Executive Summary:

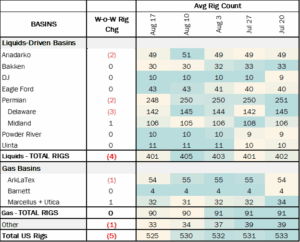

Rigs: The total US rig count decreased during the week of Aug. 17 to 525.

Infrastructure: Production has been strong recently after a dip in the spring.

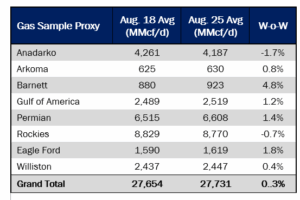

Supply & Demand: The US natural gas pipeline sample, a proxy for change in oil production, increased 0.28% W-o-W across all liquids-focused basins.

Rigs:

The total US rig count decreased during the week of Aug. 17 to 525. Liquids-driven basins decreased by 4 rigs W-o-W from 405 to 401.

- Permian:

- Delaware (-3): EOG Resources, ConocoPhillips, Civitas Resources

- Midland (+1): Burk Royalty

- Anadarko (-2): Downing-Nelson Oil, DJF Services Inc.

- ArkLaTex (-1): Tanos Exploration IV

- Marcellus + Utica (+1): CNX

Infrastructure:

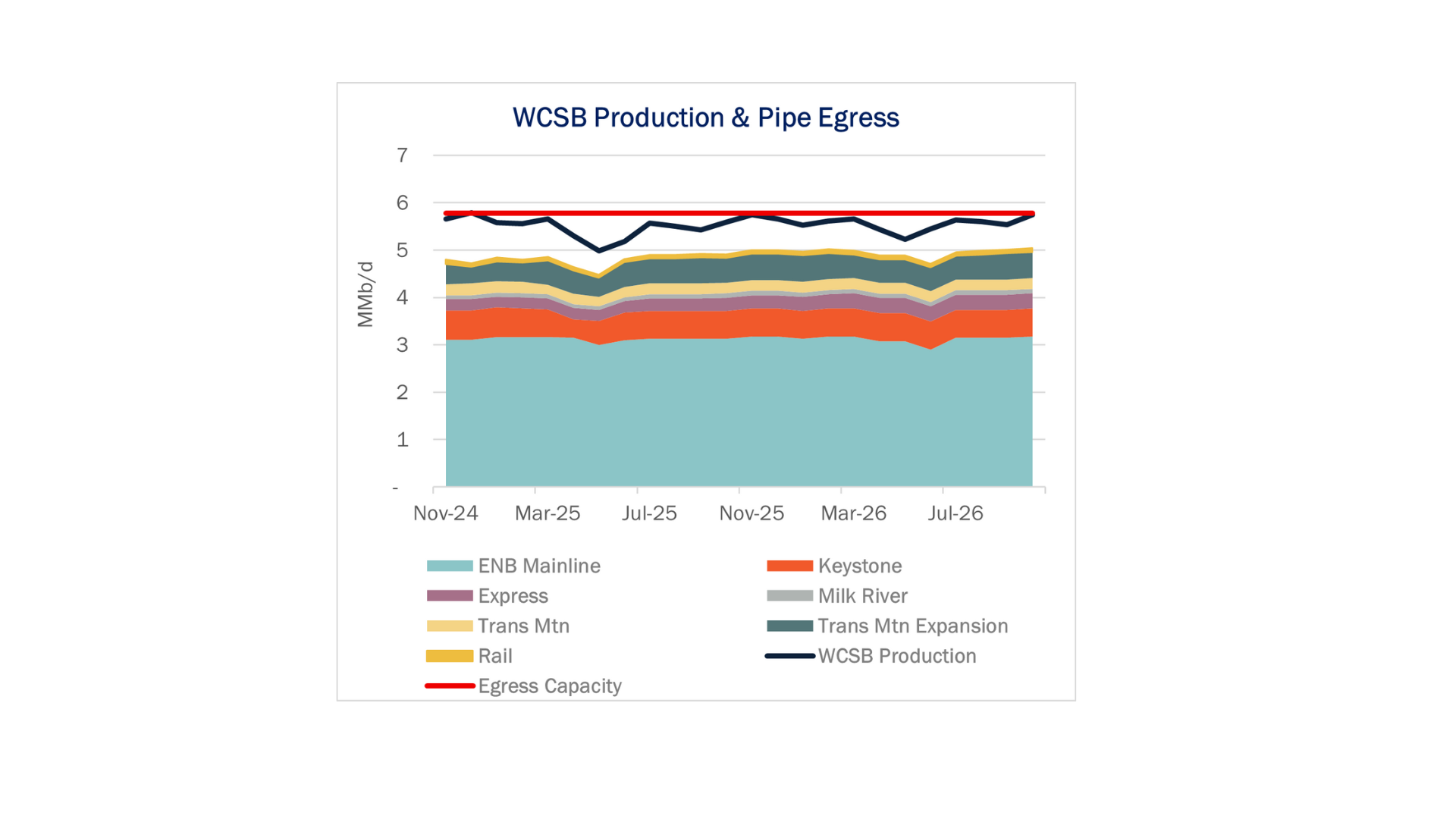

Pipeline takeaway remains the primary constraint for crude oil growth from Western Canada, prompting new efforts to expand systems for producers.

Production has been strong recently after a dip in the spring. Alberta’s oil patch faced significant disruptions in May as wildfires curtailed up to 335 Mb/d of production. The wildfires, combined with heavy maintenance turnarounds, cut oil sands production by ~890 Mb/d, the lowest monthly total since 2023. According to East Daley’s Crude Hub Model, June rebounded ~220 Mb/d, bringing total supply from the Western Canadian Sedimentary Basin (WCSB) up to ~5.2 MMb/d.

Western Canadian Select (WCS) prices have weakened ~$6 since August to ~$51.50/bbl, with the WCS-WTI spread averaging ~$12.70 and briefly narrowing below $10 in June. Weak US exports have contributed to softer demand for Canadian barrels. EIA data shows US crude exports slumped to a four-year low of 2,305 Mb/d in July as Asian and European buyers shifted to cheaper barrels, with a narrow $3 WTI-Brent spread limiting foreign pull.

Enbridge’s (ENB) 3.21 MMb/d Mainline ran ~98.4% utilized and was apportioned six of the first eight months of 2025. Vertically integrated with Flanagan South (720 Mb/d capacity) and Seaway (950 Mb/d capacity), ENB is insulated from short-term dips. The strong demand is underscored by the recent oversubscription of the Flanagan South expansion.

ENB is considering a 150 Mb/d Mainline expansion, with a final investment decision expected by YE25. The proposed 150 Mb/d Mainline expansion would increase flows to Midwest and Gulf Coast refineries, helping reduce bottlenecks and support growing oil sands output.

Meanwhile, the Ontario government in August issued an RFP for a feasibility study on a new Alberta-to-Ontario pipeline and port corridor, signaling renewed interest in eastbound export options. These proposals, alongside ENB’s potential Mainline expansion, highlight that new egress solutions are being explored. Until additional takeaway comes online, WCS pricing and export flows will remain tightly tied to existing pipeline constraints.

Supply & Demand

The US natural gas pipeline sample, a proxy for change in oil production, increased 0.3% W-o-W across all liquids-focused basins. Samples increased 4.8% in the Barnett and 1.8% in the Eagle Ford. The increases were offset by decreases of 1.7% in the Anadarko and 0.7% in the Rockies. The Rockies and the Gulf of America have a high correlation between gas volumes and crude oil volumes, whereas the Permian and Eagle Ford basins correlation is less than 45%.

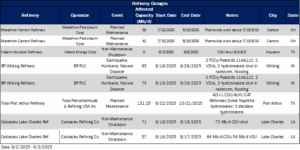

As of September 2, there was ~550 Mb/d of refining capacity offline, including downtime for planned and unplanned maintenance. The Total Port Arthur refinery accounts for 151.3 Mb/d capacity offline due to planned maintenance lasting through Oct. 21.

Vessel traffic monitored by EDA along the Gulf Coast decreased W-o-W. There were 17 vessels loaded for the week ending Aug. 30 and 21 the prior week.

Regulatory and Tariffs:

Presented by ARBO

Tariffs:

Gray Oak Pipeline, LLC: Certain available capacity discounts were increased.

Magellan Pipeline Company, L.P.: The tariffs were revised to add a new product and to update the product grade document to be consistent with ONEOK’s product grade documents.

The above information is provided by ARBO’s Oil Pipeline Tariff Monitor. For more information on regulatory proceedings or tariff rates, please contact please contact Corey Brill via email at [email protected] or phone at 202-505-5296. https://www.goarbo.com/