The Trump administration has formally eased restrictions on ethane exports to China, closing out a turbulent chapter for the NGL sector. With the largest US export market mostly unavailable in June, Indian buyers stepped into the void to keep the ethane market in balance.

On July 2, Energy Transfer (ET) and Enterprise Products (EPD) received letters from the Bureau of Industry Security (BIS) stating it had rescinded a licensing requirement for ethane exports to China, the companies disclosed in 8-K filings.

The communications from BIS, a Department of Commerce agency, end 40 days of uncertainty for the ethane trade. On May 23, the BIS sent the companies letters informing them of a special license requirement for high-purity ethane cargoes bound for China, citing a national security risk. Then on June 3, the agency denied EPD’s request to export three cargoes to China. The BIS only eased the restrictions after Washington and Beijing reached a broader trade agreement at the end of June.

The communications from BIS, a Department of Commerce agency, end 40 days of uncertainty for the ethane trade. On May 23, the BIS sent the companies letters informing them of a special license requirement for high-purity ethane cargoes bound for China, citing a national security risk. Then on June 3, the agency denied EPD’s request to export three cargoes to China. The BIS only eased the restrictions after Washington and Beijing reached a broader trade agreement at the end of June.

Companies in the ethane business adjusted amid the spat. Rather than losing total exports, terminals saw buyers from India step up their purchases to absorb cargoes normally destined for China.

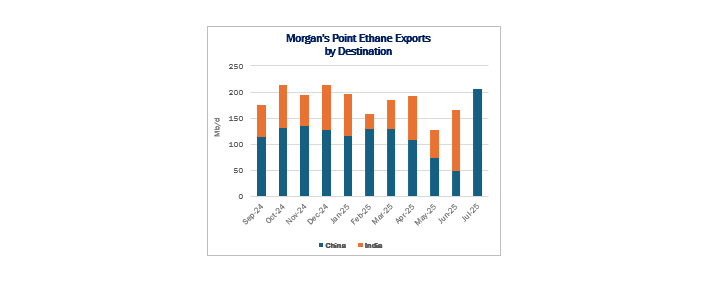

Prior to the export restrictions, EPD’s Morgan’s Point terminal had been sending ~125 Mb/d of ethane from its docks to China every month, according to ship-tracking data from Vortexa. Ethane ships had carried around 25-75 Mb/d monthly from the EPD terminal to India. When the restrictions went into effect in late May, exports to India jumped to 116 Mb/d (see figure).

The winners from this dynamic are petrochemical buyers like India’s GAIL or Reliance Industries exposed to ethane-to-ethylene spreads. Ethane prices fell from around $0.235/gal to $0.20 amid the export curbs. Prices today have returned to pre-restriction levels, and exports to China are regaining lost ground in July. However, the destination for a large share of currently waterborne cargoes in the Vortexa data (~134 Mb/d) is labeled as “Undetermined”. Whether Indian buyers continue to step up will depend on pricing and cargo availability, with eager Chinese buyers ready to resume their role as buyers of first resort. – Alex Albazzaz Tickers: EPD, ET.

NEW – The Burner Tip

The Burner Tip provides East Daley’s weekly coverage of natural gas markets. Every Thursday, The Burner Tip brings you our expert perspective on drivers shaping prices and flows in North America — including production trends, infrastructure dynamics, and forward-looking fundamentals — all grounded in EDA’s proprietary data and models. Whether you’re trading, investing, or managing risk, The Burner Tip delivers the insights you need to drive smarter strategy. Subscribe now to The Burner Tip!

Data Center Demand Monitor – Available Now!

The Data Center Demand Monitor is your go-to source for tracking data center projects and demand. We monitor and visualize nearly 300 US data center projects. Use Data Center Demand Monitor to forecast demand, identify pipeline corridors and track data center projects. — Request your demo now of the Data Center Demand Monitor!

The Daley Note

Subscribe to The Daley Note for energy insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.