Executive Summary: Rigs: US rig activity was flat in liquids-driven basins, losing 1 rig overall for the February 18 week. Flows: Gas sample across basins took a dip after the mid-January winter storm reduced flows for the rest of the month. Infrastructure: MPLX will have 1.4 Bcf/d of gas processing capacity after completing the Preakness II (+200 MMcf/d, ISD in early 2Q24) and Secretariat (+200 MMcf/d, ISD 2H25) projects. Purity Product: The latest EDA Purity Product Forecast shows slower 2H24 Permian growth for NGLs than it does for crude oil or natural gas.

Rigs:

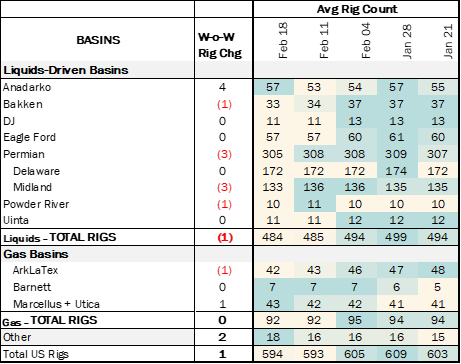

US rig activity was flat in liquids-driven basins, losing 1 rig overall for the February 18 week. However, there were notable changes within basins as the Anadarko gained 4 rigs while the Midland Basin in the Permian lost 3 rigs. The Powder River Basin lost 1 rig. The DJ, Eagle Ford, Midland and Uinta basins all remained flat with no change in rig counts.

Anadarko producers Presidio Petroleum, Calcuta Petroleum and Shelby Resources each added 1 rig in the basin. Texland Petroleum and Triple Crown Resources both dropped 1 rig in the Midland Basin, and EOG Resources dropped 1 rig in the Powder River Basin.

Flows:

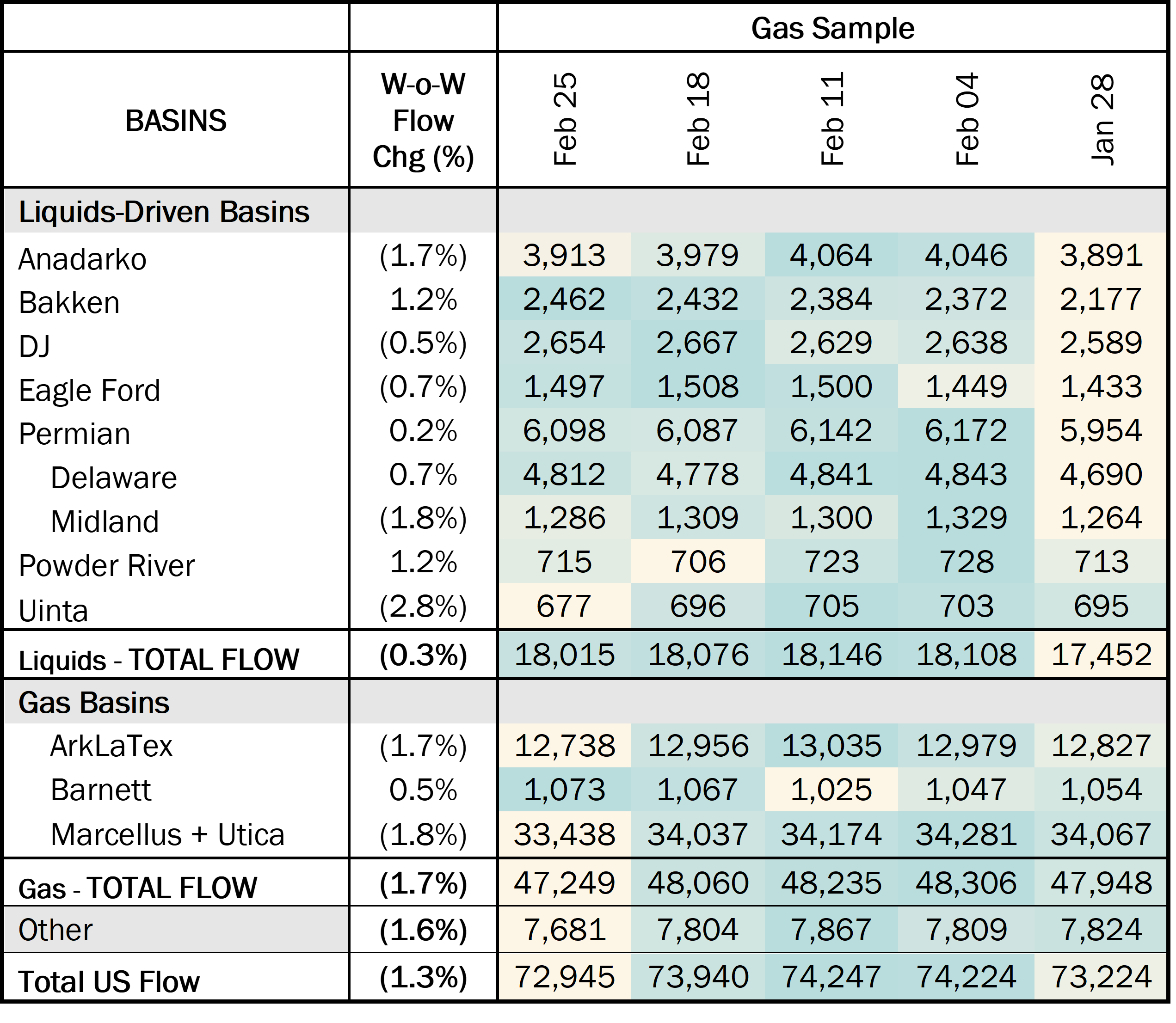

Gas sample across basins took a dip after the mid-January winter storm reduced flows for the rest of the month. Flows have mostly recovered following the freeze-offs, but samples are still below 4Q23 level. Although production has returned to normal and is relatively flat as of February 25, the drop in gas prices is prompting companies like CHK and Comstock in the Haynesville, and EQT in the Marcellus, to cut off rigs and production.

Overall US gas flow samples dropped 1.3% W-o-W for the February 25 week. In liquids-focused basins, pipeline samples were 0.3% lower W-o-W at ~18,015 MMcf/d. Bakken samples continue to increase since the January freeze-offs, up 1.2% W-o-W to 2,462 MMcf/d. These gains were offset by weekly declines in the Anadarko, Denver-Julesburg, Midland and Uinta. We expect production to continue to be flat in the upcoming weeks.

Infrastructure: MPLX will have 1.4 Bcf/d of gas processing capacity after completing the Preakness II (+200 MMcf/d, ISD in early 2Q24) and Secretariat (+200 MMcf/d, ISD 2H25) projects.

The new capacity will make way for producer-backed growth, fueled by Coterra Energy (CTRA) and GBK (see volumes breakdown in figure from Energy Data Studio). As a result, MPLX is likely to produce almost 150 Mb/d of NGLs from the tailgate of its own plants by early 2025.

As we discuss in the 2024 Dirty Little Secrets annual, East Daley believes a few midstream players are poised to link together disparate parts of the NGL value chain and try to mimic the success realized by Energy Transfer (ET), Enterprise Products (EPD) and Targa Resources (TRGP), the other three vertically integrated behemoths in NGLs.

MPLX is emerging as one of those players making a move. In addition to the 1.4 Bcf/d of gas processing capacity in the Delaware, MPLX owns a 25% interest in the BANGL NGL pipeline to move liquids from its plants. BANGL provides access to the Corpus Christi and Sweeney NGL markets on the Texas Gulf Coast, where NGL storage, fractionation and export docks are in place.

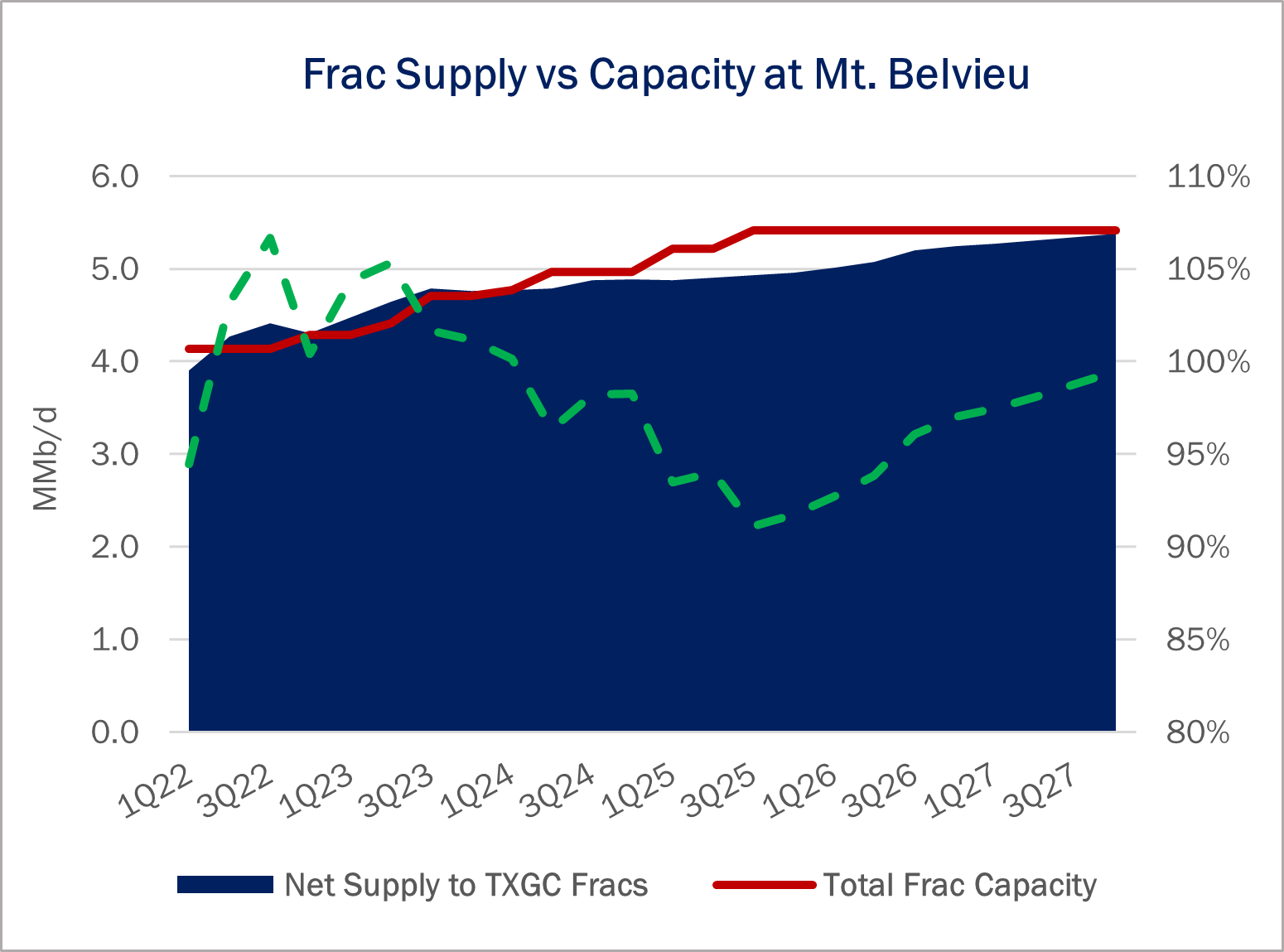

The air permit MPLX filed with the TCEQ could be a first step to owning frac capacity. Even with other fractionation expansions already announced by competitors (see figure), MPLX has an opportunity to participate in building additional frac capacity to meet NGL supply growth on the Gulf Coast. MPLX has entered the chat.

Purity Product Spotlight:

The latest EDA Purity Product Forecast shows slower 2H24 Permian growth for NGLs than it does for crude oil or natural gas. The driving force is a frac spread that plummets to almost $0.03/gal by December ’24. As covered in EDA’s first Quarterly NGL Webinar recorded on February 28, Waha’s 2H24 price resurgence will incentize more ethane rejection into the gas stream as the gas molecule becomes more valuable with respec to a relatively stable Mt. Belvieu ethane price.

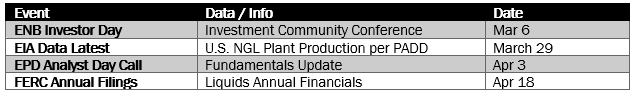

Upcoming Data Points:

Upcoming NGL / LPG Products Releases: