Monthly Production Stream: November

East Daley Analytics’ Monthly Production Stream delivers a cross-commodity snapshot of the U.S. energy landscape, from natural gas and NGLs to crude oil and capital flows. Join our analysts as they unpack the latest production trends, basin-level dynamics, and capital shifts shaping the energy market into 2026.

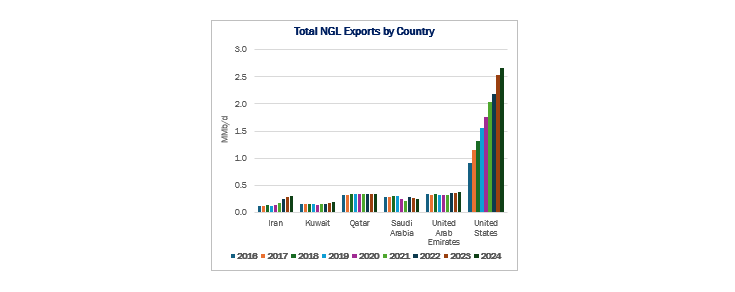

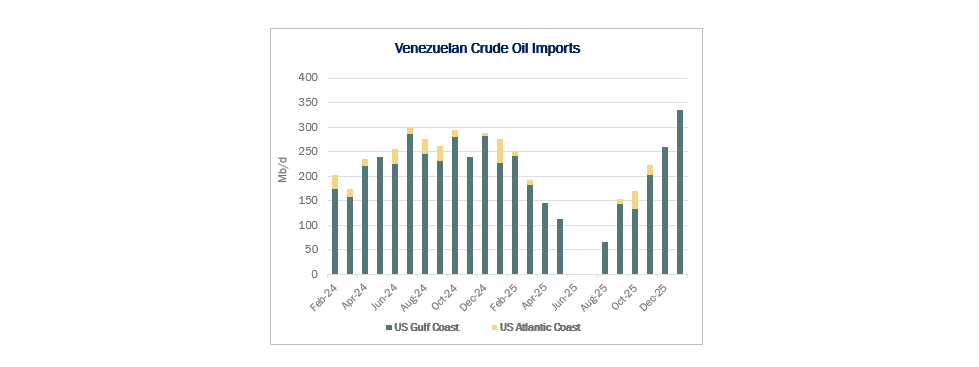

This month’s discussion highlights:

-

Rigs to Riches: Our 2025 macro production outlook and the biggest basin movers of the month, where growth is steady and where it’s starting to slip.

-

Haynesville on the Hot Seat: What happens if Haynesville can’t deliver the gas needed to meet LNG and data center demand?

-

Demand Surge Ahead: How the LNG boom and data center growth are driving gas markets, and what it means for pricing volatility.

-

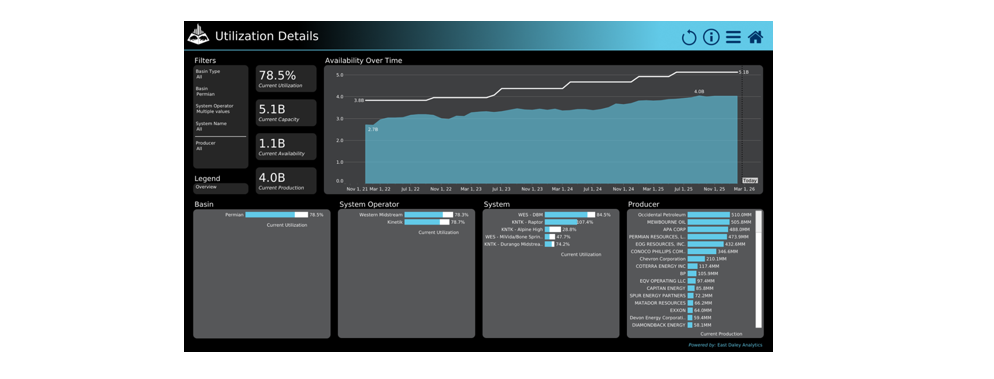

Permian Plateau: Why Permian crude is flattening even as gas volumes climb, and how that shift impacts U.S. supply balance.

-

Capital Implications: Which midstream and upstream operators stand to benefit, or risk exposure, as demand tightens and global LNG investments accelerate.

Gain actionable intelligence on production forecasts, basin-level constraints, and capital exposure, powered by East Daley’s proprietary production and infrastructure models.

Watch the Replay

Missed it live? Stream the full November Monthly Production Stream anytime. Get the straight talk on what’s moving U.S. production — gas, crude, and NGLs — and what it means for your bottom line.

Go deeper with the full slide deck. All the charts, forecasts, and basin-level insights — in one download.

Who Is East Daley?

At East Daley Analytics, we provide the most comprehensive and actionable insights into the energy sector. With a focus on midstream and upstream energy markets, our team delivers unmatched expertise through data-driven analysis, reports, and innovative solutions. Our webinars are designed to offer industry professionals the latest trends, market dynamics, and key insights to help them make informed decisions in a rapidly evolving energy landscape. With our commitment to transparency and accuracy, East Daley helps you navigate complex energy markets with confidence.

- Forecasting the Future: Hydrocarbon Production Outlook for 2025

- Back to the Eighties: Integrateds Becoming More Integrated

- Power Surge: Data Centers Driving Energy Demand and Gas Growth

- Private Equity: Filling the Infrastructure Void

Our Methodology

Granular Asset-Level Data

Deep, detailed tracking of energy assets across the midstream and upstream sectors for accurate and specific market insights.

Market Supply and Demand Forecasting

Projections based on real-time data and historical trends to provide accurate future outlooks.

Commodity Flow Analysis

Detailed analysis of commodity flows to identify market shifts and critical supply chain bottlenecks.

Earnings Model Integration

Incorporating company-level earnings with market data to create a full picture of financial performance in the sector.

Scenario Modeling

Using scenario-based analysis to test potential outcomes for market developments, helping clients assess risk and make strategic decisions.

Real-Time Market Monitoring

Ongoing monitoring of key indicators and market changes to ensure clients receive timely, relevant updates.

Final Webinar Push to Register