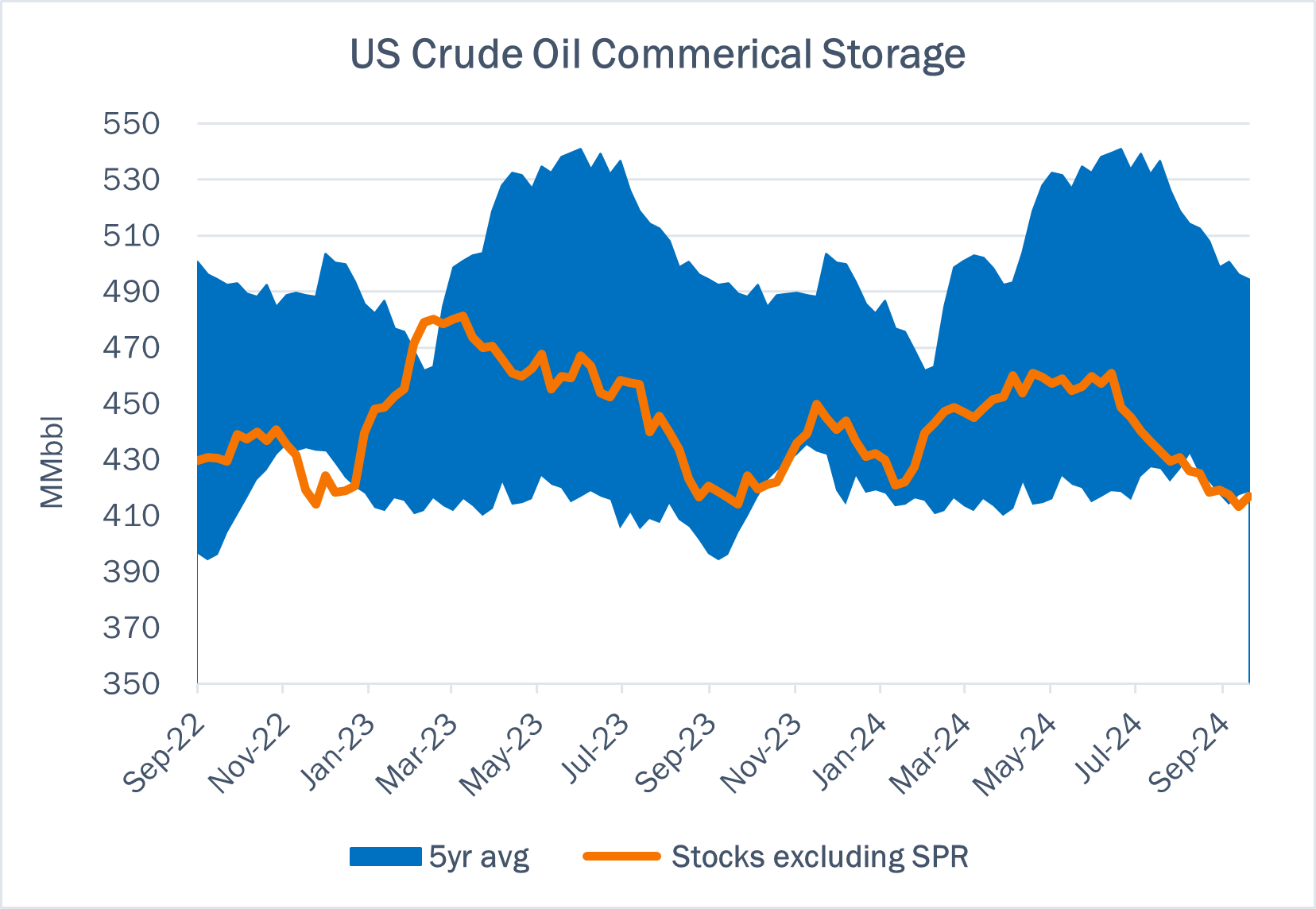

Storage:

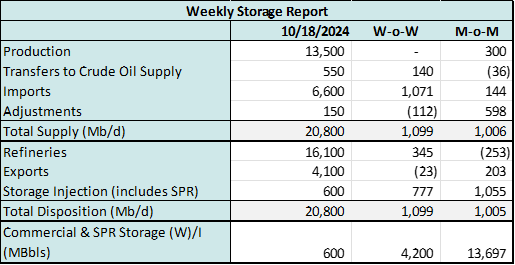

East Daley expects a 600 Mbbl injection in commercial and Strategic Petroleum Reserve (SPR) inventories for the week ending October 11. We expect total US stocks, including the SPR, will close at 809 MMbbl.

The US natural gas pipeline sample, a proxy for change in oil production, decreased .76% W-o-W across all liquids-focused basins. Samples increased 4.94% in the Gulf of Mexico and decreased 4.94% in the Barnett, and 1.47% in the Permian. The Gulf of Mexico has a high correlation between gas volumes and crude oil volumes, whereas the Permian and Eagle Ford basins correlation is less than 45%. We expect US crude production to remain flat at 1 MMb/d.

According to US bill of lading data, US crude imports increased by 1,071 Mb/d W-o-W to 6.6 MMb/d. More than 60% of the supply originated from Canadian pipelines into the US, with the remainder largely coming from ships carrying crude from Mexico, Venezuela and Brazil.

As of October 18, there was ~1323 Mb/d of refining capacity offline, including downtime for planned and unplanned maintenance. EDA expects gross crude inputs into refineries to increase by ~345 Mb/d W-o-W, coming in at 16.1 MMb/d.

Vessel traffic monitored by EDA along the Gulf Coast increased W-o-W. There were 27 vessels loaded for the week ending October 18 and 26 the prior week. EDA expects US exports to be 4.1 MMb/d.

The SPR awarded contracts for 4.85 MMbbl to be delivered in October 2024. The SPR has 385 MMbbl in storage as of October 18, 2024.

Regulatory and Tariffs:

Presented by ARBO

Tariffs:

White Cliffs Pipeline, L.L.C. Volume incentive rates were decreased, and terms revised, priority rates were canceled, and temporary volume incentive rates were canceled. FERC No 4.19.0 IS25-7 (filed Oct 1, 2024) Effective October 1, 2024.

Gray Oak Pipeline, LLC. A capacity discount rate was established for movements from Wink County, TX to Crane, TX. Existing discounts have been decreased by $0.30. FERC No 17.0.0 IS25-12 (filed Oct 1, 2024) Effective November 1, 2024.

The above information is provided by ARBO’s Oil Pipeline Tariff Monitor. For more information on regulatory proceedings or tariff rates, please contact please contact Corey Brill via email at [email protected] or phone at 202-505-5296. https://www.goarbo.com/