Exec Summary

Market Movers:

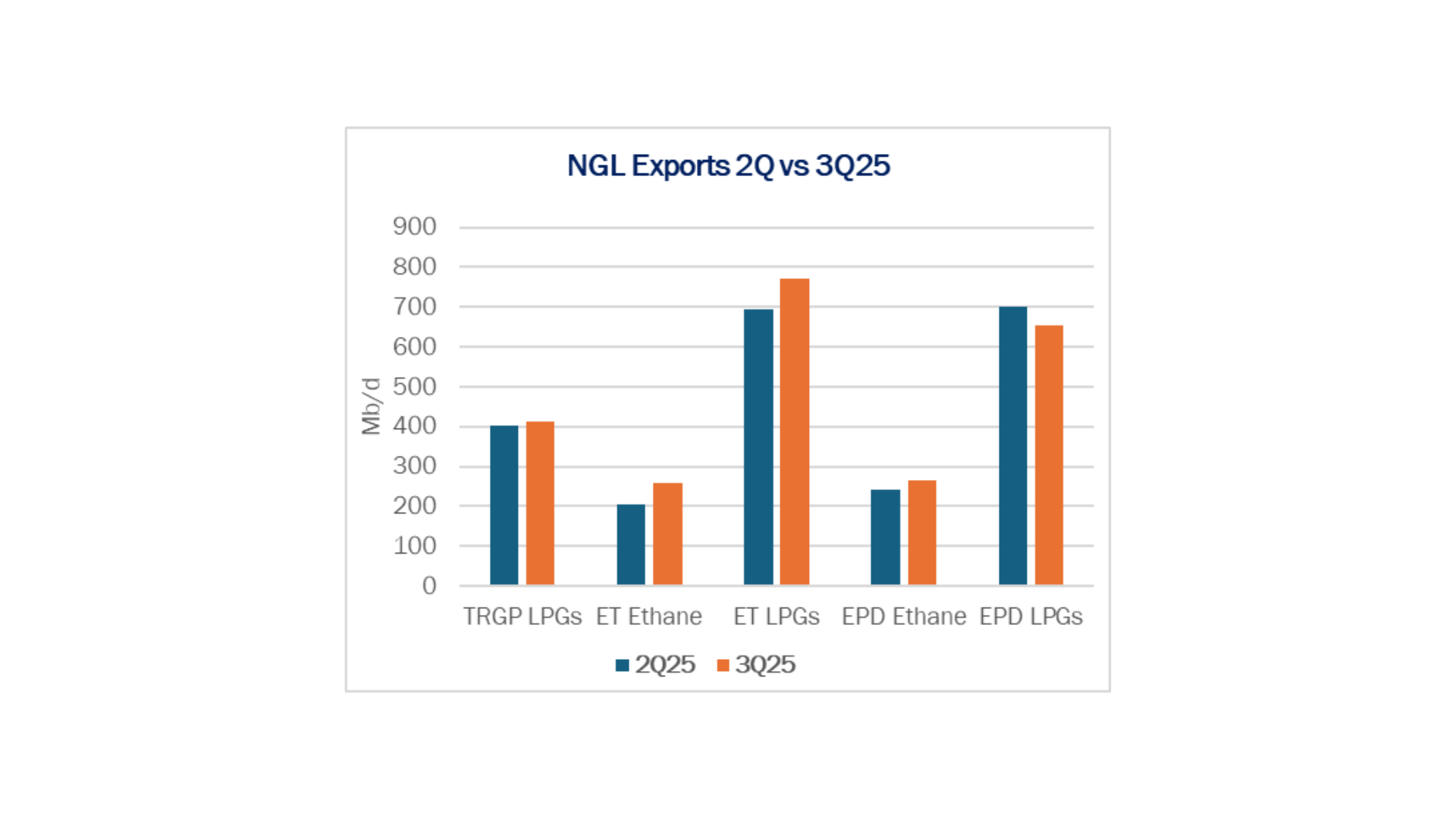

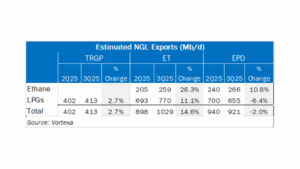

- TRGP: NGL exports up 2.7% Q-o-Q

- ET: Ethane exports up 26% and LPG exports up 11% Q-o-Q

- EPD: Ethane exports up 10% and LPG exports down –6% Q-o-Q

Estimated Quarterly Volumes:

- Trending Up Q-o-Q: Bakken (+2%), Delaware (+1.3%), Rockies (+0.8%)

- Trending Down Q-o-Q: Haynesville (-5.1%), Northeast (-1.7%)

Calendar:

- The Capital Intelligence team will be in LA on Oct. 29

- Earnings Previews & Model Releases: SMC, SOBO

- Earnings Calls: OKE (10/29), EPD (10/30), AM (10/30), GEL (10/30), DTM (10/30)

Market Movers:

The 3Q earnings season approaches, what East Daley Analytics dubs “Christmas in October,” and the latest export data provides early insight into what will likely dominate discussions across the midstream space. Here’s what we’re seeing in the field.

Targa Resources (TRGP)

We expect Targa to report a modest 2.7% Q-o-Q gain in NGL exports, maintaining steady market share despite ongoing volatility. The company’s 25 Mb/d debottleneck project will soon lift Galena Park export capacity to 500 Mb/d.

Looking further ahead, Targa’s 150 Mb/d dock expansion, scheduled for 2H27, aligns with its newly announced Speedway NGL pipeline, expected in service by 3Q27. These projects position Targa for continued growth in export capacity and supply flexibility.

Energy Transfer (ET)

ET is expected to report a 26% increase in ethane exports and an 11% increase in LPG exports. The ethane uplift was largely driven by rising flows to China, consistent with ET’s close relationship with Satellite Chemical. ET’s recently completed Nederland Flexport expansion (early 3Q) contributed to growth. However, with overall infrastructure running at roughly 80% utilization, the key question is whether ET can sustain volumes as LPG arbitrage margins tighten and the spot market normalizes.

Enterprise Products (EPD)

EPD tells a tale of two commodities: expected ethane exports up 10% while LPG exports fall 6% Q-o-Q. The early startup of the Neches River terminal underscores a strong global demand outlook for ethane, even as the LPG arbitrage window narrows, leaving ample upside for Neches River Phase 2.

However, EPD underperformed its two largest peers in the LPG export market. The company also cited lower spot rates, including one key contract renegotiated downward, signaling a bearish tone for LPG exports. While 85% of LPG capacity remains under long-term contract, the volume decline may reflect increased spot competition, likely from Energy Transfer.

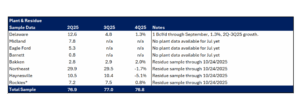

Estimated Quarterly Volumes:

Notes: 3Q25 is expressed as Q-o-Q growth from 2Q25. Rockies is the sum of Big Horn, DJ, Green River, Piceance, Powder River, San Juan, Uinta and Wind River.

- Bakken plant inlets are up 2% from 3Q25. The KMI – Outrigger II system is up 5.9% and the HESM – Tioga system is up 2.9% from 3Q25 to 4Q25. Chevron is the largest producer behind the HESM – Tioga system,

- Rockies meter point samples are up 0.8% from 3Q25. The PSX – DCP Denver-Julesburg system is up 6.3% and the EPD – Chaco plant is up 3.2% from 3Q25. Chevron is the largest producer behind the PSX system (96% of volumes), and Hillcorp is the largest producer behind the EPD system (62% of volumes).

Calendar: