Market Movers:

KMI: KMI’s 4Q25 print was a reminder that the “demand-pull” corridors are winning.

EPD: The key question for the quarter isn’t whether Bahia adds molecules, it’s how quickly the new pipe re-optimizes Permian routing into Mont Belvieu.

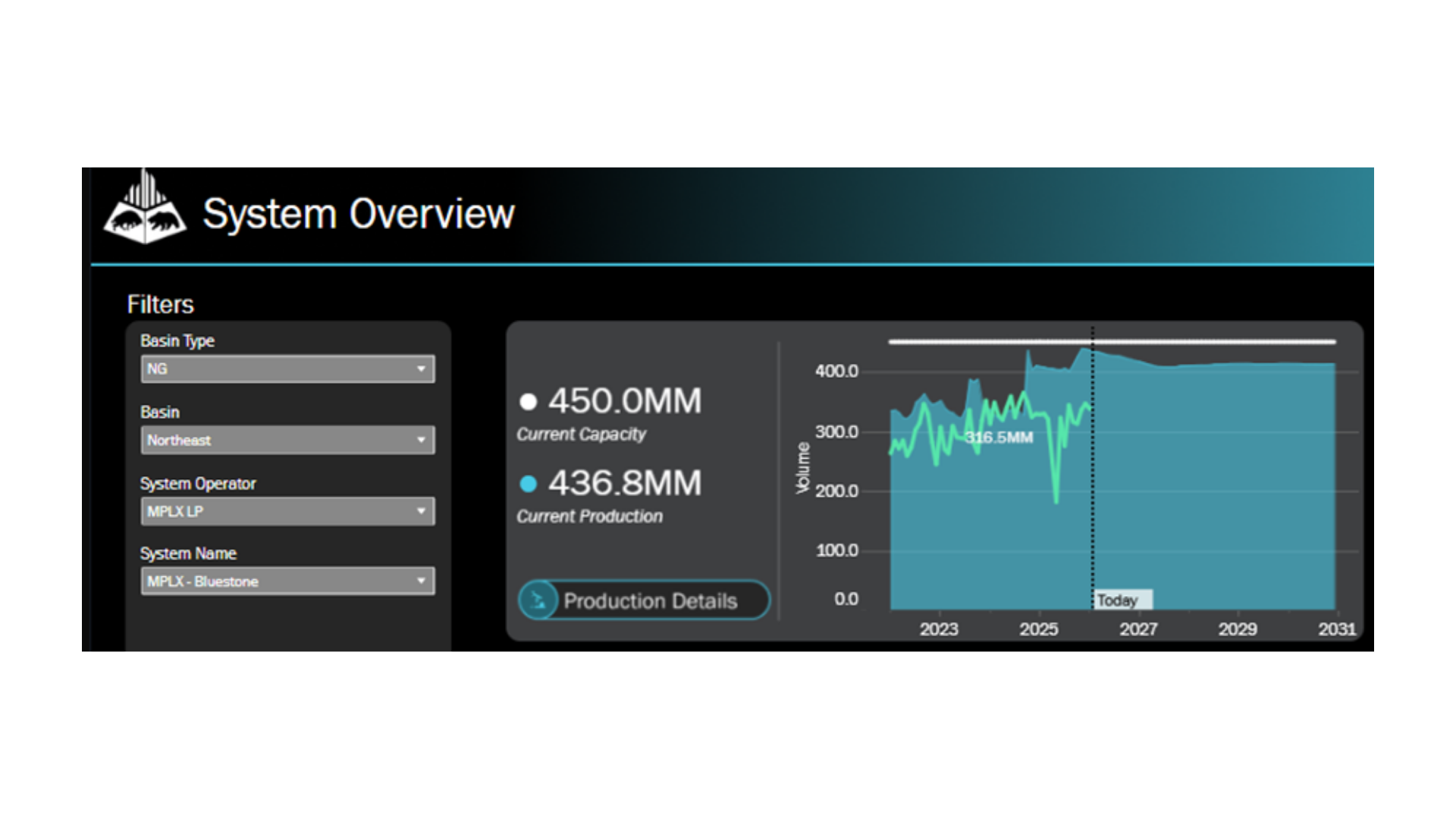

MPLX: This is the final quarter including Rockies G&P volumes after MPLX closed the $1.0B asset sale to Harvest Midstream on Nov. 13

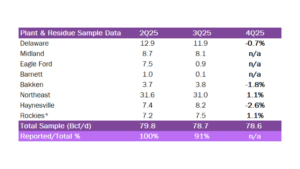

Estimated Quarterly Volumes: New 4Q25 Delaware plant data leads to an upward revision from -2.7% to -0.7% for Q-o-Q volume changes.

Calendar: EDA will be in NYC Feb 9 – 12 and in Houston Feb 25 – 27. Updated models will be released Feb 13. Earnings Previews/Reviews will be released for MPLX, EPD, PAA, ET and WES on Feb 6.

Market Movers:

Kinder Morgan (KMI) opened the 4Q25 earnings season with a bang, reporting record earnings from its natural gas business. Enterprise Products (EPD) and MPLX host the next key earnings releases on Feb. 3.

Enterprise: In East Daley Analytics’ 4Q25 Financial Blueprint model for EPD, the near-term signal is the shift in volumes across the company’s NGL value chain. NGL pipeline throughput eases to ~4,506 Mb/d (–4.0% Q-o-Q) as incremental barrels on the new Bahia Pipeline are more than offset by declines in ethane shipments on ATEX and ethane/propane on Sorrento Pipeline. However, NGL fractionation volumes rise to ~1,720 Mb/d (+5.1% Q-o-Q) on higher Mont Belvieu utilization. Exports are steady: NGL marine terminal volumes tick up to ~912 Mb/d (+0.4% Q-o-Q) as higher LPG exports offset softer ethane shipments.

EPD’s Bahia entered service in December, adding a major new artery from the Permian into Enterprise’s Mont Belvieu complex. Bahia is a 550-mile NGL line with ~600 Mb/d of initial capacity, with longer-term upside via expansion/extension plans.

For crude, we expect transportation volumes to decline to ~2,450 Mb/d (–6.9% Q-o-Q) as softness on the Seaway system outweighs gains tied to Midland-to-ECHO routing, alongside a modest dip in crude terminal volumes.

The key question for the quarter isn’t whether Bahia adds molecules, it’s how quickly the new pipe re-optimizes Permian routing into Mont Belvieu, and what it does to utilization (and margin capture) across EPD’s integrated complex in 2026.

MPLX: East Daley models 4Q25 Adj. EBITDA at ~$1.873B (+6.3% Y-o-Y) for MPLX, with growth split evenly between the Crude Oil & Products Logistics and Natural Gas/NGL Services segments.

For natural gas and NGLs, the Appalachian business drives upside. Marcellus gathering throughput rises to ~1,723 MMcf/d (+12% Y-o-Y) and total natural gas processing increases to ~7,831 MMcf/d (+6%) in our forecast. EDA models a meaningful lift on the Bluestone G&P footprint (see figure).

Meanwhile, 4Q25 is the first full quarter incorporating the Northwind Midstream acquisition, a strategic bolt-on in the Delaware Basin that expands MPLX’s sour gas handling toolkit, including treating and acid gas injection (AGI) storage capacity. The Northwind assets can treat 150 MMcf/d of sour gas today, and an expansion will take capacity to ~440 MMcf/d in 2H26.

In the Crude Oil segment, we model crude oil pipeline volumes at ~3,800 Mb/d (–0.8% Y-o-Y) and products pipeline volumes at ~2,060 Mb/d (+1.7% Y-o-Y). Volumes hold steady, but profitability improves on specific assets (e.g. Western Refining Pipeline EBITDA growth tied to Permian production, and higher flows on Northwest Pipeline).

This is the final quarter including Rockies G&P volumes after MPLX closed the $1.0B asset sale to Harvest Midstream on Nov. 13. The divestiture cleans up MPLX’s balance sheet in 2026 and makes the Northwind integration even more important as a growth driver.

Kinder Morgan: KMI’s 4Q25 print was a reminder that the “demand-pull” corridors are winning. Adj. EBITDA came in at ~$2.271B, led by a record quarter in the Natural Gas Pipelines segment as LNG-linked flows and intrastate strength outweighed softer liquids volumes.

Gas gathering volumes totaled 4,513 MMcf/d in 4Q vs 4,321 MMcf/d in our model (+4.3%), while Natural Gas Pipelines EBITDA rose to ~$1.631B and Terminals EBITDA to ~$294MM. Both businesses were helped by stronger utilization and rates, while the Jones Act fleet remained fully contracted.

The weak spot for KMI was the Products Pipelines segment. Throughput ran light, including refined products volumes of ~1,612 Mb/d (vs 1,709 Mb/d in the EDA model) and crude/condensate volumes of ~423 Mb/d (vs 428 Mb/d in our model) as legacy contracts rolled off ahead of the Double H conversion to NGL service. KMI cited consistent pressure on throughput, but said rates and the products mix cushioned the financial impact.

The CO₂ segment also disappointed. Segment EBITDA dipped to ~$145MM (–12.4% vs the EDA model) on weaker commodity/RIN dynamics, partially offset by higher RNG-related D3 RIN volumes. The bigger-picture takeaway is unchanged: KMI continues to lean into multi-year gas demand growth from LNG and power generation, which is reflected in the company’s capital allocation plans.

Bottom line: EPD’s Feb. 3 setup is about Bahia’s early ramp and the downstream utilization/margin response at Mont Belvieu. MPLX is gaining from Appalachia strength, plus the first full quarter of Northwind contributions. Meanwhile, KMI has delivered what investors want: gas-linked volumes and contracted infrastructure beating the noise in liquids.

Estimated Quarterly Volumes:

The Total Sample represents the flow sample and plant data accessible to EDA. The latest Q-o-Q percentage change is estimated by comparing either flow sample data Q-o-Q or plants within a basin that have continuously reported inlet volumes from the prior quarter to the current quarter. 4Q25 is expressed as Q-o-Q growth from 3Q25.

Rockies represents the aggregate of Big Horn, DJ, Green River, Piceance, Powder River, San Juan, Uinta and Wind River basins.

Northeast: Northeast flow sample data is up 1.1% Q-o-Q. Blue Racer Midstream is up 5.3% while MPLX’s Sherwood system is down 0.4% Q-o-Q. Top producers on Sherwood include Antero Resources (2.8 Bcf/d), CNX (66 MMcf/d) and Jay-Bee O&G (53.8 MMcf/d).

Rockies: Rockies flow sample data is up 1.1% Q-o-Q. Phillip 66’s Denver-Julesburg system is up 5.2% while MPLX’s Blacks Fork system is down 12% Q-o-Q. Top producers on Blacks Forks include PureWest Energy (87 MMcf/d), Jonah Energy (59 MMcf/d) and Greylock Energy (33 MMcf/d).

Calendar: