Chord Energy (CHRD) is strengthening its Williston Basin position with a $550MM acquisition of assets from ExxonMobil (XOM) subsidiary XTO Energy. The deal adds scale, efficiency and low-cost inventory for CHRD, and sets up several midstream assets for future growth.

The transaction with XTO, announced Sept. 15, includes ~48,000 net acres and ~90 net 10,000-foot-equivalent drilling locations. The assets currently produce ~9 Mboe/d (78% oil) and have a modest 23% projected base decline, CHRD said.

Located adjacent to Chord’s existing footprint, the acquired acreage enables longer laterals and improved capital efficiency, supporting breakevens near $40/bbl. The deal builds on CHRD’s 2023 purchase of 62,000 net acres from XTO, reinforcing a consolidation strategy designed to unlock scale and efficiency in the Williston.

Located adjacent to Chord’s existing footprint, the acquired acreage enables longer laterals and improved capital efficiency, supporting breakevens near $40/bbl. The deal builds on CHRD’s 2023 purchase of 62,000 net acres from XTO, reinforcing a consolidation strategy designed to unlock scale and efficiency in the Williston.

In the Bakken Energy Path, East Daley Analytics tracks oil, gas and NGL volumes from individual wells through midstream infrastructure, including pipelines and processing plants. We estimate XTO’s total Williston crude oil production averaged 78 Mb/d in 1Q25. The acquired assets complement CHRD’s current 235 Mb/d production while lowering the producer’s average Williston breakeven costs for new wells (previously $56/bbl vs the basin average of $47/bbl).

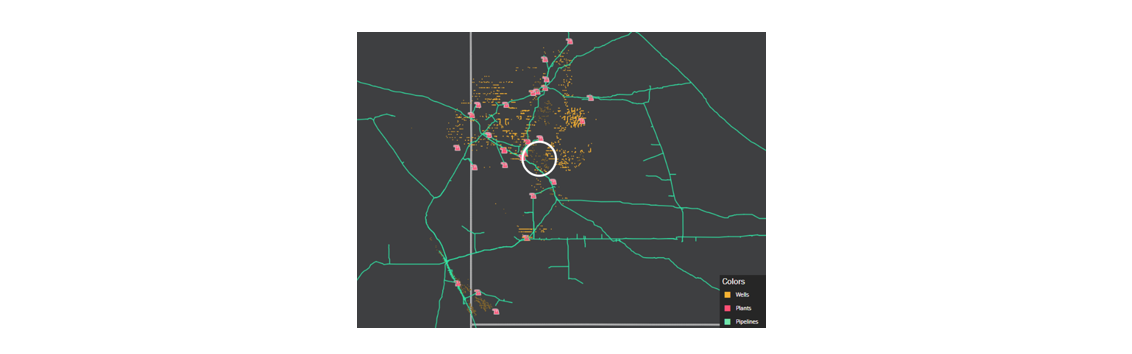

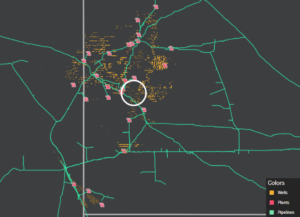

East Daley’s Bakken Energy Path shows the acquired volumes primarily flow to the ONEOK (OKE) Bakken and Hess Midstream (HESM) Tioga systems — already key outlets for CHRD (see map). This overlap enhances infrastructure synergies and aligns development with established midstream networks.

The deal underscores a broader consolidation wave in the Williston Basin. As operators combine acreage and extend laterals, drilling margins expand and capital efficiency improves, and the basin achieves a more durable production profile. For CHRD, the result is a more resilient foundation for sustained output — and a stronger platform for long-term growth. – Gage Dwan Tickers: CHRD, HESM, OKE, XOM.

Bakken Energy Path – Powered by Energy Data Studio

Energy Path is a revolutionary tool designed to transform how you view energy markets. With Energy Path, you can seamlessly track the molecule from wellhead to demand, gaining a complete view of the entire oil and gas value chain. From upstream to midstream to downstream, this multi-commodity product offers unparalleled insights across natural gas, NGLs and crude oil. The Bakken Energy Path is available now – monitor volumes and fees at every stage, empowering your decision-making with a holistic market perspective. — Request your Energy Path demo now!

Get the Data Center Demand Monitor

The Data Center Demand Monitor is your go-to source for tracking data center projects and demand. Available as part of the Macro Supply & Demand Report, East Daley monitors and visualizes nearly 500 US data center projects. Use the Data Center Demand Monitor to forecast demand, identify pipeline corridors and track data center projects. — Request your demo now of the Data Center Demand Monitor!

The Daley Note

Subscribe to The Daley Note for energy insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.