Executive Summary:

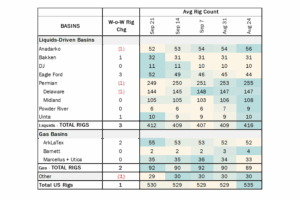

Rigs: The total US rig count increased for the week of Sept. 21 to 531.

Infrastructure: Kinetik’s recent sale of its 27.5% equity interest in the EPIC Crude Pipeline could open the door to more divestitures.

Supply & Demand: The US natural gas pipeline sample, a proxy for change in oil production, decreased 1% W-o-W across all liquids-focused basins

Rigs:

The total US rig count increased during the week of Sep 21 to 531. Liquids-driven basins increased 2 rigs W-o-W from 409 to 411.

- Permian:

- Delaware (-1): EOG Resources

- Anadarko (-1): Patterson Energy

- Eagle Ford (+3): TBM Catarina, B&L Resources, Magnetar Operating

- Uinta (+1): Uinta Wax Operating

Infrastructure:

Kinetik’s (KNTK) recent sale of its 27.5% equity interest in the EPIC Crude Pipeline could open the door to more divestitures. The company’s two crude oil gathering systems are more attractive candidates following the $500MM EPIC deal with Plains All American (PAA).

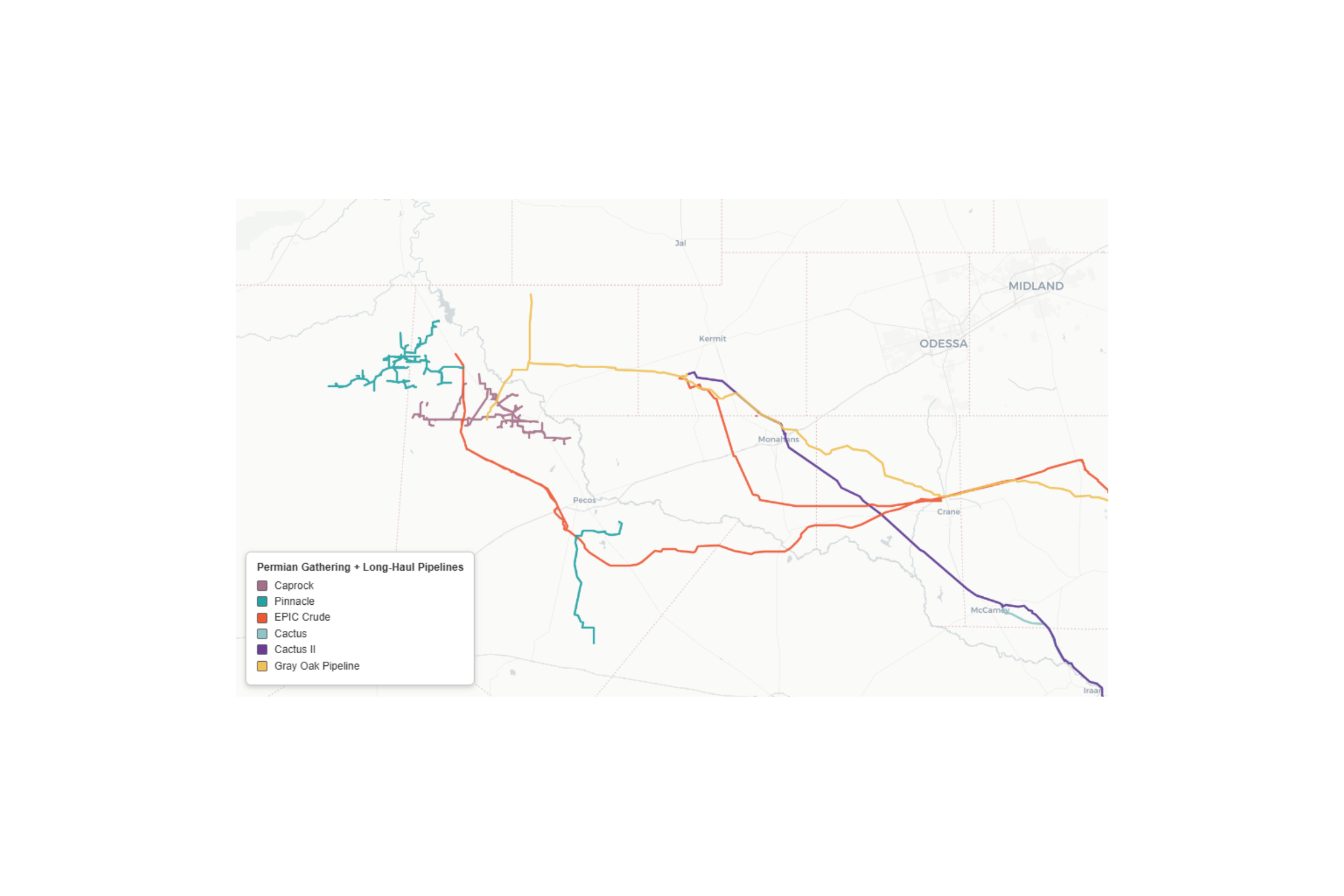

Kinetik owns the Caprock and Pinnacle crude gathering systems in the Delaware Basin, primarily based in Reeves County, TX. The assets together comprise ~220 miles of gathering pipeline and ~90 Mb of storage at the Stampede (Caprock) and Sierra Grande (Pinnacle) terminals.

The Caprock and Pinnacle systems provide upstream connectivity into EPIC and several key long-haul crude oil pipes, including Gray Oak and Cactus I/II (see map). In the KNTK Financial Blueprint in Energy Data Studio, East Daley Analytics estimates total 2025 EBITDA of ~$26MM for the two systems (~$14MM from Caprock and ~$12MM from Pinnacle). We forecast flat asset earnings over the next few years.

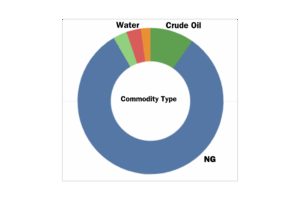

The “Peer Comparison Tool” in Energy Data Studio highlights that KNTK’s portfolio is overwhelmingly weighted toward natural gas, representing ~86% of total EBITDA (see figure). The Caprock and Pinnacle systems account for just ~2% of Kinetik’s total EBITDA. Moreover, the EPIC sale ends KNTK’s control of downstream oil assets, making the two systems less compelling components of its portfolio.

Management suggested this strategy in the EPIC announcement, emphasizing the redeployment of proceeds from non-core asset sales into growth projects and shareholder returns. KNTK is heavily invested in its Permian gas strategy, including the impending start of the Kings Landing processing complex and construction of the ECCC Pipeline.

Given their location and tie-ins, Caprock and Pinnacle would see solid buyer interest. Western Midstream (WES), Plains Oryx (PAA joint venture with Oryx Midstream) and Energy Transfer (ET) are other large operators in the Delaware/Reeves County area that could benefit from annexing the assets.

Plains in particular could have interest. PAA has been active in acquisitions recently, including the purchase of the EPIC equity stake, and the assets align with its broader “wellhead-to-water” strategy. Plains also has a track record of acquiring gathering systems, most recently purchasing Ironwood Midstream Energy. Acquiring Pinnacle and Caprock would further this vertical integration, complementing Plains’ ownership stakes in the Cactus (100%), Cactus II (70%), Eagle Ford JV (50%) and EPIC (55%) pipelines.

Bottom Line: A Caprock and Pinnacle sale would further Kinetik’s pivot toward natural gas while providing strategic buyers with valuable crude gathering infrastructure in the Delaware Basin.

Supply and Demand

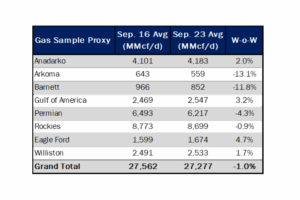

The US natural gas pipeline sample, a proxy for change in oil production, decreased 1% W-o-W across all liquids-focused basins.

The Barnett sample decreased by 11.8%, following an increase of 12.4% in prior week. Similarly, the Anadarko sample dropped 13.1%. These decreases coincided with increases in the Eagle Ford and Gulf of America samples by 4.7% and 3.2% respectively. The Rockies and the Gulf of America have a high correlation between gas volumes and crude oil volumes, whereas the Permian and Eagle Ford basins correlation is less than 45%.

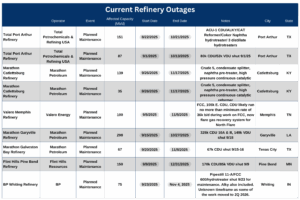

As of Oct. 16, there is currently ~1.1 MMb/d of refining capacity offline for planned maintenance. The Flint Hills Pine Bend refinery accounts for 150 Mb/d of offline capacity due to planned maintenance lasting until Dec. 31. There was no change W-o-W in planned maintenance.

Vessel traffic monitored by EDA along the Gulf Coast increased W-o-W. There were 24 vessels loaded for the week ending October 4th bouncing upwards from the 20 vessels loaded the prior week.

Regulatory and Tariffs:

Presented by ARBO

Tariffs:

Gray Oak Pipeline, LLC: Certain available capacity discounts were increased.

Magellan Pipeline Company, L.P.: The tariffs were revised to add a new product and to update the product grade document to be consistent with ONEOK’s product grade documents.

The above information is provided by ARBO’s Oil Pipeline Tariff Monitor. For more information on regulatory proceedings or tariff rates, please contact please contact Corey Brill via email at [email protected] or phone at 202-505-5296. https://www.goarbo.com/