Despite a $10/bbl correction in WTI crude oil prices, the rush is still on to build natural gas processing in the Permian Basin. Industry made several new project announcements in 1Q25 earnings, and guidance remains bullish as midstream companies position to capture value as close to the wellhead as possible.

Among new projects, Vaquero Midstream in late April announced a 200 MMcf/d cryogenic plant in the Delaware Basin. That project includes a 70-mile looping line and is expected to begin service by 1Q26. Meanwhile, Phillips 66 (PSX) said it will move forward with 300 MMcf/d of new plant expansions in the Delaware, due to start in 1Q27.

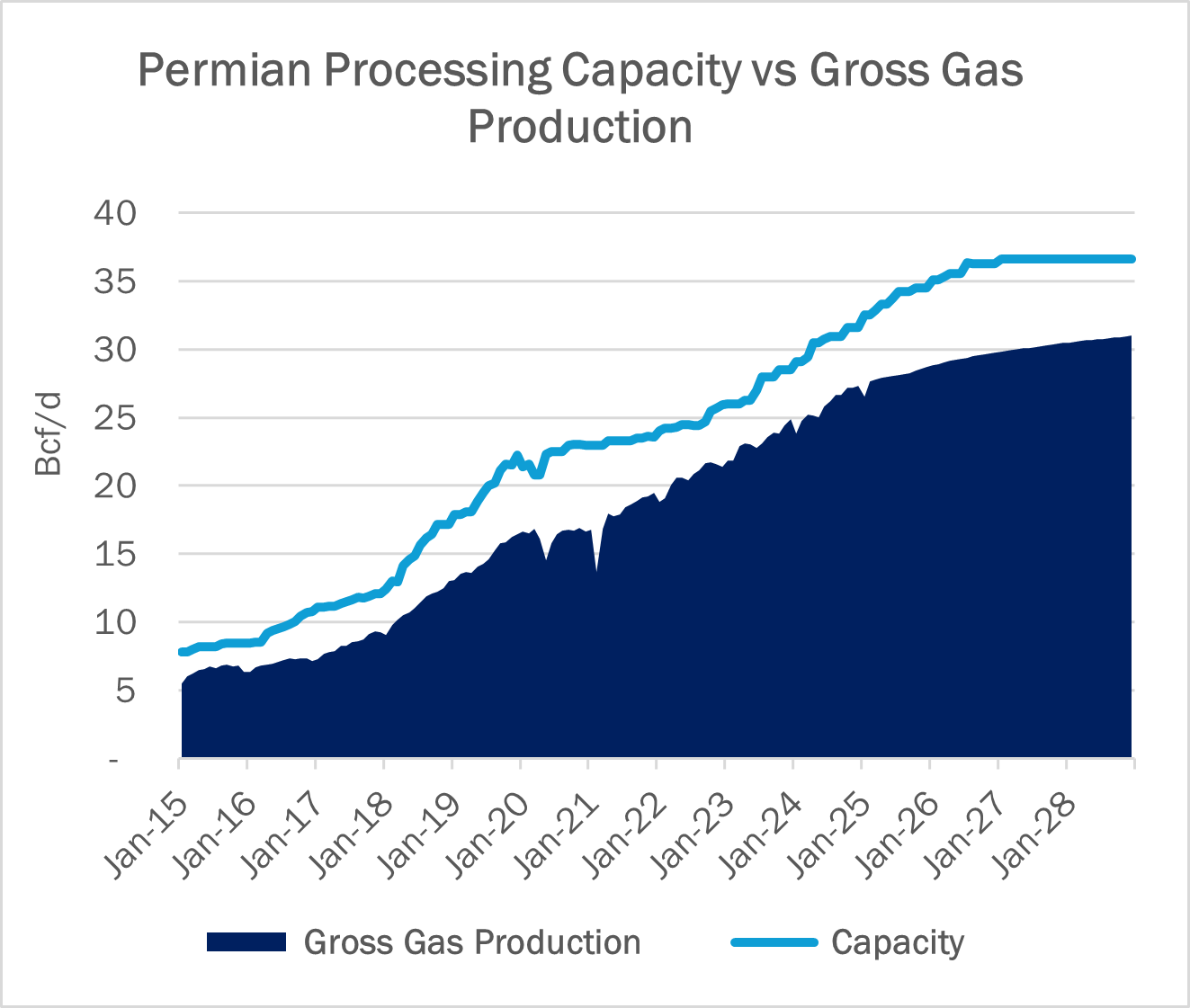

By the end of 2026, East Daley forecasts nearly 5.2 Bcf/d of additional gas processing capacity across the Permian compared to 2024. In the latest Permian Basin Supply & Demand Report, gross gas production still grows 2.1 Bcf/d (8%) by 2025 and 1.3 Bcf/d (5%) by 2026 vs the 2024 average, even with $60/bbl WTI prices.

Two distinct groups have emerged in the race to capture volumes. Integrated companies like Enterprise Products (EPD) and Targa Resources (TRGP) are aggressively expanding their footprints to secure barrels, not just at the wellhead but across the entire NGL value chain: gathering, processing, transportation, storage and export. Meanwhile, a mix of smaller private operators like Brazos, Durango and Vaquero, along with non-integrated public companies like ONEOK (OKE), Western Midstream (WES) and MPLX, are also investing in new capacity. These companies could eventually become acquisition targets for the larger, integrated players looking to consolidate their hold on the market.

EPD (21% share) and TRGP (39% share) alone account for more than half of the announced new gas processing capacity in our forecast. The remainder of the capacity comes from a mix of private and smaller public operators that continue to compete for volumes in a crowded landscape.

With the development surge, EDA’s analysis suggests that G&P capacity will remain ahead of supply growth for now. Potential constraints are more likely to emerge further downstream, a risk that TRGP and EPD appear willing to accept in exchange for securing critical volumes for their NGL transport and export networks. In addition, the Vaquero and PSX announcements show competition is intensifying elsewhere in the Permian.

Infrastructure – North Dakota has seen interest in new gas pipeline construction, with WBI Energy Transmission and Intensity Infrastructure Partners both holding open seasons since December ’24 for intrastate pipelines. The target behind these projects is a bit of a mystery though.

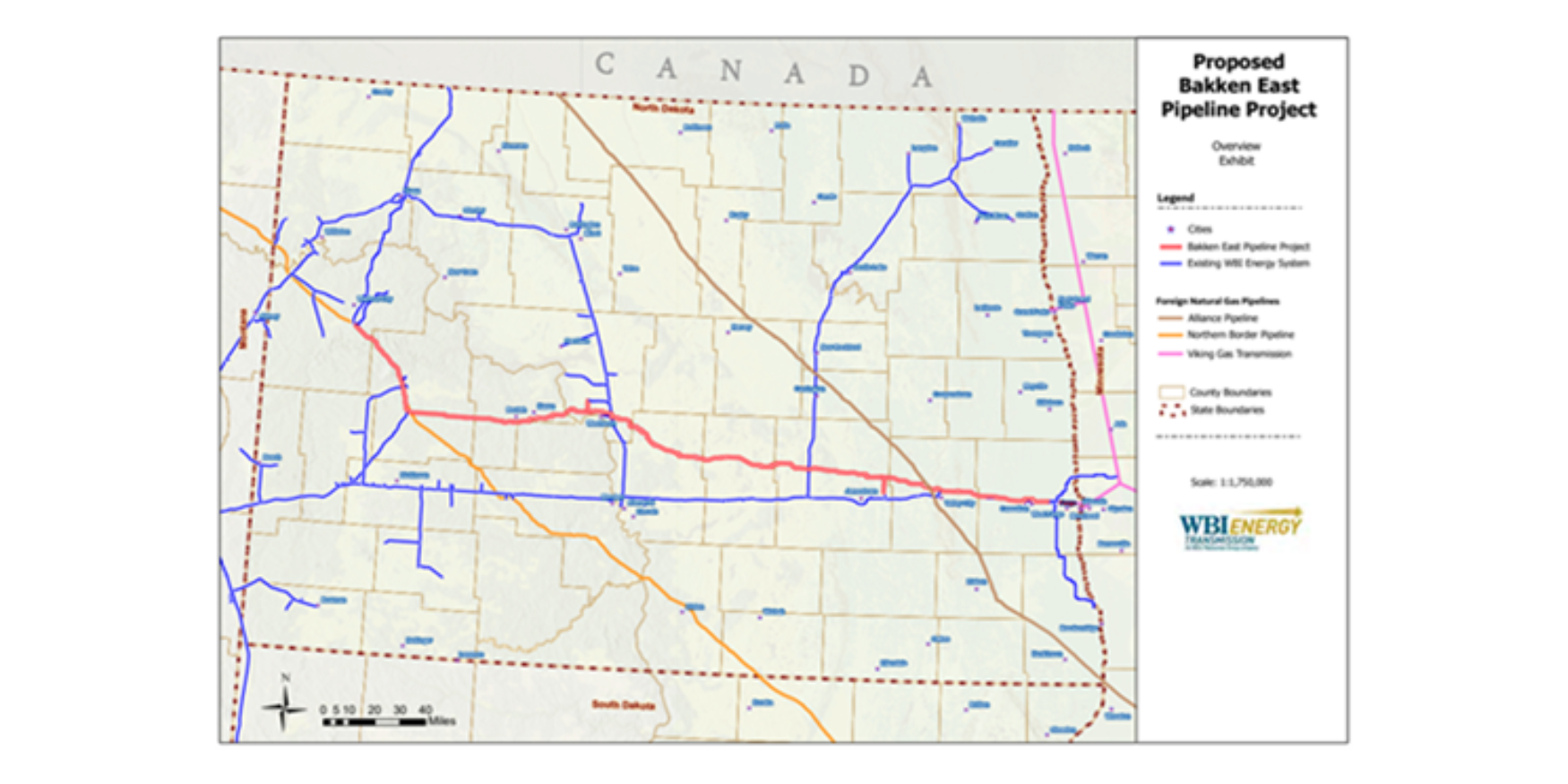

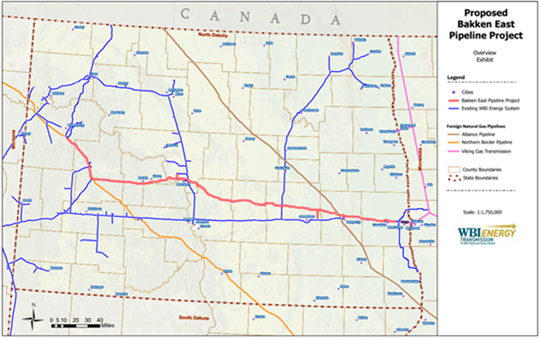

East Daley follows regional market developments in the Bakken Supply & Demand Report. WBI’s Bakken East Pipeline project held a non-binding open season aimed at addressing increasing demand in central and eastern North Dakota. The project would transport ~750 MMcf/d from the Bakken to the eastern edge of the state and has potential interconnects with the Northern Border, Alliance and Viking systems (see project map).

The Intensity Pipeline project would transport gas along a similar route. However, it would move 1.5 Bcf/d from west to central North Dakota before decreasing in size from 42 to 30 inches from the central to eastern side of the state. Though Intensity’s binding open season mentioned no prospective interconnects, the project likely has similar interconnectivity as WBI’s Bakken East Pipeline.

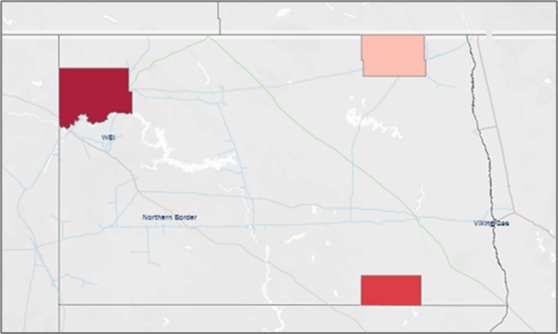

One driver behind these projects could be data centers. The Energy Information Administration (EIA) reported last year that North Dakota had the fastest relative growth in commercial electricity generation from 2019 to 2023, largely due to data center buildouts.

In the Data Center Demand Monitor, East Daley is only tracking four announced data center projects in North Dakota with estimated demand of ~82 MMcf/d (see map from the Data Center dashboard). But developers will often approach multiple potential partners about large projects prior to their announcement, which may have spurred these open seasons. Both projects aim to enter full service by 2030.

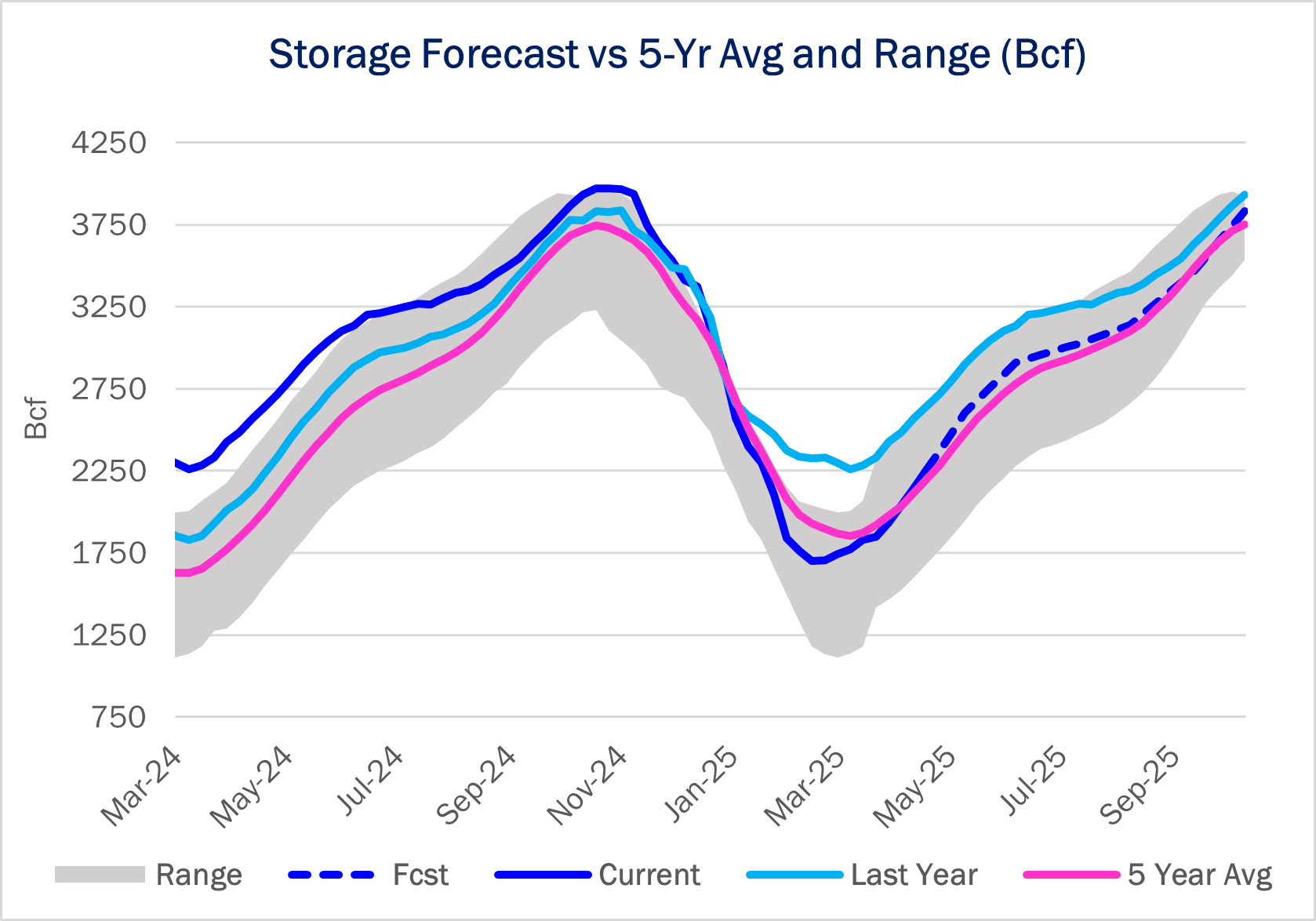

Storage – Traders and analysts expect the Energy Information Administration (EIA) to report a 116 Bcf injection for the week ending May 16. A 116 Bcf injection would be 29 Bcf greater than the 5-year average and would expand the surplus to 86 Bcf, the largest 5-year surplus since the week ending January 3.The storage deficit to last year would fall by 38 Bcf to 337 Bcf.

The 2025 injection season is about to get very interesting. Should the week ending May 16 come in above 100 Bcf, it would be the fourth triple-digit injection in a row. For reference, the injection season in 2019 saw a run of six consecutive triple-digit injections, and the 2014 shoulder months saw seven 100+ injections in a row.

Preliminary estimates for the week ending May 23 have shifted down and suggest the triple-digit run could be over. Consensus estimates now expect a mid-80s injection for the week ending May 23. The following two weeks could be in the high-90s and may not cross the 100 Bcf threshold. Weather forecasts have warmed, and forecasts for cooling degree days (CDDs) have increased in the 10- to 15-day forecast since last week. This has led to lower injection estimates and a modest increase in the prompt month on Tuesday (May 20), with June gas trading close to $3.40/MMBtu.

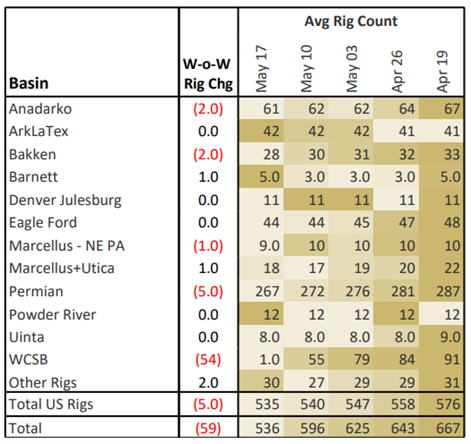

Rigs – The US rig count decreased by 5 for the May 17 week, standing at 535. The Anadarko (-2), Bakken (-2) and Permian (-5) lost rigs while the Barnett and Marcellus+Utica each gained 1 rig.

On the midstream side, Enterprise Products (EPD) is down 3 rigs net with losses on its Permian and Eagle Ford systems. Kintetik (KNTK) is up 4 rigs total with additions on its Permian systems.

East Daley’s weekly Rig Activity Tracker monitors rig activity by basin and by gathering and processing (G&P) system to better understand midstream impacts. We allocate rigs and monitor flows through 150+ public and privately owned G&P systems in every North American basin. Reach out for more information on the Rig Activity Tracker.

The Daley Note

Subscribe to East Daley’s The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices, and EDA research likely to affect markets in the short term.