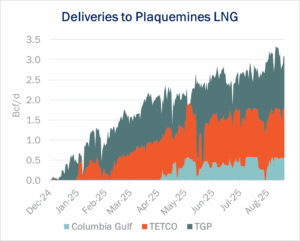

Plaquemines LNG feedgas deliveries averaged over 3 Bcf/d last week, peaking at 3.3 Bcf/d on Aug.10-11 as Venture Global (VG) continues to ramp Phase 2 of the export project.

VG in July started producing LNG from Phase 2, which includes 18 small-scale liquefaction trains. In the company’s 2Q25 earnings update, VG said it is now making LNG from 28 of 36 trains at the site in southeastern Louisiana. Once completed, Plaquemines will be able to produce 27 mtpa (~3.6 Bcf/d) of LNG. The company previously guided to a potential 92 cargoes from the Plaquemines project in 4Q25, suggesting that Venture Global expects all the trains to be online by YE25.

VG in July started producing LNG from Phase 2, which includes 18 small-scale liquefaction trains. In the company’s 2Q25 earnings update, VG said it is now making LNG from 28 of 36 trains at the site in southeastern Louisiana. Once completed, Plaquemines will be able to produce 27 mtpa (~3.6 Bcf/d) of LNG. The company previously guided to a potential 92 cargoes from the Plaquemines project in 4Q25, suggesting that Venture Global expects all the trains to be online by YE25.

VG’s Gator Express lateral supplies gas to Plaquemines and sources volumes from Tennessee Gas Pipeline (TGP), Texas Eastern (TETCO) and Columbia Gulf. TGP deliveries increased from 1.3 to 1.5 Bcf/d in the latest pipeline samples monitored by East Daley Analytics, and TETCO delivered over 1.2 Bcf/d (see figure).

Plaquemines, along with Cheniere Energy’s (LNG) Corpus Christi Stage 3 expansion, is a key driver of LNG demand growth underpinning East Daley’s bullish gas outlook in 2H25. In its 2Q25 earnings, VG raised its guidance for LNG output from Plaquemines and its Calcasieu Pass LNG project. The company now expects total cargoes to be at the high end of the previous guidance for 367-389 cargoes in 2025.

See the Macro Supply & Demand Report for more on the natural gas market outlook, and the Southeast Gulf Supply & Demand Report for a regional review of demand and pipeline flows for Plaquemines and other Louisiana LNG projects. – Kritika Gaikwad Tickers: LNG, VG.

Get the Best AI Tool in Energy

Meet Daley, the newest member of our energy team. Our new AI assistant is live and available to all East Daley Analytics clients. Early feedback has been phenomenal. Daley is platform-specific, and only pulls from East Daley’s own proprietary data and content. It’s not open-source or generic AI, but built to understand our structure, language and analytics. Whether you’re looking for a specific metric, forecast or explanation, Daley can get you there quicker. Reach out to learn more about Daley!

NEW – The Burner Tip

The Burner Tip provides East Daley’s weekly coverage of natural gas markets. Every Thursday, The Burner Tip brings you our expert perspective on drivers shaping prices and flows in North America — including production trends, infrastructure dynamics, and forward-looking fundamentals — all grounded in EDA’s proprietary data and models. Whether you’re trading, investing, or managing risk, The Burner Tip delivers the insights you need to drive smarter strategy. Subscribe now to The Burner Tip!

The Daley Note

Subscribe to The Daley Note for energy insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.