Executive Summary:

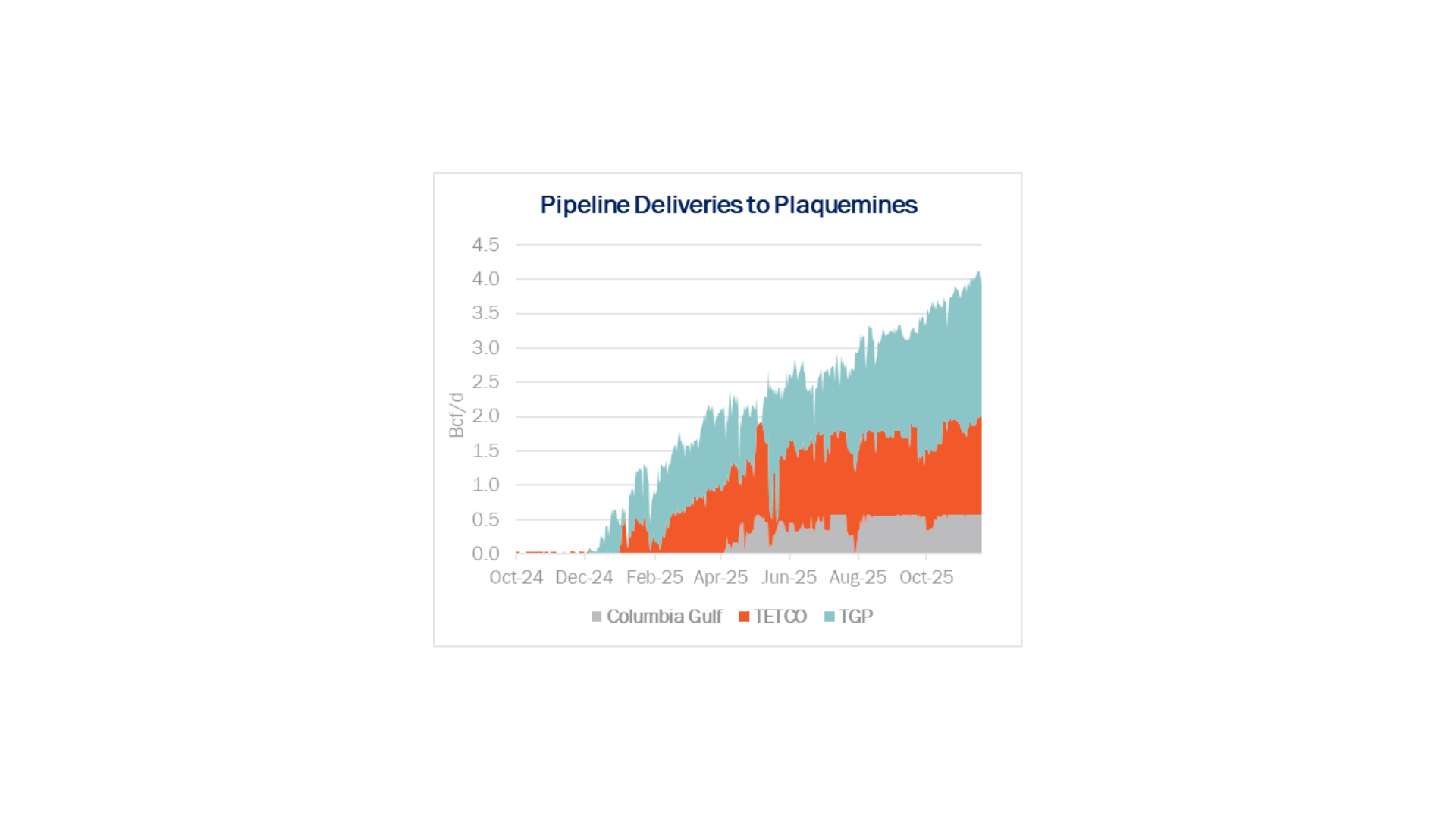

Infrastructure: Feedgas deliveries to Plaquemines LNG have exceeded 4.1 Bcf/d since Nov. 15, supporting East Daley’s outlook for higher demand this winter.

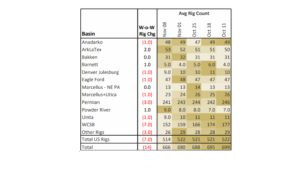

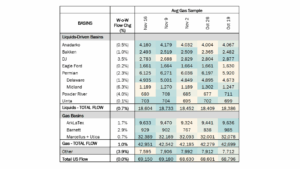

Rigs: The US lost 7 rigs for the week ending Nov. 8, bringing the total rig count to 514.

Flows: US natural gas volumes were flat in pipeline samples, averaging 69.2 Bcf/d for the week ending Nov. 16.

Storage: Traders expect the EIA to report a 15 Bcf withdrawal for the week ending Nov. 14.

Infrastructure:

Feedgas deliveries to Plaquemines LNG have passed 4 Bcf/d, the highest sustained level from the new LNG project. The gains support East Daley Analytics’ expectation for rising LNG demand this winter.

Deliveries on Gator Express, the lateral connecting Plaquemines to other pipelines in southeastern Louisiana, have exceeded 4.1 Bcf/d since Nov. 15. The highest daily delivery occurred on Nov. 15, totaling 4.12 Bcf/d.

Venture Global (VG) in July started producing LNG from Plaquemines Phase 2, which includes 18 small-scale liquefaction trains. In the company’s 3Q25 earnings update, VG said it is now making LNG from 34 of 36 trains at the site. VG predicted it would export 234-238 LNG cargoes from Plaquemines in 2025.

Once completed, Plaquemines will be able to produce 27 mtpa (~3.6 Bcf/d) of LNG. However, VG has indicated its latest LNG project will operate well above nameplate capacity, similar to the performance of its Calcasieu Pass site.

The Gator Express lateral sources volumes from Tennessee Gas Pipeline (TGP), Texas Eastern (TETCO) and Columbia Gulf. TETCO has mostly supplied the recent gains, with deliveries to Gator Express passing 1.4 Bcf/d for the first time on Nov. 15. Flows on TGP have also been strong at a sustained 2.1 Bcf/d.

Plaquemines is a key driver of LNG demand growth underpinning East Daley’s bullish gas outlook this winter. Cheniere Energy (LNG) is also ramping the Stage 3 midscale expansion at its Corpus Christi terminal, and we anticipate Golden Pass LNG will start producing LNG from Train 1 in 1Q26.

See the Macro Supply & Demand Report for more on the natural gas market outlook, and the Southeast Gulf Supply & Demand Report for a regional review of demand and pipeline flows for Plaquemines and other Louisiana LNG projects.

The Permian Basin at a Crossroads: Download Why This Pipeline Boom is Different

The Permian’s next big buildout is already taking shape — but this time, the drivers aren’t producers chasing oil. East Daley’s latest white paper reveals how gas demand from AI data centers, LNG exports, and utilities is rewriting the midstream playbook. Over 9 Bcf/d of new capacity and $12 billion in investments are reshaping flows, turning the Permian into a gas powerhouse even as rigs decline. Read Part II: Why This Pipeline Boom is Different

Rigs:

The US lost 7 rigs for the week of Nov. 8, bringing the total rig count to 514. The Permian (-3), Anadarko (-1), DJ (-1), Eagle Ford (-1), Marcellus+Utica and Uinta (-1) lost rigs while the ArkLaTex (+2), Barnett (+1) and Powder River (+1) gained rigs W-o-W.

At the company level, Enterprise (-3), Williams (-2), Western Midstream (-2), Energy Transfer (-1), Phillips 66 (-1), Kinder Morgan (-1), M6 Midstream (-1) and Kinetik (-1) lost rigs on their G&P systems while Targa Resources (+2), MPLX (+2), EnLink (+2) and Comstock (+1) gained rigs W-o-W.

See East Daley Analytics’ weekly Rig Activity Tracker for more information on rigs by basin and company.

Flows:

US natural gas volumes in pipeline samples were flat for the week ending Nov. 16, averaging 69.2 Bcf/d.

Major gas basin samples gained 1.0% W-o-W to average 43.0 Bcf/d. The Haynesville sample increased 1.7% to 9.6 Bcf/d, while the Marcellus+Utica sample gained 0.7% to 32.4 Bcf/d.

Samples in liquids-focused basins decreased 0.7% to 18.6 Bcf/d. The Permian sample declined 2.3% to 6.1 Bcf/d, while the Denver-Julesburg sample gained 3.5% W-o-W.

Storage:

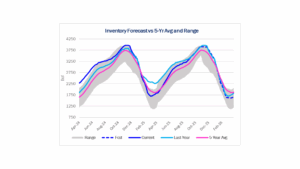

Traders and analysts expect the Energy Information Administration (EIA) to report a 15 Bcf net withdrawal for the week ending Nov. 14. A 15 Bcf withdrawal would decrease the surplus to the five-year average by 27 Bcf to 145 Bcf. The storage comparison to last year would slip further into deficit, falling to 24 Bcf under inventory a year ago.

If estimate proves accurate, this would be the first net withdrawal of the nascent 2025-26 winter. East Daley expects November to be a net withdrawal month, with little change to storage for the week ending Nov. 21 and a larger withdrawal for the holiday week ending Nov. 28.

Generally speaking, the weather outlook and impact on storage has been supportive of prices. The December, January and February contracts averaged $4.58/MMBtu Wednesday (Nov. 19), a healthy bump above prices for the same period last year. The 11- to 15-day forecast through Dec. 3 shows colder temperatures than normal across the Lower 48. December weather is important to sustain these higher prices, and so far, the forecast points to stronger demand.

See East Daley Analytics’ latest Macro Supply & Demand Report for more analysis on the winter market outlook.

Calendar:

Subscribe to East Daley’s The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices, and EDA research likely to affect markets in the short term.