The industry is banking on more natural gas supply from the Permian Basin, judging by the progress of several newly sanctioned pipelines. Yet meeting this additional demand for Permian gas will eventually hit an infrastructure wall in crude oil, according to scenario analysis using East Daley Analytics’ Production Scenario Tool (PST).

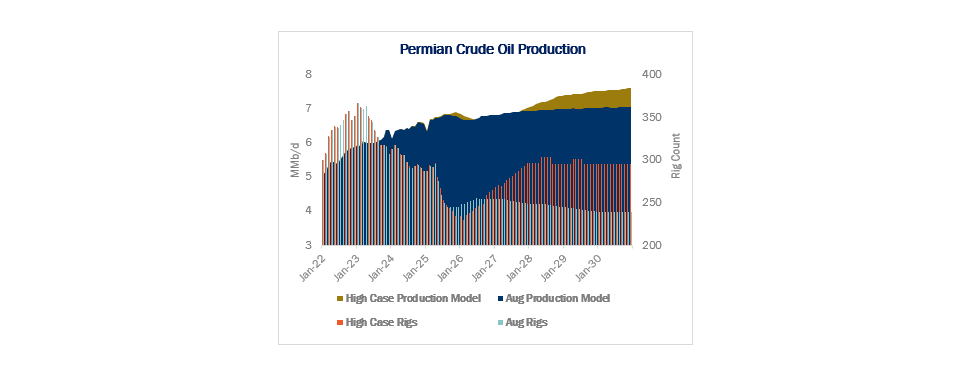

Analysts are weighing conflicting signals about the trajectory of Permian production. Rig counts have been declining since the start of the year, and many operators pared their annual guidance after crude oil prices fell in April. Forecasters at the Energy Information Administration (EIA) expect oil production to start declining in 2026. Yet shippers have been eagerly backing new gas pipelines out of the Permian, including WhiteWater’s Eiger Express and Energy Transfer’s (ET) Desert Southwest, suggesting more growth ahead.

East Daley currently forecasts Permian crude oil production to grow 292 Mb/d (4.5%) this year. The basin produced 6.44 MMb/d in 2024, and in Energy Data Studio we forecast output to average 6.73 MMb/d in 2025. From 2025-30, we expect production to grow 4.7%.

East Daley currently forecasts Permian crude oil production to grow 292 Mb/d (4.5%) this year. The basin produced 6.44 MMb/d in 2024, and in Energy Data Studio we forecast output to average 6.73 MMb/d in 2025. From 2025-30, we expect production to grow 4.7%.

On the gas side, Permian residue production averaged 18.6 Bcf/d in 2024. In Energy Data Studio, we model output will rise to 20.9 Bcf/d in 2025, or ~12% growth Y-o-Y. Between 2025-30, we forecast residue gas volumes climb another 4 Bcf/d as associated gas continues to expand alongside oil. We assume eastbound gas egress operates at ~83% utilization, westbound flows from the Permian remain full, Mexican exports are demand-constrained, and northbound flows decline sharply.

East Daley designed the PST to evaluate alternative market scenarios under different rig and commodity price assumptions. We tested a high-case scenario focused on gas, assuming that newly sanctioned Permian gas pipelines with a final investment decision (FID) run near 90% utilization. Under this view, Permian gas production grows nearly 8 Bcf/d from 2025–30 (average to average). Achieving this pace of growth would require rig counts to increase to 295 by YE30, up from ~249 in August ‘25 (see chart).

While cheap Permian gas is essential to meet nearly 17 Bcf/d of incremental LNG demand, this growth path would create major problems for crude egress. With Corpus Christi volumes already near capacity, additional barrels are forced onto Cushing and Houston routes, pushing those systems to near-full utilization. By YE29, Plains All American’s (PAA) Basin and Sunrise pipelines return to pre-COVID throughput, Enterprise Products’ (EPD) Midland-to-ECHO I and III pipes average 106% utilization, and ET’s West Texas Gulf runs at ~97% in the Crude Hub Model.

To be clear, this is not East Daley’s base case, and we view this crude scenario as highly unlikely. Current prices don’t support the required drilling escalation, while local demand is steady — meaning incremental barrels must find a home overseas. The EIA’s Short-Term Energy Outlook expects global demand to rise only 2.2 MMb/d from 2024–26, leaving limited room for US shale growth as OPEC+ supply returns.

It is often easier to rule out what won’t happen than to pinpoint exactly what will. What we can say: unchecked gas growth at current gas-to-oil ratios (GORs) is untenable given crude infrastructure and downstream demand constraints. Yet these new pipelines will not sit idle — the pull from LNG and data centers, exceeding 20 Bcf/d of incremental demand, is too strong.

Bottom line: The Permian is at a crossroads. Crude appears to be nearing its structural limits, while natural gas is pushing for new market share. For both commodities to thrive, producers may need to pivot rigs toward gassier acreage, maximizing GORs to fill gas pipelines without overwhelming crude infrastructure. To learn more, clients can access East Daley’s Production Models in Energy Data Studio to run scenario analysis. – Gage Dwan and Oren Pilant. Tickers: EPD, ET, PAA.

Meet Daley, the Best AI Tool in Energy

Meet Daley, the newest member of our energy team. Our new AI assistant is live and available to all East Daley Analytics clients. Early feedback has been phenomenal. Daley is platform-specific and only pulls from East Daley’s own proprietary data and content. It’s not open-source or generic AI, but built to understand our structure, language and analytics. Whether you’re looking for a specific metric, forecast or explanation, Daley can get you there quicker. — Reach out to learn more about Daley!

Get the FERC Intrastate Pipeline Data

East Daley Analytics’ FERC 549D Intrastate Contract Data delivers contract shipper data for intrastate pipelines — scrubbed and ready to use. Use the 549 data to identify which intrastate pipelines have available capacity, understand pipeline rate structures, gain insights into shippers, and spot contract cliffs and opportunities for higher rate renewals. Reach out to East Daley to learn more.

The Daley Note

Subscribe to The Daley Note for energy insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.