Executive Summary:

Infrastructure: Civitas Resources is trimming its Denver-Julesburg Basin footprint with two asset sales totaling $435MM.

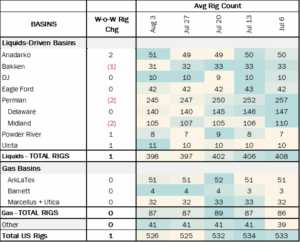

Rigs: The total US rig count increased during the week of Aug. 3 to 526.

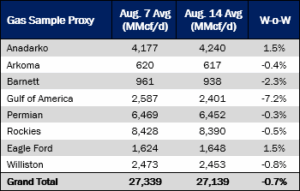

Supply & Demand: US natural gas pipeline samples decreased 0.7% W-o-W across liquids-focused basins.

Rigs:

The total US rig count increased during the week of Aug. 3 to 526. Liquids-driven basins increased by 1 rig W-o-W from 397 to 398.

- Permian – Midland (-2): Vital Energy, ExxonMobil

- Bakken (-1): Kraken Resources

- Anadarko (+2): Roberson Oil, WSR Operating

- Powder River (+1): Devon Energy

- Uinta (+1): FourPoint Resources

Infrastructure:

Civitas Resources (CIVI) is trimming its Denver-Julesburg (DJ) Basin footprint with two asset sales totaling $435MM. The offloaded properties produce ~10 Mboe/d, 50% weighted toward oil.

CIVI disclosed plans to sell DJ assets back in February; both deals are set to close in late 3Q25. The assets are non-core and represent roughly 6.8% of CIVI’s DJ output, according to its 2Q25 investor presentation. Proceeds will go to debt reduction and share repurchases as CIVI reinstates its 50/50 capital return model, eliminating the possibility of further Permian acreage acquisitions. The company said the transactions carry a ~4x FY26E EBITDAX multiple.

According to an East Daley half-cycle breakeven analysis, DJ development becomes unprofitable at oil prices below ~$62/bbl vs ~$42/bbl in the Permian Basin, suggesting these assets lack the profitability to interest large public buyers at current WTI prices. A smaller, DJ-focused operator is better positioned to run lean and extract cash flow from mature production; a private equity-backed E&P is likely the most economical fit.

Earlier this year, East Daley Analytics highlighted that Occidental (OXY), Chevron (CVX) and CIVI control ~75% of DJ oil production and are all repositioning. OXY is focused on debt reduction after acquiring CrownRock, while CVX is prioritizing growth through the Hess acquisition. With the majors pulling back, smaller pure-play operators are likely to step in.

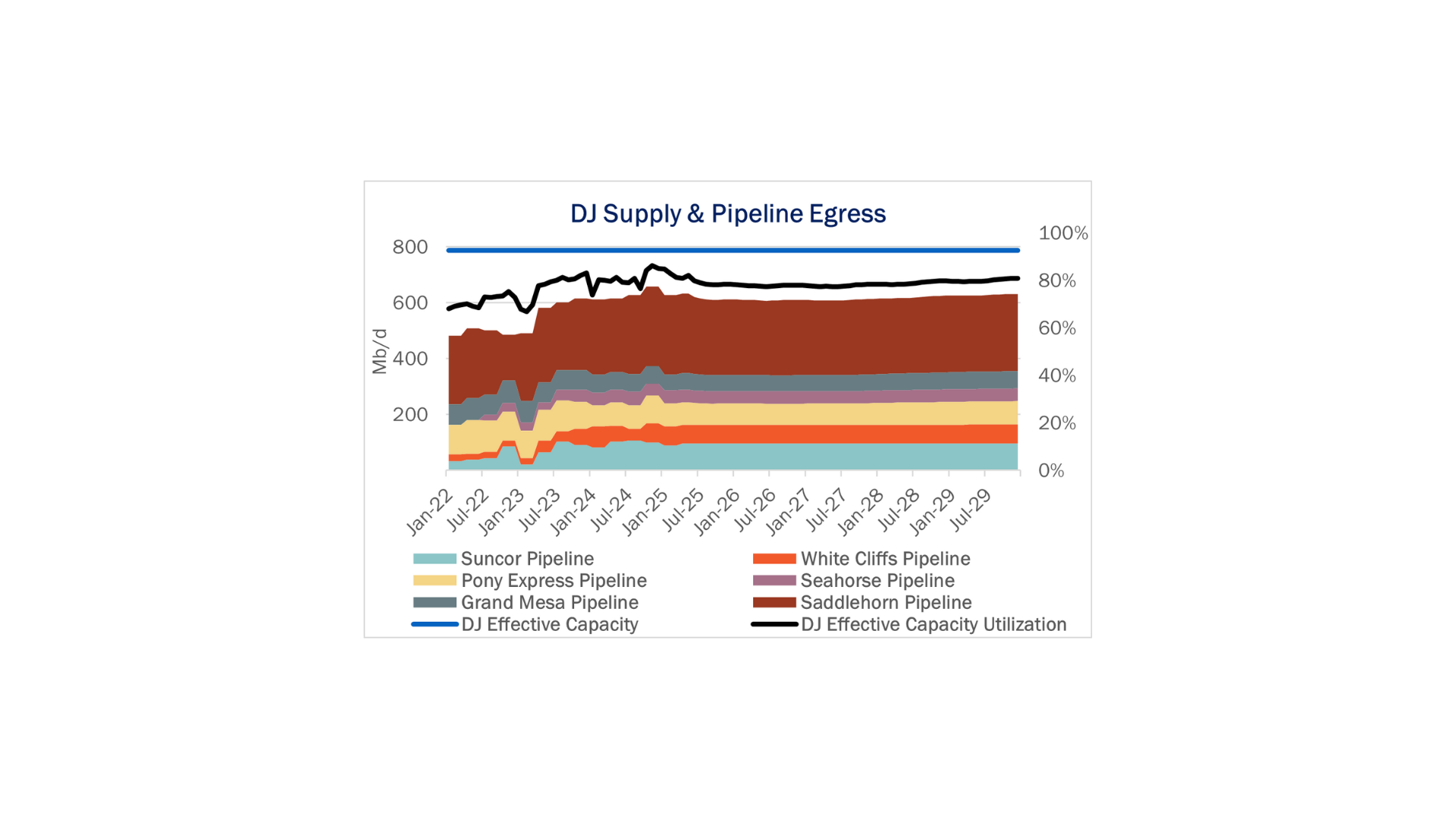

DJ egress remains structurally long. According to East Daley’s DJ Crude Oil Supply & Demand Report, nameplate takeaway capacity totals 787 Mb/d, and current flows average ~622 Mb/d (~80% utilization). Furthermore, our DJ Production Scenario Tool forecasts production to decline 2.3% from 2025 to 2027.

Supply & Demand

US natural gas pipeline samples, a proxy for change in oil production, decreased 0.7% W-o-W across all liquids-focused basins. Samples decreased 7.2% in the Gulf of America and 2.3% in the Barnett. The decreases were offset by increases of 1.5% in the Anadarko and 1.5% in the Eagle Ford. The Rockies and the Gulf of America have a high correlation between gas volumes and crude oil volumes, whereas the Permian and Eagle Ford basins correlation is less than 45%.

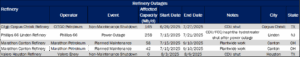

As of Aug. 15, there was ~100 Mb/d of refining capacity offline, including downtime for planned and unplanned maintenance. The Marathon Canton refinery accounts for all capacity offline due to plantwide work.

Vessel traffic monitored by EDA along the Gulf Coast decreased W-o-W. There were 24 vessels loaded for the week ending Aug. 15 and 29 the prior week.

Regulatory and Tariffs:

Presented by ARBO

Tariffs:

Seaway Crude Pipeline Company, LLC: Temporary Volume Incentive rates were unchanged for August, 2025.

Marketlink, LLC: Temporary Volume Incentive rates were unchanged for August, 2025.

The above information is provided by ARBO’s Oil Pipeline Tariff Monitor. For more information on regulatory proceedings or tariff rates, please contact please contact Corey Brill via email at [email protected] or phone at 202-505-5296. https://www.goarbo.com/