Executive Summary: Rigs: The total US rig count increased by 6 during the week of April 6 to 577. Infrastructure: Energy Transfer (ET) has built one of the most extensive crude oil midstream footprints in the Permian Basin, transporting a significant share of Permian barrels via its network of gathering systems, transmission lines and export docks. Storage: East Daley expects a 6.7 MMbbl injection into commercial and Strategic Petroleum Reserve (SPR) inventories for the week ending April 18.

Rigs:

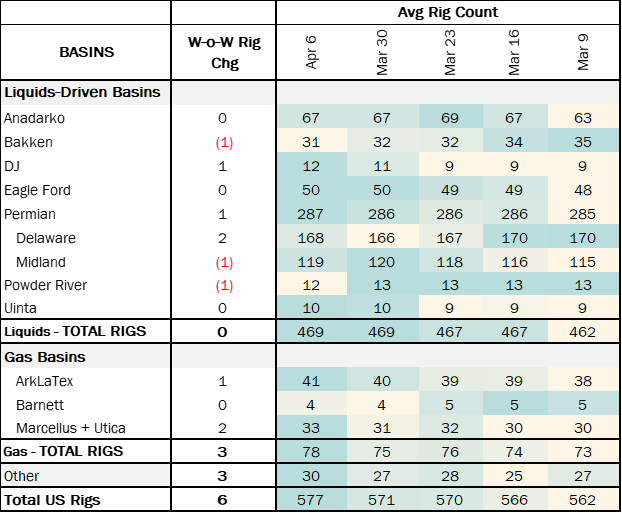

The total US rig count increased by 6 during the week of April 6 to 577. Liquids-driven basins remained flat W-o-W at 469.

- Permian (+1):

- Delaware (+2): EOG Resources, Civitas Resources

- Midland (-1): CrownQuest Operating

- DJ (+1): Occidental Petroleum

- Bakken (-1): Phoenix Capital Group Holdings

- Powder River (-1): Occidental Petroleum

Infrastructure:

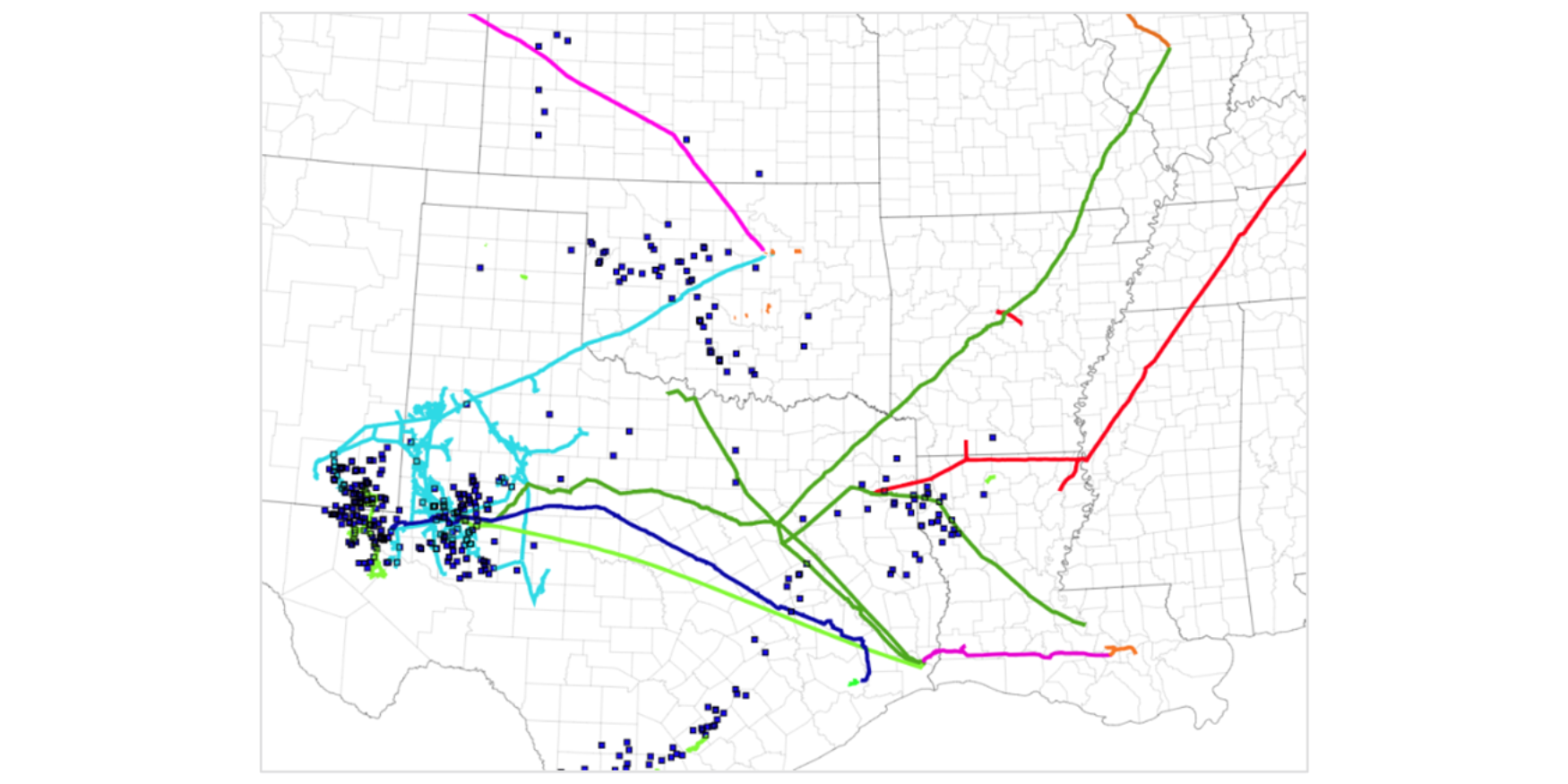

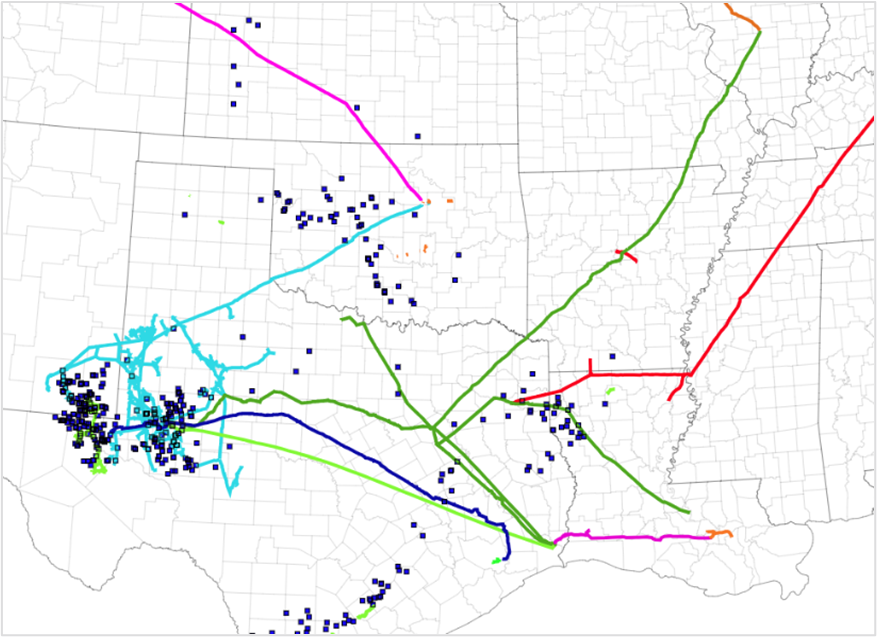

Energy Transfer (ET) has built one of the most extensive crude oil midstream footprints in the Permian Basin, transporting a significant share of Permian barrels via its network of gathering systems, transmission lines and export docks. ET casts a wide reach, delivering crude to refineries from Texas and the Gulf Coast to the Midwest, plus to domestic and international docks in Corpus Christi, Houston and Nederland.

East Daley covers ET’s asset footprint in the Crude Hub Model. The company operates ~5,000 miles of gathering systems in the Permian Basin following its acquisition of Lotus Midstream and the Centurion Pipeline in 2023. Centurion is one of largest and most connected gathering systems in the region. Barrels gathered on Centurion can flow north to Cushing via the Centurion transmission line, deliver to Houston on ET’s Permian Express Pipelines, or route to ET’s West Texas Gulf Pipeline in Colorado City. Centurion serves as a key connector for Permian barrels to reach major PADD 3 market hubs in Cushing, Houston, Nederland and Louisiana.

The Permian Express Pipeline system includes four pipelines with a combined capacity of ~640 Mb/d. When integrated with ET’s West Texas Gulf, Amdel, and PELA pipelines, the total takeaway capacity reaches ~1.8 MMb/d. These pipelines collectively provide Permian crude access to all major Gulf Coast refining and export markets. Throughput in 2024 averaged ~980 Mb/d. In addition, ET holds a 5% equity stake in the Wink to Webster Pipeline, which adds another ~1 MMb/d of Permian takeaway to Gulf Coast hubs.

ET has a diverse portfolio of docks, facilitating crude movements to domestic and international markets. ET acquired an interest in NuStar Energy in spring 2024 via its ownership in Sunoco (SUN), gaining a strategic foothold in the Corpus Christi market. The NuStar dock primarily loads barges bound for domestic refiners in Louisiana, with average 2024 throughput of ~150 Mb/d. ET’s Houston Fuel Oil Terminal Company (HFOTC) serves as a major import/export hub, exporting ~200 Mb/d and importing ~100 Mb/d throughout 2024.

ET is also among the top contenders to develop an offshore export port designed to service Very Large Crude Carriers (VLCCs). Blue Marlin Offshore Port (BMOP) would repurpose existing Gulf Coast gas infrastructure and construct new connections to supply barrels from the Houston and Cushing markets. ET has communicated that it expects up to 45% of its exports to be of Canadian origin via Keystone/Marketlink and Cushing markets, in addition to direct access to neat Bakken production.

The jury is still out whether BMOP will go forward, as the project is still in the approval process for a deepwater port license. However, ET is a step ahead of the competition, having secured a Heads of Agreement (HOA) with TotalEngeries.

Storage:

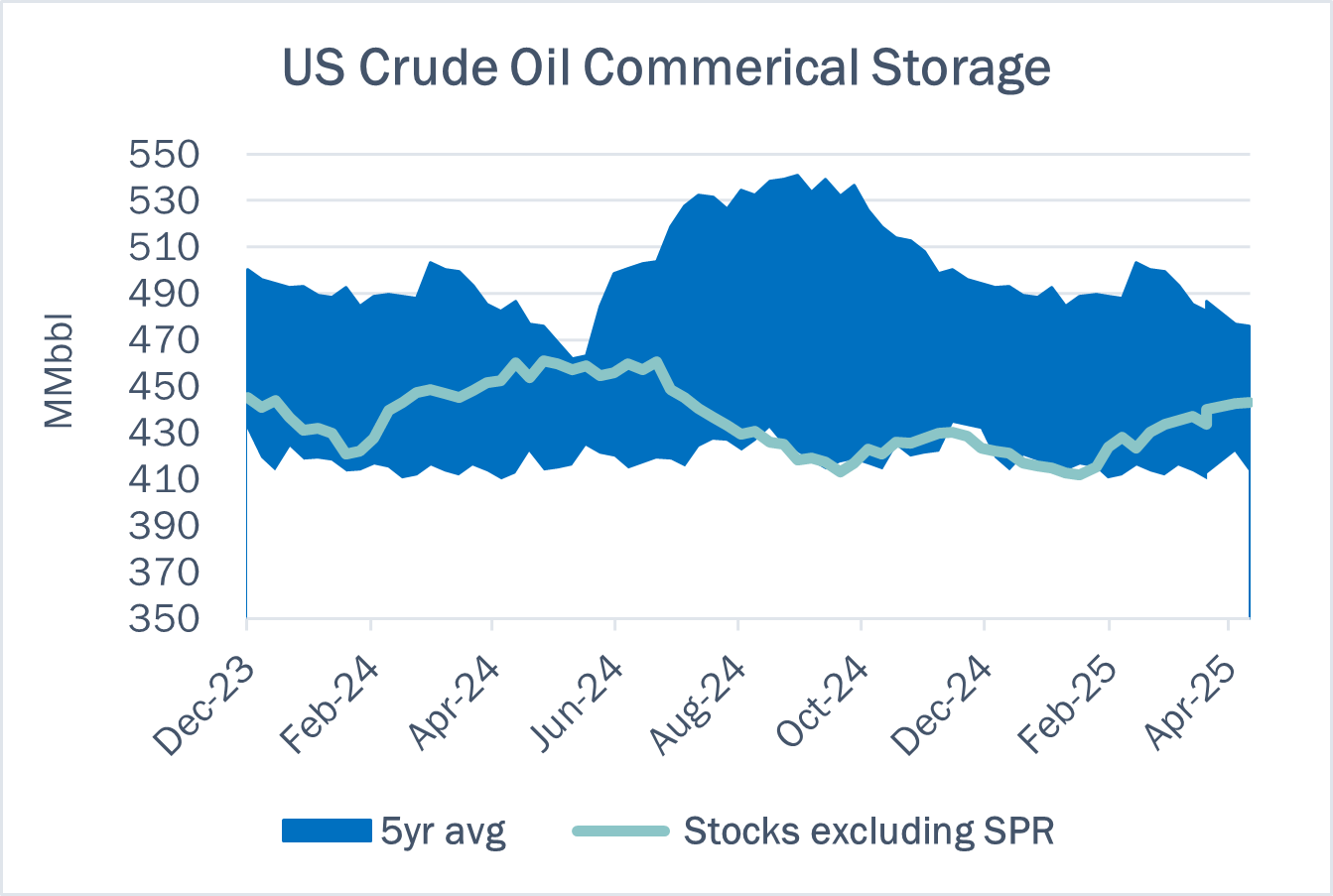

East Daley expects a 6.7 MMbbl injection into commercial and Strategic Petroleum Reserve (SPR) inventories for the week ending April 18. We expect total US stocks, including the SPR, will close at 847 MMbbl.

The US natural gas pipeline sample, a proxy for change in oil production stayed flat W-o-W across all liquids-focused basins. Samples increased 8.8% in the Eagle Ford and decreased 2.8% in the Permian and 1.3% in Williston Basins. The Rockies and the Gulf of Mexico have a high correlation between gas volumes and crude oil volumes, whereas the Permian and Eagle Ford basins correlation is less than 45%.

We expect US crude production to be 13.5 MMb/d. According to US bill of lading data, US crude imports increased to 6.4 MMb/d. More than 60% of the supply originated from Canadian pipelines and vessels into the US, with the remainder largely coming from vessels carrying crude from Mexico, Venezuela and Nigeria.

As of April 18 , there was ~620 Mb/d of refining capacity offline, including downtime for planned and unplanned maintenance. EDA expects gross crude input into refineries to increase, coming in at 16.2 MMb/d.

Vessel traffic monitored by EDA along the Gulf Coast decreased W-o-W. There were 25 vessels loaded for the week ending April 18 and 32 the prior week. EDA expects US exports to be 3.5 MMb/d.

The SPR awarded contracts for 6.0 MMbbl to be delivered To Choctaw February –May 2025 and 2.4 MMbbl to be delivered to Bryan Mound April – May, 2025. The SPR has 397 MMbbl in storage as of April 11, 2025.

Regulatory and Tariffs:

Presented by ARBO

Tariffs:

Hiland Crude, LLC. The joint tariff with Tallgrass Pony Express Pipeline was canceled in its entirety as the committed rates have expired. FERC No 9.19.0 IS25-240 (filed February 26, 2025) Effective April 1, 2025.

Enable Bakken Crude Services, LLC The committed shipper rate to Lost Bridge, ND was increased pursuant to the terms of the TSA. FERC No 1.39.0 IS25-289 (filed April 15, 2025) Effective June 1, 2025.

The above information is provided by ARBO’s Oil Pipeline Tariff Monitor. For more information on regulatory proceedings or tariff rates, please contact please contact Corey Brill via email at [email protected] or phone at 202-505-5296. https://www.goarbo.com/