Executive Summary:

Infrastructure: Antero Resources is high-grading its Appalachian asset base, exiting non-core dry Utica gas acreage and consolidating the liquids-rich Marcellus position that defines its competitive moat.

Exports: Enterprise’s Neches River ethane terminal posted a standout week, moving 235 Mb/d, nearly double its 120 Mb/d nameplate capacity.

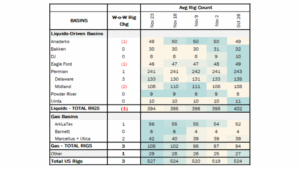

Rigs: The total US rig count increased during the week of Nov. 23 from 524 to 527. Liquids-driven basins decreased by 1 rig W-o-W from 395 to 394.

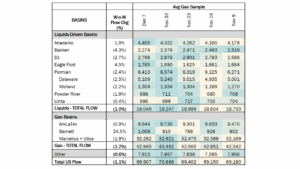

Flows: US natural gas volumes in pipeline samples averaged 69.9 Bcf/d for the week ending Dec. 7, down 1.1% W-o-W.

Calendar:

Infrastructure:

Antero Resources (AR) announced a pair of transactions that reshape its Appalachian portfolio. The producer will acquire HG Energy’s upstream assets in West Virginia for $2.8B in cash while divesting its Utica upstream assets in Ohio for $800MM.

The deal for HG Energy adds ~850 MMcfe/d of 2026 production, and the Utica asset sale removes ~150 MMcfe/d, resulting in a net +700 MMcfe/d production gain. On net, the deals yield a 20% uplift to Antero’s 2025 production guidance of 3.4-3.45 Bcfe/d.

The HG package includes 385,000 net acres, 400+ high-net royalty interest locations, and a ~75% liquids exposure, extending Antero’s core Marcellus inventory by five years. The companies expect to close the deal in 2Q26. Antero has identified $950MM of synergies over 10 years across drilling and completion work, development optimization, marketing and water handling. The acquisition price represents 3.7x estimated 2026 EBITDAX.

Antero did not disclose the buyer of the Ohio Utica properties, but said the price monetizes the non-core assets at ~8x estimated 2026 EBITDAX. AR expects to close the sale in 1Q26.

Antero expects to finance the HG acquisition through free cash flow, the Utica sale proceeds, and a $1.5B 3-year term loan, with leverage projected to fall below 1.0x in 2026.

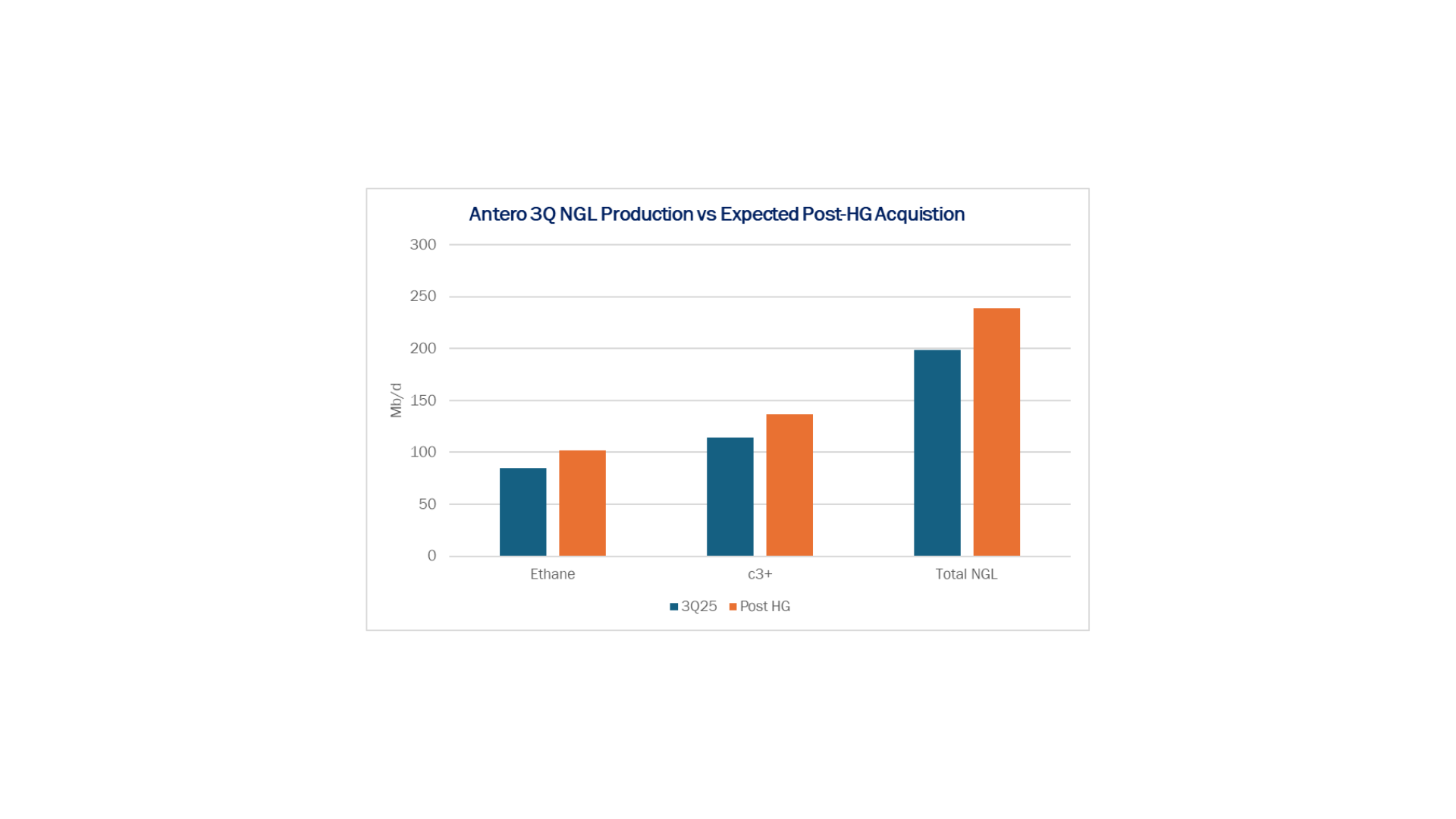

Antero is executing a high-grading of its asset base, exiting dry, non-core Utica gas and consolidating the liquids-rich Marcellus position that defines its competitive moat. Net of the divestiture, AR gains ~0.7 Bcfe/d of production, but more importantly, a step-change in NGL leverage.

HG’s West Virginia acreage is contiguous to AR’s core development corridor, unlocking longer laterals and shared infrastructure that meaningfully reduces breakeven costs for new wells. The shift from the Utica to liquids-rich Marcellus rock expands AR’s ethane and LPG uplift, enhances raw-mix recovery, and solidifies AR’s position as Appalachia’s premier liquids producer.

From a basin perspective, this deal pushes more high-quality liquids barrels into the Northeast system at a time when downstream relief remains tight. Antero emerges with more scale, more liquids, and greater marketing leverage, reinforcing its structural advantage in an increasingly consolidated Appalachia.

The Permian Basin at a Crossroads: Download Why This Pipeline Boom is Different

The Permian’s next big buildout is already taking shape — but this time, the drivers aren’t producers chasing oil. East Daley’s latest white paper reveals how gas demand from AI data centers, LNG exports, and utilities is rewriting the midstream playbook. Over 9 Bcf/d of new capacity and $12 billion in investments are reshaping flows, turning the Permian into a gas powerhouse even as rigs decline. Read Part II: Why This Pipeline Boom is Different

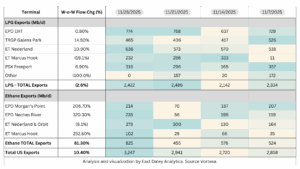

Exports:

US NGL exports increased 10.4% for the week starting Nov. 28, driven by a sharp 81.3% surge in ethane exports. LPG volumes slipped 2.6% on the week. Enterprise’s Neches River ethane export terminal posted a standout week, moving 235 Mb/d, nearly double its 120 Mb/d nameplate capacity.

Rigs:

The total US rig count increased during the week of Nov. 23 from 524 to 527. Liquids-driven basins decreased by 1 rig W-o-W from 395 to 394.

- Anadarko (-1): Pablo Energy II LLC

- Eagle Ford (-1): Caturus

- Permian:

- Delaware (+3): Civitas Resources, V-F Petroleum, EOG Resources

- Midland (-2): Exxon, Blackbeard Operating LLC

Flows:

US natural gas volumes in pipeline samples averaged 69.9 Bcf/d for the week ending Dec. 7, down 1.1% W-o-W.

Major gas basins declined 1.2% W-o-W to average 42.9 Bcf/d. The Haynesville sample declined 0.9% to 9.6 Bcf/d, while the Marcellus+Utica sample slid 1.9% to 32.3 Bcf/d.

Samples in liquids-focused basins decreased 1.0% to 19.0 Bcf/d. The Permian sample declined 2.4% to 6.4 Bcf/d, while the Eagle Ford sample gained 4.5% W-o-W.

Calendar: