Kinetik’s (KNTK) recent sale of its 27.5% equity interest in the EPIC Crude Pipeline could open the door to more divestitures. The company’s two crude oil gathering systems are more attractive candidates following the $500MM EPIC deal with Plains All American (PAA)

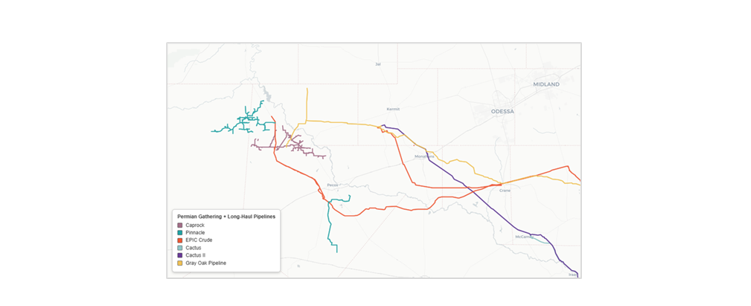

Kinetik owns the Caprock and Pinnacle crude gathering systems in the Delaware Basin, primarily based in Reeves County, TX. The assets together comprise ~220 miles of gathering pipeline and ~90 Mb of storage at the Stampede (Caprock) and Sierra Grande (Pinnacle) terminals. The Caprock and Pinnacle systems provide upstream connectivity into EPIC and several key long-haul crude oil pipes, including Gray Oak and Cactus I/II (see map). In the KNTK Financial Blueprint in Energy Data Studio, East Daley Analytics estimates total 2025 EBITDA of ~$26MM for the two systems (~$14MM from Caprock and ~$12MM from Pinnacle). We forecast flat asset earnings over the next few years.

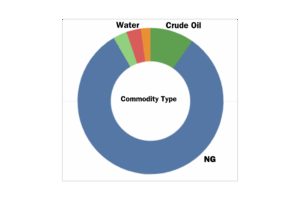

The “Peer Comparison Tool” in Energy Data Studio highlights that KNTK’s portfolio is overwhelmingly weighted toward natural gas, representing ~86% of total EBITDA (see figure). The Caprock and Pinnacle systems account for just ~2% of Kinetik’s total EBITDA. Moreover, the EPIC sale ends KNTK’s control of downstream oil assets, making the two systems less compelling components of its portfolio.

Management suggested this strategy in the EPIC announcement, emphasizing the redeployment of proceeds from non-core asset sales into growth projects and shareholder returns. KNTK is heavily invested in its Permian gas strategy, including the impending start of the Kings Landing processing complex and construction of the ECCC Pipeline.

Given their location and tie-ins, Caprock and Pinnacle would see solid buyer interest. Western Midstream (WES), Plains Oryx (PAA joint venture with Oryx Midstream) and Energy Transfer (ET) are other large operators in the Delaware/Reeves County area that could benefit from annexing the assets.

Plains in particular could have interest. PAA has been active in acquisitions recently, including the purchase of the EPIC equity stake, and the assets align with its broader “wellhead-to-water” strategy. Plains also has a track record of acquiring gathering systems, most recently purchasing Ironwood Midstream Energy. Acquiring Pinnacle and Caprock would further this vertical integration, complementing Plains’ ownership stakes in the Cactus (100%), Cactus II (70%), Eagle Ford JV (50%) and EPIC (55%) pipelines.

Bottom Line: A Caprock and Pinnacle sale would further Kinetik’s pivot toward natural gas while providing strategic buyers with valuable crude gathering infrastructure in the Delaware Basin. – Keland Rumsey Tickers: ET, KNTK, PAA, WES.

The Permian Basin at a Crossroads: Download the Latest White Paper

The Permian Basin at a Crossroads: Download the Latest White Paper

The Permian Basin is the heart of the US energy industry, supplying half of crude oil and NGL production and nearly 20% of natural gas. Yet market pressures are forcing changes, prompting billions in new pipeline investments and reorienting how operators approach the basin. East Daley’s new white paper, The Permian Basin at a Crossroads, is the first of a 3-part series looking at the shifts underway in the Permian. In this series, we reveal how LNG demand and AI data centers could transform Permian gas into a primary revenue driver. We also review the multi-billion-dollar infrastructure needed to unlock this shift, and what’s at stake for oil, gas and midstream operators. — Click here to download the The Permian Basin at a Crossroads white paper!

Meet Daley, the Best AI Tool in Energy

Meet Daley, the newest member of our energy team. Our new AI assistant is live and available to all East Daley Analytics clients. Early feedback has been phenomenal. Daley is platform-specific and only pulls from East Daley’s own proprietary data and content. It’s not open-source or generic AI, but built to understand our structure, language and analytics. Whether you’re looking for a specific metric, forecast or explanation, Daley can get you there quicker. — Reach out to learn more about Daley!

The Daley Note

Subscribe to The Daley Note for energy insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.